Starting from version 3.0.81 in the 1C:Accounting 8 program, simplified accounting of electronic travel tickets is supported for all users, including those who do not have integration configured with the Smartway service. Now such users can independently enter tickets purchased from different agents into the accounting system, and then reflect travel expenses in the advance report. In this case, you can use both a general and a simplified form of an advance report. 1C experts talk about new features of the program.

In 1C: Accounting 8, starting with version 3.0.81, accounting for expenses on electronic tickets purchased by an organization for employee business trips has been simplified. Users who do not download tickets from the Smartway service can now independently enter tickets purchased from different agents into the accounting system, as well as reflect any transactions with tickets (additional payment, exchange, return).

To do this, the program uses the Tickets directory (Directory section), the Ticket Receipt document (Purchases section) and a special accounting account 76.14 “Purchase of tickets for business trips”.

For companies using the Smartway business trip management service, all tickets purchased by the company are automatically uploaded to the directory, without the need to manually enter data. Additional ticket transactions, such as exchanges or refunds, are also reflected automatically. For more information about simplifying business trip accounting in “1C: Accounting 8” version 3.0 and integration with the Smartway service, see the article “Business trips in 1C: simplifying accounting and integration with Smartway.”

After registering received tickets (in any way), travel expenses are reflected in the Advance Report document (Bank and Cashier section or Purchases section).

What is an electronic ticket

Like a regular ticket, such a ticket certifies the fact of carriage of a passenger or baggage, but does so in an electronic digital format. The standard form was approved by order of the Ministry of Transport of Russia dated August 21, 2012 No. 322.

After payment, the carrier’s unified information system generates a statement (it’s called a control coupon) and sends it by email. It will contain information about the route, tariff, and final cost - similar to the paper version. By law, a control coupon is a full-fledged strict reporting form (SSR).

An electronic travel document consists of a ticket and a control coupon with a unique number and series

Accounting

Accountants often have a question: should electronic tickets be taken into account in account 50.3 “Cash documents”?

In order to avoid reservations on the part of auditors, it is better to adhere to this particular, classical method, using account 50.3. Then, when purchasing electronic tickets, you must make the following entries: Debit 76 (60) Credit 51

– tickets purchased;

Debit 50.3 Credit 76 (60)

– tickets are capitalized as monetary documents;

Debit 71 Credit 50.3

– tickets issued to an accountable person.

However, a number of experts believe that since the electronic ticket does not have a paper form, then there is no need to use account 50.3. In this case, this operation is regarded as payment for a service from a third party. If you choose this method, it is recommended to open a new sub-account “Payments for electronic tickets” to account 76. The chosen method should be fixed in the accounting policy for accounting purposes (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”).

In what case does an electronic ticket confirm expenses?

The first way to confirm expenses is to provide a paper counterpart on a strict reporting form (control coupon), which encrypts information from the carrier’s automated information system. The second is to submit the ticket not to the BSO, but along with the cash receipt.

Along with the control coupon you can also provide:

- director's order to go on a business trip;

- documents confirming your stay in a hotel or location on a business trip.

If the company has checks and invoices from hotels, orders from the manager, etc., it is still necessary to provide a printed ticket and control coupon. Instead of the latter, a boarding pass with travel information, which the passenger receives after electronic check-in, is suitable. In this case, a cashier's check or bank statement is not needed since 2013.

Sometimes tickets for trips abroad are issued in a foreign language: to confirm expenses, translation of the details is needed

What about BSO?

BSO is a document that a legal entity or businessman can issue to an individual instead of a cash register check for non-cash or cash payment for services.

The use of BSO is regulated by the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash registers (approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359).

As a general rule, taxpayers issue BSO only when paying for services from the list of OKUN (OK 002-93, approved by Decree of the State Standard of the Russian Federation dated June 28, 1993 No. 163) and equivalent to them. BSO cannot be issued to a legal entity when purchasing goods. But BSO can be issued to entrepreneurs, since they are equated to individuals (paragraph 4, clause 4 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16).

For the form to be considered valid, it must include the following required details:

- name, 6-digit number and series;

- name of the company or full name of the individual entrepreneur;

- TIN and location of the enterprise;

- type and cost of service;

- payment amount;

- date of operation and document generation;

- position, full name and personal signature of the person responsible for documenting the operation;

- Stamp of the company.

If the BSO was produced in a printing house, then information about it is indicated on the form. What other requirements apply to BSO - read the article “What applies to strict reporting forms (requirements)”.

However, there are a number of BSOs, the registration of which has separate requirements approved by special regulatory legal acts. Such forms include cinema tickets, season tickets, tour packages, etc. Can an electronic ticket be considered a BSO?

Accounting for tickets when purchased by an employee

Sometimes an employee independently purchases an electronic travel document on the website using accountable funds as an individual. Expenses are written off if you have a printed ticket and boarding pass/control coupon. The latter must indicate: full name, train and seat number, price, date of travel.

If the purchase is made by a company, the accountant carries out three operations: payment, posting of the electronic document and issuance to the employee. When this function is assumed by an individual, standard posting is performed for the issuance of the accountable amount. At the end of the business trip, travel expenses are written off after approval of the advance report.

In accounting, electronic tickets containing all the necessary details are classified as primary and are used as the basis for writing off travel costs.

The company can entrust the purchase of tickets to an employee: a special wiring diagram has been developed for this case

Notes of legal actions.

At the same time, during an air flight, you only have a boarding pass in your hands, and when traveling by train, you have nothing. What to do, what needs to be presented to the organization’s accounting department in such cases.

Attached to this letter is the ITINERARY RECEIPT for your electronic ticket.

The itinerary receipt confirms payment of the ticket price in full, as well as

Your right to air travel and baggage transportation on the specified S7 flight.

To speed up the control and check-in procedure for your flight, we recommend that you

print out the itinerary receipt and take it with you to the airport.

If you have completed electronic registration for the train, then

boarding the carriage is carried out upon presentation to the conductor of the carriage of a document certifying the identity of the passenger specified in the order for the purchase of a ticket, and a boarding pass, which

You can print it on a printer or copy it to your mobile phone or tablet.

is allowed, then in the “My orders” section in the line of a specific order (must be set

sorting the list “by orders”) the “Update ticket status” link will appear after clicking

which will show the order status: “electronic registration completed” or “paid”

(if electronic registration is not completed).

We recommend reading: Certificate instead of a military ID 2021, what are the restrictions?

Also see status

You can order/ticket using the links “Order Form” and “Ticket Form” in the same order line.

Paragraph 2 of Order of the Ministry of Transport of the Russian Federation dated August 31, 2011 N 228 “On establishing the form of an electronic travel document (ticket) for railway transport” (hereinafter referred to as Order N 228) establishes that the control coupon of an electronic travel document (ticket) (extract from the automated system management of passenger transportation on railway transport) is a document of strict accountability and is used for organizations and individual entrepreneurs to carry out cash payments and (or) payments using payment cards without the use of cash register equipment.

Whether it is correct or not, I cannot say, because in our country, although there are unified regulations for working with taxpayers, a unified approach to on-site inspections, and so on, in practice it turns out that the Federal Tax Service in various cities and regions of the Russian Federation interprets federal laws and letters in their own way , it is difficult to guess how one or another inspector will react to the package of documents confirming the employee’s travel.

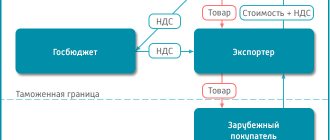

Accounting for value added tax

Companies that practice the purchase of electronic analogues, in accordance with Article 171 of the Tax Code (TC), have the right to deduct the amount of VAT included in the payment when traveling on a business trip.

To apply VAT deduction, you must:

- have on hand the control coupon in the original with the allocated tax amount;

- make an appropriate entry in the purchase book;

- enter data during the approval period for expenses.

The difficulty is that in the electronic digital version the VAT value is often not indicated on a separate line. At the railway ticket office you can request a cash register or cash register receipt with the allocated tax amount.

It is more difficult to obtain a deduction without a dedicated VAT line, but it is also possible. In parallel with the approval of the advance report, the ticket is registered in the purchase book. In practice, the dates of purchase and advance report often refer to different tax periods. This is not an obstacle, but only postpones the deadline. For example, if a business trip began in May and ended in August, VAT is deductible from the third quarter - according to the date of the advance report.

Methods for obtaining reporting documents

1. When purchasing a ticket

If you are going on a business trip and need to report to the accounting department, when placing an order, select the type of trip - “Work”. Enter the name or TIN of the company, and we will issue a document for this organization.

! If you often go on business trips or buy tickets for business travelers, it is worth registering a business account and paying for corporate orders from the organization’s account or with a bank card. You can combine a personal and corporate account and switch when purchasing tickets for personal and work purposes. Learn more about the corporate account.

2. After purchasing a ticket

If you bought a ticket to Tutu, you can download all documents in your personal account any day after purchase. Log in to Tutu.ru and go to the “Personal Orders” section. In the list of orders, select the desired ticket and click on the “Order Details” link. A separate page will open with a description of the order. At the bottom, find the “Passengers and Costs” item. By clicking on the appropriate links, you can send documents to yourself by email. email or save to your computer and print.

To order originals with a stamp, fill out the form and we will send the documents to the specified address within 5 business days.

Comparison of accounting conditions for regular and electronic railway tickets

| Accounting conditions | Regular ticket | E-ticket |

| Confirmation of document availability | Ticket on strict reporting form | Printed version of the control coupon and boarding pass |

| Proof of payment | No need | Receipt from a cash register or terminal indicating the identity of the payer |

| Documents for VAT deduction | Ticket for BSO indicating the amount of VAT | Control coupon with dedicated VAT |

| Document to confirm expenses | Ticket | Control coupon/boarding pass |

As a strict reporting form, the control coupon is suitable for confirming business trip expenses

Foreign language tickets

When traveling abroad, tickets issued in a foreign language are purchased. The position of the legislative bodies is reflected in the letter of the Ministry of Finance dated April 10, 2013 No. 03-07/11/11867. The document indicates the need to maintain primary accounting documents in Russian, which requires a translation of the forms presented line by line.

To accept expenses, translation of secondary document information is not required. If data is used for VAT deduction, translation is required based on information about the service provider, buyer, description of the document amount and tax. There are no special conditions for the form of translation. The text does not need to be notarized.

Lost ticket: what to do?

If after a business trip there is no digital ticket left, you can reprint it from your email. Unlike a control coupon, a boarding pass cannot be restored. In this case, you can obtain travel confirmation from the carrier.

Article 252 of the Tax Code allows the use of the following documents in tax accounting that indirectly confirm expenses:

- duplicate or copy;

- a certificate from the carrier indicating the passenger’s full name, route, price, date of travel.

An electronic ticket purchased by an organization for an employee’s business trip can be returned at the box office and on the website, but this requires justification. Within six months from the date of departure of the train, it is allowed to submit an application in the form of a claim for a refund. The amount of compensation depends on the reason for canceling the trip and the statute of limitations. The money is returned by bank transfer to the payer's account.

At first glance, the advent of electronic travel documents has somewhat complicated the reporting process. In fact, the procedures for confirming business trip expenses and registering VAT deductions are transparent and, after minimal practice, do not cause any difficulties for accountants.

The employee's expenses must be reimbursed

A business trip is a trip by an employee by order of the employer to carry out an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation). Any business trip involves expenses. In accordance with labor legislation, an employee’s expenses for a business trip must be compensated. In particular, you need to compensate (Article 168 of the Labor Code of the Russian Federation):

- travel expenses;

- housing rental costs;

- daily allowance – additional expenses associated with living outside your permanent place of residence;

- other expenses incurred on a business trip in agreement with the administration.

(for more details, see “Reimbursing employee travel expenses”).

The amount of reimbursement for expenses incurred can be set by the organization depending on the status of the posted employee. It is absolutely not necessary to set uniform limits for spending money on business trips for everyone. Thus, for company management, an increased amount of compensation for travel expenses may be established, and for ordinary employees, the limits on spending money on a business trip may be more modest (for more information, see “Different categories of employees can be set different amounts of daily allowance”).