This article discusses the procedure for paying an employee for the time spent on the road, if it falls on a day off. It would seem that this issue is quite fully regulated by the current legislation, according to which being on the road on a business trip is equated to work. Nevertheless, in practice a large number of questions arise, the answers to which with specific examples with links to regulations and explanations we will try to consider in this article.

Before revealing the topic of the article, let’s define the basic concepts.

What is a business trip?

Typically, a business trip is the sending of an employee of an enterprise for a certain period of time to perform some task in another division of the company or another place. There is a document regulating this circumstance. This is Decree of the Government of the Russian Federation No. 749 as amended on July 29, 2015.

Typically, travel days are counted from the time the vehicle departs and ends with its return. Business travel is considered to be the days between the date of departure and arrival. In the absence of tickets certifying travel, the start date is considered from the moment of check-in at the hotel or drawing up a rental agreement for residential premises . At a temporary place of work, the start and end dates of work must be recorded, and in the absence of other documents confirming the terms of the business trip, the countdown is based on them.

It is important to note that travel and accommodation are usually paid for by the employer. And also for the entire period of the trip, the salary of the posted worker is maintained. All cash payments provided for during the trip are made in the currency of the country to which the employee was sent.

After arrival, the employee must submit a documented report to the HR department or management team within 3 working days Documents that need to be provided:

- A complete advance report of all expenses.

- Residential rental agreement.

- Travel tickets or documents certifying it.

- Documentary evidence of expenses related to business travel expenses.

The role of daily allowances during business trips

A business trip is intended for an employee to perform, outside the place of his permanent work, a task issued to him by the employer (Article 166 of the Labor Code of the Russian Federation). The employer is a person directly interested in the results of this trip, and that is why the law obliges him (Article 167 of the Labor Code of the Russian Federation):

- maintain the employee’s place of work and salary;

- reimburse him for travel-related expenses.

If you have questions about business trips, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Reimbursable expenses are divided into (Article 168 of the Labor Code of the Russian Federation, clause 12, clause 14, clause 23 of the Regulations, approved by Government Resolution No. 749 of October 13, 2008):

- related to the organizational side of the trip - travel, accommodation and other expenses arising from the preparation of documents, insurance, reservations, payment of mandatory payments, fees, services inextricably linked with the trip;

- compensating the employee for inconveniences arising from the distance from his permanent place of residence and requiring additional costs from him.

The second group of expenses is the daily allowance.

What if you are leaving on a business trip on a weekend?

This often happens when you need to be at a business trip on Monday morning. Therefore, the departure date falls on Saturday or Sunday. There are two calculation options: double or single, with a written request from the employee to use time off on this date. Daily allowances are calculated only for those days during which the business trip lasted.

It happens that a business trip is delayed, and the employee has to be away from home on weekends. Payment in this case occurs only if the employee worked on these days, which is officially certified in the form of an order. Then the calculation is made in double amount or time off and a single payment are taken.

What is average earnings and how to calculate it in relation to business trip payments

The average salary of an employee is a value that is used when calculating many indicators of remuneration - vacation pay, compensation for it, sick leave, severance pay, etc. At the same time, the rules for calculating this value, depending on the specific goal, can vary significantly.

Resolution No. 922 regulates two procedures for calculating the average salary: the first of them is universal (it is suitable for the total mass of payments, including remuneration for work on a business trip), the second is specialized (for calculating payment for vacations and compensation for them). Another procedure for calculating the value under consideration is established for disability benefits - it is regulated by a separate document.

The fundamental difference between calculating average earnings for business trips and calculating the same amount for vacations is that in the first case the calculation is made in working days, while in the second - in calendar days.

The law prescribes payment for work on a business trip according to average earnings

The ultimate goal of the calculation itself is to calculate the average daily earnings - the conditional amount of wages per day of work. Subsequently, this value will be multiplied by the number of business trip days.

The algorithm for calculating the average salary consists of several stages:

- establishing the period of time for which information will be included in the calculation;

- establishing the range of payments that will be included in the calculation;

- directly calculating average daily earnings.

Selecting a period for calculating the average salary

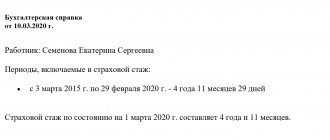

According to the general rule (clause 4 of Regulation No. 922), for the calculation under consideration, 12 full calendar months should be selected - those of them that precede the beginning of the period for payment of which the manipulation is carried out.

In order to correctly calculate average earnings, you will need to refer more than once to the production calendar

Example 1. HR specialist S.I. Peacock has been sent on a business trip since January 22, 2021. The month preceding January 2018 is December 2021. This month will be the final month in the calculation period, and should be counted 12 months ago. Thus, the period taken into account in calculating the average salary for Pavlin’s travel payments is from 01/01/2017 to 12/31/2017. Starting February 5, 2021, Pavlin is planned to be sent on a work trip again. To pay for this business trip, a new payment period must be selected - from 02/01/2017 to 01/31/2018.

The goal of the procedure at this stage is still not only the period, but also the number of days actually worked by the employee during this period. And in almost 100% of cases, the stage of determining the 12-month period is followed by the stage of subtracting the days to be excluded from it. Thus, clause 5 of Regulation No. 922 requires the exclusion from the calculation of all time periods when payments to the employee were made based on the same average salary, and among them:

- days of temporary inability to work (sick leave);

- days of labor (paid) leave;

- days falling on various social holidays;

- days of downtime, as well as strikes in which the employee himself did not participate;

- business travel days;

- all other time intervals (except for those intended for feeding the child), paid “on average”.

The total number of working days for the selected 12-month period should be determined in accordance with the production calendar. After summation, all working days falling within the above excluded periods should be subtracted.

Example 2 (for source data, see example 1). To calculate the total number of working days for the period from 01/01/2017 to 12/31/2017, you should sum up their number for each month of this period:

17 for January + 18 for February + 22 for March + 20 for April + 20 for May + 21 for June + 21 for July + 23 for August + 21 for September + 22 for October + 21 for November + 21 for December = 247 days .

For the period taken into account S.I. Peacock:

- was on labor leave - from 06/19/2017 to 07/17/2017 (according to the production calendar, this time corresponds to 21 working days);

- was on business trips - from 02.13 to 15.02.2017, 09.4.2017 (these periods account for 4 working days);

- was sick - from May 22 to May 26, 2017 (5 working days);

- calculation of the total number of working days for the period: 247 days – (21+4+5) days = 217 days.

It often happens that in a certain clause 4 of Regulation No. 922 of the 12-month period, the employee actually worked only part of it. In such a situation, it is necessary to determine the number of working days for the period actually worked and, accordingly, take into account payments only for this time.

Example 3. Manager S.I. Amilavskaya has been sent on a business trip since January 15, 2021. In accordance with Regulation No. 922, the 12-month period that is taken into account when calculating her average earnings is from 01/01/2017 to 12/31/2017. However, Amilavskaya got a job in the organization (immediately after graduating from the institute) only on 08/01/2017. Thus, only the period from 08/01/2017 to 12/31/2017 will be taken into account when calculating the period.

Calculation of the number of working days in the period: 23 days for August + 21 days for September + 22 days for October + 21 days for November + 21 days for December = 108 days.

During this period, Amilavskaya:

- was on sick leave - from November 13 to November 15, 2017 (3 working days);

- was on a business trip - December 11, 2017 (1 working day).

Total number of days in the period: 108 days – (3+1) days = 104 days.

An even more rare, but valid situation is that the employee did not work at all in the 12-month period defined in accordance with paragraph 4. In this case, you should proceed in accordance with one of the following options:

- if in an even earlier period there are actually days worked, this period should be taken for calculation;

- if the employee did not previously work, but worked in the current month, the current month should be taken into account;

- if the employee did not work this month (for example, he goes on a business trip immediately after being hired), the average salary is calculated based on his salary.

Example 4. On January 18, 2021, cashier A.N. Simonov. with her consent, she is sent for an internship in another city, as an employee who has returned from maternity leave to gain the necessary work experience. Meanwhile, from July 1, 2021, Simonova actually did not work, being on maternity leave. Thus, the period from 01/01/2017 to 12/31/2017 is excluded from the calculation, and the period from 01/01/2016 to 12/31/2016 will be taken into account in the actually worked part (to 06/30/2016). Further manipulations will be carried out by analogy with those described in example 3.

If we assume that Simonova was hired in January 2018 (a date earlier than January 18), then only the days she worked in that month can be included in the calculation. And if the reception took place on January 18, the average earnings will be equal to Simonova’s salary divided by the average number of working days in a month.

Establishment of the payment circle for calculation

Once the counting period and the number of days included in it have been determined, it is time to determine the circle of payments. Clause 2 of Regulation No. 922 outlines it quite clearly - these are all payments included in the wage system. So, this does not include:

- all one-time incentive payments - bonuses, awards, etc.;

- financial assistance (including vacations, health benefits, etc.);

- all types of compensation and social payments (payment of utilities, travel, etc.);

- vacation pay, other types of pay “on average”.

For each employee, the average salary changes every month

On the contrary, the following should be included in the calculation:

- wages (time-based or piece-rate, in cash or in kind);

- all bonuses paid (for length of service, for professional excellence, for category, etc.);

- monthly bonuses (for production results);

- bonus based on the results of work for the year - the so-called “13th salary”, regardless of the time of payment.

Regarding the accounting of bonuses such as the “13th salary”, clause 15 of Regulation No. 922 contains special conditions. Thus, the bonus applies to the month according to the results of which it was paid and in that part of it that falls on this month.

Example 5 (see source data in examples 1, 2). Payments according to the list of clause 2 of Regulation No. 922 to Pavlin for the period from 01/01/2017 to 12/31/2017 amounted to 540,000 rubles. The calculation of an employee’s average daily earnings will look like this:

540,000 rub./217 days = 2,488.5 rub.

Calculating the amount of travel allowances

Having the amount of the average daily salary, you can quite simply calculate the amount of remuneration for the period of the business trip. It is enough just to multiply it by the number of business trips.

Example 6 (for source data, see examples 1, 2, 5). Duration of S.I.’s business trip Pavlina – 3 working days. Calculation of wages for these days (excluding daily allowance and reimbursement of expenses):

RUR 2,488.5 × 3 days = 7,465.5 rub.

How are travel allowances calculated on weekends?

Usually all working days are counted. Daily calculation is not carried out if the trip took one day. To calculate pay, the employee's average earnings for the past year are calculated. To do this, the amount of all wage payments during is divided by the amount of days actually worked. The result is multiplied by the number of days that the employee will be on a business trip.

Example

An employee of the Vesna enterprise, Petr Kolesnikov, was sent on a business trip for this organization to a subsidiary branch for 5 days. After all the necessary calculations, it turned out that Kolesnikov worked 180 working days. At the same time, he earned 30,000 rubles monthly. Calculation of Kolesnikov’s average salary:

- 30000Х12/180 = 2000 rubles per day.

- Calculation of travel allowances for 5 days:

- 2000X5=10000 rubles.

Typically, daily rates on a weekend are determined by the head of the company or an employee authorized by him. The standard amount of these payments, established by the law of the Russian Federation, is 700 rubles per day, if the business trip is carried out on the territory of Russia; abroad, the amount of these payments is 2,500 rubles per day. These payments are not subject to tax. But if the amount exceeds the norms, then from the point of view of the tax code this is considered the income of an individual and therefore the amount exceeding the norm is subject to tax.

As for the execution of the order, it is standard. If the business trip falls on a weekend, then an order is written to recruit the employee to work, due to production needs, on the weekend.

How to pay for travel allowances when traveling abroad?

To answer this question, you should seek information from Letter No. 1037-IH of the Ministry of Labor, which summarizes the basic rules for such payments. To summarize the information contained in the letter, we learn that employees on short-term business trips in another country are paid for each day they are abroad, including the time spent on their trip. From the moment an employee travels outside the borders of Russia, he is accrued travel allowances in strict accordance with the rules established in the country where he will arrive.

Further, upon returning back, payment is calculated according to the rules that apply on the territory of the Russian Federation (also from the moment of entry into Russia and further movement around the country, to the point of work or to home). The same rule applies if an employee crosses the borders of several countries as part of his work. In this case, travel allowances are paid each time according to the standards established in the country where the specialist is sent.

How to correctly fill out a time sheet?

Despite the employee being on a business trip, the days must be marked as working days in his timesheet. With the only difference: days spent on a business trip are marked either with the letter “K” or the number “06”. This is when the business trip falls on regular working days. On weekends, these marks will look different: in the form of the letters “RV” or the number “03”.

At the same time, it is possible to mark two values on the timesheet at once in order to see when work during the trip coincided with days off. This is done in order to know for which days worked double wages are calculated. Payment for travel expenses on weekends and holidays is calculated equally. But entering both values at once ensures that the calculation is carried out in certain amounts, and the employee retains all his rights while he is absent from his main job.

Let's sum it up

- Per diem is a payment that compensates the employee for inconveniences arising from the distance during a business trip from his permanent place of residence. The amount of this payment is set per 1 day (day). For civil servants it is defined by law. Other employers set the daily allowance amount independently.

- You must pay per diem for all days you are on a business trip. These days also include days on the road. They may also coincide with general days off or non-working holidays. In addition, days of forced delay in transit are also subject to payment. Departure/arrival dates are most often determined by travel documents, but if the place of departure of transport is remote from the place of permanent work, they may shift taking into account the time of arrival. If it is possible to return to your place of permanent residence every day, daily allowances are not paid.

Is it possible to refuse a business trip on a day off?

Any employee has every right to refuse a business trip on a weekend or holiday. A business trip is work anyway, so if it goes on the weekend, it turns out that they kind of “disappear.”

The Labor Code of the Russian Federation (Article 113) describes in detail in what situations an employee can be attracted to work on a day off. The article states that this only happens under extreme circumstances, such as a catastrophe or the threat of a natural disaster. In these cases, the employee does not have the right to refuse a business trip, since there is a vital need for it. Refusal in this case will be considered a violation of labor laws, and is punishable by a fine or dismissal.

In the absence of compelling reasons and the need for a business trip, a written agreement is concluded to involve the employee in work on a weekend or holiday. Such an agreement is drawn up by the traveling employee and the head of the organization.

Some tips:

- Before sending an employee on a business trip, it is necessary to double-check the start and end dates of the trip in advance.

- Check travel dates to ensure they coincide with weekends.

- Carefully fill out timesheets to ensure that employee accruals are made correctly.

Every person has the right to rest. Therefore, the manager needs to be more attentive to the legality of arranging a business trip for his employees on weekends or holidays.

10th method. Listening to audiobooks or podcasts

Nowadays, almost everyone has a smartphone that allows them to listen to audiobooks or other useful recordings while traveling on public transport.

If you think that you need to focus on upcoming matters, then you are somewhat mistaken. Modern people have very little time to expand their horizons and obtain useful information, so listening to such recordings while traveling will allow you to get acquainted with books that you could always read. This method is also ideal for self-education and advanced training, since you can not only listen, but also read specialized literature and undergo training.

8th method. Spend time on yourself and your loved ones

The modern pace of life does not allow us to pay enough attention to ourselves and others; people simply do not have the opportunity to communicate with friends or relatives. A great way to make better use of your travel time is to simply talk to them on the phone, send an email, or communicate on social media. Many people try to devote part of their working time to this, which further aggravates the situation. You need to remember that Internet traffic in large companies is thoroughly checked, especially for visits to social networks, so refusing them during working hours will help you improve your business reputation.

This is interesting: The real cost of traveling by car

2nd method. Try practicing meditation

For most people, this process is maximally linked to external paraphernalia, such as special rooms, relaxing music, loose clothing or a rug. However, if we turn to the origins of this concept, it becomes clear that meditation is the liberation of the mind from external influences, a kind of brain reboot, getting rid of the paraphernalia of the external world. This method is a logical continuation of the previous one. If you notice that complete distraction has a beneficial effect on your well-being and the effectiveness of your activities throughout the day, then switching to the practice of meditation may give even more productive results.

4th method. Use the time to brainstorm

The ability to abstract yourself from everything that is happening around you, focus on what is really important to you, and think about priority tasks - this is the potential that you need to make the most of while commuting. Every morning, when your brain is not yet loaded with everyday tasks, when you have not yet gotten tired and have not started dreaming of rest, you should just relax and allow your brain to come to the only correct solution to the tasks at hand.

Brainstorming allows you to focus your attention on what really matters, not just about work, but about your life in general.

7th method. Get to work without haste

There is an opinion that reducing travel time allows you to make the most of it for other purposes, and this is partly true. But from the point of view of your emotional state and mood, it would be much better to leave the house a little earlier and spend a little more time on the road. In return, you get a feeling of relative freedom, since you can go to a cafe at any time and drink a cup of coffee, buy a magazine, or pay more attention to what is happening around you. It is this feeling that allows you to realize that work is not your whole life, that it is just a tool to satisfy your material needs and nothing more.

5th method. Find the optimal route

Maximum use of travel time does not mean that travel time can be unreasonably increased. It's worth experimenting with your route a little to figure out which way to get to work or school is best for you. For example, if you drive your own car or walk, you should pay attention to the ability to get there not only along the main streets, but also along small alleys. This will allow you to avoid heavy city traffic, choose a more scenic route, save yourself from being stuck in traffic jams and, ultimately, reduce travel time.