In accordance with paragraph 5 of PBU 10/99, these expenses, as related to the manufacture and sale of products, the acquisition and sale of goods, represent expenses for ordinary activities.

Expenses for cellular communication services are reflected in cost accounts.

The choice of a specific cost accounting account will depend on the specifics of the organization’s activities and the accounting methodology adopted by the enterprise. EXAMPLE 1. ACCOUNTING COMMUNICATION COSTS FOR SEVERAL TYPES OF ACTIVITY

Poseidon LLC carries out several types of activities - production, trade.

The management personnel of the entire enterprise, production management personnel, as well as businessmen are provided with business cellular communications. The enterprise's expenses for cellular communications by type of activity for the period amounted to: - for management personnel - 6809.78 rubles, including VAT - 1038.78 rubles .— production personnel – 4823.84 rubles, including VAT 18% – 735.84 rubles, – commercial personnel – 9869.99 rubles, including VAT 18% – 1505.59 rubles, In the organization’s accounting based on documents from the cellular operator, the following will be reflected: DEBIT 26 “General business expenses” CREDIT 60 “Settlements with suppliers and contractors”

- RUB 5,771.00.

(6809.78 – 1038.78) – expenses for payment for cellular communication services for the reporting period for management personnel are reflected, excluding VAT; DEBIT 20 “Main production” CREDIT 60 “Settlements with suppliers and contractors”

- 4088 rubles.

(4823, 84 – 735.84) – expenses for payment for cellular communication services for the reporting month for production personnel are reflected, excluding VAT; DEBIT 44 “Sales expenses” CREDIT 60 “Settlements with suppliers and contractors”

- 8364.40 rubles.

(9869.99 – 1505.59) – reflects the costs of paying for cellular communication services for the reporting month for commercial personnel excluding VAT; DEBIT 19 “Value added tax on purchased assets” CREDIT 60 “Settlements with suppliers and contractors”

- 3280.21 rubles.

(1038.78 + 735.84 + 1505.59) – VAT is reflected on expenses for cellular communication services for the reporting month based on the UPD received from the telecom operator; DEBIT 68 subaccount “Calculations with the budget for VAT” CREDIT 19 “Value added tax on acquired assets”

- 3280.21 rubles.

– VAT on cellular communication services for the reporting month is deducted in settlements with the budget; DEBIT 60 “Settlements with suppliers and contractors” CREDIT 51 “Settlement accounts”

- 21,503.61 rubles. (6809.78 + 4823.84 + 9869.99) – the debt for cellular communication services has been repaid.

Agreement with the operator

To provide employees with mobile communications, an organization can not only compensate them for telephone calls, but also independently enter into a contract with a cellular operator.

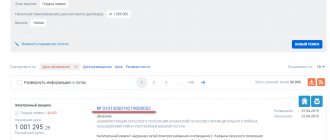

The procedure for concluding agreements for the provision of mobile communication services is defined in Section II of the Rules approved by Decree of the Government of the Russian Federation of May 25, 2005 No. 328. Under the agreement, the mobile operator provides the organization with a certain number of subscriber numbers (SIM cards) and periodically issues invoices for payment of negotiations .

Rules for using a business phone

Advice: to control the expenditure of funds, it is advisable to develop rules for the use of company mobile phones. You can install in them:

- limit on expenses for business telephone calls;

- prohibition on conducting personal telephone conversations;

- procedure for reimbursement of expenses for personal negotiations, etc.

Based on these rules, an organization can qualify personal negotiations as causing material damage and withhold the corresponding amounts from employees (Article 232 of the Labor Code of the Russian Federation).

When issuing SIM cards, employees must be familiarized with these rules upon signature.

Compensation for mobile communications to employees: legislative framework

The validity of this expense item is stated in Article 164 of the Labor Code, which prescribes compensation in monetary terms for expenses that the employee incurred as a result of the work process. Article 188 of the Labor Code stipulates the following cases of additional payments to employees:

- for the use of personal property (in this case, a mobile phone);

- depreciation of this property.

Important! If the cost of a mobile phone is less than 40 thousand rubles, then depreciation is not charged on it, and the cost of the phone is written off at a time as the material costs of the enterprise.

Among other things, the enterprise must separately pay the costs for using cellular communications. Articles 41 and 45 of the Labor Code of the Russian Federation state that the collective agreement, as well as local regulatory acts, must describe in detail issues regarding this type of payment. Their size must be discussed bilaterally between the employee and the enterprise and included as a separate clause in the employment contract or additional agreement.

The legislation clearly defines the requirements for the economic justification for including such compensation in expense items. Otherwise, the company may be subject to administrative liability.

| The company has the right | The employee has the right |

| establish the amount, procedure and timing of payment of compensation for the use of a mobile phone | receive compensation for using a personal phone for corporate purposes |

| set out the conditions for reimbursement of expenses for cellular communications | for a salary increase to cover cell phone expenses |

| approve the list of documents regulating the need to incur expenses for cellular communications from an economic point of view |

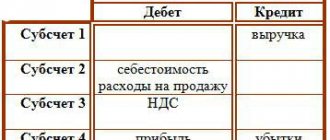

Accounting

Include the costs of paying for communication services as expenses for ordinary activities (clauses 5 and 7 of PBU 10/99). In accounting, reflect settlements with the mobile operator on account 60 “Settlements with suppliers and contractors” (Instructions for the chart of accounts).

Depending on which department the employee works in and what functions he performs, reflect the accrual of mobile communications costs by posting:

Debit 20 (23, 25, 26, 29, 44...) Credit 60

– the cost of mobile communication services is reflected (based on documents presented by the telecom operator).

An organization can pay with a telecom operator in cash or using express payment cards (clauses 43 and 44 of the Rules approved by Decree of the Government of the Russian Federation of May 25, 2005 No. 328).

Reflect the payment for mobile communication services by bank transfer using the following posting:

Debit 60 Credit 51

– paid for mobile communication services.

Situation: how to reflect settlements with a mobile operator using an express payment card in accounting?

If an organization pays a telecom operator using express payment cards, the accounting must show the difference between the real and nominal value of the card. As a rule, such cards are purchased by an employee who enjoys the right to use mobile communications. When issuing an advance for the purchase of a card, make an entry in your accounting:

Debit 71 Credit 50

– an advance was issued for the purchase of an express payment card (based on a cash receipt order).

After the card is activated and the employee submits an advance report, two entries need to be made in accounting:

Debit 60 Credit 71

– paid for the services of a mobile operator (for the amount of the nominal value of the card);

Debit 20 (23, 25, 26, 29, 44...) Credit 71

– expenses associated with the purchase of an express payment card are reflected (the difference between the real and nominal value of the card).

An example of reflecting settlements with a mobile operator using express payment cards in accounting

Manager of Alpha LLC A.S. Kondratyev is included in the list of employees entitled to use mobile communications at the expense of the organization. Kondratyev’s job description provides for the use of mobile communications to perform official duties.

In March, Kondratiev was on a business trip. To carry out urgent telephone conversations, he purchased an express payment card for mobile communication services. The nominal value of the card is 500 rubles. When purchasing it, Kondratyev paid the seller 520 rubles.

Upon returning from a business trip, he attached the used card and a cash receipt in the amount of 520 rubles to the advance report.

The organization’s accountant made the following entries in the accounting:

Debit 60 Credit 71 – 500 rub. – paid for the services of a mobile operator;

Debit 26 Credit 71 – 20 rub. – expenses associated with the purchase of an express payment card are reflected;

Debit 71 Credit 50 – 520 rub. – the employee is reimbursed for the overexpenditure according to the advance report.

In addition to official services, the organization can also pay for personal negotiations of employees. If employees do not reimburse these costs, include them in other expenses (clause 11 of PBU 10/99):

Debit 73 Credit 60

– the cost of personal telephone conversations is reflected, which is not subject to reimbursement at the expense of employees;

Debit 91-2 Credit 73

– the cost of personal telephone conversations that are not reimbursed by employees has been written off;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments”

– personal income tax is withheld, calculated from the cost of personal telephone conversations, which is not subject to reimbursement at the expense of employees (when paying the next salary);

Debit 91-2 Credit 69

– insurance premiums are charged on the cost of personal telephone conversations, which are not subject to reimbursement at the expense of employees.

If employees reimburse the cost of personal negotiations, make the following entry:

Debit 73 Credit 60

– reflects the cost of personal telephone conversations, subject to reimbursement at the expense of employees;

Debit 70 Credit 73

– the cost of personal telephone conversations is deducted from the employee’s salary.

Main Features of Cost Reimbursement

Reimbursing the costs of cellular communication services involves performing a number of actions. Let's look at some of them.

Rent a phone from an employee

If an employee’s activities are directly related to the use of a cell phone, then the device turns from personal property into a tool used by the company. Therefore, it is reasonable and legal to rent a phone from an employee. You can do this in two ways:

- Drawing up a telephone rental agreement on the basis of Articles 606-625 of the Civil Code of the Russian Federation. The document specifies the lease term, the amount of compensation and the procedure for their payment.

- Drawing up an agreement for the free operation of the device.

It is not necessary to enter into an agreement. All the necessary points can be specified in the employment agreement.

Opinion of the Ministry of Finance of the Russian Federation on personal income tax when compensating an employee for mobile communication services .

Account details

Account details are necessary in order to establish the actual time of telephone conversations. Therefore, based on the actual time, the amount of payments can be determined.

It must be said that the need to detail the account is not specified in legislative acts. There are different opinions on this matter. The Ministry of Finance and tax authorities, as a rule, consider the presence of detail necessary. A number of arbitration courts, on the contrary, argue that the presence of this document is not at all necessary.

Spending limits on mobile communications

To reduce company costs, limits are usually set on cellular communications. The following options exist:

- Unlimited tariff. Its main advantage is that there is no need to control employee spending on cellular communications. Payments to the mobile operator will be fixed. Their size will remain the same regardless of the duration of telephone conversations.

- Setting limits. This is necessary in order to reduce the number of unnecessary calls. The size of the limits is established in the order of the head or in the relevant Regulations.

Having limits allows you to discipline employees. Calls over the limit are considered economically unjustified and therefore are not taken into account for tax purposes.

How do limits work? Let's look at an example. The limit on telephone communications in the company is 3,000 rubles per month. The employee “spoke” in the amount of 3,500 rubles. In this case, only the amount of 3,000 rubles will be reimbursed. 500 rubles will have to be paid to the employee himself.

FOR YOUR INFORMATION! It is important to set limits that correspond to actual costs. If the limit is too low, it will degrade economic efficiency. If the established limit is constantly violated, it makes sense to increase it.

Personal income tax and insurance premiums

The cost of personal negotiations not reimbursed by employees is their income in kind (subclause 1, clause 2, article 211 of the Tax Code of the Russian Federation). Regardless of what tax system the organization uses, personal income tax must be calculated from this income. Withhold the tax amount when paying any sums of money to an employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

The cost of personal conversations between employees must include contributions to compulsory pension (social, medical) insurance and contributions to insurance against accidents and occupational diseases. This is due to the fact that this payment is considered as payment for employee services. The employer makes such payments within the framework of the employment contract. In addition, they are not included in the closed list of payments not subject to contributions for compulsory pension (social, medical) insurance, or in the closed list of payments not subject to contributions for insurance against accidents and occupational diseases. This conclusion follows from Part 1 of Article 7, Article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 1 of Article 20.1, Article 20.2 of the Law of July 24, 1998 No. 125-FZ.

The procedure for calculating other taxes and contributions depends on what taxation system the organization uses.

Results

Currently, it is impossible for organizations to carry out activities without communication services, which can be expressed by working with Internet resources, as well as the use of mobile and landline communications.

The reflection of these services in accounting and the procedure for their taxation depend on the purpose of their use and documentation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BASIC: income tax

When calculating income tax, include the costs of paying for mobile communication services as other expenses (subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, the organization must have documents confirming the production nature of telephone conversations. This is the requirement of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Situation: what documents confirm the production nature of an employee’s conversations on a mobile phone? The organization independently entered into an agreement with a cellular operator.

The list of documents confirming the production nature of telephone conversations is not defined by law. Despite this, the courts are inclined to believe that the organization is obliged to prove the connection between the costs of paying for communication services and its production activities (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated January 19, 2009 No. KA-A40/12732-08, Western Siberian District dated May 4, 2005 No. F04-2733/2005 (10928-A27-40) and East Siberian District dated May 27, 2005 No. A58-1983/03-F02-2300/05-S1).

Controlling agencies recommend confirming the production nature of telephone conversations:

- contracts with a mobile operator for the provision of services;

- detailed accounts of mobile operators;

- job descriptions that state when performing what duties an employee can use mobile communications;

- orders of the head of the organization on approval of the list of employees who, due to the duties they perform, require mobile communications.

The listed documents are given in letters of the Ministry of Finance of Russia dated June 23, 2011 No. 03-03-06/1/378, dated June 5, 2008 No. 03-03-06/1/350, dated July 27, 2006 No. 03- 03-04/3/15. The above list is also referred to by some arbitration courts (see, for example, decisions of the FAS Moscow District dated September 2, 2008 No. KA-A40/8318-08, Volga District dated September 22, 2005 No. A65-23196/2004-CA1 -32).

Advice: there are arguments that allow organizations to take into account the costs of paying for mobile communication services for tax purposes without detailed invoices. They are as follows.

The Tax Code of the Russian Federation does not contain a list of mandatory documents that can be used to confirm expenses incurred. Moreover, the fact of expenses can be confirmed by any document, even indirectly indicating this (clause 1 of Article 252 of the Tax Code of the Russian Federation). Neither tax legislation, nor communications legislation, nor accounting legislation contain requirements for mandatory decoding of conversations made, receiving detailed invoices and drawing up a report on each call. In addition, the content of the negotiations constitutes a communication secret protected by law (Article 63 of the Law of July 7, 2003 No. 126-FZ). This means that the organization is not obliged to confirm the production nature of these expenses by detailing the accounts.

Thus, the organization has the right to justify the costs of paying for mobile communication services, in particular, by the concluded agreement with the mobile communication operator, payment documents, organizational and administrative documents of the head of the organization, etc. This conclusion is confirmed by judicial practice (see, for example, the definition of the Supreme Arbitration Court RF dated September 3, 2008 No. 11211/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated July 2, 2008 No. F04-3910/2008(7317-A81-14), Moscow District dated June 3, 2009 No. KA-A40 /4697-09-2, dated February 24, 2009 No. KA-A40/12268-08, dated July 9, 2008 No. KA-A40/5861-08 and dated July 19, 2007 No. KA-A40/5441- 07, Ural District dated December 8, 2008 No. Ф09-9153/08-С3, Northwestern District dated January 15, 2009 No. A56-6560/2008, Volga District dated May 23, 2008 No. A55-10554/07 , dated May 16, 2008 No. A55-13148/07, Central District dated March 6, 2009 No. A35-4080/07-C8).

The tax inspector may ask who exactly and for what production purpose this or that employee spoke on a mobile phone. Therefore, prepare in advance additional information confirming the production nature of the negotiations. This could be contracts with counterparties, business correspondence, certificates on the status of mutual settlements, etc.

Tax inspectors have no right to demand reports on the content of telephone conversations (paragraph 8 of the letter of the Ministry of Taxes and Taxes of Russia dated May 22, 2000 No. VG-9-02/174).

Advice: in the internal documents of the organization, stipulate the obligation of employees to prepare reports on business calls made during the month using the provided mobile connection.

Such reports can be compiled based on transcripts provided by the telecom operator. The employee must justify each call indicated in the transcript. In this case, the tax inspectorate will not be able to accuse the organization of not confirming the production nature of the expenses.

If the organization uses the accrual method, then reduce the tax base as bills for payment for telecom operator services are presented or on the last day of the month (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation). If the organization uses the cash method, write off expenses only after they are actually paid to the operator (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Do not take into account the cost of personal conversations between employees when calculating income tax (with the exception of cases when an employee compensates for the organization’s expenses for paying for his personal telephone conversations). They are not related to the activities of the organization and are not economically justified (see, for example, letter of the Federal Tax Service of Russia for Moscow dated October 19, 2005 No. 20-12/75319).

An example of how expenses for mobile communication services are reflected in accounting and taxation. The organization applies a general taxation system

In March, Alpha LLC entered into an agreement with a mobile operator for the provision of services on a 100% prepayment basis. The operator provided the organization with 2 subscriber numbers. By order of the head of Alpha, the following have the right to use mobile communications:

- Commercial Director;

- Chief Accountant.

The organization determines income and expenses using the accrual method. In March, Alpha transferred an advance payment of 5,000 rubles to the operator’s current account. In April, the operator issued an itemized invoice and invoice to the organization. The total cost of telephone conversations in April was 4,720 rubles. (including VAT - 720 rubles). Based on the decryption of the invoice, the organization’s accountant determined that the cost of personal telephone conversations amounted to 590 rubles. (including VAT - 90 rubles). Of them:

- for the commercial director - 236 rubles. (including VAT - 36 rubles);

- for the chief accountant - 354 rubles. (including VAT - 54 rubles).

Employees do not reimburse the cost of personal telephone conversations.

Alpha calculates contributions for insurance against accidents and occupational diseases at a rate of 0.2 percent. The organization charges insurance premiums for compulsory pension (social, medical) insurance at general rates.

The following entries were made in the organization's records.

In March:

Debit 60 subaccount “Settlements for advances issued” Credit 51 – 5000 rub. – prepayment for the provision of mobile communication services for April is listed.

In April:

Debit 26 Credit 60 – 3500 rub. (4720 rub. – 720 rub. – (590 rub. – 90 rub.)) – reflects the cost of office telephone conversations for April;

Debit 19 Credit 60 – 630 rub. (720 rub. – 90 rub.) – VAT on mobile communication services is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 630 rub. (720 rubles – 90 rubles) – accepted for deduction of VAT on the cost of business telephone conversations;

Debit 73 Credit 60 – 590 rub. – the cost of personal telephone conversations is reflected, which is not subject to reimbursement at the expense of employees;

Debit 19 Credit 73 – 90 rub. – VAT on mobile communication services is taken into account;

Debit 91-2 Credit 73 – 500 rub. – reflects the cost of personal telephone conversations that are not reimbursed by employees;

Debit 91-2 Credit 19 – 90 rub. – VAT is written off from the cost of personal telephone conversations;

Debit 60 Credit 60 subaccount “Settlements for advances issued” – 4720 rubles. – the prepayment amount has been credited;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 77 rubles. (RUB 590 × 13%) – personal income tax is charged on the cost of personal calls from employees;

Debit 91-2 Credit 69 subaccount “Settlements with the Pension Fund” – 129.80 rubles. (590 rubles × 22%) – pension contributions are accrued;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” – 17.11 rubles. (590 rubles × 2.9%) – social insurance contributions in case of temporary disability and in connection with maternity in the Federal Social Insurance Fund of Russia are calculated from the cost of personal negotiations of employees;

Debit 91-2 Credit 69 subaccount “Settlements with FFOMS” – 30.09 rubles. (590 rubles × 5.1%) – contributions for health insurance to the Federal Compulsory Medical Insurance Fund are calculated from the cost of personal conversations between employees;

Debit 91-2 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 1.18 rubles. (590 rubles × 0.2%) – contributions for insurance against accidents and occupational diseases are calculated from the cost of personal conversations between employees.

When calculating profit tax for April, Alpha’s accountant included 3,677 rubles in other expenses. (4000 rub. – (590 rub. – 90 rub.) + 177 rub.). The accounting reflects a permanent tax liability:

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 118 rubles. (RUB 590 × 20%) – reflects a permanent tax liability for expenses that do not reduce taxable profit.

Unspent advance amount of 280 rubles. (5000 rubles - 4720 rubles) is counted towards payment for mobile communication services in the next month.

Construction and installation work is carried out

In this case, the costs of providing access to the telephone network should be considered capital and taken into account on account 08 “Investments in non-current assets” with subsequent admission to account 01 “Fixed assets” as fixed assets (both in accounting and tax accounting) ( p 4 , 12 PBU 6/01 [3], paragraph 1 of Article 257 of the Tax Code of the Russian Federation , Chart of Accounts and instructions for its use [4]).

After the construction and installation work has been completed and the initial cost of fixed assets (communication facilities and structures) has been formed, the subscriber, by virtue of clause 29 of the Rules for the provision of communication services , can transfer these communication facilities and structures to the telecom operator for ownership, for free use or for technical maintenance, or may not be transferred, then their operation must be carried out by the subscriber in accordance with the regulatory and technical documents of the federal executive body in the field of communications. If the subscriber independently operates communication facilities and facilities or transfers them into the ownership of a telecom operator, then the subscriber does not have problems with reflecting such operations in accounting and tax accounting.

Let's consider the features of accounting and taxation when transferring communication facilities and facilities for free use to a telecom operator. In this case, according to Chap. 36 of the Civil Code of the Russian Federation, the subscriber and the telecom operator must enter into a free use agreement (loan agreement). In the subscriber’s accounting, fixed assets transferred for free use will be accounted for in account 01 subaccount “Fixed assets transferred for free use.” In accordance with clause 17 of PBU 6/01, their cost is repaid by calculating depreciation.

In tax accounting, fixed assets transferred under contracts for free use are excluded from depreciable property (clause 3 of Article 256 of the Tax Code of the Russian Federation ), and, therefore, depreciation is not charged on them. Thus, the specified difference in the calculation of depreciation leads to the emergence of a permanent taxable difference in accounting and the accrual (based on clause 7 of PBU 18/02 [5] ) of a permanent tax liability: Debit 99 “Profits and losses” Credit 68 “Calculations with the budget on income tax .

VAT on the cost of communication facilities and facilities transferred for free use to a telecom operator is not deductible, and the previously accepted one is restored and paid to the budget, since by virtue of clause 2 of Art. 171 of the Tax Code of the Russian Federation , tax amounts presented to the taxpayer and paid by him during the acquisition of goods (work, services) in relation to goods (work, services) acquired for the implementation of transactions recognized as objects of taxation are subject to deductions.

The subscriber can also transfer the created communication facilities and structures to the telecom operator for maintenance. The accounting procedure and taxation of this operation will depend on the terms of the agreement for the maintenance of communication facilities and facilities. Since in each specific situation the terms of contracts may be different, and there is no single standard contract, we will not consider accounting and taxation in this case within the framework of this article. When concluding maintenance contracts, subscribers should take into account that, in accordance with clause 29 of the Rules for the Provision of Communication Services, the telecom operator, when establishing the cost of maintenance, compensates the subscriber for funds spent on construction work, including under a contract, in the amount of depreciation charges.

Example 1.

Negotiations took place outside of business hours

Situation: is it possible to take into account the cost of mobile telephone conversations made during non-working hours when calculating income tax? The organization independently entered into an agreement with a cellular operator.

Answer: yes, you can.

To do this, indicate in the employee’s job description that he can conduct official negotiations during non-working hours. For example, contacting counterparties from regions located in other time zones. In addition, you can indicate that the head of the organization (immediate supervisor) should always be able to contact the employee. A similar point of view is expressed in the letter of the Ministry of Finance of Russia dated December 7, 2005 No. 03-03-04/1/418. It is confirmed by judicial practice (see, for example, decisions of the Federal Antimonopoly Service of the North-Western District dated July 20, 2007 No. A05-692/2007, Moscow District dated January 19, 2009 No. KA-A40/12732-08, dated May 31, 2006 No. KA-A41/4511-06).

Purchasing a mobile phone at the expense of the organization

Situation: is it possible to take into account the costs of purchasing a mobile phone for the director of an organization when calculating income tax? The cost of the phone is less than 40,000 rubles. The director will pay for telephone conversations from his own funds.

Answer: no, you can't.

In order to take expenses into account when calculating income tax, they must be economically justified and documented (Clause 1, Article 252 of the Tax Code of the Russian Federation).

Paying for telephone calls from the employee's (director's) own funds means that the telephone itself was purchased for his personal use. Such a telephone cannot be recognized as property that is used in activities aimed at generating income. Consequently, the costs of its acquisition are not economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation).

What are communication services?

The concept of communication services (hereinafter referred to as CS), their subject matter, as well as information about the parties involved in their provision and consumption are contained in the Law “On Communications” dated July 7, 2003 No. 126-FZ (hereinafter referred to as Law 126-FZ).

The parties to the implementation of the management system are the buyer of services and the seller providing the management system - the operator (Clause 12, Article 2 of Law 126-FZ). The subject of the relationship between the CS, according to clause 32 of Art. 2 of Law 126-FZ, expressed by activities related to telecommunications and the organization of postal operations: receiving, processing, storing, transmitting and delivering messages. Depending on the type of connection, the DCs can be expressed (Clause 1, Article 12 of Law 126-FZ):

- public network - use of public telephones;

- dedicated network - use of your own Internet, telephone;

- technological network - used by certain groups of people to organize the production process;

- a special-purpose network for government agencies;

- postal network.

Next in our article we will consider accounting for the purchase of telecommunication services.

Purchasing express payment cards

Situation: is it possible to take into account the cost of express payment cards for mobile communications purchased for employees when calculating income tax? The organization independently entered into an agreement with a cellular operator.

Answer: yes, you can. But such expenses must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Expenses for communication services reduce taxable profit as part of other expenses associated with production and sales (subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation).

But in the case of cards there is one caveat. The fact is that after their activation, only the card itself remains, on which only the card number and its denomination are indicated. Hence, the Russian Ministry of Finance concludes: express payment cards themselves are not a basis for writing off expenses for their purchase (letter of the Russian Ministry of Finance dated January 26, 2006 No. 03-03-04/1/61). It is necessary to prove the production nature of the conversations paid for through them. To do this, the organization can submit other supporting documents (statement of card issuance, orders, job descriptions of employees, etc.) (Clause 1 of Article 252 of the Tax Code of the Russian Federation).