Hiring agents for business development is a common commercial practice. It is used, for example, to expand the customer base, collect and analyze commercial data. Such services may be of a legally significant nature, but they may also have informational value, while the actions of the agent themselves do not carry any legal consequences for the customer. According to the Civil Code of the Russian Federation, the agent’s services must be paid.

Question: According to the terms of the agency agreement, the principal must pay a fee in the amount of 15% of the transaction. After two months, he reduced the reward to 10%. The agent demanded payment of remuneration in accordance with the terms of the contract. The principal did not comply with the requirement, and the agent, on the basis of Art. 450 of the Civil Code of the Russian Federation filed a lawsuit to terminate the contract. After the commencement of legal proceedings, the principal paid the debt. Are there grounds to terminate the contract? View answer

Article 1005 of the Civil Code of the Russian Federation

In accordance with Art. 1005 of the Civil Code of the Russian Federation, under an agency agreement, one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

According to paragraph 1 of Art. 1005 of the Civil Code of the Russian Federation, under a transaction concluded by an agent with a third party on his own behalf and at the expense of the principal, the agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction.

To relations arising from an agency agreement, under the terms of which the agent acts on his own behalf, the rules provided for in Chapter 51 “Commission” of the Civil Code of the Russian Federation are applied, unless these rules contradict the provisions of Chapter 52 “Agency” of the Civil Code of the Russian Federation or the essence of the agency agreement (Article 1011 Civil Code of the Russian Federation).

At the same time, on the basis of Art. 1001 of the Civil Code of the Russian Federation, in addition to paying the agency (commission) remuneration, the principal (committee) is obliged to reimburse the agent (commission agent) for the amounts spent by him on the execution of the agency (commission) order.

Parties

Based on the definition regulated by Art. 1005 of the Civil Code of the Russian Federation, I speak to the parties to the agency agreement:

- principal - customer;

- agent - performer.

The principal and agent can be both individuals and legal entities.

Important! Considering that agency agreements are concluded in the field of entrepreneurial activity, a government employee or other person who, in the process of carrying out business activities, does not have the goal of making a profit cannot be a party to the agreement as a principal or agent.

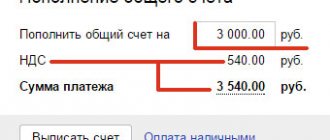

VAT in the payment order

By virtue of paragraph 1 of Art. 39, paragraph 1, art. 146 of the Tax Code of the Russian Federation, reimbursement of expenses to an agent is not a sale and does not create an object of VAT taxation, therefore, it does not require the presentation of VAT and the preparation of an invoice by the taxpayer. That is, formally, when the principal transfers the amount of reimbursement of expenses to the agent, there is no need to allocate VAT as a separate line.

At the same time, the details, form, and details numbers of the payment order are established by Appendices 1-3 to the Regulation of the Bank of Russia of the Russian Federation dated June 19, 2012 N 383-P “On the rules for transferring funds” (hereinafter referred to as Regulation N 383-P). The “Purpose of payment” field of the payment order provides an indication of the purpose of payment, the name of goods, works, services, the number and date of contracts, commodity documents, and may also indicate other necessary information, including in accordance with the law, including VAT (clause 24 Appendix 1 to Regulation N 383-P).

When accepting a payment order, the bank is obliged to check the completion of the “Purpose of payment” details regarding the presence of the name of the paid service, reference to the number and date of the agreement or product document (Message of the Bank of Russia dated December 27, 2012 “Answers to questions on the application of the Bank of Russia Regulations dated June 19, 2012 N 383-P “On the rules for transferring funds”).

As explained in the Message of the Bank of Russia dated 03/01/2013 “Answers to questions on the application of Bank of Russia Regulation No. 383-P dated 06/19/2012 “On the rules for transferring funds”, the requirement to indicate in payment documents information about the payment or non-payment of VAT is established by the Tax Code RF, which stipulates that in payment documents, including registers of checks and registers for receiving funds from a letter of credit, primary accounting documents and invoices, the corresponding amount of tax is allocated as a separate line (clause 4 of Article 168 of the Tax Code of the Russian Federation). That is, in terms of indicating VAT in the purpose of payment, Regulation N 383-P refers to the norms of the Tax Code of the Russian Federation.

It turns out that if VAT is included in the cost of services, then in the payment order by which compensation for the cost of these services is made, VAT is indicated in the amount reflected, in particular, in the invoice.

At the same time, let us recall that in Art. Art. 168 and 169 of the Tax Code of the Russian Federation there are no special provisions regulating the procedure for issuing invoices by commission agents (agents). However, the financial department, with reference to the Rules for filling out an invoice used in calculations for value added tax, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax cost”, notes that commission agents (agents) draw up invoices to principals (principals) for goods (work, services) purchased for them based on invoices received from sellers. The specified Rules do not establish any exceptions for commission agents (agents) applying the simplified tax system (letter of the Ministry of Finance of Russia dated July 20, 2012 N 03-07-09/86, dated September 30, 2014 N 03-07-14/48815).

We also note that clause 1.25 of Regulation N 383-P states that banks do not interfere in the contractual relations of clients. Mutual claims regarding settlements between the payer and the recipient of funds, except those arising through the fault of banks, are resolved in the manner prescribed by law without the participation of banks.

Expert of the Legal Consulting Service GARANT

Member of the Chamber of Tax Consultants Dmitry Gusikhin

Agent and principal: payment accounting

The taxation of a transaction often depends on what agreement the company has entered into with its partner for its implementation. If the organization’s cash receipts include funds received under an agency agreement, then the accountant needs to remember the peculiarities of their accounting.

Agreement: features and differences In accordance with an agency agreement, one party (agent) undertakes, for a fee, to perform on behalf of the other party (principal) any actions on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal (clause 1 Article 1005 of the Civil Code). Moreover, if an agent makes transactions on his own behalf, then he is responsible for the execution of the contract and acquires rights under it. In the case when an agent makes a transaction on behalf of the principal, the rights and obligations arise from the principal.

An agency agreement has much in common with commission and assignment agreements. The difference is that the agency agreement provides not only for the execution of transactions (as an agency and commission agreement), but also for the performance of actual actions. For example, this could be collecting information, preparing and conducting negotiations.

The Civil Code calls an essential condition of an agency agreement (that is, one without which it is invalid) only the subject of the agreement - these are the actions performed by the agent.

Such agreements, in particular, are used by mobile phone stores. According to it, the organization (communication shop) provides the operator with services for accepting payments from subscribers for mobile communications and transfers the received funds to the operator. Payment from subscribers goes to the organization's cash desk, and the operator receives a notification about it. Funds are credited to the organization's current account and subsequently sent to the operator's current account. In this case, the organization acts as an agent on behalf of the principal - the telecom operator. The rights and obligations under the contract, stipulated by the payment by subscribers, arise with the telecom operator. This is also stated in the letter of the Department of Tax Administration for Moscow dated November 21, 2005 No. 18-12/3/85786.

Encouraging inventors

A specialist may spend some time creating an object of industrial property. As a result, the organization pays him royalties. This type of incentive has the nature of remuneration and has stimulating and compensating features.

On the one hand, royalties increase the employee’s interest in working on further improving his invention. On the other hand, they compensate for moral losses from realizing the impossibility of owning the rights to the product.

Provisions of the agency agreement

The agreement is concluded in writing with the inclusion of mandatory conditions that define the main points of accounting. The document states:

- The range of legal actions of the agent. An agreement that does not contain the subject matter may be declared void. A list of acceptable transactions and restrictions on them (acceptance of payments, filing claims, etc.) is indicated.

- The person on whose behalf the intermediary will act (his own or the principal).

- The amount of payment is set as a fixed amount or a percentage of the selected indicator.

- Agent's expenses reimbursed under the contract.

- Deadlines for submitting a report on fulfilled obligations. The absence of an indication of the frequency of agent reporting allows you to provide data as transactions are completed or the contract expires.

In the standard version, a list of expenses incurred by the agent is presented as part of the reporting. Additional conditions include the conditions for termination and the possibility of assigning rights in the form of a subagency agreement.

Features of agent accounting

Receipts to the intermediary from partners and property received to fulfill obligations are not income of the agent. The agent may participate in settlements of the principal amounts of the contract or settlements are made directly from third parties. The procedure for making payments is established by the agreement.

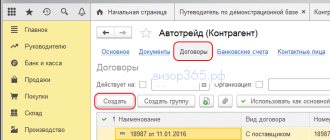

Accounting for transactions with the agent is carried out on , to which sub-accounts are opened with numbering assigned in an order convenient for accounting:

- 76/1 “Settlements of obligations” for accounting for receipts and transfers under the intermediary agreement.

- 76/2 “Calculations of remuneration” for accounting for accrued and transferred amounts of remuneration.

- 76/3 “Calculations for compensation of expenses” for conducting operations to record the agent’s expenses related to the fulfillment of obligations.

If intermediaries within the framework of agency agreements must take into account operations for the supply of inventory items, account 002 “Inventory items accepted for safekeeping” is used to account for material assets. The assets received by the agent do not become the property of the intermediary and continue to belong to the principal.

The execution of the principal's transactions depends on the agent's report data. The principal's revenue is all income received from the transaction. The expense part consists of the amounts paid for receiving the goods and the agent's remuneration.

An agency agreement has certain features (you can become more familiar with them by studying a sample agency agreement), which include the following:

- An agency agreement is of a continuing nature, which means that it cannot be concluded for the completion of any one specific transaction. That is, under an agency agreement, the agent undertakes to perform (and not perform) certain actions for the principal.

- Like a commission agreement, an agency agreement may limit the agent's actions to a certain territory.

- The contract may contain a provision that the agent undertakes not to enter into similar agreements with other principals or a similar condition for the principal, according to which he cannot enter into such agreements with other agents.

- The principal fully funds the agent to carry out his instructions, since the agent always acts on behalf of the principal.

- In most cases, an agency agreement implies the possibility of the agent concluding a subagency agreement. That is, the agent can shift his obligations under the contract to a third party (the exception is contracts in which such a possibility is excluded by agreement of the parties).

Forms

The Labor Code stipulates various forms of remuneration, trying to take into account all the abundance of types of employer-employee relationships. The following options are worth considering.

Forms of remuneration. Photo: en.ppt-online.org

Time wages

The most common payment option for work in post-Soviet countries, including the Russian Federation. This can be either an hourly wage or monthly payments. First, it is calculated how many hours/days a person has worked, then this indicator is multiplied by the current rate and the amount required for payment is obtained. Its size may be affected by bonuses that are either issued on the initiative of management or are provided for in the employment contract when it is drawn up and when a person is hired.

Interesting fact! It is common to use a salary - the amount specified in the employment contract, which is guaranteed to be paid monthly. In practice, the salary often does not depend on the actual amount of time worked, but here the initiative is entirely on the side of the authorities and depends on the relationships established in fact between specific people.

Piece wages

The definition of piecework payment is more complex than in the previous case; there are the following varieties:

- Direct piecework wages . In this case, the employer sets certain prices per unit of actions performed, parts produced, etc. employee. Accordingly, the hired worker receives a certain final amount based on the amount of work performed. With this form of relationship, the person’s qualification level is taken into account;

- Piece-bonus wages. A more complex version of the previous type of payment, which, in addition to the payment of funds for each useful action, also provides for the receipt of a bonus issued for exceeding the established production plan;

- Piece-progressive wages. This provides for gradual progress, including increased pay depending on output. Any work above the norm is paid additionally;

- Indirect piecework wages. It is used to calculate payments to employees involved in servicing workplaces, for example, adjusters, assemblers, etc. Since the success of the workers’ activities depends on their work, the salary is calculated by multiplying the indirect piece rate by labor productivity, that is, the amount of work actually performed by the workers on the equipment.

Formula: Piecework wages.

Photo: infourok.ru There are also other options:

- time-based bonus wages,

- chord,

- mixed forms of payment.

The latter is the most common, as it allows management to approach the payment of salaries in the most flexible manner, taking into account as much as possible the wishes and characteristics of the work activity of each employee.

What is the correct purpose of payment?

Hello. Under an agency agreement, I issue parcels and accept cash via courier services Boxberry, DPD, etc. You have to collect cash yourself; for what purpose of payment is it better to transfer it to the account? These funds are not mine and I transfer 100% of the funds accepted by me back to the courier services, and once a month I receive an agent’s remuneration. simplified tax system at 6%. I would like the tax authorities not to consider this as my money, and on the other hand, I am not a paying agent.

Hello, do you have an agency agreement stipulating that you receive funds due to your principal, they will not be included in the accrual base

the agent on the usn does not take into account in his income:

1) property (including funds) that was received by him in connection with the fulfillment of obligations under the intermediary agreement. In particular, these may be: - funds transferred to the intermediary by the principal for the purpose of purchasing goods (works, services) from third parties for the principal; 2) property (including funds) that was received by the intermediary to reimburse the costs incurred by him on behalf of the principal, if such costs are not subject to inclusion in the intermediary’s expenses in accordance with the terms of the concluded agreements, paragraphs. 9 clause 1 art. 251 Tax Code of the Russian Federation

A similar position is expressed regarding the accounting of other people’s funds to determine the income limit of the simplified tax system.

Receipts listed in paragraphs. 9 clause 1 art. 251 of the Tax Code of the Russian Federation are not taken into account when the intermediary determines the income limit for applying the simplified tax system, which is established by clause 4 of Art. 346.13 Tax Code of the Russian Federation Letters of the Ministry of Finance of Russia dated 09/20/2007 N 03-11-04/2/229, dated 05/29/2007 N 03-11-04/2/146, dated 11/07/2006 N 03-11-04/2/232 , Resolution of the Federal Antimonopoly Service of the Moscow District dated November 15, 2011 N A40-121205/10-76-693

Since you receive funds as part of the agent’s activities, questions can only arise regarding confirmation that the funds are transferred specifically in pursuance of the agency agreement.

The agent undertakes, for a fee, to perform, on behalf of the principal (which is usually understood as the seller - a legal entity / individual entrepreneur), legal and other actions on his own behalf, but at the expense of the principal or on behalf and at the expense of the principal. Art. 1005 of the Civil Code of the Russian Federation.

In order for this money not to be considered yours, in the purpose of payment it is worth indicating that the receipt is made in connection with the fulfillment of obligations under an agency agreement, indicate the details of a specific agreement, and subsequently periodically (once a month) with each of your principals (courier service), it is worth signing a deed that will indicate the amounts transferred by you as being transferable in connection with the agreement.

Mandatory compensation incentives

Employee benefits that the employer pays, based on current legislation, are the following additional payments:

— minor employees due to the need to reduce their working hours; — for work on holidays and weekends, as well as overtime; - in case of defective production or failure to meet the required production standards, which occurred through no fault of the employee; - up to the average salary in case of deviations from normal conditions of the production process; - a worker up to the rank assigned to him, if he was sent to perform a task corresponding to a lower qualification.

Payment under an agency agreement payment purpose

In accordance with the terms of the agreement concluded with the telecom operator, the amount of remuneration due to the organization is withheld from the amounts to be transferred to the telecom operator. The agent organization must calculate VAT for payment to the budget on the amount of remuneration (subclause 1, clause 1, article 146, clause 1, article 156 of the Tax Code).

If a transfer designated as “payment for services rendered” is received on the card, this is a sign of income that may have been received by its owner in circumvention of the law. Well, a payment made from a card for some services is a sign of entrepreneurship. But transfers marked “loan” between cards of individuals risk blocking only if they are of a non-standard nature. For example, loans are transferred quite systematically to different recipients. What if you don’t indicate the purpose of the payment at all during the transfer?

Hourly

In the Russian Federation and the post-Soviet space, it is traditional to work at a rate, or for the salary specified in the contract. Salary wages are convenient for both the employer and especially the hired worker, since in fact the amount of time worked is secondary for him, and he usually receives a full salary. But entering hourly wages on the part of the employer is not difficult, since the hours worked by a person are recorded in any case, even when the salary is given for a rate.

Depending on the agreement between employees and the organization, the hourly wage may be as follows: regular, bonus, standardized.

Purpose of payment payment for agency services

According to paragraph 1 of Art. 861 of the Civil Code of the Russian Federation, citizens can make cash payments without restrictions on the amount, if the payments are not related to business activities.

To determine the date of receipt of income, carefully read the clause of the contract that establishes the agency fee and the procedure for its payment.

The airline operates both domestic and international flights. Air tickets are sold through sales agents - Russian organizations. Revenue from agents is received as a total amount for domestic and international transportation; in the “purpose of payment” column, “revenue under agency agreement N... for the period...” is indicated. Is the agent required to indicate the amount of VAT in the payment instructions?

It is important to confirm the economic feasibility of the transaction; this may be a feasibility study. The execution of the principal's transactions depends on the agent's report data. The principal's revenue is all income received from the transaction. The expense part consists of the amounts paid for receiving the goods and the agent's remuneration. Enterprises use account 76 and subaccounts similar to an open agent. The numbering of subaccounts is indicated approximately; the number is assigned by an accounting employee.

Is a contract considered gratuitous if it does not indicate a price?

Regardless of whether the parties indicated the condition in the price agreement or not, the agreement in any case is considered compensated.

If the parties have not determined the amount of remuneration for the agent, the agreement will not be considered not concluded, since the price condition is not essential. In such situations, the amount of remuneration is determined in the manner provided for in paragraph 3 of Art. 424 of the Civil Code of the Russian Federation, taking into account the practice of executing similar agreements.

Article 424 of the Civil Code of the Russian Federation “Price”

Read also: Calculation of advance payment in 2021

How is payment made under an agency agreement?

Since the ownership of material assets purchased for the customer does not pass to the intermediary, the procedure for their acceptance should be specified in the intermediary agreement.

Therefore, the question is very popular now: how to transfer money using a card, so as not to provoke the bank again and avoid problems with blocking?

When transferring funds to an agent, is it necessary for the principal to indicate in the payment order the amount of VAT re-billed on the basis of the invoice?

Particularly difficult in the taxation of transactions under commission agreements is the preparation of invoices for VAT deduction. The principal receives from the commission agent separately issued invoices for the amounts received from the supplier and for the remuneration accrued under the contract. Additionally, the principal is given a copy of the invoice issued by the supplier to the commission agent for storage.