For entrepreneurs who want to “put down roots” in Crimea or Sevastopol (a new subject of the federation), the next 25 years promise to be a real tax haven. The favorable tax situation will affect many areas of business, so today entrepreneurs are preparing the necessary documents to obtain the status of a participant in the state support program for Crimea.

The entire Crimean peninsula is officially recognized as a Special Economic Zone (SEZ) until 2040, and this step can safely be considered a favorable factor for the development of business in Crimea and attracting new investments into the economy of the republic.

- Conditions for participation in the SEZ of Crimea and Sevastopol

- Reduced tax rates and other benefits for business in Crimea

- Features of taxation in Crimea and Sevastopol

- Freedom of customs space and port zones of Crimea

- Land use and construction on the territory of the Crimean SEZ

- Economic interaction with mainland Russia

- Termination of the contract of a FEZ participant voluntarily and forcibly

- Legislative framework for the Special Economic Zone in Crimea

- SEZ management bodies

The current conditions of the FEZ in Crimea are the most attractive for investors, due to a number of reasons. For example, the preferences and benefits associated with various areas of business are quite serious, including:

- 2% maximum tax rate on profits in the first 3 years of activity;

- Providing the opportunity to pay insurance premiums from salary in the amount of 7.6% during the first 10 years;

- The opportunity to have a “0” corporate property tax rate for 10 years;

- The tax rate under the National Tax Service was zero until 2021, and during the next five-year period it was 4%.

These, like many other pleasant tax surprises, are designed to stimulate and develop the economic activities of entrepreneurs on the Crimean peninsula. As stated by the current Deputy Minister for Crimean Affairs A. Sokolov, the Russian government is striving to create new incentives and opportunities for local businesses, to help them adapt to Russian laws and modern conditions.

In addition, loyalty is also due to the fact that the political and economic risks that have arisen and sanctions sentiments, which are directly related to activities on the peninsula, require certain compensation. And these types of benefits can push the development of business in Crimea and make the conditions as profitable and attractive as possible for both local entrepreneurs and foreign sponsors.

So far, in practice, the conditions for working in a free economic zone on the new Russian territory have not yet been fully worked out, so it is quite difficult to talk about the pros and cons. It is clear that in the course of setting up the new system, it will be necessary to adopt additional laws, amendments, or make some changes to existing laws - depending on the first experience gained and related nuances. But today we can call the conditions for entering the zone of economic freedom quite simple.

Conditions for participation in the SEZ of Crimea and Sevastopol

The operation of the SEZ on the peninsula is regulated by Federal Law dated November 29, 2014 under N 377-FZ. The current legislation does not yet provide for restrictions on the organizational and legal form of individual entrepreneurs or legal entities wishing to become participants in the SEZ.

Entrepreneurial activity in the SEZ is limited; it cannot concern the use of subsoil for the purposes of exploration and extraction of minerals, development of deposits on the continental shelf of the Russian Federation.

This means that any legal entity. persons and individual entrepreneurs registered and registered in Crimea with tax authorities have the right to receive the status of a SEZ participant. It is mandatory to have a corresponding investment declaration on the implementation of an investment project in the territory of the Republic of Crimea. As Andrey Sokolov, Deputy Minister for Crimean Affairs, said in an interview with CrimeaBusinessConsulting, in order to fully enter the profitable economic zone, it is necessary to have a registration of an individual entrepreneur/legal entity in Sevastopol or Crimea, as well as an investment project with a capital investment of at least 3 million rubles for the first 3 years of activity. Without the status of an independent legal entity, various representative offices and branches of companies will not be able to enter the zone.

For smooth entry into the free economic zone, a number of conditions and formalities must be observed. Mandatory are:

- Registration of an individual entrepreneur or organization in Sevastopol or the rest of Crimea.

- Registration with local tax authorities.

- Submitting a corresponding application with a request to conclude an agreement with the possibility of operating in a FEZ. This application is submitted in writing to the Council of Ministers of Crimea or the Legislative Assembly of the city of Sevastopol.

- Attachment of the specified documentation package when submitting an application. Such documents are: - for legal entities. persons - photocopies of constituent documents, - copies of documents on tax registration, - photocopies of state registration certificates. registration of individual entrepreneur or legal entity. person - an investment declaration set out in the appropriate form.

- Filling out the established sample investment declaration. The content of the declaration is determined by the standards of Federal Law Federal Law No. 377, reflecting the following information: - type of activity, - purposefulness of the investment project, - economic and technical definition of the investment project (the size of the average salary and the number of planned job vacancies must be indicated), - the amount of total capital financial investments, planned within the framework of the project (in particular, information is required on planned investments in the first 3 years, counting from the date of conclusion of the contract), - a reflection of the implementation of the investment project in Crimea or Sevastopol, - a reflection of the schedule of annual investments in the first 3 years of activity.

- The next point is waiting for the relevant authorities to make a decision and the final conclusion. The procedure and timing of consideration depend on the size of capital investments. If the investment amount is more than 100 million rubles, the application with the draft agreement and attached documentation is sent for consideration to the expert council on SEZ issues no later than 7 days. The council reviews the application within 15 days, and the body may require the applicant to make any changes to the submitted declaration. If the declared amount is less than 100 million rubles, the application is required to be considered by the highest executive authorities of Sevastopol or the Republic of Crimea, depending on the place of registration of the applicant. Review takes place within a 7-day period.

- Conclusion of an agreement on work in a free economic zone. The concluded agreement is then included in the register of participants in the free economic zone.

- The last organizational issue is obtaining a certificate of inclusion of the participant in the unified register of SEZs. It is from this time that the applicant becomes a full participant and receives the right to carry out business and other types of activities in the territory of the free economic zone under special tax regimes. Opportunities and conditions are governed by the framework of the concluded agreement.

Refusal to conclude an agreement is practically impossible if the participant has fulfilled all the specified requirements and provided all the necessary information and documents. This point is also regulated by current legislation.

What should you keep in mind regarding the percentage of deductions?

Exceeding the above safe percentage of deductions is not a violation. However, it is fraught with increased interest of tax authorities in the data included in the declaration. At a minimum, the inspection may ask you for clarification.

Important! Recommendation from ConsultantPlus We recommend giving detailed explanations and submitting supporting documents, even if the tax authority has not requested them. This will reduce the risk of your organization being selected for an on-site audit. For an example of written explanations regarding the fact of a high share of tax deductions for VAT, see K+. This can be done for free.

Read more about transferring deductions to a later date here.

Reduced tax rates and other benefits for business in Crimea

According to Russian legislation, in this situation there are 2 types of tax benefits. The former include benefits determined for zone participants, and the latter are general benefits that apply to all individual entrepreneurs and organizations operating in the zone.

Benefits for residents of FEZ in Crimea and Sevastopol include:

- Reduced corporate income tax rates and the possibility of using increased depreciation rates for fixed assets;

- When working on VAT - tax benefits when placing products under the customs procedure of a free zone of customs control;

- Possibility of zero taxation on the property of organizations for 10 years;

- Total insurance premiums for the 10-year period have been reduced to 7.6%;

- Land tax is not paid in the first 3-year period of operation.

The SEZ Law may establish a certain list of requirements regarding the reimbursement and payment of VAT, as well as the application of tax deductions for excise duties. In addition, there are certain issues when registering FEZ participants as payers of special taxes.

How tax regimes for small businesses can be combined

Any entrepreneur has the right to carry out several types of business activities using a combination of different tax regimes. In Russia, it is a common phenomenon when a small enterprise uses a combination of the simplified tax system (where the revenue limit is 64.02 million rubles for 2014; but when it is calculated, the turnover that falls under UTII is not taken into account) and UTII (where there is no upper limit on revenue ).

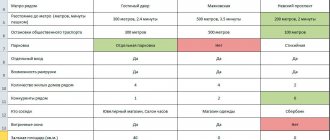

To make it more clear, let's summarize these possibilities in a table.

Table 3. Combination of tax regimes

| Option for combining tax regimes | Allowed/prohibited | Basis (norm of the Tax Code of the Russian Federation) |

| OSNO + UTII | Allowed | Clause 7 of Art. 346.26 |

| OSNO + USNO | Forbidden | Clause 2 of Art. 346.11 |

| OSNO + ESKHN | Forbidden | Clause 3 of Art. 346.1 |

| UTII + USNO | Allowed | Clause 4 art. 346.12 |

| UTII + Unified Agricultural Tax | Allowed | Clause 7 of Art. 346.2 |

| USNO + ESKHN | Forbidden | Subclause 13, clause 3, art. 346.12 |

| simplified taxation system 6% + simplified taxation system 15% | Forbidden | Clause 2 of Art. 346.14 |

Features of taxation in Crimea and Sevastopol

Income tax in the Crimean economic zone is the most pleasant and profitable, because FEZ participants pay corporate income taxes at reduced rates. This is the case when it comes to taxes to the regional budget. And residents are completely exempt from paying taxes to the federal budget - for 10 years from the date of receipt of the first profit. Tax rates are determined by the highest executive bodies of Crimea and Sevastopol, but their amounts will not exceed the established maximum. For example, for the first 3 years a participant pays 2% income tax to the local budget, from 4 to 8 years of activity - 6%, starting from the 9th year of operation - 13.5%.

No less comfortable is the fact that participants in the free economic zone are also exempt from taxation in relation to property on the balance sheet of organizations. The important point is that tax-free property must be acquired or created for the purpose of carrying out certain activities in the territory of the FEZ. The property must also be located within the zone. Participants are exempt for 10 years, the countdown of which begins from the next month after the property is registered.

This type of property includes not only the property of organizations, but also property transferred by local governments to the balance sheet of the enterprise. It is believed that the most relevant benefits in this area will be for the housing and communal services sector and those organizations that manage a large number of property holdings.

A similar option is a discount on land taxes. The criteria for providing benefits are practically the same - the location of the land plot on the territory of the SEZ, as well as its operation in order to implement the terms of the agreement in the territory of the zone. The validity period of these benefits is 3 years from the month the FEZ participant entered into ownership of a specific plot if all necessary conditions are met.

Premiums are paid at 7.6% over a 10-year period. This benefit applies to residents who received the status of a FEZ participant no later than a 3-year period from the date of formation of the free economic zone on the Crimean peninsula.

Compliance with all rules, conditions, benefits will be fully monitored. But although all tax audits will be carried out by the Federal Tax Service, any unscheduled audits must be strictly coordinated with the Ministry of Crimea and individual economic bodies of the constituent entities.

Safe VAT deduction in your region: where to look

All necessary information is published on the websites of regional tax services.

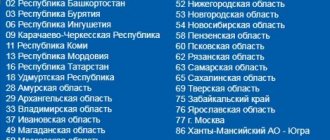

We strongly recommend that you check the percentage of deductions in your organization's tax bill against the average for your region (read on to learn why this is important). As of November 1, 2020, the Federal Tax Service updated regional statistics on deductions. Current data on the safe percentage of VAT deductions is shown in the table below:

| Region | Safe share of deductions as of 11/01/2020 | Safe share of deductions as of 08/01/2020 | Safe share of deductions as of 06/01/2020 | Safe share of deductions as of 02/01/2020 | Safe share of deductions as of 11/01/2019 | Safe share of deductions as of 08/01/2019 | Safe share of deductions as of 05/01/2019 |

| Republic of Adygea | 84,6 | 85,3 | 86,2 | 86,6 | 85,9 | 86,3 | 86,8 |

| Altai Republic | 88,9 | 90,9 | 94,0 | 101,8 | 90,8 | 91,8 | 93,3 |

| Republic of Bashkortostan | 91,4 | 92,2 | 93,2 | 94,2 | 91,1 | 89,4 | 90,4 |

| The Republic of Buryatia | 97,3 | 97,5 | 95,2 | 93,1 | 90,6 | 91,6 | 89,6 |

| The Republic of Dagestan | 82,9 | 83,6 | 83,6 | 80,4 | 83,6 | 84,6 | 84,6 |

| The Republic of Ingushetia | 92,9 | 92,3 | 91,6 | 93,0 | 93,3 | 94,3 | 93,8 |

| Kabardino-Balkarian Republic | 90,7 | 89,6 | 87,5 | 93,2 | 91,6 | 91,9 | 90,4 |

| Republic of Kalmykia | 79,5 | 84,5 | 93,3 | 71,0 | 80,9 | 83,2 | 87,9 |

| Karachay-Cherkess Republic | 90,1 | 91,3 | 92,4 | 91,6 | 92,2 | 92,3 | 92,8 |

| Republic of Karelia | 79,0 | 79,9 | 79,9 | 78,4 | 74,9 | 76,7 | 80,6 |

| Komi Republic | 78,4 | 79,4 | 79,1 | 80,1 | 76,4 | 76,5 | 76,1 |

| Mari El Republic | 88,4 | 87,9 | 88,4 | 88,3 | 87,3 | 87,1 | 89,1 |

| The Republic of Mordovia | 89,1 | 89,7 | 90,7 | 90,0 | 92,5 | 93,1 | 93,3 |

| The Republic of Sakha (Yakutia) | 94,4 | 93,4 | 89,5 | 88,7 | 91,0 | 90,1 | 86,9 |

| Republic of North Ossetia–Alania | 86,7 | 86,6 | 86,5 | 85,4 | 89,1 | 89,5 | 89,5 |

| Republic of Tatarstan | 90,8 | 90,8 | 90,9 | 91,3 | 87,9 | 87,5 | 87,4 |

| Tyva Republic | 81,5 | 80,7 | 78,9 | 78,0 | 78,4 | 77,2 | 82,5 |

| Udmurt republic | 80,7 | 80,1 | 78,0 | 78,2 | 80,0 | 79,4 | 79,8 |

| The Republic of Khakassia | 87,0 | 88,0 | 88,0 | 89,6 | 89,7 | 90,1 | 90,1 |

| Chechen Republic | 96,5 | 97,7 | 97,1 | 97,4 | 97,7 | 100,5 | 66,9 |

| Chuvash Republic | 83,6 | 83,2 | 82,9 | 82,0 | 83,7 | 84,3 | 85,6 |

| Altai region | 89,6 | 90,5 | 91,1 | 90,4 | 89,9 | 89,7 | 89,9 |

| Transbaikal region | 91,4 | 91,0 | 90,0 | 88,3 | 89,6 | 87,4 | 87,5 |

| Kamchatka Krai | 92,7 | 94,0 | 92,1 | 88,4 | 90,2 | 89,8 | 82,4 |

| Krasnodar region | 90,7 | 90,9 | 91,5 | 93,2 | 90,6 | 90,6 | 91,1 |

| Krasnoyarsk region | 76,5 | 74,2 | 73,5 | 72,5 | 78,1 | 79,6 | 80,9 |

| Perm region | 86,9 | 87,1 | 87,6 | 87,2 | 82,1 | 80,9 | 80,9 |

| Primorsky Krai | 94,2 | 94,1 | 94,7 | 96,5 | 94,6 | 93,5 | 93,2 |

| Stavropol region | 90,0 | 89,6 | 88,8 | 89,4 | 88,8 | 88,9 | 88,8 |

| Khabarovsk region | 90,4 | 90,0 | 89,8 | 91,9 | 92,9 | 92,3 | 91,7 |

| Jewish Autonomous Region | 82,7 | 82,5 | 83,2 | 89,8 | 87,2 | 90,9 | 105,8 |

| Nenets Autonomous Okrug | 149,2 | 142,6 | 139,3 | 157,7 | 148,5 | 141,5 | 157,2 |

| Khanty-Mansiysk Autonomous Okrug – Yugra | 67,0 | 67,7 | 64,6 | 64,0 | 58,7 | 57,0 | 56,6 |

| Chukotka Autonomous Okrug | 136,5 | 137,2 | 126,0 | 116,1 | 120,7 | 115,5 | 111,3 |

| Yamalo-Nenets Autonomous Okrug | 72,4 | 72,4 | 70,9 | 69,4 | 64,4 | 62,9 | 62,0 |

| Tver region | 88,7 | 87,7 | 87,9 | 88,4 | 90,2 | 89,7 | 90,8 |

| Tomsk region | 80,6 | 79,8 | 76,5 | 76,5 | 77,2 | 76,8 | 76,8 |

| Tula region | 95,8 | 96,0 | 96,1 | 97,1 | 97,0 | 97,5 | 96,7 |

| Tyumen region | 84,6 | 85,3 | 84,4 | 87,1 | 84,2 | 84,6 | 84,5 |

| Ulyanovsk region | 88,5 | 88,5 | 88,4 | 89,2 | 91,0 | 90,8 | 90,8 |

| Chelyabinsk region | 90,0 | 90,5 | 90,1 | 91,1 | 91,0 | 90,7 | 90,8 |

| Yaroslavl region | 86,7 | 90,1 | 88,3 | 86,1 | 89,3 | 89,9 | 87,7 |

| Moscow | 88,9 | 89,1 | 89,8 | 89,0 | 88,7 | 88,0 | 88,0 |

| Saint Petersburg | 87,9 | 88,1 | 88,5 | 89,0 | 87,9 | 87,7 | 87,6 |

| Amur region | 131,2 | 131,7 | 128,4 | 136,0 | 130,1 | 127,3 | 131,1 |

| Arhangelsk region | 85,0 | 91,1 | 93,7 | 108,3 | 77,0 | 83,0 | 78,7 |

| Astrakhan region | 76,5 | 74,3 | 72,0 | 71,8 | 65,9 | 64,5 | 60,4 |

| Belgorod region | 92,0 | 92,6 | 92,9 | 93,3 | 91,6 | 91,8 | 92,0 |

| Bryansk region | 93,8 | 94,5 | 94,6 | 93,7 | 90,0 | 88,6 | 86,3 |

| Vladimir region | 84,9 | 84,4 | 83,8 | 85,1 | 85,3 | 85,8 | 85,7 |

| Volgograd region | 91,6 | 92,9 | 94,6 | 96,3 | 90,7 | 88,3 | 89,2 |

| Vologda Region | 98,7 | 100,0 | 98,7 | 101,3 | 98,9 | 99,3 | 99,9 |

| Voronezh region | 92,9 | 93,0 | 92,8 | 92,7 | 93,0 | 92,8 | 93,6 |

| Ivanovo region | 91,3 | 91,3 | 92,0 | 91,9 | 92,5 | 92,5 | 92,9 |

| Irkutsk region | 78,4 | 78,1 | 77,1 | 77,7 | 77,1 | 77,2 | 77,9 |

| Kaliningrad region | 64,3 | 64,3 | 62,9 | 63,6 | 60,3 | 60,3 | 61,3 |

| Kaluga region | 87,3 | 88,0 | 87,3 | 86,9 | 90,0 | 89,9 | 89,8 |

| Kemerovo region - Kuzbass | 94,1 | 94,3 | 95,4 | 97,7 | 90,8 | 89,4 | 88,7 |

| Kirov region | 88,3 | 89,3 | 91,2 | 98,0 | 87,2 | 87,6 | 88,9 |

| Kostroma region | 85,2 | 85,8 | 86,2 | 86,0 | 86,5 | 86,2 | 88,0 |

| Kurgan region | 85,2 | 85,1 | 84,3 | 85,0 | 85,8 | 86,1 | 86,2 |

| Kursk region | 93,5 | 94,0 | 91,9 | 93,4 | 90,0 | 90,8 | 92,1 |

| Leningrad region | 88,4 | 88,9 | 90,9 | 88,8 | 86,2 | 87,0 | 88,9 |

| Lipetsk region | 104,2 | 104,8 | 103,8 | 103,2 | 104,7 | 105,6 | 106,9 |

| Magadan Region | 103,0 | 104,3 | 101,1 | 97,0 | 98,0 | 98,8 | 95,4 |

| Moscow region | 88,5 | 88,5 | 88,4 | 88,4 | 89,2 | 89,2 | 89,1 |

| Murmansk region | 188,8 | 193,3 | 193,4 | 232,4 | 122,1 | 103,2 | 84,5 |

| Nizhny Novgorod Region | 90,4 | 91,2 | 91,3 | 92,1 | 89,0 | 88,3 | 88,6 |

| Novgorod region | 96,6 | 96,0 | 95,7 | 98,6 | 95,8 | 95,1 | 97,6 |

| Novosibirsk region | 88,9 | 88,9 | 88,9 | 88,8 | 89,7 | 89,7 | 90,0 |

| Omsk region | 84,9 | 84,6 | 86,3 | 89,4 | 88,4 | 88,7 | 89,2 |

| Orenburg region | 74,3 | 74,1 | 71,6 | 73,7 | 71,5 | 69,9 | 70,8 |

| Oryol Region | 91,6 | 91,8 | 91,4 | 91,3 | 93,1 | 92,6 | 93,5 |

| Penza region | 88,8 | 89,2 | 89,9 | 90,8 | 91,1 | 91,1 | 90,7 |

| Pskov region | 89,7 | 90,3 | 89,3 | 90,7 | 89,2 | 88,1 | 90,7 |

| Rostov region | 92,7 | 92,0 | 92,2 | 91,0 | 92,7 | 92,9 | 93,7 |

| Ryazan Oblast | 82,0 | 81,8 | 81,7 | 82,2 | 82,1 | 83,9 | 85,6 |

| Samara Region | 84,0 | 82,4 | 83,5 | 84,5 | 83,4 | 83,2 | 83,9 |

| Saratov region | 84,6 | 85,2 | 85,6 | 87,6 | 84,1 | 83,6 | 84,0 |

| Sakhalin region | 95,0 | 94,9 | 93,8 | 72,0 | 98,9 | 97,2 | 94,7 |

| Sverdlovsk region | 91,0 | 91,2 | 91,0 | 91,1 | 91,7 | 91,5 | 91,3 |

| Smolensk region | 92,8 | 92,7 | 91,5 | 91,7 | 95,4 | 94,6 | 94,1 |

| Tambov Region | 94,9 | 95,3 | 95,8 | 96,6 | 96,3 | 97,2 | 99,1 |

| Republic of Crimea | 86,5 | 86,8 | 86,2 | 86,8 | 85,9 | 86,4 | 87,2 |

| City of Sevastopol | 81,2 | 81,4 | 80,9 | 81,1 | 81,4 | 81,3 | 81,1 |

| Baikonur city | 62,1 | 71,7 | 74,1 | 72,1 | 93,4 | 71,5 | 74,5 |

How to calculate your share of deductions? You can find out about this in ConsultantPlus. The experts not only gave the formula and comments on it, but also gave an example of the calculation. Get trial access to K+ for free and go to the Ready-made solution.

Freedom of customs space and port zones of Crimea

Along with the development and creation of a free economic zone, its analogue in customs terms is being created - a Free Customs Zone. Within the jurisdiction of the Free Economic Zone, any goods will be able to be used and placed on the territory of the Free Economic Zone without paying taxes and customs duties. Also, measures of non-tariff or unlimited regulation of certain types of products, as is customary in the countries of the Customs Union, will not be applied. To import goods with zero taxation, FEZ participants will need to provide a certificate confirming the resident’s participation in the FEZ register.

With the export of products from the free economic trade zone, everything is a little different. For example, if a company purchased goods within the framework of a free economic zone or specific products were manufactured with the participation of such goods, then when exporting these goods from the territory of the free economic zone, the company will be required to pay additional customs duties and fees, from which in other cases it was exempt, including import VAT .

However, there is an exception to the rule. If the goods were purchased to carry out activities in the zone, then after the expiration of the 5-year period, the products will be available for export to any other regions of Russia without customs payments and procedures.

In this case, the resident of the zone has the right to choose whether he pays VAT and customs duties for individual components of the product, or for goods produced using these components. If two or more business entities take part in the import and export of goods, then the benefits for customs duties are retained in full.

The next point is Federal Law 377, a law that provides for subsidies that reimburse the costs of FEZ participants. Such costs include fees, taxes, customs duties for goods imported for construction, equipment, and technical equipment of facilities necessary for residents of the zone to implement declared plans and projects. At this time, regulations governing the payment of subsidies of this type are at the development stage.

The same provisions in the legislation of the Russian Federation determine the status of seaports in Crimea and Sevastopol - according to the adopted amendments to the laws, they are considered free ports. On the territory of free ports they use the rules and procedures in accordance with the legislation of the Customs Union.

Also, by decision of the Government of the Russian Federation, a separate procedure for customs procedures is established in free ports. These procedures may concern the transport of passengers, vehicles, cargo, animals and various types of goods. At the moment, the Government’s decision has not yet been made, although a draft document has already been developed.

Payment procedure

The procedure for paying tax depends on whether the company has divisions and what category the enterprise belongs to. And the amount is paid directly in two methods - through the cash desk of a banking organization or online on the official website of the Federal Tax Service, using the Pay taxes service.

When paying through a bank cash desk, the operator issues the payer a payment receipt form, which they fill out on the spot themselves. When paying the fee online, you must first fill in the required fields, and the system will automatically generate a payment invoice. After this, you need to click on the “Pay” button, and the funds will be debited from the account specified in the corresponding field.

The main rules for paying tax depending on the characteristics of the company:

- Regardless of the category of payer, taxes and advance payments are paid strictly within the period established by law.

- If a Russian organization has an office in Crimea, then the head of the unit has the right to independently pay the fee to the local Federal Tax Service. But the head of the company can also contribute tax funds for all branches, including the main office. Using the last payment option, management must notify the tax authorities in writing.

- Enterprises that were created during the first tax period with an income of less than 5 million rubles. for the first month of work pays advances quarterly. And in case of excess income, the payer pays tax funds monthly.

Land use and construction on the territory of the Crimean SEZ

Article 17 of Federal Law 377 defines certain procedures relating to land use and construction on the territory of the SEZ. The law will come into force in January 2021, and its application in practice will concern the placement of those facilities that are considered necessary for the implementation of investment projects planned by participants.

At the same time, it is also quite important that the land plots necessary for the participant to implement the plans will be provided by the municipality or the state for rent for a period agreed in advance - without any bidding options.

The planning of the territory of the FEZ and the development of relevant documentation, as well as decision-making in this direction will be dealt with by the Council of Ministers of Crimea or the Government of Sevastopol. Documentation on the planning of the territory and the placement of objects on it must be prepared by the participants at their own expense. Objects will be located by prior approval of the location, or in accordance with the layout of the territory. There will be no public hearings when approving the location of facilities by the Federal executive authorities. Moreover, urban planning regulations do not apply to areas intended for the placement of objects.

Preparatory work can begin even before the actual issuance of a construction permit - from the date of submission of design documents. Local authorized bodies are able to determine lists of types of preparatory work. And the permits for the construction of facilities, as well as for the commissioning of facilities, are issued by the Council of Ministers of the Republic of Crimea and the authorities of Sevastopol.

Economic interaction with mainland Russia

It is worth considering the fact that any activity of companies implies compliance with the general provisions of the Tax Code of the Russian Federation, and benefits for FEZ participants are provided only in certain cases. Such preferential provisions may be applied in favor of activities carried out by the company within the framework of the Free Economic Zone.

In other cases, benefits may only be applicable if separate accounting is maintained, the rules and regulations of which are also at the development and planning stage. It turns out that separate accounting can be difficult due to certain specifics of the company’s activities, when it is necessary to determine the scope of the agreement and those items for which business is conducted on a general basis.

Example: an entity is engaged in consulting, providing consultations both in the Crimea and in another region of Russia. Moreover, the organization is registered in a free economic zone, the central office is located here, and branches are located throughout the mainland. But the law does not provide for any restrictions or prohibitions for SEZ participants when expanding business activities to other regions of Russia.

Another option in which the working conditions in the SEZ will be of interest to mainland businessmen is the absence of prohibitions on the use of various types of transport outside the zone. That is, after a SEZ participant purchases vehicles, they can subsequently be used in operation on the mainland and in international transport.

These are primarily specialized types of transport intended for the transport of passengers and goods: buses, tractors, tractors, air, rail and water transport. However, there are some nuances here too.

Firstly, it will be impossible to use transport for personal purposes. And secondly, subsequently such vehicles will be limited in terms of their stay on the territory of mainland Russia.

Termination of the contract of a FEZ participant voluntarily and forcibly

Losing the status of a FEZ participant is possible for a number of reasons – not only when the contractual terms expire. In addition, the contract may be terminated by agreement of the parties or due to the termination of the company's activities.

Also, if certain violations were revealed during inspections, the participant may be forcibly deprived of his rights - through the courts and on the basis of provided evidence of violation of the terms of the contract. The executive authorities of Crimea and Sevastopol may demand termination of the contract through the court in cases where:

- Indication of incorrect information - underestimation of the size of capital investments with a clear difference from the figures specified in the contract, or unreasonable changes in the schedule of annual investments in the first 3 years;

- Changes in the focus of the investment project;

- Carrying out business activities on the territory of the zone that were not provided for by this agreement;

- Other violations of contractual terms for the implementation of the established investment declaration.

If this agreement is terminated due to a court decision, the FEZ participant is excluded from the unified register. Disputed issues are considered by the Arbitration Court of Sevastopol or the Arbitration Court of Crimea.

Taking into account Article 41 of Part One of the Arbitration Procedural Code, a participant in a free economic zone has the right to present its arguments in the process of considering controversial issues. He can present any evidence, try to defend his position, appeal court decisions and acts.

How will the VAT increase affect prices?

Experts believe that raising the VAT rate to 20% will restrain the growth of the Russian economy in 2021. First Deputy Prime Minister and Head of the Ministry of Finance Anton Siluanov said that the VAT increase could accelerate inflation in 2021 from the expected 3% to 4-4.5%.

According to Anton Tabakh, Managing Director for Macroeconomic Analysis and Forecasting of the Expert RA rating agency, an increase in the VAT rate could accelerate inflation in 2021 and thereby stimulate the Central Bank to increase the key rate. Alexey Kudrin stated that the tax increase will accelerate inflation in 2021 by 0.4 percentage points, inflation will remain at 4% for the year.

Russian President Vladimir Putin said during his annual big press conference that a slight increase in prices due to the VAT increase in Russia should be limited to the beginning of 2021. The President also drew attention to the fact that the Central Bank is taking certain actions, including increasing the key rate from 7.5% to 7.75% in mid-December last year.

Putin drew attention to the fact that in many countries VAT is 20% or higher, while in Russia, even after increasing this tax, the so-called effective VAT rate for the economy as a whole will be less than 20%, since almost all benefits have been preserved - for medicines, children's goods, for IT companies and so on.

As for the impact of this step on the growth of housing and communal services tariffs, as the president emphasized, in recent years this figure has increased by about 4%, and in 2021 it will grow by a total of 4.1%. At the same time, tariff indexation will be carried out in two stages, because due to the increase in VAT, a certain increase in the cost of services and goods associated with the need for the normal functioning of the housing and communal services system is expected.

Legislative framework for the Special Economic Zone in Crimea

- Federal Law of the Russian Federation dated November 29, 2014 No. 377-FZ “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol.”

- Federal Law of the Russian Federation dated November 29, 2014 No. 379-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the adoption of the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol” "

- Federal Law of the Russian Federation dated November 29, 2014 No. 378-FZ “On amendments to certain legislative acts of the Russian Federation in connection with the adoption of the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 25 “On approval of the approximate form of an agreement on the conditions of activity in a free economic zone.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 26 “On approval of the investment declaration form.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 27 “On approval of the form of the certificate of inclusion of a legal entity, individual entrepreneur in the unified register of participants in the free economic zone.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 28 “On approval of the Procedure for the work of expert councils on free economic zone issues.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated March 11, 2015 No. 53 “On approval of the personal composition of the expert council on issues of a free economic zone in the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated December 29, 2014 No. 61-ZRK/2014 “On establishing the corporate income tax rate on the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated November 19, 2014 No. 7-ZRK/2014 “On the property tax of organizations.”

- Law of the Republic of Crimea dated December 29, 2014 No. 60-ZRK/2014 “On establishing the rate of the unified agricultural tax on the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated December 29, 2014 No. 59-ZRK/2014 “On establishing the tax rate paid when applying the simplified taxation system in the territory of the Republic of Crimea.”

- Order of the Council of Ministers of the Republic of Crimea “On issues of organizing the functioning of a free economic zone on the territory of the Republic of Crimea” dated December 31, 2014 No. 1639-r.

SEZ management bodies

- Ministry of the Russian Federation for Crimean Affairs (regulatory and legal support for the functioning of the SEZ, maintaining a register of SEZ participants, etc.). — Address: 295000, Simferopol, st. Karl Marx, 28/10, “Liter B”. — Phone/fax: +7 10 38 (0652) 788-428. — Official website: https://mincrimea.gov.ru/

- Expert advice on SEZ issues on the territory of the Republic of Crimea and the city of Sevastopol (review and decision-making on the conclusion of agreements on the conditions of activity in the SEZ for projects with a capital investment volume of over 100 million rubles).

- Council of Ministers of the Republic of Crimea (authorized body - Ministry of Economic Development of the Republic of Crimea) and the Government of Sevastopol (authorized body - Main Directorate of Economic Development) (organizational and logistical support for the activities of expert councils, acceptance and consideration of documents, conclusion of agreements on the conditions of activity in the SEZ for projects with a volume of capital investments of up to 100 million rubles, monitoring the implementation of the terms of contracts, preparing an annual report on the results of the functioning of the SEZ).

- Ministry of Economic Development of the Republic of Crimea - Address: 295000, Simferopol, Kirova Avenue, 13 - Telephone/fax: +7 10 38 (0652) 544-294, 274-404. — Official website: https://minek.rk.gov.ru/

- Main Directorate of Economic Development of the Department of Economic Policy and Finance of the Government of the City of Sevastopol - Address: 299011, Sevastopol, st. Lenina, 2, - Office tel., reception tel.: +7 (8692) 54-47-73, fax

Prepared based on materials from the CrimeaBusinessConsulting information agency