VAT restoration is an operation that reflects the restoration of an accrued tax amount that was previously declared as a deduction. In simple words, the taxpayer has lost the right to use the benefit, and obligations to the Federal Tax Service must be restored and paid to the budget. There are quite a few reasons for carrying out this operation. In addition, accounting is individual for each case. How to restore VAT previously accepted for deduction, postings and accounting features will be discussed in the article.

Payers of value added tax have not only obligations to calculate and pay money to the budget. Also, this category of entities has the right to reduce tax obligations on a number of business transactions. For example, the amount of tax paid to suppliers for the supply of goods, works, and services used in taxable activities can be declared in the form of a deduction. That is, the amount of obligations to the budget is reduced by the amount of confirmed and declared deductions.

In practice, it often happens that the right to a tax deduction is lost after a certain time or as a result of various kinds of reasons. For example, the same product purchased for conducting activities subject to VAT began to be used in activities exempt from VAT. Consequently, the deduction provided earlier becomes unjustified. This means that it must be restored and paid into the budget. And this is far from the only case in which VAT restoration is required.

VAT on advances

According to the existing methodology, when accepting assets (goods, works, services) for accounting, or when returning an advance due to termination of a contract, VAT must be restored, previously accepted for deduction from the prepayment. These are more technical manipulations, understandable and not controversial.

Letter of the Ministry of Finance dated February 8, 2021 No. 03-07-11/7650 clarified the situation when an advance was issued for one product, but in fact, by agreement of the parties, another product was received as an advance payment. According to the Ministry of Finance, when replacing one product with another within the same transaction, the advance payment does not return. And despite the fact that a different product is indicated in the invoice for the advance payment, there is no need to restore VAT - which the tax authorities previously insisted on.

But do not confuse the replacement of goods with offset. In case of offset, the transaction is terminated. And the advance is considered returned. With all the ensuing consequences: 1) the seller on the date of offset can deduct the VAT that was accrued on the advances received and 2) the buyer, during offset, must restore the VAT if he accepted it for deduction upon prepayment. Letter of the Ministry of Finance dated April 1, 2014 No. 03-07-R3/14444 is about this.

Changes to VAT for exports and a new list of documents to confirm the zero rate

These changes come into effect on April 1, 2021. They will affect those who declare a zero rate and export. According to the changes, the list of documents that need to confirm this zero rate is changing.

For international postal shipments or for express cargo, a customs declaration register is added to the list of documents. It is maintained electronically. This register will need to be included in the package of documents that are collected to confirm the zero rate. Without it, the package of documents will be incomplete, and tax authorities can easily refuse to apply the zero rate.

Elena Strokova, 3rd class adviser to the State Civil Service of the Russian Federation, expert consultant on taxes and accounting, tells more about the changes:

When is VAT required to be restored by law?

The situations are listed in paragraph 3 of Article 170 of the Tax Code. This:

1) Transfer of property (intangible assets and property rights) as a contribution to the authorized capital (or contribution to an investment partnership, share contribution of a cooperative or when replenishing the target capital of an NPO).

The company that received the assets has the right to deduct VAT recovered by the transferring party. Based on documents on the transfer of assets (with the allocation of the VAT amount).

VAT must be restored in the quarter in which the property is actually transferred.

2) The company switches to a special regime: simplified tax system, UTII or PSN (IP)

VAT should be restored in the quarter preceding the transition to the special regime. The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

3) The company decided to apply the VAT exemption under Article 145 of the Tax Code.

The procedure for VAT recovery depends on the date of application of such exemption:

If the company applies the exemption from the first month of the quarter, VAT is restored in the previous quarter (before the start of the exemption). If the transition to the exemption is from the second or third month of the quarter, VAT should be restored from the current quarter.

The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

4) The company received budget investments or subsidies to compensate for previously incurred expenses for the acquisition of assets and payment for work (or services).

5) The company's assets began to be used for transactions that are not subject to VAT - not subject to taxation, exempt from taxation, not recognized as sales for VAT purposes.

Non-VAT-taxable transactions and conditions are listed in Article 149, paragraph 2 of Article 146 of the Tax Code.

VAT is reinstated in the quarter in which assets began to be used in non-VAT-taxable transactions. The restored amount of VAT can be recognized as part of other expenses when calculating income tax.

In general, the amount of “input” VAT that the company previously declared for deduction is restored in proportion to the book value of the assets. Which is determined according to accounting data - taking into account accrued depreciation at the time of transition. Without taking into account revaluation.

A special procedure has been established for real estate and for adjusting VAT when receiving budget funds.

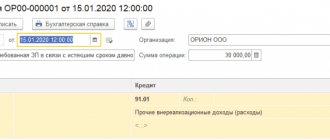

Postings when restoring tax

Actions with tax previously used as a deduction when paying to the budget are reflected in accounting on accounts 19, 68, 91, etc. For more information about transactions for VAT restoration , read our article “The nuances of VAT restoration and what transactions are used in this?” .

Reflection of operations to recover VAT from advance payments is also accompanied by recording of accounting entries. You will find complete information about them in the article “Procedure for recovering VAT from advances (postings).”

Restoration of VAT on real estate

On real estate, VAT is restored not at once, but in equal shares over 10 years.

The 10-year period is counted from the year in which real estate depreciation began. And VAT needs to be restored only in those years when the property was used in non-VAT-taxable transactions. For other years (when the object was used in VAT-taxable activities), it is not possible to recover VAT. The technique is simple. Once you understand the examples, there will be no difficulties in the calculations.

If the property is fully depreciated or more than 15 years have passed since it was put into operation, there is no need to restore VAT on it.

Subsidies and VAT

The effect of received budget funds on the payment of VAT directly depends on the purpose of these subsidies.

- If subsidies are received to reimburse (finance) expenses: a VAT tax deduction for goods (work, services) purchased through subsidies is not claimed. Or restored if previously accepted.

- If subsidies are received to compensate for lost income: upon receipt they are included in the VAT tax base. VAT deductions for purchased goods (works, services) are recognized in the general manner and cannot be restored.

- If subsidies are received to compensate for lost income when applying state-regulated prices or benefits to individual consumers in accordance with the law : such subsidies are not included in the tax base, VAT deductions for purchased goods (works, services) are recognized in the general manner and cannot be restored.

When adjusting (restoring) VAT upon receipt of budget funds, the calculation takes into account the type of reimbursed expenses (taxable or non-taxable), their volumes, the period of receipt, and the share of reimbursement of expenses through subsidies is calculated. Also a simple formula.

What amount is restored?

The amount of obligations that must be fulfilled to the state treasury is calculated based on the results of each fiscal period as reduced by the amount of fiscal deductions and increased by the amount of the restored tax. Thus, the amount of VAT subject to recovery is calculated using the following formula:

VATsupl = VATaccrual – VATvych + VATvost, where

VAT is the amount of tax payable;

VAT accrual – the amount of the accrued mandatory payment;

VATvych – the amount of tax deduction;

VATvost – the amount of the restored payment to the budget.

Write-off of assets: fixed assets, goods, materials

Until 2021, the issue of restoring VAT when writing off fixed assets, goods, and materials remained acute and controversial. But under the pressure of court decisions - most of them taken in favor of business - the regulatory authorities sharply changed their position to the opposite. (Bravo!). And they secured it with letters: Ministry of Finance dated March 2, 2021 No. 03-03-06/1/13389 and Federal Tax Service dated April 16, 2021 No. SD-4-3 / [email protected]

Arbitration practice over the years has clearly confirmed that when fixed assets are liquidated before the end of their useful life due to physical or moral wear and tear, or when goods or materials are written off, there are no grounds for VAT recovery. Since this is not provided for in paragraph 3 of Article 170 of the Tax Code.

The controllers butted heads for a long time, but finally agreed to this: Paragraph 3 of Article 170 of the Tax Code establishes cases in which tax amounts are subject to restoration. In cases not listed in paragraph 3 of Article 170, VAT amounts are not subject to recovery. (Quote from a letter from the Ministry of Finance)

You will not have to recover VAT in the event of an accident, fire, natural disaster or other loss of property due to circumstances beyond the control of the company. And also when the shelf life expires or due to natural loss.

It does not matter on what basis the assets were written off. The main thing is that they were purchased for VAT-taxable activities.

Also catch current letters from the Ministry of Finance of Russia dated May 15, 2021 No. 03-07-11/34572, dated March 15, 2021 No. 03-03-06/1/15834 and the Federal Tax Service dated May 21, 2015 No. GD-4- 3/ [email protected] /.

This is the general case, but the specifics may be different.

In the recent ruling of the Supreme Court dated December 21, 2021 No. 306-KG18-13567, a special clause was noted that the company does not lose the right to deduct VAT if the inability to use fixed assets is due to the occurrence of unfavorable events, and not the taxpayer’s refusal to conduct business.

For example, if fixed assets were liquidated voluntarily - for example, in connection with the cessation of any type of activity, or in connection with the liquidation of a company - the tax office may require VAT restoration.

Results

VAT must be restored if the assets on which VAT was claimed for refund began to be used for non-taxable transactions. All cases when it is necessary to restore VAT are named in Art. 170 Tax Code of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- PBU 19/02, approved. by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

And again the focus is on tax benefits

In their letters, the Ministry of Finance and the Federal Tax Service, including on issues of VAT restoration, refer to the position of the arbitrators given in paragraph 10 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 N 33 “On some issues that arise in arbitration courts when considering cases related to the collection of tax for added value."

Controllers have changed tactics: all cases of asset write-off are now closely studied through the prism of unjustified tax benefits.

Now, for each fact of write-off of property, companies themselves have to prove that the disposal of assets was facilitated by circumstances beyond its control. And stock up on relevant documents and confirmations.

Tax authorities and courts are ordered to:

- evaluate the accuracy and completeness of the submitted documents on the disposal of property,

- investigate and take into account the circumstances of disposal, the nature of the taxpayer’s activities and the conditions of its business,

- take into account the compliance of the volume and frequency of disposal of property with the level usual for such activities,

- assess the likelihood of disposal of property for reasons specified by the company,

- evaluate the excessiveness of losses and the validity of the arguments presented.

All this must be taken into account and documents must be prepared to defend your position. If the tax authorities cannot prove that the company’s actions are aimed at obtaining an unjustified tax benefit, there will be no need to restore VAT when writing off assets.

And further. When writing off assets, courts pay attention to the completeness and correctness of supporting primary documents. Reliable evidence of damage, loss, evidence of their disposal. The bigger, the better.

What are these: orders to create commissions and conduct an inventory in connection with an event that resulted in damage or loss, acts of write-off, acts of damage, of combat, of breakdowns, of the occurrence of events, orders of approval of acts, inventory sheets, documents of disposal.

For write-off acts, you can use both unified forms, and you can develop and approve your own forms of primary documents in the order on accounting policies. From January 1, 2013, the use of unified forms is not mandatory, but the documents developed by the company - to be recognized as full-fledged primary ones - must contain the necessary details and information.

When regulatory authorities require VAT to be restored

The Ministry of Finance and the Federal Tax Service insist on the restoration of VAT in cases where property can no longer be used in the organization’s activities and is not transferred to anyone.

However, extensive arbitration practice indicates that there is no obligation to restore VAT: - in case of shortages, thefts of inventories and fixed assets (Decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 N 10652/06, FAS Resolutions NN A19-19165/06-F02-2618/07, in case No. A17-2257/2008-05-21); — in case of destruction of MPZ and OS as a result of fire and natural disasters (FAS Resolution NN KA-A41/2501-09, in case No. A82-15724/2004-37, in case No. A56-5351/2009); - when writing off fixed assets before the end of the depreciation period due to moral, physical wear and tear or liquidation (FAS Resolutions NN A33-8478/06-F02-375/07, F03-2765/2009, in case N A45-4004/2009); — when writing off goods due to the expiration of their shelf life (FAS Resolution N F04-4806/2007(36309-A03-42)); - for raw materials and materials that turned out to be defective or used for the manufacture of finished products in which a defect was discovered (FAS Resolutions NN F04-4812/2006(25040-A46-31), KA-A41/1528-08, in case N A55-11139 /2008); - when writing off inventories due to loss of marketability (FAS Resolutions in case No. A82-15724/2004-37, in case No. A27-1420/2010). The main argument of all courts is this: the list of cases when it is necessary to restore VAT is given in paragraph 3 of Art. 170 of the Tax Code of the Russian Federation and is closed. Therefore, in all other cases, the input tax does not need to be restored. So, if tax authorities insist on restoring VAT in the above cases and you are ready to argue with them, then you can confidently go to court, they will support you and recognize the additional VAT charge as illegal.

Write-off of accounts receivable

As a general rule, if the contractor returns the advance payment to the customer, he must restore VAT from the advance payment previously accepted for deduction.

But there are situations when the company paid an advance, but the contract was not fulfilled for various reasons and the advance was not returned. Accounts receivable are stuck.

So, the Ministry of Finance believes that when such a “debt” is written off, the VAT on the advance payment, previously accepted for deduction, must be restored. And he even issued a number of categorical letters on this topic: dated 06/05/2018 N 03-07-11/38251 and dated 06/23/2016 N 03-07-11/36478. The motive is this: the services were not provided and there is no right to a deduction for them.

Courts take a business position: The Tax Code does not contain provisions according to which, in the event of termination of a contract or non-fulfillment, the taxpayer is obliged to restore VAT on the amounts of a previously issued advance.

If you find yourself in such a situation, check out the useful resolutions: AS of the Volga District dated November 16, 2021 No. A65-27794/2015 and AS of the West Siberian District dated March 12, 2021 No. A27-27184/2016.

Reducing the price of goods already received by the buyer

The supply agreement between the buyer and seller may contain a clause under which the supplier provides a discount on goods shipped in previous periods. After the price of the product has been reduced, the buyer must recover VAT on the difference between the new price and the one indicated in the shipping documents.

Attention! The new cost of the goods, taking into account the discount provided, must be recorded in the agreement, which will be the basis for adjusting VAT.

The tax restoration at the reduced value is reflected in account 60, intended to record the status of settlements with suppliers.

And if the reorganization

Who must pay VAT in the case when a legal entity created by separation (successor) receives assets from its predecessor upon creation under a transfer deed, and subsequently uses them in VAT-free activities.

According to the current legislation - the Tax Code - no one. The legal predecessor does not have to “restore” VAT. When transferring property, there is no obligation to restore VAT. And such a transfer itself is not recognized as an object of VAT taxation.

The legal successor also has no obligation to charge VAT or restore VAT: VAT is restored by the one who applied the deduction.

There are no legal opportunities to get hold of VAT restoration. But everyone knows that business willingly uses this legislative gap to optimize taxation, including in the well-known scheme for transferring property: when you need to sell property, but don’t want to pay taxes: you “transfer” the property to a new legal entity and sell a share in the authorized capital .

But the controllers have a different opinion. The position of the Ministry of Finance is expressed in letters dated May 3, 2021. No. 03-07-11/29894 and dated April 05, 2021 No. 03-07-11/20201. And it is categorical: if the legal successor uses the received assets for VAT-free transactions, he must restore the VAT accepted for deduction by the legal predecessor.

And the Supreme Court (determination dated October 17, 2014 N 307-KG14-1534, and regional courts on the side of taxpayers: Resolution of the Arbitration Court of the East Siberian District dated March 23, 2021 N F02-1379/2016, Resolutions of the Volga-Vyatka District Arbitration Court dated 27 February 2015 N A17-3124/2014, FAS of the North-Western District dated April 30, 2014 N A52-1617/2013, West Siberian District dated March 14, 2014 N A81-2538/2013, dated June 20, 2021 N A27 -15970/2016, Ural District dated February 25, 2014 N F09-495/14).

The courts' conclusion: the assignee should not restore VAT, since he did not claim the deduction. The obligation to restore VAT in the cases specified in paragraph 3 of Article 170 lies with taxpayers who previously accepted the tax as a deduction. Yes, that's logical.

But if the tax authorities prove the receipt of an unjustified tax benefit for the purpose of non-payment of VAT, reveal the control and interdependence of companies, establish the formality or absence of a business purpose for the reorganization, the judges will support the auditors. There is also such a ruling of the Supreme Court of the Russian Federation dated October 9, 2021. N 305-KG16-7109.

How to recover VAT during reorganization, and who should do it, is still a controversial issue. There is a strange opinion of the court, which, having assigned the obligation to restore VAT to the successor, motivated this by the fact that “ not a single norm of Ch. 21 of the Tax Code of the Russian Federation does not exempt an organization from VAT restoration when switching to a special regime solely on the grounds that before the transition the legal entity carried out a reorganization. A different interpretation of the legal norms would mean that in order to avoid the restoration of VAT when switching to a special regime, the taxpayer would only need to carry out a reorganization.” Yes, a strange interpretation of legal norms... Fortunately, I have found one such “original” solution...

It is possible that the issue of restoring VAT in connection with the reorganization will be resolved in the near future. Bill No. 720839-7 with large-scale changes to the Tax Code is currently under consideration in the State Duma. Among others, it is proposed to define a special procedure for the restoration of VAT amounts accepted for deduction by the reorganized organization: to assign the obligation to restore VAT to the successor in the event of a transition to special taxation regimes.

Or maybe this bill will not pass? Or will it be returned for revision? We keep it under control. Autumn session of legislators.

New VAT benefits for civil aviation in 2021

Amendments to Ch. 21 of the Tax Code of the Russian Federation, which was introduced by Federal Law No. 324-FZ of September 29, 2019, expanded VAT benefits. They come into effect on January 1, 2021.

Thus, a zero VAT rate is established for the import into Russia of civil aircraft subject to registration in the State Register of Civil Aircraft of the Russian Federation, and aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft on the territory of Russia (Article 150 of the Tax Code of the Russian Federation) .

A number of transactions related to civil aviation are also exempt from VAT:

- for the sale of civil aircraft registered in the State Register of Civil Aircraft of the Russian Federation;

- for the transfer or leasing of civil aircraft registered (subject to registration) in the State Register of Civil Aircraft of the Russian Federation;

- for the sale of aircraft engines, spare parts and components used for the construction, repair and modernization of civil aircraft in Russia.