Which organizations are required to conduct a mandatory audit of reporting: 6 cases under Law No. 307-FZ

Which organizations are required to conduct audits? In Art. 5 of the Law “On Auditing Activities” dated December 30, 2008 No. 307-FZ lists cases of conducting a mandatory audit. The law describes the criteria for organizations subject to mandatory audit, as well as other conditions taken into account when deciding when to conduct a mandatory audit:

In fact, the list of cases of mandatory audit is open. This means that companies not listed there may also be subject to mandatory audit if such a requirement is established by other federal laws.

See also:

- “Small businesses have been exempted from mandatory audit: the law has been adopted”;

- “Standard audit for 2021: new criteria and table.”

Next, we will consider the main cases of mandatory audit under Law No. 307-FZ (in the figure these are cases 1-5). Case 6 does not require special decoding, since the law lists specific organizations. They are required to conduct an audit annually, regardless of the fulfillment/non-fulfillment of other mandatory audit criteria.

Find out how to pass a mandatory audit in the Typical Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

How is the check carried out?

The audit should be carried out annually; if there is a large volume of reporting, experts recommend dividing the audit into a number of stages, having previously carried out some preparatory work to develop a strategy (drawing up by the auditor a schedule agreed with the client).

Next, the following must be checked sequentially:

- charter of the organization/enterprise;

- primary documents;

- accounting registers and the procedure for its implementation.

If the inspectors detect any shortcomings, the performing auditor forms the necessary recommendations. Accordingly, a distinction is made between an unmodified audit report, if the reporting is impeccable, or a modified one, if deficiencies are identified.

PJSC or JSC: who needs to audit the statements

Legislators have singled out the obligation to conduct audits by joint-stock companies as a separate case. As soon as the phrase “joint stock company” appears in the legal name of a company, it automatically has an obligation to conduct an audit. It does not matter whether this form was chosen by the owners when the company was founded or whether it acquired this status after a transformation or change of organizational and legal form. The form does not matter: PJSC or JSC.

Which companies are recognized as joint stock companies and what types of them exist are shown in the figure:

Types of audit checks

The following types of audit control activities are distinguished:

- complete audit - analysis of all documentation of the enterprise, audit of accounting and reporting: accounting, tax;

- selective - checking certain areas of the company’s activities, which ultimately can give a reliable complete picture of business processes;

- combined. It is carried out using the methods of the first two;

- documentary - only the documentary base is subject to verification, bypassing inventory studies, personnel surveys, and structure building analytics;

- actual. It takes into account the audit of reporting on site, inventory together with employees, and activity analytics.

Mandatory or optional audits are planned directly at the enterprise. It should only be carried out by a certified expert who is a member of a self-regulatory organization of auditors. Such an expert must be included in the register and comply with the requirements of international standards.

Are you allowed to participate in organized trading? Get ready for the audit!

If an issuing company wishes to include its securities in the quotation list, it must submit an application of a certain form to the auction organizer and provide detailed information about itself. The standards for admission of securities to public placement, circulation and listing are given in Art. 14 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ and in the Regulations on the admission of securities to organized trading (approved by the Bank of Russia dated February 24, 2016 No. 534-P).

The fact that the issuing company's securities are admitted to organized trading places it in the category of persons obligated to audit the financial statements.

The intricacies of accounting and taxation of transactions with securities will be revealed in the following materials:

- “Is the sale of securities subject to VAT?”;

- “Accounting for securities in accounting (nuances).”

How the type of reporting prepared affects the obligation of an audit

If a company presents and/or publishes summary (consolidated) financial statements, it automatically falls under mandatory audit (Clause 5, Article 5 of Law No. 307-FZ).

The requirements for consolidated reporting (its preparation, presentation and disclosure) are established by the Law “On Consolidated Financial Reporting” dated July 27, 2010 No. 208-FZ. The main provisions of this law, which help to understand the nuances of consolidated reporting, are presented in the figure:

Presentation and disclosure of consolidated financial statements is a process monitored by the Central Bank of the Russian Federation (with the exception of certain categories of reporting companies).

Find out more about the specifics of preparing consolidated financial statements here.

Revenue exceeded the criterion of 800 million by 1 ruble - an audit is inevitable

The number of persons required to conduct an audit may include companies that have never encountered an audit. To do this, it is enough to exceed the threshold level for one or both financial indicators specified in paragraph 4 of Art. 5 of Law No. 307-FZ.

The specific cost criteria in question are shown in the figure:

Who should conduct a statutory audit if the specified financial indicators are exceeded? Does the legal form of the company or its types of activities matter? In this case, exceeding one or both financial indicators is a separate criterion based on which a mandatory audit is assigned.

Example

The production structure of TekhnoStroyProekt LLC has been designing and manufacturing specialized electrical installations for the last 10 years. Thanks to a large contract in 2020, sales revenue amounted to RUB 801,331,120. The amount of assets at the end of this period is RUB 20,678,455.

Of the two criteria, only one was exceeded, however, TekhnoStroyProekt LLC is obliged to conduct an audit for 2021 and submit an audit report.

It does not matter that revenue exceeded the threshold level by only a fraction of a percent. For any excess of the established criterion (even by 1 ruble), the law requires an audit.

The considered cases of conducting a mandatory audit in accordance with the requirements of Law No. 307-FZ are not a complete list. We will tell you further who else is required to audit the annual financial statements.

Find out what is the responsibility for failure to conduct a mandatory audit in ConsultantPlus. If you don't have access to the system, get a free trial online.

Responsibility

For the absence (non-submission, non-publication) of an audit report on the Fedresource, the legislation provides for administrative liability : clauses 6-8 of Art. 14.25 of the Code of Administrative Offenses of the Russian Federation in the form of a fine in the amount of 5,000 to 50,000 rubles, and in case of a repeated offense - disqualification of the official from 1 to 3 years.

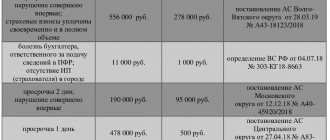

Consequences of failure to conduct a mandatory audit (fines)

1. Fines from tax authorities, executive authorities exercising control and supervision functions in the financial and budgetary sphere, the Accounts Chamber of the Russian Federation and control and accounting bodies of constituent entities of the Russian Federation (Article 28.3 of the Administrative Code).

For failure to provide an audit report to the tax authority, liability is not established (Article 14 of Law No. 402-FZ; subparagraph 5, paragraph 1, Article 23 of the Tax Code of the Russian Federation), however, the tax authority, having established during the inspection that the person being inspected does not have an audit report , has the right to draw up a protocol on an administrative offense.

Article 15.11 of the Code of Administrative Offenses of the Russian Federation provides for fines for gross violations of accounting and reporting rules, including for the lack of an auditor’s report on the accounting (financial) statements (if an audit of the accounting (financial) statements is mandatory). The amount of the fine for a manager for lack of a conclusion ranges from 5,000 to 10,000 rubles, and for a repeated violation - from 10,000 to 20,000 rubles, or the manager faces disqualification for a period of 1 to 2 years.

We also note that in accordance with paragraph 3 of Article 52 of Federal Law No. 208-FZ “On Joint Stock Companies”, information (materials) to be provided to persons entitled to participate in the general meeting of shareholders in preparation for the general meeting of shareholders of the company include , including the annual report of the company and the conclusion of the audit commission (auditor) of the company based on the results of its audit, annual accounting (financial) statements, auditor's report and the conclusion of the audit commission (auditor) of the company based on the results of the audit of such statements.

Thus, the absence of an audit report is a violation of the requirements of the law on the procedure for preparing and holding general meetings of shareholders, participants in limited (additional) liability companies and owners of investment shares of closed mutual investment funds, liability for which is provided for in Part 2 of Article 15.23.1 of the Code of Administrative Offenses of the Russian Federation and entails entails a fine:

— for citizens in the amount of 2 to 4 thousand rubles;

- for officials - from 20 to 30 thousand rubles or disqualification for up to one year;

- for legal entities - from 500 thousand to 700 thousand rubles.

2. Fines from the Bank of Russia

The most serious sanctions may be imposed by the Bank of Russia.

A public JSC is obliged to disclose an annual report and annual accounting (financial) statements (Article 92 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”, hereinafter referred to as Law No. 208-FZ). Requirements for the content of the annual report of joint-stock companies are established in the Regulations on the disclosure of information by issuers of equity securities, approved. Bank of the Russian Federation dated December 30, 2014 No. 454-P

Failure by a joint-stock company an audit report on its website on the Internet , as well as failure to submit to shareholders, an audit report within the prescribed period is a violation of legal requirements regarding the presentation and disclosure of information on financial markets. Disclosure of information not in full (accounting statements must be disclosed together with the auditor's report), and (or) unreliable information, and (or) misleading information entails the imposition of an administrative fine:

- for officials - from 30,000 to 50,000 rubles. or disqualification for a period of 1 to 2 years;

— for legal entities — from 700,000 to 1,000,000 rubles. (clause 2 of article 15.19 of the Code of Administrative Offenses of the Russian Federation).

3. Fines from Rosstat

For failure to provide an audit report to a set of financial statements submitted to Rosstat (in the case of a mandatory audit), the organization and its official may face an administrative fine (Article 19.7 of the Code of Administrative Offenses of the Russian Federation):

— from 300 to 500 rubles (for officials);

— from 3 thousand to 5 thousand rubles (for legal entities).

At the same time, the imposition of a fine does not relieve the organization from the obligation to submit an audit report to the statistical authorities (clause 4 of article 4.1 of the Code of Administrative Offenses of the Russian Federation).

Let us note that the storage period of the auditor's report on the accounting (financial) statements is not limited (Part 1, Article 29 of Federal Law No. 402-FZ; Article 408 of the List, approved by Order of the Ministry of Culture of August 25, 2010 No. 558).

The statute of limitations for bringing to administrative liability for violation of accounting legislation is 2 years from the date of commission of the administrative offense (Article 4.5 of the Code of Administrative Offenses of the Russian Federation).

Results

Cases when a mandatory audit is needed are described in Law No. 307-FZ and many other federal laws. This category includes joint-stock companies, organizations with a certain amount of revenue and amount of assets, as well as many other business entities (whose securities are admitted to organized trading, publish consolidated statements, etc.).

Sources:

- Federal Law of July 27, 2010 No. 208-FZ

- Federal Law of December 30, 2008 No. 307-FZ

- Federal Law of April 22, 1996 No. 39-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.