Exporting goods and own products outside of Russia is a financially profitable operation for taxpayers. The legislation provides for a special procedure for calculating and refunding value added tax (VAT) for enterprises involved in export activities:

- the VAT rate on goods/services shipped for export is set at 0%;

- tax paid on the purchase of products intended for export abroad is subject to reimbursement from the state budget.

Due to the need to return from the budget VAT paid on Russian territory, fiscal authorities pay special attention to enterprises that use export operations. An unreasonably claimed VAT refund or failure to comply with the regulations for confirming the right to apply a preferential tax rate is fraught with substantial additional payments to the budget and penalties.

VAT when exporting goods from Russia

The peculiarities of the value added tax when exporting products are discussed in clause 2 of Art. 151, paragraph 1, art. 164, paragraph 1, art. 165, paragraph 9 of Art. 167 of the Tax Code of Russia. Exported goods and materials are not sold to Russian consumers, so the state returns the tax previously paid by the manufacturer. The terms “no tax paid” and “0% rate” are used synonymously. All primary documents confirming the export of goods that should be submitted to the tax office are specified in the agreement on the Eurasian Economic Union dated May 29, 2014 (Appendix No. 18) and in Article 165 of the Tax Code of the Russian Federation. Taxpayers and agents provide supporting documents in electronic format; the validity of the provisions is enshrined in the order of the Federal Tax Service dated September 30, 2015 No. ММВ-7-15/427.

Shipment of goods by a Russian supplier from abroad

Let's imagine the situation. A Russian manufacturer sells its products to a foreign partner. In this case, the manufacturing plant is located on the territory of a third state, from where the shipment is made, bypassing Russian territory. Is this an export or not, and what about VAT?

The law says the following. We can talk about the emergence of an object subject to VAT only when it is sold on the territory of the Russian Federation. Russia is recognized as a place of sale only if the goods were on its territory at the time of shipment or transportation. In the case under consideration, the Russian Federation is not the place of sale and, therefore, there can be no talk of any VAT or its reimbursement.

Tax accounting and VAT reporting for export

In tax accounting, operations for the export of goods are recorded separately from the rest, using special registers. Organizations are required to maintain separate VAT accounting for exports and domestic sales of goods, works and services. It consists of using subaccounts and separate statements and journals. Sections 4-6 are completed in the tax return:

- if the zero rate is confirmed, then sheet 4 of the declaration is drawn up;

- if not confirmed - sheet 6 of the declaration;

- sheet 5 is rarely used.

The declaration form identifies more types of export transactions than the Tax Code of the Russian Federation - an individual accounting register is provided for each of them.

ConsultantPlus experts analyzed in detail the specifics of taxation during exports: how to calculate VAT, what rates to use, how to maintain separate accounting. Use these instructions for free.

Consequences of non-compliance by the exporter with the prescribed regulations

The absence of a complete package of documents or failure to submit them to the tax authority results in the following sanctions for the exporter:

- additional VAT at a rate of 18% (10% when exporting goods from the relevant list);

- the tax base is determined by the moment the cargo actually crosses the border of the Russian Federation;

- calculation of penalties from the date of shipment of goods.

If the exporter is late in providing documents, he can count on a VAT refund in the next tax period. After the full list of documents is submitted to the Federal Tax Service, the supervisory authority decides to conduct a desk audit.

However, this procedure will begin only from the beginning of the next quarter and will last three months.

Tax rate for exporters

The tax rate for the export of goods from Russia is 0% (subclause 1, clause 1, article 164 of the Tax Code of the Russian Federation). In other words, exporters are not exempt from value added tax: they are its payers, must submit declarations, and have the right to claim deductions for incoming amounts. To take advantage of the preferences, you must confirm your export transactions. They must be confirmed by documents provided for in Article 165 of the Tax Code of the Russian Federation.

Here are the main documents for confirming a 0 rate when exporting in 2021:

- original or copy of a foreign trade contract;

- customs declaration;

- copies of transport and shipping certificates.

In addition, the zero rate applies to the customs regimes listed in paragraph 2 of Art. 151 Tax Code of the Russian Federation:

- export;

- customs warehouse for export;

- free customs zone;

- re-export;

- removal of supplies.

Deadline for collecting supporting documents

The period for confirming the legality of using the 0% rate is uniform (180 days) and does not depend on the specific situation for which such a rate is applied, but it can start from different dates (clause 9 of Article 165 of the Tax Code of the Russian Federation):

- placing goods under customs regime;

- export from the territory of the Russian Federation;

- preparation of documents accompanying the goods;

- execution of a document confirming the provision of services.

The generated set of documents must be submitted to the Federal Tax Service along with the tax return issued for the period in which this set was collected (clause 10 of Article 165 of the Tax Code of the Russian Federation).

Right to refuse

From 2021, 0% value added tax on exports has become not an obligation, but a right of payers. They were given the opportunity not to officially apply the exemption to exported goods. Refusal is possible for all export transactions as a whole, provided that an application is submitted to the tax service no later than the 1st day of the quarter from which the taxpayer plans to pay VAT according to the usual rules.

IMPORTANT!

You cannot refuse the zero rate when exporting to the EAEU. The provisions of the Treaty on the EAEU regarding the justification of clause 3 of the protocol do not provide for such an opportunity for taxpayers (clause 1 of Article 7 of the Tax Code of the Russian Federation).

The total period of refusal is no less than a year. Payers need this if they want to accept tax deductible at rates of 20% or 10% from suppliers who, having the right to a zero rate, do not want to confirm it, highlighting the regular tax in their invoices. To apply this benefit, the company will have to collect documents to confirm the 0 rate for export and submit them to the Federal Tax Service.

In past periods, tax authorities paid close attention to those who regularly “forget” to collect the necessary documents. Organizations were cunning, tried to buy VAT documents, carried out some export operations at the usual rate of 10% or 20% (18% until 2021), but processed something at 0%. Now there is no need to resort to such difficulties.

Export to other foreign countries

When exporting goods to countries outside the EAEU, you can confirm the application of a 0% VAT rate with the appropriate documents:

Articles on the topic (click to view)

- Commitment or document? // BC found out what a manufacturer's warranty is

- About sales receipts: filling out, issuing

- What is the fine for driving on a toll road without paying?

- Visa to Spain for Russians - 2021: how to apply for it yourself

- Difference between a loan and a credit card - how a credit card differs from a loan

- Accounting for financial guarantees

- What does judicial practice on bankruptcy of individuals indicate?

- a copy of the foreign trade contract or, in its absence, an acceptance or offer;

- agreement for the provision of intermediary services - if the export is carried out through a third party (attorney, agent, intermediary);

- customs declaration (copy or register in electronic form);

- commodity and transport documents (bill of lading, CMR waybill, air or combined waybills).

All documents presented must have official marks from customs services, indicating the actual export of goods from the territory of Russia.

During a desk audit, tax authorities may request bank statements or invoices for an export transaction, so it is advisable for the seller to prepare copies of documents to be attached to the VAT return.

VAT tax base for export of goods

The tax base for value added tax when selling goods for export from the Russian Federation is determined as the cost of goods under the terms of concluded agreements (clause 1 of Article 154 of the Tax Code of the Russian Federation).

Please note that the tax base should be determined exclusively in Russian rubles. If the contract is concluded in a foreign currency, then recalculate at the official ruble exchange rate of the Central Bank of Russia on the date of shipment of the goods.

But the moment of determining the tax base for an export transaction directly depends on when you collected the package of documents. Please note that when exporting goods to the EAEU, the tax base is determined in the following order:

- If documents and confirmations are prepared within 180 days from the moment the goods are determined to be subject to the customs export procedure, then determine the tax base as the last day of the reporting quarter in which the documents were collected and include the information in the declaration.

- If documents and confirmations were collected after 180 days, then determine the tax base at the time of shipment.

For transactions with partners in the EAEU, please note that the confirmation period for the 0 VAT rate for export is 180 days from the date of shipment. This affects the determination of the tax base. VAT at a rate of 0% on the advance payment is not required to be charged and paid, according to the general rules.

IMPORTANT!

In his work, the taxpayer is obliged to organize separate accounting when registering transactions of a different nature. For example, when exporting raw materials and non-commodity goods and when producing products for sale in the Russian Federation. Methods for maintaining separate accounting should find a place in the accounting policy of the entity.

Deduction for export transactions

Exporter in accordance with Art. 172 of the Tax Code of the Russian Federation can take advantage of the deduction. At the same time, for export transactions, the deduction is applied to the amounts of input VAT, i.e., the tax paid upon the acquisition of goods (work, services) subsequently sent for export. From July 1, 2016, the deduction of input VAT for exporters of primary and non-commodity goods is carried out according to different rules.

You will learn which goods are classified as raw materials from the material “Which goods are raw materials for deducting VAT from the exporter .

Read about the use of deductions by exporters of non-commodity goods in the material “Non-commodity exporters apply deductions according to general rules .

Exporters of primary goods must restore input VAT on purchased goods (works, services) that are used for export operations. When this needs to be done, read the material “VAT on goods that are used for the export of raw materials is restored” .

In what cases is it not necessary to distribute input VAT on indirect costs, read the article “ Is it necessary to distribute “input” VAT on indirect costs between domestic and export sales?” .

You can also read about the specifics of applying the deduction within the framework of export operations in the article “ How to apply a VAT deduction for export operations .”

Refund, refund or deduction of VAT on export

All three terms meaning reduction or exemption from tax payments are often found on the Internet, and they are easy to confuse:

- the deduction refers to the calculation of the amount of tax (Article 171), determined by the enterprise itself when filing a declaration;

- refund or return of VAT when exporting from Russia is a general concept for offset and return (Article 176), the issue is decided by the Federal Tax Service on the basis of submitted documents: declarations and applications.

Paying taxes often leads to a situation where, due to deductions, the tax amount becomes negative. Further steps for tax refund:

- The company submits a declaration and an application for credit or refund of VAT. Offset on the declaration - the amount goes towards fines, arrears or future payments; If the documents indicate a return, the amount is transferred to a bank account.

- The tax office checks information in reporting declarations within three months, as provided for in Article 88 of the Tax Code of the Russian Federation on a 0 percent VAT rate for exports. Tax authorities are authorized to request additional documents, such as copies of invoices, sales ledgers or clarifying declarations.

- She then makes a decision within seven days about full, partial, or refusal of reimbursement. The form of compensation - offset or refund - is determined either by the Federal Tax Service to cover arrears to the budget, or according to the application.

- The Federal Inspectorate sends payment documents to the Treasury the next day after the decision on the return is made. The money is transferred by the Treasury within five days.

When can an exporter receive budget money?

Upon completion of a three-month desk audit, the tax service makes a decision in which it orders the exporting company to fully or partially reimburse the “input” VAT paid. The law allocates the supervisory authority no more than 7 calendar days to make a decision.

The taxpayer may declare his intention to use the refund amount to cover the existing arrears on mandatory payments. If such an application is not received by the Federal Tax Service, the compensation amount must be received in the exporter’s current account within five banking days.

Step-by-step instructions for confirming the zero VAT rate for export

When exporting to Belarus, Kazakhstan, Armenia, zero VAT is confirmed:

- An agreement under which a buyer from an EAEU country imports products.

- Application for import of goods and payment of indirect taxes from the buyer.

- Transport or shipping documents (consignment note TTN is recommended).

How to confirm the 0 VAT rate when exporting to other countries - send to the Federal Tax Service:

- An agreement or other documents related to the transaction, if there is no agreement (for example, an offer and acceptance).

- A copy of the customs declaration or an electronic register (a separate register is provided for each type of transaction).

- Copies of transport or shipping documents with customs marks or their electronic register.

Other documents (bank statements, invoices) do not have to be attached to the declaration, but should be kept in case the tax office asks to confirm the information specified in the declaration.

If the taxpayer has not provided documents confirming the zero tax rate, then VAT must be calculated according to general principles, and all calculations must be disclosed in the declaration. For example, at a rate of 10% or 20%.

Where and in what form to submit documents

It is necessary to submit documents to confirm zero VAT to the tax office at the place of registration of the legal entity - this can be done on paper or in the form of electronic registers through the electronic document management (EDF) operator system.

As a rule, a paper package of documents to confirm 0% VAT is used by small companies that have 10–30 deliveries of goods during the year. And large participants in foreign trade activities that move goods in large volumes submit electronic registers to the Federal Tax Service.

5% rule

The 5% rule refers to the procedure for assessing VAT on business transactions, in which the taxpayer must keep separate records of transactions that are subject to VAT and those that are not subject to or subject to taxation at different rates, in accordance with Art. 170 Tax Code of the Russian Federation (Part.

2) dated 05.08.2000 No. 117-FZ. Keeping 2 types of records is very cumbersome and it is very easy to get confused. But as of July 1, 2021, this rule has been significantly adjusted and simplified in many ways. Let's look at the situation using an example.

Let’s say a business entity carries out transactions both subject to VAT and non-taxable. In this case, the subject in accordance with paragraph.

4 tbsp. 170 of the Tax Code of the Russian Federation is required to keep separate records for these transactions.

But some types of general business expenses (for example, selling or administrative) are difficult to separate between the two types of transactions performed. It is for such expenses that the “5% Rule” exists.

Its essence is as follows: if the limit is 5% of the total volume of VAT-free acquisitions of goods, works or services, then it has the right to deduct the entire volume of input tax for the reporting period, including that part that relates to the above goods, works or services. This conclusion is contained in the letter of the Federal Tax Service of the Russian Federation No. ШС-6-3/827 dated November 13, 2008.

This rule represents a relaxation for businesses in terms of separate accounting. In essence, this means that if transactions with a preferential VAT tax regime are episodic for a company, which is expressed in a low level of expenses for them (1/20 of the total costs), then there is no need to complicate your task and keep separate records of operations.

And this has already become the rule of law.

- If all costs are aimed exclusively at preferential types of transactions (not subject to VAT at a rate of 18%), then the amount of input tax should be included in the prices of goods, works and services that are exempt from VAT.

Thus, as part of the reduction in budget revenues and in the absence of prerequisites for their growth, the Government of the Russian Federation is taking a number of fiscal measures - in particular, a law has been adopted to increase the VAT rate in 2021 to 20%. In this regard, any amendments that facilitate accounting and indirectly provide competitive advantages to domestic small and medium-sized businesses are constructive and beneficial for the entire economy as a whole.

Detailing the VAT accounting algorithm in different modes (including during export operations) is just such a case.

Before carrying out export operations, you must study VAT accounting, its rates, types and features of calculation. In our article you will find answers to questions about tax preferences for exports in 2021, registration of transactions and declaration of these transactions.

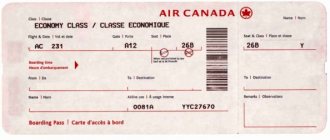

Shipping documents

International transportation can be carried out by different types of transport. For each of them a corresponding invoice is issued:

- bill of lading is governed by the Convention on the Carriage of Goods by Sea;

- air waybill was developed by the Convention for the Unification of Rules for Air Transport;

- CMR is issued for each auto delivery;

- The frachtbrief original is drawn up according to the rules of Federal Law No. 18 “Charter of Railway Transport”.

Copies of shipping documents must contain marks from the customs authority.

Statement from the bank

Although a bank statement is a supporting document, it does not contain all the information on the transaction. You additionally need to attach a payment order or swift message to it. The Federal Tax Service requires an extract only when carrying out goods exchange transactions.

If the revenue came from a third party, then it is necessary to submit a contract of agency between the foreign company and the payer. By the way. Since 2006, all export transactions must be paid by the buyer from a bank account.

Tax principles

The destination country imposes tax on all imported goods. It is paid by the end consumer. In the country of origin, VAT is imposed on all local goods, regardless of the place where they are consumed. The absence of export duties indicates signs of free trade. Although Russia has not joined the WTO, it is still necessary to take into account these principles of taxation of foreign economic transactions. In the Russian Federation, all export transactions are subject to a zero rate.

Overpricing

To obtain a VAT refund when exporting a car from Russia, an overvaluation scheme is used. The higher the price indicated in the documents, the more VAT will be refundable. At the same time, there is one obligatory condition - foreign exchange earnings must go directly to the exporter’s account. In this case, an additional expense item will appear. You will have to pay a percentage of foreign currency earnings to the state. This is how VAT is refunded when exporting cars from Russia.