Which primary can be used in 2021

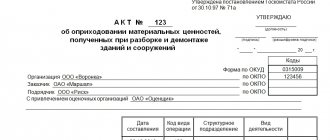

From 01/01/2013 you can use:

- Forms of primary documents independently developed by the business entity (Part 4, Article 9 of Law No. 402-FZ). They must contain all the mandatory details of the primary document provided for in Part 2 of Art. 9 of Law No. 402-FZ;

- Unified forms of primary accounting documentation developed by the State Statistics Committee of Russia, which were mandatory for use previously. They can be used unchanged, or you can adjust them “to suit you” by adding the necessary details and (or) deleting unnecessary ones.

The chosen procedure for using document forms must be approved by the head of the business entity. This can be done in the accounting policy or by a separate order.

IMPORTANT! Unified forms are required for bank and cash documents, as well as for the waybill (Letter of the Ministry of Finance dated January 25, 2017 No. 03-01-15/3482).

Read about the current procedure for registering cash transactions in the material “Procedure for Conducting Cash Transactions.”

Reasons for non-return

Reason No. 1. Lack of interest of the counterparty in returning documents

When you already have a signed invoice and the goods are in the warehouse, the counterparty is not motivated to return the document to the supplier. To return the primary, additional steps are required that require, at a minimum, time.

Reason No. 2. Extra costs for sending documents

The minimum tariff for sending a registered letter is 60 rubles. VAT included. To many counterparties, such an amount may seem significant, and they will not consider it necessary to increase their expenses.

Reason No. 3. Lack of order in working with documents

Documents can get “lost” on the desks of managers and accountants or simply accidentally end up in the trash bin.

Reason No. 4. Reluctance to pay for goods/services

The buyer does not want to sign documents in order not to pay for the service or product.

I will share the pain of non-return of primary goods in an organization that provided maintenance and repair services for office equipment. The company's clients are legal entities, the amounts of each sale were small, but there were a lot of documents. A maximum of 60-70% of paper copies were returned voluntarily. As a rule, a person came from the counterparty without a power of attorney or seal, received services, took with him documents with a promise to sign them in the accounting department and return them the next time he visited. Of course, at the next visit he did not have the signed documents with him or it was already a different person. Services were again provided, documents were issued, promises to return them were repeated, but the documents were never returned. As a result, many clients were in no hurry to pay for services.

Regular measures were taken to return documents: constant calls to debtor companies, official letters, trips with a driver to organizations, printing duplicates of primary documents, because the original copy was lost. It was not always possible to return signed documents.

Mandatory details of the primary document

Each primary document must have all the required details, the list of which is contained in Part 2 of Art. 9 of Law No. 402-FZ. Only then can it be taken into account.

So, the document must contain:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person who completed the transaction (business transaction) and is responsible for the correctness of its execution. Or the name of the position of the person responsible for the correct registration of the event;

- signatures of responsible officials indicating their last names and initials or other details necessary to identify these persons.

Read about the most commonly used primary documents in the article “Primary accounting documents - list”.

Correction of sick leave

Quite often on specialized forms you can see the question: “Can an employer correct sick leave.” According to the rules established by the FSS, this document can only be corrected if the error was made by the employer himself. The uniqueness of the sick leave certificate lies in the fact that it falls into the category of both medical and financial documents. It is this aspect that is the reason for the increased requirements for filling out this form.

It is important to note that a temporary disability certificate containing gross errors may not be accepted by the FSS . In this situation, the employee may lose his rightful financial compensation. The Social Insurance Fund has identified a list of errors, the presence of which does not cause the need to correct the document. Such errors are considered technical defects. Among them are:

- indicating some words in capital letters;

- empty cells containing no dashes;

- presence of extra spaces;

- incorrect indication of the employer's company name;

- presence of a stamp on the filled fields.

It should also be said that in some cases the FSS accepts forms of incapacity filled out with a ballpoint pen. It is important to note that errors not included in the list given above are considered as gross violations of the rules for filling out the form . In this case, the employee will need to contact the medical institution again to obtain a duplicate sick leave certificate.

But what to do if an error in the temporary disability sheet was made by the employer. In this case, incorrect information is crossed out with a thin line. It is important to note that when filling out this form you must use only a gel pen. After the incorrect inscription has been crossed out, a new mark is made on the back of the sheet.

In order for the document not to lose its legal force, it is necessary to do so . After entering new information, the form is certified with the company seal and signature of the responsible person. Not only the head of the company can fill out sick leave. These powers are available to the chief accountant and representatives of the personnel department.

Corrections must be made by the person who originally filled out the document. In the event that an employee carries out his activities in an individual entrepreneur, a company seal is affixed only if it is available. In the event that one of the lines of the form in question contains completely incorrect information, the sentence is crossed out completely. On the back of the document there is a mark indicating that the crossed out line is invalid.

Correction of an error in the primary document must be indicated by the inscription “Corrected” and confirmed by the signature of the persons who signed the document

As practice shows, errors when filling out temporary disability sheets are most often made when indicating the name of the company. This mistake can be made by both a representative of a medical institution and an employer. In the event that incorrect information about the employer is indicated by the attending physician, the form cannot be corrected. Such a document will be accepted in any case. The reason for such an error may be the incorrect indication of the place of work by the employee himself.

When an error in the company name is made by the head of the enterprise, the incorrect information is corrected using the standard method. To do this, the company name is crossed out with a straight line. The correct information appears on the reverse side of the sheet. It is important to note that this type of inaccuracy is technical. Since this form contains the company’s registration data, FSS employees can use this information to identify the company.

It is also often the case that an employer incorrectly indicates the amount of compensation due to an employee. As a rule, such a mistake is made in the case of new employees who did not have time to provide the employer with a certificate of earnings received at their previous place of employment. In this case, the form loses its legal force.

In order to correct this information, you will need to prepare a separate document, which will be submitted to the FSS with an incorrectly compiled form. This step will avoid the need to correct the temporary disability certificate. It is important to note that submitting two documents (sick leave and a benefit recalculation document) allows the employee to receive all payments due.

Electronic document forms

The primary accounting document can be drawn up both on paper and in the form of an electronic document with an enhanced qualified electronic signature (Part 5, Article 9 of Law No. 402-FZ, Part 3, Article 19 of the Law “On Electronic Signatures” dated 06.04. 2011 No. 63-FZ).

Moreover, it is necessary to duplicate electronic documents on paper only in cases where the submission of the primary document to another person or to a government body on paper is provided for by law or agreement (Part 6, Article 9 of Law No. 402-FZ).

Which documents cannot be corrected?

If an error is made in a paper cash or banking document, corrections cannot be made to it (clause 4.7 of Bank of Russia Instructions No. 3210-U dated March 11, 2014, clause 16 of the Regulations on accounting and financial reporting in the Russian Federation). You will have to draw up a new document.

Rationale

Documents on paper are drawn up by hand or using technical means designed for processing information, including a personal computer and software, and signed with handwritten signatures. In documents drawn up on paper, with the exception of cash documents, corrections may be made containing the date of correction, surnames and initials, as well as the signatures of the persons who prepared the documents to which corrections were made.

Documents in electronic form are drawn up using technical means, taking into account their protection from unauthorized access, distortion and loss of information. Documents executed electronically are signed with electronic signatures. Corrections to documents executed electronically after the documents have been signed are not permitted.

Consequences of improper execution of primary documents

First of all, violations in the preparation of primary documents may become the basis for liability under Art. 120 Tax Code of the Russian Federation.

The following are subject to this responsibility:

- taxpayers are organizations, and from January 1, 2014 also individual entrepreneurs (paragraph 1, paragraph 1, article 120 of the Tax Code of the Russian Federation; subparagraph “a”, paragraph 34, article 1, part 3, article 6 of the law of July 23, 2013 No. 248-FZ);

- tax agents (subparagraph “b”, paragraph 34, article 1, part 3, article 6 of Law No. 248-FZ; paragraph 3, paragraph 3, article 120 of the Tax Code of the Russian Federation). Note that until 2014, the wording of Art. 120 of the Tax Code of the Russian Federation directly indicated only the taxpayer, which raised doubts about its applicability in relation to tax agents. There was an opinion that they could not be the subject of this offense. At the same time, the Federal Tax Service insisted on the opposite (letter dated December 29, 2012 No. AS-4-2/22690).

In addition, the lack of properly executed primary documents may lead to a recalculation of the tax base and additional tax charges.

More details about the liability arising from Art. 120 of the Tax Code of the Russian Federation, read the material “Fine for gross violation of the rules for accounting for income and expenses” .

Poor quality document from a partner

Here's another example. It shows that if you received an unfinished document from your partner, this does not mean that penalties can be imposed on your company.

EXAMPLE The tax inspectorate conducted an on-site audit, as a result of which a decision was made to hold the company accountable. The basis for this decision was, in particular, the lack of invoices in the 1-T form. However, the court did not agree with the point of view of the tax authorities, pointing out that the fact that the company posted the purchased goods was confirmed by invoices in the TORG-12 form. In response to this, the tax inspectorate gave another argument: in the invoices (TORG-12) there is no reference to the number and date of the invoice. But the arbitrators did not agree with this argument either, emphasizing that “the absence of a reference to the number and date of the waybill, upon actual acceptance of the goods for registration, confirmation by witnesses of the fact of delivery of the goods by the supplier, does not indicate the absence of delivery of the goods” (resolution of the Federal Antimonopoly Service of the West Siberian District dated September 22, 2010 in case No. A27-391/2010 (by decision of the Supreme Arbitration Court of the Russian Federation dated January 21, 2011 No. VAS-67/11, the case was refused to be transferred to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the order of supervision)).

RESULTS

Since 2013, taxpayers have the right to use both unified and independently developed forms of primary accounting documents. The main thing is to consolidate the form used in the accounting policy of the enterprise. Unified forms for recording cash and banking transactions, as well as transport invoices, remained mandatory.

Sources:

- tax code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- Law “On Electronic Signature” dated 04/06/2011 N 63-F

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Making corrections to the registry office certificates through the court

Chapter 36 of the Code of Civil Procedure of the Russian Federation “Consideration of cases on making corrections and changes in civil status records” is devoted to the procedural features of the consideration of such cases. It briefly and succinctly describes the procedure for submitting such an application to the court and the requirements for its content.

The court's decision in such a case serves as the basis for eliminating irregularities in the civil status act, that is, for the civil registry office to make changes and corrections to the vital record and issue a new certificate. Therefore, it must clearly state: which entry is incorrect and how it needs to be corrected or changed, in relation to which person it was made, which body of the registry office and when.

According to the law, such applications are considered by the court in a special proceeding; there will be no defendant in this case.

To submit an application for corrections and changes to the act record, two conditions must be met:

- on this issue, a refusal from the registry office to make corrections and changes must be received;

- there is no dispute about the right.

If making corrections to the certificate may violate the rights and interests of other persons, you can prepare for a dispute. Most often, this situation arises during inheritance. In this case, the application cannot be considered in a special proceeding; it is necessary to file a lawsuit in court.

For example, a birth certificate is evidence of the origin of a child from the persons indicated in the document. And it is permissible to change the information about the father, even with the consent of the interested parties, must be made in the manner of claim proceedings, since such changes entail the termination of the rights of the previously indicated person as the father. And, for example, correction of the date and place of birth can be made in a lawsuit only if there is a substantive dispute caused by incorrectly entered information.

If, during the consideration of the case, a dispute about the law arises, the court must leave the application without consideration and explain to the interested parties their right to protect their rights in the manner of litigation.

The range of applicants is exactly the same as in the out-of-court settlement of these issues.

The application should be submitted to the court at the applicant’s place of residence, regardless of where the vital record is stored and compiled.

In addition to the general requirements for statements of claim, the application for corrections and changes must indicate: what is the incorrectness of the vital record in the civil status act, when and by what authority the refusal to correct or change the record was received.

Thus, the extrajudicial and judicial procedure for making corrections and changes to the vital records of the Civil Registry Office is very clearly reflected in the current legislation. However, civil procedural legislation does not reveal all the features of consideration of such cases; only obvious formal distinctive features are indicated.

If you have any questions, you can consult with our specialists in Moscow by calling the number: + or writing on WhatsApp.

The legality of the refusal of the civil registry office is not the subject of judicial review as part of the consideration of cases on making corrections or changes to the civil status record.

Evidence in cases of corrections or changes in civil registration records

When considering this category of cases, the court establishes the range of facts to be proven, based on the norms of the Law “On Acts of Civil Status”.

The basis of the statement is of great importance for forming an accurate conclusion about the subject of proof in a particular case. Therefore, as previously stated, the application must clearly state what incorrectness is contained in the civil registration record, how it needs to be corrected, by which body and when it was refused to make changes and corrections to the civil registration record.

The subject of proof in these cases includes facts of a substantive nature, indicating:

- about the presence of incorrectness in the act record;

- about the applicant’s interest in eliminating the irregularities.

In addition, the following facts and procedural nature must be established:

- refusal of the civil registry office to make changes and corrections;

- the absence of a dispute about the right, possible from the event recorded in the act record;

- other circumstances relevant to a particular case.

The burden of proving the incorrectness of the civil registration is placed on the applicant himself; he needs to provide evidence with which he can convince the court that there is an error in the civil registration.

In some cases, the court may assign the responsibility of proving the correctness of the information contained in the act record to the registry office, which compiled this record. For example, if the date of birth is later than the date of compilation of the civil status record.

If the applicant applies to the court after a significant period of time, and the documents that form the basis for the state registration of a civil status act are lost or destroyed, it will be very difficult to correct the civil status record. In such cases, we recommend that you seek the help of a professional lawyer. You can contact our specialists in Moscow by number: + or via WhatsApp.

Contacting the registry office

Pre-trial appeal to the civil registry office must comply with the requirements imposed on it by the current legislation on acts of civil status. If they are not followed, the court will leave the application for corrections or changes in the civil status record without consideration. This can happen, for example, if the applicant applied to the wrong registry office or did not present a passport when submitting the application.

Interest in fixes

As a general rule, the applicant in cases of corrections or changes in civil registration records is not required to prove his interest. However, if corrections or changes are made to the deed record in relation to another person, the applicant must prove his interest.

Written evidence

Establishing an incorrectness in a civil status record can be made primarily on the basis of written evidence. In fact, the evidence will be those documents that were attached pre-trial to the application to the registry office for corrections and changes in the vital record and, accordingly, the refusal of the registry office.

Request for evidence by the court

The court is competent to request any evidence, including copies of civil status records of the applicant’s relatives. When the subject of legal proceedings is a restored civil status record, the documents that served as the basis for its restoration may be requested. For example: a birth document issued by a medical organization; a court decision on divorce that has entered into legal force; a court decision on the adoption of a child that has entered into legal force, and others.

Witness's testimonies

Witness testimony by itself, as a rule, cannot be a sufficient basis for correcting civil registration records.

Conflicting evidence

If the evidence contains conflicting information about the facts to be established in a particular case, the court must determine which of them has greater evidentiary value. For example, if there are contradictions between a birth certificate record and a passport of a citizen of the Russian Federation, priority should be given to the birth certificate record, since it contains primary information, and all subsequent records and documents issued on their basis must be in accordance with the information contained in the record birth certificate.

Solution options

Traditional methods

Terms in the contract

Specify in the contract the procedure for returning documents, who bears the costs and responsibility for late return.

Appointment of a person in charge

When everyone is responsible, no one is responsible. Therefore, it is necessary to assign someone responsible for controlling the return of documents. This could be a contract manager, an accountant, a secretary - it all depends on the size of the organization and internal business processes.

Coverage of document delivery costs

Together with the PUD, you can send the counterparty a paid envelope with a return address - all he has to do is go to the post office.

Digital ways

Assignment to the person in charge

The process of approving an outgoing primary document can be transferred to an electronic document management system (EDMS). Some DMPs are initially created in the EDMS and only after approval are entered into the accounting system. So why not use the system's capabilities to control returns?

After approval and signing, the person in charge will first receive a task to send documents to the counterparty, and then a task to control the return. Thus, the employee will not forget which documents must be returned from the counterparty; he will always have a list of DMPs to be returned at hand. As part of the return control task, you can set up regular sending of an e-mail to the buyer (the address can be specified in the organization’s card) with a reminder of the need to return signed documents.

Using Barcoding

The fact of return of a paper document from a counterparty in the electronic document management system can be confirmed automatically. When maintaining an electronic financial archive in an organization, each primary accounting document is equipped with an accounting system barcode or EDMS. When the secretary scans a document signed by the buyer, a new version of the document is automatically created in the financial archive.

Artificial intelligence (AI) technologies

AI is increasingly being used in organizational activities. Artificial intelligence built into the EDMS will help control the return of documents from counterparties. Smart technologies will recognize the counterparty, the basic details used to identify the document, and will also determine the presence of signatures and seals. The AI will find in the financial archive which document the scanned copy belongs to, and if there are signatures and a seal on the part of the buyer, it will mark the document as returned.