Current as of 01/01/2021, Pavel Sokolov (Expert)

The company's entry into the international space is, of course, a huge breakthrough in its activities, ample opportunities for development, expanding the sales market, and increasing profits. This is a new step in achieving not only profit, but also a certain respectability, solidity, and confidence in the future. However, in addition to material and moral dividends, exporting goods brings a lot of trouble and headaches. First of all, this concerns “legal problems”, that is, the preparation of a package of necessary documents for the export of goods .

In order for your product to reach the buyer safely and on time, you need to understand as thoroughly as possible the algorithm for preparing foreign economic activity and the basic requirements for documentation.

Where and in what form to submit documents

It is necessary to submit documents to confirm zero VAT to the tax office at the place of registration of the legal entity - this can be done on paper or in the form of electronic registers through the electronic document management (EDF) operator system.

As a rule, a paper package of documents to confirm 0% VAT is used by small companies that have 10–30 deliveries of goods during the year. And large participants in foreign trade activities that move goods in large volumes submit electronic registers to the Federal Tax Service.

Features of paperwork for export to China

The large population and the pace of development of the Chinese economy have turned China into one of the most attractive markets from an economic point of view. Export volumes from Russia to China are growing every year. According to data for 2021, China ranks 1st among countries importing Russian goods. The main items of Russian export to China are mineral fuel, oil, petroleum products, timber, ore raw materials, non-ferrous metals, and chemical products. Raw materials for food and light industry, agricultural products - soybeans, fish, etc. are in great demand.

The current situation is favored by the simplicity of completing a package of documents for export to China. Their list differs little from the generally accepted one, for example.

- Certificate of origin of goods.

- A document confirming a restriction or ban on the import of products.

- Documents confirming the classification code of products according to the Product Nomenclature. Etc.

However, it must be taken into account that when carrying out the first export operation, it will be necessary to submit a document that confirms its legal capacity. In addition, for some groups of goods, the Chinese side establishes a list of manufacturers with whom it is ready to cooperate. All other participants in foreign trade activities can also obtain permits for export to the Celestial Empire, but for this they must undergo appropriate accreditation by the Chinese side.

In some cases, China's partners may require that goods be prepared for import into their territory - for example, use packaging and stickers with information in Chinese.

What documents need to be submitted

- If you submit documents on paper, you must submit to the tax office (Article 165 of the Tax Code of the Russian Federation):

- Contract for the supply of goods (or a copy thereof). If the contract has already been submitted to the tax authority, then there is no need to send it again. It is enough to send a notification with the details of the previously submitted document and the name of the tax authority to which it was submitted.

- A customs declaration (or a copy thereof) with a mark from the customs authority on the release of goods and a mark on the actual export of goods from the territory of the Russian Federation.

Until 2021, the exporter also had to submit to the Federal Tax Service copies of transport or shipping documents with a mark from the customs authority on the export of goods. Now these documents are submitted only upon request from the tax authorities.

- If you submit documents electronically through the EDI system, then you need to send to the tax office:

- Electronic register of customs declaration.

Where are we exporting to?

The main flow of exports from our country comes from neighboring countries that are members of the EAEU.

These are Kyrgyzstan, Belarus, Kazakhstan and Armenia.

Export taxation is basically no different from Russian, with the exception of value added tax (VAT). This tax still applies, but at a rate of .

The documents provided to justify this rate differ depending on the country of destination: EAEU countries or other foreign countries.

When are customs stamps needed?

An important condition for confirming zero VAT is the presence of stamps from the customs authority on the customs declaration. Tax legislation provides for two types of marks:

- “Release permitted” - about the placement of goods under the customs export procedure;

- “Goods exported” - about the export of goods from the territory of the Russian Federation.

The original marks are affixed in the form of a rectangular stamp with lilac-pink-blue mastic (the shade depends on the degree of wear of the stamp pad). In addition, the mark can be indicated in the form of information and be an analogue of the original stamp for electronic customs declaration.

Let's figure out in what cases the tax office needs one or another mark and in what form.

"Release permitted"

In a letter dated July 31, 2018 No. SD-4-3/ [email protected], the Federal Tax Service explained: if a company submits a customs declaration in electronic form - and there can be no other option, since 100% of customs declarations in the Russian Federation are submitted in electronic form - then It is enough to present it in the form of information about the release of goods. Such a mark will appear in the document automatically when the customs authority finishes checking the declaration and sends a corresponding message to the customs declaration service.

The Federal Tax Service also clarifies that in the future it is not necessary to affix the original “Release Permitted” stamp to printed copies of customs declarations.

It happens that the accounting department of an exporting company asks for a “Release Permitted” stamp to maintain internal records. Then the stamp can be obtained at the customs post where the goods declaration was submitted. In the case of remote declaration of goods, the stamp can be placed at the customs post indicated in column 30 of the customs declaration “Location of goods”.

The customs mark in the form of information about the release of goods in a copy of the electronic customs declaration looks like this:

List of documents required when exporting goods

The customs clearance procedure is a labor-intensive process, the successful outcome of which depends on many factors. It begins long before visiting customs and is accompanied by the preparation of the next package of documents.

Foreign economic contract

The document regulates the rights and obligations of the parties involved in the export. This is a kind of agreement on the supply of products, according to which the seller exports the goods from Russia, and the buyer receives and pays for it. The document is drawn up in writing and must reflect all delivery conditions - insurance, customs clearance, transportation, possible risks, etc.

Transaction passport

The document is required if the contract value of the transaction exceeds $50,000. The transaction passport regulates currency control of all export transactions. In this case, a document is drawn up for each transaction separately, and for currency control of the transaction the following set of documents is provided.

- Certificate of foreign exchange transactions.

- Certificate of supporting documents.

In some cases, for example, if, according to a foreign economic contract, payments are made periodically, then there is no need for these certificates.

Customs declaration

The export customs clearance procedure itself begins with the submission of a customs declaration, which includes a declaration of customs value and is filled out on paper or electronic media. At this stage of the process, it is advisable to use the services of a customs broker, who has a well-functioning mechanism for productive interaction with the Federal Customs Service authorities.

Invoice

Invoice (invoice) - which indicates the details of the seller, buyer, contract number, price characteristics of the goods and terms of delivery of products (according to the terms of the contract).

Transport documents

Depending on the method of cargo transportation, you must select one (or more) transport documents to submit.

- Consignment note – for road transport.

- International railway waybill – when sending cargo by rail.

- Bill of lading – in case of transportation by sea.

- Air waybill – when sending goods by air.

Documents on compliance with prohibitions and restrictions

In this case, we are talking about documents, the content of which is determined in accordance with the Commodity Nomenclature of Foreign Economic Activity. These can be sanitary and epidemiological reports, licenses, certificates of conformity, etc. – all documents that reflect the properties, quality of the cargo and provide a comprehensive description of its goods.

Certificate (or declaration) confirming the origin of the product

Manufacturer exporters submit cost estimates for goods, cost estimates for works (services), conclusions from the Federal executive authorities of the Russian Federation, etc., and documents required by the procedure.

If the exporter is not the manufacturer of the cargo, then he is obliged to submit a contract for the purchase of goods and documents confirming the fact of payment under the contract for the purchase of goods in Russia, as well as an extract from his personal account showing the cost of the transaction.

If the cargo being shipped is of foreign origin, then a cargo customs declaration with an agreement, invoice and payment documents for the imported goods will be required.

Documents confirming the classification code of products according to the Product Nomenclature

This package of documents includes a description of the product, its technical documentation and a quality certificate that justify the use of the specified HS code.

Documents on payment of customs duties

A customs order and a bank statement will be required if a customs declaration is submitted in writing. When declaring electronically, it will be enough to indicate the data of these documents in the declaration - indicate the number, date and amount of payment.

Document on the customs value of products

The list of these documents depends on the method used to determine the cost of the product. It may include a contract, constituent documents of the declarant, invoice, insurance, agreement with the carrier, waybill, etc.

At the same time, you need to be prepared for the fact that, according to Art. 67 of the Customs Code, customs may adjust the declared value of exported products. The decision is made on the basis of an audit, the results of which can be refuted by a number of additional documents. For example, provide customs with accounting or valuation reports, insurance, leasing agreements, rental agreements, etc.

Packing list

The document contains information about packaging, weight, number of pieces, and the shipment of products. The packing list is compiled for each product name separately.

Documents confirming the ownership of the cargo being shipped

The exporter, who is not the manufacturer of the goods, submits a purchase agreement for the exported cargo, an invoice for the purchased goods and payment documents. The exporter-manufacturer must present a calculation of the cost of goods certified by the chief accountant of his company.

Important!

When entrusting the procedure for customs clearance of exports to a customs broker (or other person), you must issue a power of attorney confirming his right to represent your interests when interacting with the Federal Customs Service.

Have any questions or problems with Export?

Don’t know how to solve them at the lowest cost? Contact EIG professionals, because solving foreign trade problems is our job!

Or contact us by phone,

Or via email

"The goods have been exported"

As for o, it must be obtained in the form of an original stamp only if the exporting company will submit documents confirming zero VAT to the tax office on paper.

The stamp is affixed to the customs declaration and transport document by the customs authority at the border crossing point. At the same time, the inspector enters information about the export of goods into the database of the Federal Customs Service of Russia and then this information is transferred to the Federal Tax Service for control (clause 17 of Article 165 of the Tax Code of the Russian Federation).

If the stamp was not affixed at the checkpoint, then confirmation of the fact of export can be obtained from the customs office where the goods were declared. To do this, you must submit an application to the customs post, which is drawn up in any form, and the following must be indicated:

- registration number of the goods declaration, which requires confirmation of the fact of export;

- serial number and description of the product;

- code of the customs authority of the place of departure.

The application can be submitted either in paper or electronic form. Within 10 days, the customs authority will send the declarant information about the actual export of goods in the same way - in writing or electronically.

If an exporting company submits electronic registers to the tax office, then it is not required on customs documents - neither in the form of information, nor in the form of an original stamp (Clause 15 of Article 165 of the Tax Code of the Russian Federation). However, to prepare the register, information on the date of actual export of goods will be required. They can be obtained through your personal account on the FCS portal using the information service “Information about the export of goods.”

Features of export from Russia

On the territory of the Russian Federation, the procedure for customs clearance of goods is regulated by the Customs Code of the EAEU. It involves a number of mandatory actions that the exporter must perform when moving his cargo across the border of the Russian Federation. At the same time, the procedure for registering goods for export has a number of features. Unlike imports, when carrying out imports, customs officers do not pay particularly close attention to the cost of exported products. But they jealously control a number of other important points.

- Livestock products must have a veterinary certificate confirming their safety.

- Phytosanitary documents must be submitted for agricultural products.

- When exporting plant seeds, you must obtain an opinion from the Seed Fund of the Russian Federation.

- Paintings, antiques and other cultural goods can be exported only with a certificate from the Ministry of Culture of the Russian Federation, which confirms that they do not represent historical or cultural value.

- Military goods must have appropriate permission from the military department.

- Exporting intellectual property requires permission from the copyright holder. Etc.

These nuances are due to the fairly strict requirements of the current legislation of the Russian Federation in relation to exported cargo. And in order to avoid unpleasant misunderstandings, it is better to ask in advance what documents are needed to export a certain type of product.

How to respond to a tax demand after submitting documents

The tax inspectorate may request documents in the following cases (clause 1.2 of Article 165 of the Tax Code of the Russian Federation):

- if the information provided by the taxpayer does not correspond to what the tax authority has;

- if the Federal Tax Service does not have information that the Federal Customs Service transmits as part of departmental exchange.

If, based on the results of the reconciliation, the tax office has requested a transport document, the exporter must submit a paper invoice with the original “Goods Exported” stamp.

If the tax office has requested a declaration from an exporter who used an electronic register to confirm zero VAT, then it is enough for him to submit a copy of the electronic customs declaration, printed from his software, with customs information about the release of goods (in the future, put the “Release permitted” stamp on this copy of the EDT no need). At the same time, the “Goods exported” stamp on a paper copy is not required (clause 15 of Article 165 of the Tax Code of the Russian Federation) - this has been permitted since October 2021 by amendments to Federal Law dated August 3, 2018 No. 302-FZ in the provisions of Art. 165 Tax Code of the Russian Federation.

Preparation of documents for export - where to go?

Actually, the specifics of the documents themselves tell the foreign trade participant where to go to get them completed.

- A foreign economic contract is drawn up directly between the exporter and the importer (purchaser of the cargo).

- To obtain a transaction passport and currency control certificates, contact a branch of the Bank of Russia.

- To justify the zero VAT rate, you will need to visit the tax authorities.

The export customs clearance procedure itself is carried out in the customs clearance and control department at the location of the shipper. In this case, you need to submit all of the above documents and perform three mandatory actions.

- 1. Present the cargo to customs control authorities.

- 2. Complete a customs declaration for export.

- 3. Make mandatory payments.

Next, for customs clearance you will need to go through the customs control procedure. This means that representatives of the Federal Customs Service can take any action against the exporter and the products he exports. For example.

- Oral survey.

- Inspection or inspection of cargo.

- Checking the markings.

- Receiving explanations. Etc.

Often, customs control actions are applied selectively, since it is impossible to thoroughly check each participant in foreign trade activities, because it paralyzes the work of customs. After all, checking everyone’s activities and load will require a lot of time and resources.

If you are also interested in importing to Russia and want to save your nerves and time, you can read our article - “What documents are needed to import goods to Russia?”

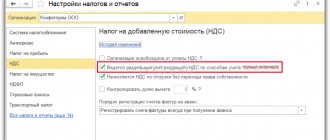

License

Any tariff for the “Reporting via the Internet” service.

- In the “Federal Tax Service” section, create a report and select a registry form.

- How to find the form?

- On the “Title Page” tab, provide information about the declaration for which you are sending supporting documents:

- ND for VAT - name of the declaration file;

ND for excise taxes - file name and declaration code;

- ND for VAT - name of the declaration file;

- On the Registry Documents tab, fill in the information manually or load it from a file.

Fill in manuallyClick “Add” and select the transactions for which you apply a zero rate.

Go to the created folder, click “Add” and fill in the information. To specify documents for another operation, click “<< To list of sections”.

Load from file

Files to be uploaded must match the templates.

- Check and submit a report to the inspectorate.

If for the specified period there is a submitted VAT or excise tax return in VLSI, the file name will be filled in automatically.

Click Next.

Click Import from Excel and select the file.

When the tax authority sends a receipt of acceptance, the register is considered submitted.

Deadline for confirmation of zero VAT rate

Documents confirming the right to apply the 0% rate must be submitted to the Federal Tax Service along with the declaration no later than the expiration of 180 calendar days from the moment the goods are placed under the customs export regime. In this case, the end of the 180-day period is not associated with the period in which the deadline for filing the return expires, but with the tax period for which the tax return is filed.

When selling services/work related to exports, the procedure for establishing a 180-day period for submitting documents depends on the type of these services, as well as the type of transport used during transportation. Failure to submit documents to the Federal Tax Service after 180 days will result in the company being subject to VAT on the cost of goods sold at the main current rate - 10% or 20%.

How to get a tax deduction?

A tax deduction is an amount by which the tax calculated for payment can be reduced. Typically these are the VAT amounts that the exporting organization paid when purchasing goods within the country.

According to paragraph 3 of Art. 172 of the Tax Code of the Russian Federation as amended in 2021, input VAT related to exports on goods listed in paragraphs. 1 and 6 clauses 1 art. 164 of the Tax Code of the Russian Federation, is accepted for deduction in the general manner, that is, it is calculated on the date of receipt of goods, work, and services.

Thus, when exporting such goods, you will not need to wait for the collection of a complete package of documents; usually an invoice from the supplier is sufficient. It is important that the VAT paid must be highlighted as a separate line in all primary documents.

A reduction in maternity leave worries many young mothers. Does the employee want to terminate the employment contract? Find out how to do this by reading our article.

If you need to calculate vacation pay in 2021, then the visual examples given here will help you with this.

TRANSPORTATION, SHIPPING DOCUMENTS AND CONTRACT

In practice, inspectors check for the presence of customs marks not only on the declaration, but also on shipping documents. Therefore, to minimize risks, it is better for the exporter to ensure that the marks are affixed.

If the invoices (and the contract) are drawn up in a foreign language, then the inspectors require their translation into Russian. However, the Tax Code of the Russian Federation does not oblige the exporter to submit such transfers. The Russian Ministry of Finance also pointed this out in a letter dated March 25, 2008 No. 03-07-08/67. Therefore, the refusal to apply the zero VAT rate in the absence of a “Russian version” of the papers is unlawful. The judges note that Article 165 of the Tax Code of the Russian Federation does not make the application of the zero rate dependent on the submission of translations of documents (Resolution of the Federal Antimonopoly Service of the Moscow District dated December 4, 2006 No. KA-A40/11640-06).

Also, claims from controllers may be caused by the absence of a foreign buyer’s mark on shipping documents. However, the courts also support exporters in this case (Resolution of the Federal Antimonopoly Service of the Moscow District dated February 15, 2008 No. KA-A40/430-08).

Refusal to apply the zero rate may also be caused by a discrepancy between the exporter’s addresses in the documents (for example, if some papers indicate the legal address, while others indicate the actual address).

Inspectors may consider an export unconfirmed even if the names of the exported products in the papers (for example, invoices and contracts) do not match or do not completely match.

If a company wants to avoid disputes, such inconsistencies should be resolved.

BANK STATEMENT

Often, inspectors consider exports to be unconfirmed for the following reason: the actual revenue received is less than the cost of the product specified in the export contract. This difference may arise, for example, due to the fact that the selling organization pays a commission fee to a foreign bank for the transfer of foreign currency funds from a foreign buyer (that is, the foreign bank withholds this amount from the proceeds).

Refusal to apply the zero VAT rate in such a situation is unlawful.

True, in the case under consideration, firstly, it is necessary that the export contract stipulates that the bank's commission fee is paid by the seller of the goods. Secondly, the exporter, among other documents, should submit to the inspection a SWIFT message indicating:

- sender of the payment (foreign buyer), contract number and amount transferred by him in accordance with the contract;

- the recipient of the payment (Russian exporter) and the amount transferred by the intermediate (foreign) bank to the Russian bank.

A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated January 17, 2005 No. 03-04-08/06.

Claims from inspectors may also arise due to the fact that the bank statement is not certified by the bank’s seal. Such a reason for refusing to apply the zero rate is illegal. After all, current regulatory documents do not provide for statements of personal accounts issued to clients to be certified by the bank’s seal. This is confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated January 13, 2006 No. A56-9914/2005).

Another complaint is that the bank statement does not contain the number and date of the export contract or the name of the product. However, the form of the bank statement is unified, and information about the contract or type of goods is not provided in it.

Additionally, we note: if the contract provides for cash payments, copies of cash receipt orders confirming the actual receipt of revenue from the foreign partner, as well as a bank statement indicating that the exporter has deposited money into an account in a Russian bank, must be submitted to the tax office. This procedure is provided for in subparagraph 2 of paragraph 1 of Article 165 of the Tax Code of the Russian Federation.

If the contract provides for a foreign trade barter transaction, documents confirming the import of goods received in exchange for products and their receipt must be submitted to the tax office (instead of an extract) (subclause 2, clause 1, article 165 of the Tax Code of the Russian Federation).

Confirmation of zero VAT rate: documents

The basic set of documents justifying the application of a 0% VAT rate when exporting outside the Customs Union and selling related services depends on the type of transport of the carrier and the type of services provided.

A special procedure applies if it is necessary to confirm the fact of export to a country that is a member of the EEC: you should ask the buyer for a statement of payment of indirect taxes and attach it to the declaration. Perhaps the electronic document flow of interaction between the tax and customs authorities of the EAEU countries will simplify this procedure in the future, but for now this is the case. In the absence of such a statement, it will not be possible to apply a zero rate.

Tax authorities consider the submission of an incomplete set of documents as failure to comply with the deadlines for confirming the company’s right to a 0% rate and this, accordingly, entails the accrual of tax at the current rate on the date of shipment (including due deductions), as well as penalties. The possibility of using the zero rate returns when the package of necessary documents is completed and submitted to the Federal Tax Service. In any case, the penalty must be paid.