The line codes indicated in the financial statements are used when filling out documents that are sent for verification to the tax authorities. In this case, the numbers are indicated after the name of the line. In order to fill out the documents correctly and without violations, you need to know the decoding of line 1520 of the balance sheet. If you study the appendix to the order that regulates the completion of financial statements, you will see that under this code lies accounts payable. However, in addition to the name, it is also necessary to take into account which account balances are included in this column in order to fill it out correctly. Then it will be possible to prepare reports for sending to the relevant authorities.

What does accounts payable consist of on the balance sheet?

The company's creditors are usually the organizations with which it is in contact:

- counterparties – suppliers, customers, contractors, lessors, insurers, etc.;

- regulatory authorities, state budget and extra-budgetary funds.

Due to accounting rules, the company's personnel periodically become creditors, since accrued salaries are issued the following month. Accounts payable may also include accountable amounts when the MOL acquires value or services for the business needs of the company, exceeding the amount of advances issued.

In addition, this block of obligations includes invoice amounts for supplies on credit or in installments due for receipt in the future.

Analytical accounting of settlements with suppliers

Instructions for using the Chart of Accounts provide that analytical accounting on account 60 is maintained for each submitted invoice, and settlements in the order of scheduled payments are maintained for each supplier and contractor.

https://www.youtube.com/watch?v=ytdevru

In addition, analytical accounting of settlements with suppliers and contractors should be organized in such a way as to make it possible to obtain the necessary data by supplier by:

- accepted and other payment documents for which the payment deadline has not yet arrived;

- settlement documents not paid on time;

- uninvoiced deliveries;

- advances issued;

- bills issued, the payment term of which has not yet arrived;

- overdue bills of exchange;

- received commercial loan, etc.

Accounts payable: line in the balance sheet

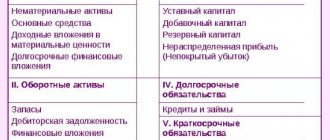

In which section of the balance sheet are accounts payable shown? Like all the company's liabilities, it is recorded in the liabilities side of the balance sheet. She is assigned line 1520 in the fifth section of the passive. This line generates data on debt generated at the end of the reporting period. These liabilities have a maturity of no more than 12 months and are therefore classified as short-term.

Long-term accounts payable occupies a separate fourth liability section on the balance sheet, separated from short-term liabilities. This includes the amount of loans and credits taken out by the company for a long period (more than 1 year), estimates, and other liabilities.

Unlike debts to creditors, accounts receivable are indicated on the asset side of the balance sheet, since they represent a share of the company’s property that belongs to it, but is temporarily held by other enterprises. Subsequently, the debts of the debtors are paid in money or in supplies/services (depending on the terms of the contracts).

Let's return to line 1520. It summarizes the final credit balances of the accounts:

- sch. 60 “Settlements with suppliers/contractors” for amounts for goods and materials/services purchased but not yet paid for by the company;

- sch. 62 “Settlements with buyers/customers” for received advance payments against agreed future deliveries;

- sch. 68 “Calculations for taxes/fees” for taxes intended for payment to the budget;

- sch. 69 “Calculations for social insurance and social security” for accrued contributions for payment to the funds;

- sch. 70 “Calculations for wages” based on the amounts of salaries of company employees calculated for payment;

- sch. 71 “Settlements with accountable persons” for amounts paid by financially responsible persons for the MC purchased by them as part of the overexpenditure of the advance advance issued;

- sch. 75 “Settlements with founders” for calculated but not yet issued dividends;

- sch. 76 “Settlements with other debtors/creditors” for other debts. For example, it may include the amount of penalties imposed for violation of the terms of agreements.

In other words, the composition of accounts payable on the balance sheet is very diverse and combines a whole block of calculations that are typical for any enterprise.

Uninvoiced deliveries

It often happens that goods (raw materials, supplies) are received from sellers without accompanying documents - a sales note or a waybill. Such deliveries are called uninvoiced, and in order to reflect such a supply in accounting, the buyer’s accountant must independently draw up an acceptance certificate. It is best to draw up the act in the unified form TORG-4 or M-7. The cost of the accepted valuables in the act is indicated at the book value without VAT - under the contract or based on previous deliveries (clause 39 of Order No. 119n dated December 28, 2001).

If later, according to the invoice received from the seller, a discrepancy between the delivery price and the accounting price is revealed, adjustment entries are made in accounting for the amount of the difference in prices (clause 40 of Order No. 119n dated December 28, 2001, clauses 2 and 4 of PBU 21/2008).

Postings for adjusting the value of the invoice:

- The invoice price is higher than the registered price:

- Dt 10, 41 Kt 60 - the cost of goods not yet sold and not transferred to production has been increased;

- Dt 90 Kt 60 - the cost of goods transferred or sold on the date of receipt of the invoice has been increased, but in the current year;

- Dt 91 Kt 60 - the cost of goods transferred or sold on the date of receipt of the invoice, but in the past year, has been increased.

- The invoice price is lower than the registration price:

- Dt 10, 41 Kt 60 - reversal of the difference in the cost of goods not yet sold and not transferred to production;

- Dt 90 Kt 60 - reversal for the amount of the difference in price. The cost of goods transferred or sold on the date of receipt of the invoice, but in the current year, has been reduced;

- Dt 60 Kt 91 - the difference in price reflects the profit of previous years, identified in the reporting for goods transferred into production or sold in the past year.

In tax accounting, when calculating income tax, the cost of uninvoiced supplies cannot be taken into account as expenses, since these are not expenses confirmed by documents. Therefore, under OSN, such supplies are recognized as expenses for tax accounting purposes on the later of the dates.

VAT can be deducted only after receipt of the invoice.

When applying the simplified tax system, such goods are taken into account in expenses if two conditions are met: the documents were received from the seller and the delivery was paid for (clause 2 of article 346.16, clause 2 of article 346.17 of the Tax Code of the Russian Federation).

Features of the formation of accounts payable

When preparing a balance sheet, the accountant does not have the right to roll up the amounts of receivables and payables. The debt (even if there is a debit and credit balance for one counterparty) should be indicated in detail: in the assets of the balance sheet - receivables, in liabilities - accounts payable.

All amounts of short-term accounts payable are detailed by type and structure (for example, to suppliers, budget, funds). Such analytical information is indicated in sections 5.3 and 5.4 of the explanations to the balance sheet. In them, receivables and payables are described in detail, since the balance sheet records only the total amount of debt at the end of the period for all short-term liabilities.

What applies to the creditor

In addition, accounts payable may include:

- debts to suppliers for work, goods, services;

- advances received from buyers and customers;

- overpayment of taxes, insurance premiums, fees;

- unpaid wages to employees;

- duty to the accountable person;

- obligations to other creditors.

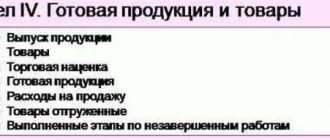

Accounts for accounting

To carry out payments to the creditor, the Chart of Accounts approved at the legislative level is used. In accounting, these types of debts accumulate in the following accounts:

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security.”

How to write off accounts payable

When writing off overdue debts, non-operating income is used in tax accounting, since, in fact, the company made a profit without repaying its debts. Postings for write-off:

- Debit 60, 62, 70, 71, 76 Credit 91.1 “Other income” - the creditor for the counterparty is written off.

Note from the author! If the creditor sues the organization or signs a reconciliation report, the debt can be restored to the books.

The creditor may be written off after the expiration of the limitation period, which is determined by Art. 196 of the Civil Code of the Russian Federation, over 3 years. The onset of delay is considered to be the day of violation of the terms of the contract for payment or shipment of goods.

The company paid an advance in the amount of:

- 1,500,000 * 40% = 600,000 rubles.

The unpaid balance was:

- 1,500,000 - 600,000 = 900,000 rubles.

The certificate of completion of work was signed on 01/30/2018, which means that the debt must be repaid by 02/07/2018. However, the company’s bank account did not have enough funds, so it paid only on February 16, 2018. The delay is calculated in calendar days. Payment to the creditor was delayed by 10 days.

Nuances of filling out the section

Like any financial document, the credit balance line cannot be inaccurate. Even the nuances that arise when filling out the form are precisely worded. These include:

• Amounts in foreign currency. If there are amounts indicated in foreign currency in the data on the credit debt, they must be converted into national currency (rubles) at the exchange rate at the time of filling out the reports. That is, the rate at which euros or dollars (for example) were converted into rubles must correspond to the date indicated at the end of the document. Only the official exchange rate is taken into account. • The procedure for completing documentation is carried out in a special manner if the debt arose as a result of a commercial loan or was formed as a result of a commodity exchange transaction. • In the line indicating credit debt, according to the law, the management of the enterprise indicates only those data that are considered significant. • Line 60, which indicates the amounts of debts to suppliers and contractors, has the greatest weight in the document. This includes not only the credit of the account, but also the debit of accounts for accounting for inventories, capital investments and costs. In accounting, these are considered to be account 07 “Equipment for installation”, account 08 “Investment in non-current assets”, account 10 “Materials”. Also, this section is often supplemented with other accounts - 15 “Procurement and purchase of materials. Values", 41 "Products".

Useful: Payment of Social Security Fund for individual entrepreneurs in 2021

The organization's decision on whether the data is significant depends on specific points: the assessment and nature of the indicator, the specific circumstances of its occurrence. According to the same legislation, when forming a balance sheet, the materiality of the specified data is determined by a complex of qualitative and quantitative factors.

Reflection of the creditor in the reporting

Drawing up a “Balance Sheet” report at the end of the financial year is the direct responsibility of each organization. The creditor in Form No. 1 is reflected in the liability side of the balance sheet in the following sections:

- "Short-term liabilities";

- "Long term duties".

How to take into account debt by maturity

The difference between the sections lies in the assessment of the timing of accounts payable. The company's debt for more than 12 months must arise in “Long-term liabilities”. Accordingly, if the creditor is less than or equal to 12 months, then it is shown in “Short-term liabilities”. Repayment periods are calculated according to the terms of agreements with creditors, with the exception of calculations:

- With a budget.

- With extra-budgetary funds.

- With staff.

Payment of taxes and insurance premiums is regulated by federal and regional legislation, depending on the type. Accumulation of tax liens can lead to bank account seizure and company bankruptcy.

As for settlements with staff, delays in wages entail financial and criminal liability. This is established by Federal Law No. 272-FZ and the Labor Code.

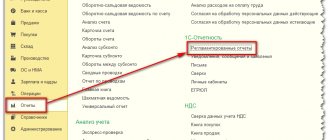

How to calculate the amount of current liabilities of an enterprise

Now that we know what data is reflected in the lines under code 1510-1550, we can move on to the algorithm for calculating the value of the enterprise’s current liabilities. Knowing the volume of total debt with a maturity of less than a year is important for assessing the solvency of a company :

- if it turns out that the company is unable to cope with the repayment of short-term (current) obligations, then it can be considered insolvent;

- the lower the indicator of short-term liabilities, the higher the solvency and liquidity of the organization.

So, below is a diagram for calculating the amount of short-term (current) liabilities of the company: