The transfer of administration of pension contributions to the Federal Tax Service did not relieve organizations and individual entrepreneurs from submitting reports to the Pension Fund. Moreover, the Foundation has introduced its own forms, both mandatory and additional. Particularly important is the issue of filling out the so-called “zeros”. This term refers to reports that lack information for a period. Which accounting forms are submitted in the “zero” version and who is vested with this responsibility - disputes on this issue between Fund officials and policyholders have not stopped to this day.

Mandatory reports to the Pension Fund of Russia

Key changes in terms of insurance coverage for citizens, which were carried out back in 2021, significantly reduced the composition of the forms required to be submitted to the Pension Fund of the Russian Federation.

Now policyholders fill out only two mandatory reports - SZV-M and SZV-STAZH. In addition to mandatory reporting, representatives of the Pension Fund have the right to request other information. For example, information about the insurance experience of specialists for past periods. The forms and deadlines for providing such data are usually reflected in a written request for information.

Russian organizations are subject to significant fines for failure to submit mandatory forms. Thus, for untimely submission of SZV-M, Pension Fund employees will fine the company 500 rubles. And not for the entire report, but for each insured person, which must be reflected in this form. That is, if there are 10 people in the company, you will have to pay 5,000 rubles for late SZV-M.

The form is monthly, so if the deadlines are violated several times, the amount of penalties becomes increasingly significant. Many companies, fearing fines, do not take risks and submit zero reports to the Pension Fund in 2021. To figure out whether it is worth sending zero reports, let us recall the conditions for filling them out.

Responsibility for late submission of reports

Incorrect, untimely sending or failure to submit zero reporting at all threatens the enterprise with penalties in accordance with Article 80 of the Tax Code of the Russian Federation.

A fine may also be assessed if there is no information letter explaining that the company is temporarily not operating.

In the case of PFR reporting, the fining party is the fund itself. The cost is purely symbolic: failure to submit zero reports for one quarter is punishable by a fine. However, if such negligence is repeated, the amount increases tenfold.

In addition, the company's current account may be blocked, but the company is unlikely to notice this, given that during downtime, transactions on the current account should not occur. In this situation, the enterprise loses not only money, but also, what is much more important, favorable attitude from government agencies, which should not be abused.

To keep records of warehouse operations, it is necessary to carefully record the movement of products in the warehouse. Primary documentation provides great assistance in this, which includes all the papers accompanying commodity units when moving from the supplier to the warehouse and from the warehouse to the consumer.The procedure for accounting for goods in a warehouse varies depending on the methods of storing materials and on some other factors, such as, for example, the frequency of receipt of materials at the warehouse. Read about warehouse accounting of goods here.

It is necessary to understand that any document flow with the participation of government bodies, be it the Social Insurance Fund, the Pension Fund of the Russian Federation or the tax office, is a very important matter. Timely submission of all reports guarantees the entrepreneur no problems in the future, as this once again proves the responsibility with which the businessman approaches his business.

SZV-M

The obligation to submit a monthly form is assigned to legal entities, individual entrepreneurs and representatives of private practice (lawyers, lawyers, notaries, detectives) who use hired labor in their activities.

That is, if the company has at least one employee with whom an employment contract or a civil law contract has been concluded, then the SZV-M must be taken. Moreover, the position of this employee does not matter. This clause directly applies to directors and management companies.

The reporting form includes information about the insured persons with whom employment contracts or civil servants' agreements were concluded during the reporting period. Even if in the current month there is no obligation to calculate and pay insurance premiums for such employees, SZV-M will have to be submitted. For example, if employees went on a long vacation at their own expense, then you need to account for them.

IMPORTANT!

If the report contains information about the insured person with an error, then a fine of 500 rubles will also be issued for such an oversight. A similar punishment is provided for each specialist who was simply forgotten to be indicated in the reporting form.

We talked in more detail about the rules for drawing up the form in a separate material, “SZV-M reporting: step-by-step instructions for filling out.”

Results

Filling out a zero calculation for insurance premiums is mandatory even if there are no indicators. To fill out the cover sheet for calculating insurance premiums in 2021 with zero reporting, standard data about the company is sufficient. Place zeros in the cells of sections 1 and 3, intended for summary and quantitative indicators, and cross out the remaining empty spaces.

It is better to fill in the fields for the BCC, otherwise difficulties may arise with the generation of an electronic insurance report.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Zero SZV-M

To avoid penalties, prepare zero reporting to the Pension Fund in form SZV-M. Moreover, this will have to be done in the following cases:

- The activities of an individual entrepreneur or company have been suspended.

- The activity is seasonal, the “dead” season has begun.

- The company has no employees, only the director.

- An employment contract has not been concluded with the sole director.

- There are no accruals in favor of employees.

- Other cases provided for by law.

For information on how to correctly draw up a report and in what situations this must be done, read the special material “In what cases is a “zero” SZV-M drawn up and submitted.”

How to submit a zero unified calculation for insurance premiums to the tax office

To pass the zero calculation of insurance premiums in 2021 , you will need:

- fill out the calculation form - download it here for reporting from the 1st quarter of 2021 to reporting for 9 months or here (since starting from the first reporting campaign of 2021, you need to use a new form, approved by order No. ED dated October 15, 2020 -7-11/ [email protected] );

- check the correctness of the entered data (which program is best to do this, see here);

- send the calculation to the tax authorities no later than the 30th day of the month following the end of the quarter (clause 7 of article 431 of the Tax Code of the Russian Federation).

Before filling out the report, please check in advance:

- passport data, full name, SNILS and TIN of the insured persons;

- when entering a surname, pay attention to the presence of the letters “e” and “e” (Soloviev, Vorobyov) - in them, “e” cannot be replaced with “e”, otherwise the inspectors will not accept the calculation.

The scheme of working with zero calculation is practically no different from filling out this report if there are payments to employees - the differences are only in the amount of data entered.

Zero SZV-EXPERIENCE: to pass or not

A different procedure is provided for the annual form SZV-STAZH. The form itself does not provide for the submission of empty “zero” fields. Therefore, there is no need to provide zero SZV-STAGE to the Pension Fund. Read more about the rules for submission: “We fill out and submit the SZV-STAZH form to the Pension Fund of the Russian Federation.”

Please note that this conclusion can be made after analyzing the electronic format of the form. For example, if the tabular part of the report is not filled out (there will be no records about the insured persons), then the report will not pass logical control. This means that providing a “blank” form does not make any sense.

How to fill it out correctly

Federal Tax Service Order No. ММВ-7-11/ [email protected] contains detailed information regarding the rules for filling out certain documents.

In the absence of information and indicators for calculating the DAM, the filling features in this case are as follows:

- The title page is filled out in the standard order.

- Section 1 is devoted to summary data related to the payer’s obligations for insurance premiums.

- Next come the Subsections, which are designated as 1.2 and 1.5. They are associated with mandatory types of insurance, medical and pension for each specific unit.

- Section 3 contains personalized information regarding all insured persons.

They separately check the correctness of the entered data, for which you can use special programs. INN and SNILS, full name with other passport data for insured persons are specified in advance if possible. Inspectors will not accept the calculation if the letters e are changed to similar ones.

The differences between this type of report and other similar documentation are only in the amount of information that is filled out in a particular case.

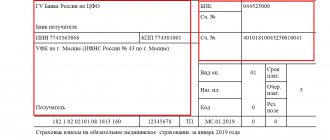

The tax identification number is indicated according to the information from the registration certificate itself. Compared to individual entrepreneurs, for companies this number is half as long. The same applies to checkpoints - they are taken from direct documents that were issued by the tax authorities.

IPs put dashes in the checkpoint line because they don’t have any information.

A separate line is devoted to the year for which the report was submitted and the period on the basis of which the information is provided. It is mandatory to have all information related to the activities of a particular company.

Two subsections in the first application are completed by all employers. 1.3 and 1.4 apply to certain categories of employees if they are related to social security.

The third appendix to the first section becomes mandatory if payments were made in connection with the following phenomena:

- Burial.

- Care for disabled children, including through payment for additional days off.

- Upon the birth of a child.

- If registration was carried out in the early stages of pregnancy.

- Care for children.

- Pregnancy, childbirth.

- Temporary loss of ability to work.

Each payment requires an indication:

- Total amount of expenses.

- Paid days during which the ability to work was lost.

- The total number of cases that served as the basis for the transfers.

Each accountant chooses for himself how it is more convenient to fill out title cards. It is recommended to use special programs that allow you to enter some information automatically.

Special reporting of NPOs to the Ministry of Justice of the Russian Federation

There are special reports for NPOs that must be submitted to the Ministry of Justice of the Russian Federation. The composition of the reporting depends on the type of NPO and is posted on the website of the Ministry of Justice of the Russian Federation.

For example, for public associations, form OH0003, notification of continuation of activities, is filled out.

Information about NPOs that are foreign agents is submitted more frequently. For example, zero reporting includes a report on the activities of an NPO and information about its personnel. Such NPOs must submit an audit report, even if there was no activity.

NPOs that are foreign agents, as well as structural divisions of a foreign non-profit non-governmental organization are required to conduct an audit (Clause 1, Article 32 of Law No. 7-FZ).

NPO reporting to Rosstat

The list of reports and deadlines for each non-profit organization can be found on the website of the Federal State Statistics Service by filling out the appropriate fields: TIN, OGRN or OKPO. A number of federal statistical surveillance forms are submitted only when an observable event occurs.

If the statistical form itself indicates that it is submitted only upon the occurrence of a certain event, then zero statistical reporting is not submitted to Rosstat (Letters dated 04/08/2019 No. SE-04-4/49-SMI, dated 05/17/2018 No. 04-04-4/48-SMI, dated 01/22/2018 No. 04-4-04-4/6-SMI).

Resources for submitting zero reporting to the Pension Fund

If time is limited and you do not have time to fill out the necessary data and prepare lists for zero reporting, then you can use one of the specialized computer resources. Such services perform work on the report for a low price and are in demand in such situations. In order for the resource to create a report, the entrepreneur needs to fill in the basic details and codes of the organization, and then the program itself will create a zero reporting of the Pension Fund of the Russian Federation and send the finished task to the email of the individual entrepreneur or his organization.

You should also choose the form of the enterprise - a legal entity or an individual entrepreneur, because there are certain differences between the forms. The cost of such assistance is quite reasonable and you can pay for it in any convenient way.

Do you need to select material for your study work? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Such resources will be especially beneficial for young companies that do not have the services of an accountant. Instead of studying all aspects of creating reports, it is easier for an entrepreneur to pay for finished work.

Other legal aspects

Article 431 of the Tax Code of the Russian Federation also regulates issues related to the execution of a document and its transfer to regulatory authorities.

If a zero report is submitted, the employer simply reports that during the reporting period he did not have:

- Insurance deductions.

- Labor benefits, which often serve as a calculation base.

- General activities for the reporting period.

Zero calculations are considered as such conditionally, since they contain enough information. They still contain information that allows you to calculate the length of service for an employee. For this purpose, they fill out the third section, where they provide personal data for each person.

All numerical values are considered equal to zero, and the corresponding values are written in the cells. The empty parts of this form are simply filled in with blanks.

Continuous page numbering is a mandatory requirement. At each of them you need to fill out information on the Taxpayer Identification Number (TIN) and checkpoint. The same applies to the presence of the date of completion along with the seal of the manager.

There are a number of official requirements that apply to the document.

- Use capital block letters that run from right to left.

- When entering information manually, the ink color should be black or purple or blue. Other colors are prohibited; in their case, the machine does not recognize the information, and there is a need to resubmit the document.

- Courier New with a height of 16-18 mm is the optimal choice of font.

- It is prohibited to use corrective agents and other similar compounds. It is recommended to redo the sheet completely, even if the slightest mistakes are made.

- A stapler or paper clip cannot be used to join pages together. Moreover, if their presence negatively affects the integrity of the sheets themselves and the printing elements.

- Each sheet in the report is printed on a separate page.

- Only individuals without a TIN fill out the line “Last name __I. ABOUT.".

It is also useful to read: Administration of insurance premiums