No financial system will operate stably if banks do not have free commercial cash at their disposal. Obliging a business entity to hand over the surplus balance, rather than storing the money in its cash register, turned out to be possible only by force with the prospect of applying administrative liability. Thus, any amount in the cash register in excess of the prescribed limit will result in an unpleasant surprise of up to 5,000 rubles for officials and up to 50,000 rubles for the legal entity itself. Cash balance limit for 2021 for small businesses latest news

In March 2014, the Directive of the Bank of Russia announced the abolition of several provisions regarding the conduct of cash transactions for small businesses, and from June 1, 2014, funds can be stored in the company's cash desk without restrictions on the amount and time period.

We decipher the concept of “cash limit”

In simple terms, the phrase “cash limit” is deciphered quite simply: this is the maximum allowable amount of cash in the cash vault, safe or cash register of a commercial company at the end of the day. This norm was introduced by the Central Bank of the Russian Federation, and the accounting department of an enterprise must set this limit individually at the beginning of each calendar year.

Setting and maintaining a cash limit is a headache for many accountants. In order to avoid surpluses, they have to constantly monitor cash, and if in the evening there is suddenly more money in the cash register than the established norm, then the accounting representative needs to go to the bank to deposit funds into the company’s current accounts. Otherwise, it is unlikely that you will be able to avoid administrative punishment during any inspection.

Features of drawing up an order

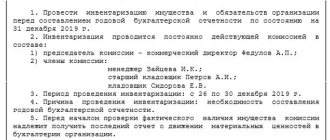

Before drawing up an order, the organization must choose a suitable calculation formula for itself. If a company accepts payment for goods and services in cash, then the calculation must be made based on the volume of receipts, otherwise - on the amount of payments made minus wages and benefits.

Next, the corresponding calculations are made. They are usually included in a separate application. The text of the order itself will be the same in both cases. It must contain the following details:

- full name of the organization;

- number and name of the order;

- date of compilation;

- city of compilation;

- period of validity (this can be not only a year, but also a quarter, a month, you don’t have to specify a time frame at all, but then the document will be valid until a new order is adopted or the current one is cancelled);

- the size of the established limit (indicated in rubles);

- the period between the delivery or receipt (depending on the payment method) of cash is indicated in working days.

Such a document is signed by the head of the organization. It is important to specify who will control the execution of the order. Here you can specify the chief accountant, for example. If the manager monitors the execution himself, then a note must be made that he reserves responsibility and control over the implementation of the order.

As it was before

Previously, absolutely all enterprises and organizations dealing with cash had to limit the remaining funds in the cash register. Since June 2014, this practice has changed: now some business representatives may not set limits. It is not surprising that many wanted to exercise this right.

However, audits carried out by tax authorities discovered some violations caused by insufficient knowledge of the legislative framework regarding the unlimited maintenance of cash balances and, as a result, applied penalties to a number of enterprises and organizations.

That is why, in order to avoid claims from tax authorities, you need to exercise your right to an unlimited cash register competently and with a clear understanding of all the rules of this process.

General rules for limits

Individual entrepreneurs and organizations that work with cash and have a cash register must have an order for a cash limit - the form and content of the order has several options. Let us consider further these options and the rules for drawing up such documents in more detail.

Working with a cash register involves maintaining a cash register. This book keeps records of the availability and movement of cash from a business entity. The transactions in this book are recorded by the cashier/accountant or manager/entrepreneur. The book must reflect the current cash balances at the end of the day. The values of these balances should not exceed the limits established by the organization/individual entrepreneur. When excess cash is generated, it must be collected through a bank or sent to a servicing financial institution. Responsible persons must ensure that current cash balances comply with the internal order on the cash limit, and the manager is obliged to ensure that the business entity has such a document and that it is correctly drawn up in accordance with the latest legislative norms.

Cash balances and cash flows are regulated by Central Bank Regulation No. 373 of November 12, 2011; non-compliance gives the right to supervisory authorities to apply penalties to the entity.

In what cases is exceeding the limit at the cash register acceptable?

As stated in the law, on strictly defined days, enterprises and organizations can quite legitimately allow cash surpluses. In particular:

- If payment of wages, social, material assistance, scholarships, etc. is expected, but no more than five working days from the date of withdrawal of money for these purposes from the company’s current account;

- If cash transactions are carried out on non-working holidays or weekends, there may also be amounts in the cash register above the limit values.

Any other circumstances cannot serve as an excuse for exceeding the limit and will inevitably entail administrative punishment in the form of fines.

Sample order

Similar articles

- Order on pre-holiday shortened working day

- Cash limit calculation

- The procedure for conducting cash transactions in 2016-2017

- Cash balance limit for 2021: sample calculation

- Sample of filling out an order to conduct an inventory

If you can’t, but really want to: the right to refuse the cash limit

The law gives some categories of enterprises and organizations, as well as individual entrepreneurs, the right to refuse to maintain the maximum established financial indicators at the cash desk.

Commercial companies classified as small businesses, as well as all individual entrepreneurs, can take advantage of this right, regardless of the tax regime they apply.

Waiving the limit at the cash register does not imply any special actions; it is quite enough to simply meet certain parameters:

- maximum income - no more than 800 thousand excluding VAT for services performed and goods sold;

- limited personnel - for the last calendar year, the number of employees at the enterprise should not exceed 100 people;

- participation in the authorized capital - no more than a quarter of the share of other legal entities.

If a company meets these requirements, then it can safely keep unlimited funds in the cash register.

In cases where the right to no cash limit arises not from the moment of registration of the enterprise, but, for some other reasons, in the course of its activities, then in order to use it, the management of the enterprise needs to take the following steps:

- In a written resolution, cancel the previously issued order establishing a cash limit;

- Issue a new order stating that from such and such a date there is no cash limit.

Cash Payment Basics

The legislator does not establish a ban on the use of cash by an entrepreneur for settlements with his counterparties (Article 861 of the Civil Code of the Russian Federation). Also, Decree of the Central Bank of Russia No. 3073-U “On cash payments” dated 10/07/2013 regulates the relationships and payments made in cash by a businessman with his counterparties, including people.

The Central Bank of Russia does not supervise the following operations:

- Settlements with the participation of the Central Bank of the Russian Federation as a party;

- Payments made for banking operations;

- Payment from customs services;

- Issuance of salaries to employees and other social benefits;

- Cash withdrawal for personal needs of individual entrepreneurs not related to the activities carried out.

Various financial transactions of a businessman with civilians are not controlled by anyone, but with organizations there is a clearly established limit under one written agreement, limited to the amount of one hundred thousand rubles, this is the current norm for 2021.

Setting a cash limit: procedure and rules

As mentioned above, all large enterprises and organizations are required to introduce cash restrictions. If this is not done, then by law the cash limit is considered zero. In order to set a limit on the finances stored in the cash register, the head of the enterprise or organization needs to issue a corresponding order. There is no need to submit any applications or notifications to the tax authority.

Attention! Individual entrepreneurs or legal entities working in the field of small and medium-sized businesses can set a cash limit on their own initiative.

As a rule, the justification for such actions is the desire to ensure control over the safety of cash. At the same time, you need to understand that if the corresponding order is issued and the cash limit is set, then the accounting department of the enterprise or individual entrepreneur is obliged to comply with it, and take all the excess to the bank. If any violations are discovered during the audit, tax inspectors will certainly resort to administrative punishment.

Purpose of establishing

Establishing a certain cash limit is necessary to reduce cash in circulation. Considering that most financial transactions occur non-cash, a large amount of cash negatively affects the development of the economic sector.

Periodicity

There is no statutory deadline for determining the limit, as well as legal grounds for changing it in any direction. Organizations independently calculate the cash register limit, as well as the validity period of the established limit.

The head of the enterprise sets cash limits based on the issued order, and also cancels it with another order. An order issued without an expiration date sets a cash limit for an indefinite period. A sample order can be found on any thematic website.

How to calculate cash limit

This is the question that most interests novice accountants. There is no need to rack your brains over it - calculation options are provided for by law:

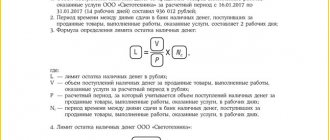

- Based on the volume of cash receipts using the formula:

Limit = Revenue / Billing period x Days - By the volume of cash issuance (if there is no cash proceeds) using the formula:

Limit = Issues / Billing period x Days

Explanations:

Revenue is the amount of funds from the sale of services and the sale of goods. If the enterprise has just been created, then here you need to indicate the expected amount of revenue;

The billing period is from 1 to 91 days inclusive. It can be chosen absolutely arbitrarily;

Days – from 7-14 working days between cash deposits. It should be remembered that the fewer the number of days, the less money should remain in the cash register.

Thus, if an enterprise, due to circumstances established by law, is obliged to strictly observe cash discipline, carry out nightly calculations of daily revenue and deposit balances with the bank, then this must be done in accordance with all the rules and regulations established by the legislator. Otherwise, it is unlikely to be able to avoid administrative sanctions from regulatory authorities.

How is the cash balance limit set for certain categories of business entities?

As can be seen from the formulas, the company needs to carry out activities for some time in order to calculate the cash balance limit. What should newly created organizations do? For them, Directive 3210-U provides for the establishment of a limit based on estimated, rather than actual, volumes of receipts or issues.

Source:

People's Advisor

Heading:

Cash transactions

cash balance limit cash register cash transactions

- Bela Trombach, expert in accounting, taxation, budgetary accounting

Sign up 7800

9750 ₽

–20%

What document is required for an individual entrepreneur?

Despite the democratic nature of the new CBR act, individual entrepreneurs were not exempted from all documents drawn up during cash transactions. The issuance of money on account must still be documented. Such accounting is mandatory. The basic rules of the Central Bank of Russia in this regard establish the following:

- When an individual entrepreneur himself takes money from the cash register for any needs, for example, for a taxi, then an application is not drawn up, and a report on the money issued is drawn up at the discretion of the entrepreneur. You can draw up a separate document or display the issuance of money in KuDiR as an expense.

- If an individual entrepreneur gives money to his employee, then he must first receive a statement from him about the need to issue funds for certain needs. The employee must later submit a report on the funds received and return the balance.

It is worth noting that the new Directive of the Central Bank introduced ambiguity in the situation with hired employees. It does not clarify whether similar requirements apply to persons working under an employment contract, for example, freelancers, online workers. Therefore, it is not yet clear what to do with such agreements and how to register them.

However, the issuance of money to such persons is recognized as the issuance of funds on account. Therefore, even if there is not an employment, but a civil law contract with a person, the issuance of money is carried out exclusively on account. For convenience, an individual entrepreneur can determine an example of filling out such a document independently.

Cash discipline in 2021 for individual entrepreneurs

Let us summarize the rules by which individual entrepreneurs should perform cash transactions and work with cash.

If most of the above rules are mandatory for organizations, then for individual entrepreneurs cash discipline in 2021 is less strict.

Individual entrepreneurs have the right not to set a cash limit, and if they do not do this, then they do not have the obligation to hand over cash for crediting to a bank account.

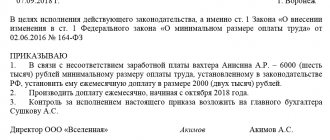

Individual entrepreneurs have the right to do without registering settlement and cash registers and maintaining a cash book, provided they maintain tax records (for which books of income and expenses are used). Read more about this here. But in the case of issuing wages to employees in cash, individual entrepreneurs are required to draw up pay slips (form T-53) or payroll slips (form T-49), which record the fact of issuing cash from the cash register.

and payrolls

26723 downloads

24956 downloads

12496 downloads

16560 downloads

32678 downloads