After changes in legislation from 2021, alcohol can only be sold by punching a receipt through an online cash register.

Important

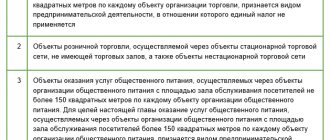

that drinks such as

beer, cider, mead

and

poire are

allowed for sale by individual entrepreneurs. In contrast to the retail sale of other alcohol, which is allowed only to organizations (Clause 1, Article 16 of Law No. 171-FZ).

Cash register equipment (CCT) should be used by shops and public catering establishments, including those selling alcohol and draft beer, regardless of the taxation system - simplified tax system, OSN, UTII, Patent. Any alcohol is considered an excisable product!

The main laws on the use of cash registers when selling alcoholic beverages are 54-FZ and 171-FZ. Federal Law No. 171-FZ regulates the production, sale and consumption of alcohol. Federal Law 54-FZ stipulates specific cases of use.

Is it possible to sell beer without a cash register?

As before, retail trade in a foamy, intoxicating drink does not require special licenses. You can read about this in the updated content of Federal Law 171 of 1995. Most of the requirements for entrepreneurs relate to the conditions for equipping premises, their territorial location and time of implementation. As for the need for organizations to sell beer on UTII through a cash register, you should pay attention specifically to the taxation regime.

According to the general rule, the sale of alcoholic beverages in stores under the conditions of registration in the Unified State Automated Information System requires mandatory reporting on purchases of the drink. Tracking the volumes sold is not so important. As for the need to use a cash register, for general and simplified taxation systems such a requirement is mandatory. Until recently, the use of a cash register for draft beer raised a large number of questions when enterprises operated on a patent or calculated imputed income.

The situation with the conflict is explained by the ambiguity in the different interpretations of the two Laws. The first is 54, dated 2003. The updated version of Article 2.1 states that when working under the patent and imputed income (UTI) regimes, organizations can operate until mid-2021. This requirement was tied only to the time of equipping points of sale with equipment established by the legislator.

The second fundamental document is Law of 1995 No. 171. It indicates the mandatory use of cash register equipment for urban settlements. An exception to this rule was the relaxation of requirements for public catering establishments.

On April 1, 2021, the new Law 261, which was published in 2021, came into force. According to the regulation, the use of online cash registers for selling beer has become mandatory. At the same time, the legislator excluded such criteria for relief as the regional affiliation of the place of sale and the chosen taxation regime.

The Plenum of the Supreme Court also agreed with this interpretation, recognizing this norm as special. The use of an online cash register for draft beer will make the work of businessmen easier in the future. At the end of the reporting periods, you will need to report not only for the volumes of purchased drinks, but also to clarify inventory balances.

Legal norms

The main federal laws regulating the sale of alcohol are:

- No. 171 of November 22, 1995, regulating the production and sale of alcohol;

- No. 54 of May 22, 2003, establishing the procedure for using cash registers;

- No. 202 of June 23, 2016, prohibiting the production and sale of alcohol in polymer packaging with a volume of over 1.5 liters (amendments to Federal Law No. 171);

- No. 261 of 07/03/2016, providing for obtaining separate licenses for the sale of alcohol, incl. for catering establishments (amendments to Federal Law No. 171);

- No. 290 of 07/03/2016, regulating the use of online cash registers for the sale of alcohol and other types of products/goods, as well as for the provision of services (amendments to Federal Law No. 54).

What to do as an LLC on UTII

In continuation of the current version of Law 261, the Supreme Court draws attention to the priority of the newer normative act. This is also stated in Article 346.26 of the Tax Code, according to which the obligation to introduce special equipment into retail locations is imposed on individual entrepreneurs and organizations.

Thus, enterprises operating under the imputed income tax regime should also use control equipment for their activities.

Legal requirements for retail sale of beer

As noted above, the sale of low-alcohol products, namely beer, does not require a special license. In all other respects, the legislator has established a number of restrictions, most of which relate to limiting access to alcohol by a certain circle of people. First of all, minor children and women are protected from beer on tap.

Further conditions for the sale of such alcohol are divided into groups:

- Object and territorial affiliation. According to this group of norms, it is prohibited to sell foam potions in organizations and preschool educational institutions, in the locations of sports, cultural and military facilities. Beer cannot be found at gas stations, on public transport and at corresponding stops. The legislator protected citizens from the foamy drink in places of active public gatherings, including airports and even markets. The exception to the rule remains availability for sale in public catering establishments.

- The second group of legislator requirements requiring the sale of draft drinks concerns the size of the retail space. The legislator obliges organizations to locate in stationary facilities equipped with a foundation. An extract from the unified state register can serve as confirmation that beer is not sold in tents. In addition, there is a requirement for beer bottling enterprises. In urban conditions, a retail outlet must be located on at least 50 square meters of area. For rural settlements the norm is two times less. If the outlet sells only a foamy drink, then compliance with the quadrature obligation is not necessary.

- Third on the list is a recommendation on implementation time. Selling low-alcohol drinks should begin no earlier than 8 o’clock. At late times, beer is prohibited from being sold after 11 p.m. It is worth noting that the legislator granted the right to regulate trading periods to local authorities. On holidays, restrictions may be introduced by local regulations.

- Among the initiatives of local authorities is a ban on the sale of foamy drinks in apartment buildings. In most cases, it is recommended to study local regulations before organizing sales.

Fines for beer sellers

Business owners working with alcohol should carefully read the provisions of the articles of the Administrative Code.

Article 14.16 of the Code of Administrative Offenses provides for liability for the sale of beer to minors. This violation, if detected, may entail liability for both individuals and legal entities. The seller may be issued a fine ranging from 30 to 50 thousand rubles. The manager risks receiving a bill of 100 to 200 thousand rubles. An organization may be subject to a fine ranging from 300 thousand rubles to half a million.

Directly for the non-use of special devices, such as online cash registers for alcohol, the norm is provided in Article 14.5 of the Code of Administrative Offenses. Sanctions for individual entrepreneurs and companies for a single violation are as follows:

- Officials organizing the sale of alcohol face a minimum fine of 10,000 rubles. The final amount is calculated as 25-50% of the illegal turnover;

- Persons with legal status may be subject to a minimum amount of 30,000 rubles. For the absence of the required device at a retail outlet, the relevant authorities will be charged from 75% to 100% of the proceeds generated outside the framework of current legislation.

Tougher sanctions are indicated for the repeated lack of an online cash register for UTII beer sales. In this case, supervisory authorities may suspend the activities of the organization or individual entrepreneur for 90 days. If during the violation the turnover in revenue exceeded 1 million rubles, officials may be prohibited from engaging in certain types of activities.

In addition, the absence of a cash register in a UTII company when selling beer may lead the organizers to violate the rules for issuing electronic receipts to customers, for lack of reporting on tax requests, or for using outdated equipment.

Registration of individual entrepreneurs in EGAIS

Which taxation system is better for individual entrepreneurs in retail trade - what to choose

To legally sell alcohol, all entrepreneurs must connect to EGAIS, a unified system for controlling the circulation of alcohol. The same applies to beer trade, but in a slightly reduced form. In this case, you need to connect to the system solely to prove the purchase of goods from trusted suppliers. It is important to know how to register in EGAIS (beer, retail) for individual entrepreneurs.

Connect to EGAIS

Below are step-by-step instructions on how to connect a business to the system:

- Go to the online service of Rosalkogolregulirovaniya.

- There you need to register your individual entrepreneur;

- Get a special individual key.

- Pass it on to the supplier to be reflected on all invoices.

The supplier will also use it to charge products from their number.

Note! There is no need to record the sale of each individual bottle. Confirming the legality of wholesale purchases is quite sufficient.

Which cash register is suitable for selling beer?

The first place to start choosing suitable equipment is to consult the tax office register. As of the beginning of 2021, this list included more than 130 units of various equipment. Taking into account the not always acceptable costs of re-equipment, the legislator allows the modernization of equipment that was used before the adoption of the updated Law.

Minimum functionality of the equipment:

- To operate as an individual entrepreneur selling beer, online cash registers must have an interface for connecting to the Internet. Both wired and wireless connections are allowed;

- In addition to supporting online trading processes, the machines must support the ability to send a database 30 days in advance. Ensuring the exchange of information with tax service servers is carried out by fiscal data operators (abbreviation in the technical specifications OFD);

- The equipment must have a module for printing paper receipts for subsequent issuance of draft beer to customers;

- Equipment for accepting payments by bank cards.

Expert opinion

Irina Smirnova

Online checkout expert

Ask a Question

In order to use equipment of previous generations, it is necessary to deregister the equipment with the inspection, upgrade it to minimum functionality, obtain an electronic signature and enter into an agreement with one of the OFD suppliers. After this, you should contact the registrar and ask for the updated modules to be included in the registry.

What is the law 54 Federal Law about?

Online cash registers help the state control company sales and receive more taxes. Previously, an entrepreneur filed a declaration with the Federal Tax Service, and the tax office relied on his honesty. With the new machines, reports on sales and returns are sent to the Federal Tax Service automatically, and trading outside the cash register is considered illegal.

Alcohol dealers were among the first to switch to new equipment last year, and for entrepreneurs there was a deferment on imputation and patents. From July 1, 2021, everyone who sells alcohol will install new equipment.

The new devices have a fiscal drive - a special device that records sales and returns of the outlet. The drive generates a check and transmits it to the fiscal data operator.

The operator checks the information from the check, encrypts this data and sends confirmation to the cash register and a report to the tax office. This is how the Federal Tax Service finds out how much taxes the company must pay. If the deductions are less than they should be according to cash reports, the Federal Tax Service comes with an audit and fines the entrepreneur.

Online cash registers print fiscal receipts that have legal force. Using the check number, the buyer can find out information about the company and details of the purchase. For example, when purchasing alcohol, you can use the QR code on the receipt to find out who produced the bottle and where.

Also, knowing the receipt number, you can go to the website of the fiscal data operator and see what purchase amount the store indicates in sales. If a client bought a sofa for 20,000 rubles, but the store writes that it was for 10,000, it means that the seller is hiding part of the income. You can complain.

You can also go to court with a fiscal receipt, for example, if the seller does not want to return money for expired goods, but according to the law he must.

How does an online cash register for selling alcohol differ from a regular one?

The specialized equipment market offers a variety of equipment models that differ in functionality, fault tolerance and other characteristics.

The main differences between the updated devices are their expanded functions:

- The equipment can work on all types of goods, including excisable ones;

- Support for alternative protocols allows you to organize work on the road;

- Integration with modern accounting programs (1C: “Accounting”, “Warehouse”);

- Modern technology has already been adapted to work in critical conditions. Catering enterprises purchase equipment that can operate for up to 30 days;

- Compact form factor. Improvements in technology make it possible to reduce the size of all devices, which have even greater functionality than equipment of previous generations.