The topic of this article is interesting in its ambiguity and surprise for a wide range of consumers, which, in fact, are all of us. “Is VAT withheld from individuals?” Ask a similar question to tax department employees, and you will receive a seemingly specific, but in fact a generalized answer that individuals are not included in the list of entities recognized as VAT taxpayers (Article 143 of the Tax Code of the Russian Federation). But is this really so, if you “dig deeper”? Let's try to figure it out.

Let's remember what VAT is

Many people know that VAT is “value added tax”. But not everyone knows what this “added value” is. From ignorance, as usual, all the questions related to the VAT topic.

Added value is the part of the cost of a good, product or service that is created directly in a given organization. I will not give a formal definition here. In fact, we can say that the term “created,” it seems to me, is not always appropriate. Well, for example, what does a seller “create” by simply purchasing goods from one company and reselling it to another (or individuals)? Yes, it probably doesn’t create anything other than a markup...

In any case, according to the law, when selling goods, products or services, it is necessary to pay a tax, which is called value added tax or otherwise VAT.

Remembering the definition of VAT, we should not forget that it is an indirect tax. If you forget about this important circumstance, you may miss the most important thing. Namely, this kind of taxes is paid, in fact, by the final buyer; the selling company is only a collector of this tax.

Who is the VAT payer?

Ask anyone and you'll get more or less the same answer. Less knowledgeable citizens will say that VAT is paid by companies. Those more knowledgeable about taxation and accounting will tell you that value added tax is paid only by those organizations and individual entrepreneurs that are subject to the general taxation system (+ some other cases, but these are details).

The meaning of such answers is the same - everyone unanimously declares that ordinary people (individuals) do not pay VAT or, to put it smartly, “are not VAT payers.”

By and large, this seems to be the case: after all, you, for example, are like an ordinary physical person. person does not submit a VAT return to the tax office? Of course not, why would that be! But if you look deeper, and also remember the definition of indirect taxes, it may turn out that individuals still pay VAT, even though they do not file declarations and generally do not think about this topic in most cases.

Documents required for return

When applying to the Federal Tax Service for a refund, the payer must provide the following documents:

- completed tax return in form 3-NDFL;

- application form with account details;

- income certificate in form 2-NDFL;

2-NDFL

- invoices;

- contract for the supply of goods;

- sheets from purchase and sales ledgers.

Even homeless people pay VAT

By the way, this is not a joke at all.

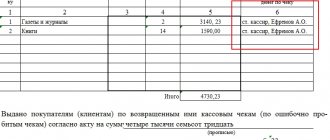

Just look at any receipt from the store and you will see the amount of tax you paid there. This is the amount of VAT that you, as an individual, paid in this case. The peculiarity is that this amount is already included in the price of the goods and cannot be separated in any way (it goes “into the load”).

In general, no one wants to notice any particular trouble here, because you are offered to pay the VAT amount as part of the product, and not separately. And in general, VAT on checks is allocated somewhere at the very bottom - who looks there? So in any case, you pay VAT every time you buy something in a store (if it is something subject to VAT, of course).

Pay attention to the trick:

Since you still RECEIVE THE GOODS for your own money, do you really care what taxes are ALREADY included in its price? That's why no one notices them.

Now let's imagine another situation when the VAT paid by you (as an individual) will be very noticeable. I will give one example, and then you can expand it to similar situations.

The figure below shows a screenshot of the payment form of the Yandex.Direct advertising system. For those who don’t know, I’ll explain the point: you transfer a certain amount to the account of the advertising campaign, and then you can spend this money on displaying your advertising on the Yandex network and on the search engine page.

In any case, the meaning is the same - you transfer a certain amount of money not for a product, but for a service, and the transferred amount is reflected in your personal account.

So, in the example given, the amount of 3,000 rubles will be credited to the account, and not 3,540, as some might think. And this is where it becomes very unfortunate that as much as 18% of the amount you transferred will be lost. There are many such cases, but one is enough. By the way, we were talking specifically about a payment from an individual , and not from an organization (namely, a simple individual, not even an individual entrepreneur).

Reporting

In 2021, the Federal Tax Service made changes to the declaration form. A complete list of updates can be seen in Order No. CA-7-3/853 dated 12/28/18.

At the moment, the form includes a title page and twelve sections to fill out + attachments to them. Not all of them are required to be completed, only the title and first sections are required for reporting. The remaining sections are completed only if necessary.

The standard composition of the declaration consists of the following sections:

- a title page on which reliable information about the taxpayer’s registration is entered;

- No. 8, containing data from the purchase book;

- No. 9, containing data from the sales book;

- No. 3, which calculates the tax payable;

- No. 1, which indicates the amount of VAT payable or refundable for the accounting period;

- sections No. 10 and No. 11, with data from the log of received and issued invoices.

When carrying out transactions with a special taxation procedure, you may need to fill out the following sections:

- No. 2 - when paying tax as a tax agent;

- No. 4, No. 5, No. 6 - for transactions with a zero rate;

- No. 7 - for non-taxable transactions.

VAT is a tax for the poor

But this is half a joke. I just wanted to note the fact that in the end it is individuals who are the true source of income under the VAT item in the state. budget. Companies, in fact, only “toss” these amounts between each other. Perhaps I'm exaggerating a little, but let's estimate on our fingers.

Firstly, a VAT payer company, unlike an individual, can make such a trick as “accepting VAT for deduction”. Every time a company buys something from its suppliers, it can reduce the tax it pays to the budget by the amount of VAT added to the product. This number will not work for an individual.

Secondly, imagine a company that sells goods to individuals. VAT is added to the amount of the goods on top (read about VAT “above” and “including” here). As you saw above, the buyer (individual) pays the amount of VAT along with the goods, and then the company transfers the amount of this tax to the budget (minus what is accepted for deduction on their own purchases). Well, WHERE did the company ultimately get the money to remit the tax? That's it!

Let's go a little further. Companies make a profit from sales. Of course, this is after all taxes have been deducted, but nevertheless, I will repeat once again: PROFIT. What do you get when you purchase a product? But the tax has already been paid!

Of course, I’m not saying that let’s not pay taxes at all. But think about this thing: you pay VAT when purchasing a product and pay with money on which you have also already paid income tax. The VAT rate is usually 20% (most often) or 10%; income tax (personal income tax) is in most cases 13%. For example, let's add 20+13 and find that you give away 33% of your income!

But won't it be too much? Especially if we compare the income of individuals and companies in absolute terms? This is where the name of the subtitle comes from - as you can see, it’s not such a joke.

For those in the tank:

The store bought the goods from the supplier for 120 rubles, including VAT of 20 rubles. The company can take these 20 rubles as a deduction, that is, pay less tax to the budget by the specified amount. Then the goods were sold to an individual Vasya for 240 rubles (+100 rubles markup and another 40 rubles (20%) VAT on top).

The total profit (simplified) was 100 rubles. Those additional 40 rubles, which the store will then transfer to the budget, were essentially paid by the buyer and this amount is not an expense for the company.

Of course, out of 100 rubles. profits need to be paid income tax, but this is not what we are talking about now.

Personal income tax amount for non-residents

Personal income tax rates on income of non-residents of the Russian Federation (clause 3 of Article 224 of the Tax Code of the Russian Federation) are:

- 13% - from the salary of a foreigner who is a highly qualified specialist, a refugee, an employee on a patent, a person who has received temporary asylum in the Russian Federation, or a citizen of a member state of the EAEU (Article 73 of the Treaty on the EAEU dated 05/29/2014, Letters of the Federal Tax Service dated 03/16/2016 N BS-3-11/ [email protected] , Ministry of Finance dated 02/13/2017 N 03-04-05/7673, dated 07/11/2016 N 03-04-06/40397, dated 07/17/2015 N 03-08-05/41341 );

- 15% - from dividends;

- 30% - from other income.

Personal income tax on the income of a non-resident of the Russian Federation is calculated separately for each payment on the date of receipt of income (clause 2 of Article 210, clause 3 of Article 226 of the Tax Code of the Russian Federation). Tax is calculated by multiplying the amount of taxable income by the tax rate. Deductions for personal income tax are not provided to non-residents (clause 4 of article 210, clause 3 of article 224, clause 1 of article 225 of the Tax Code of the Russian Federation).

Lyrical digression - read by EVERYONE!

And one more thing.

We ALL give almost a THIRD of our income to the state. Just imagine that EVERY person in the country does this!

Let's imagine that we would not pay this money as taxes, but simply each person MONTHLY used a THIRD of his income not for himself personally, but for the common good, and not some abstract one, as they say on TV, but for very specific ones things. For example, make repairs in the common corridor of the house, lay out a lawn at the entrance, install normal lighting on the street, and so on.

Don’t you think that in this case we would all simply live in a fairy tale?

But we give all this HUGE pile of money to the budget. Therefore, a question arises that EVERYONE should think about:

WHERE IS ALL THIS? WHAT DOES OUR MONEY GO FOR?

Another example on the essence of VAT for individuals

Well, let's continue the conversation, otherwise I got a little distracted.

Once, a couple of years ago, out of curiosity, I wrote myself a 1C configuration for accounting for household income and expenses. Like 1C:Money, only simpler and tailored to your needs. So, during development it was necessary to draw up your own chart of accounts. I’ll say right away that accountants don’t have to worry, since usually the phrase “chart of accounts” means a document from the Ministry of Finance. Here we are talking about an object in 1C and nothing more.

It is necessary to come up with a chart of accounts, since the standard one is not suitable here. But the plan itself is absolutely necessary, since when accounting in 1C, it is on it that various amounts “hang” (I won’t go into details here, so as not to confuse non-programmers). So, when drawing up this chart of accounts, I wanted to take into account the amount of VAT that I pay in stores when purchasing something (well, it’s just interesting). If so, then you need a VAT account.

Now comes the most interesting part. As any accountant knows, to account for VAT on purchases, there is an active account 19. It is active because this VAT can then be deducted. But from the point of view of an individual, the situation turned out to be exactly the opposite: the account for the same VAT in the sense of the word turned out to be passive, and even off-balance sheet. However, the latter does not matter. But the fact that from the point of view of individuals, VAT is a pure expense , this is 100% correct.

GPC with freelancers

GPC agreements with freelancers have their pros and cons.

The advantages are that contributions are lower than with an employment contract, and there is no personnel fuss with work books, personal cards, etc. and so on.

The downside is that there are still contributions and they are by no means small, closing documents require close attention from tax authorities, the Social Insurance Fund and banks.

GPC agreements with freelancers: five problems and one solution.

You can avoid these problems by hiring freelancers to solve certain problems using a special service.

Solar Staff is a service for automating document flow and payments to distributed teams and freelancers, your general contractor for settlements with individuals.

We described how it works here.