Payment amounts

The total mandatory fixed payment for insurance premiums of individual entrepreneurs for 2021 is 40,874 rubles. It includes a contribution to compulsory health insurance – 32,448 rubles. and compulsory medical insurance contribution – 8426 rubles. (clauses 1, 2, clause 1, article 430 of the Tax Code of the Russian Federation).

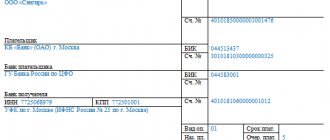

The deadline for payment of the fixed payment for 2021 is no later than December 31, 2020. You can pay your fees in installments throughout the year or in one lump sum. Transfer contributions for compulsory medical insurance and compulsory medical insurance to the Federal Tax Service in two separate payments:

- ;

- An example of a payment with income of 1 percent in 2020.

BCC of a fixed contribution to OPS – 182 1 02 02140 06 1110 160.

BCC of a fixed contribution for compulsory medical insurance – 182 1 02 02103 08 1013 160.

| Type of contribution | KBK |

| Insurance premiums for compulsory health insurance for yourself (including 1% contributions) | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance for yourself | 182 1 0213 160 |

If the fee is paid to the wrong BCC, it will be stuck in unclear payments. The tax office will not see it and may charge a penalty on the amount owed. However, this is illegal - after all, an error in the BCC is not a basis for recognizing the obligation to pay the contribution as unfulfilled (Letter of the Federal Tax Service of Russia dated October 10, 2016 No. SA-4-7/).

If you made a mistake with the KBK, fill out an application to search (clarify) the payment. In the application, indicate the type of insurance premium, the BCC for which it was paid and the tax period (the year for which it was paid). A document confirming payment of this fee must be attached to the application.

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles. For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

What BCCs for insurance premiums are established for the Social Insurance Fund in 2020–2021

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

A sample payment order for contributions to OSS from VNiM for employees can be found in ConsultantPlus. You can get a trial full access to K+ for free.

Read more about the specifics of calculating insurance premiums when signing civil contracts in the article “Contract and insurance premiums: nuances of taxation .

All about the budget classification code 18210202140060000160: what is this KBK

Budget classification code 18210202140060000160 is needed by entrepreneurs to pay contributions. Which ones - read in the article, here is a table of all contribution codes, sample documents, reference books and useful links.

Attention! Especially for accountants, we have prepared free guides that will help you correctly calculate and pay insurance premiums:

A practical guide to calculating insurance payments in 2019. All the nuances in one document. Free download Handbook on changes in the work of an accountant in 2021 Free download Memo on the payment of social benefits in 2021 Free download KBK Handbook 2019 All codes in one document. Download for free

As you know, entrepreneurs pay insurance premiums even if they do not have employees. Such payments for pension and health insurance contributions are called “fixed”. Entrepreneurs do not have to report fixed payments “for themselves” to the tax office. However, they are not exempt from reporting taxes under their tax regime.

In the Russian Federation, contributions for pension and health insurance must be transferred in non-cash form. To make such a non-cash tax payment, an entrepreneur needs to know its KBK - that is, the budget classification code containing all the information about the transfer that the bank needs to credit the amount for its intended purpose.

Any BCC consists of 20 digits, which are divided into semantic parts that reflect information about the state administrator of the payment, the type of transfer, its recipient, etc. The typical structure of the KBK is shown in the diagram below:

KBK encoding is mandatory for indication in a payment order when transferring obligatory payments to the budget.

After reading the KBK 18210202140060000160, do not forget to look at the following documents, they will help in your work:

KBK-2018 for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from Belarus and Kazakhstan | 182 1 0400 110 |

| Income tax on dividend payments: | |

| — Russian organizations | 182 1 0100 110 |

| - foreign organizations | 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603х хх 1000 110 where xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| — for inland water bodies | 182 1 0700 110 |

| — for other water bodies | 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010x0 01 6000 120 where x depends on the type of environmental pollution |

| Regular payments for the use of subsoil, which are used: | |

| - on the territory of the Russian Federation | 182 1 1200 120 |

| — on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | 182 1 1200 120 |

| MET | 182 1 07 010хх 01 1000 110 where хх depends on the type of mineral being mined |

| Corporate income tax on income in the form of CFC profits | 182 1 0100 110 |

Read more: How to make changes to a social tenancy agreement

KBK 18210202140060000160

How is KBK 18210202140060000160 deciphered in 2021? What tax payment is hidden behind this decoding. The procedure for applying this budget classification code.

Legal entities and individuals regularly encounter budget classification codes, abbreviated KBK, when it is necessary to make a particular payment to the budget. These may be taxes, contributions, duties, interest on them, as well as fines, penalties, surcharges and other payments.

As a rule, the tax code differs from the codes for penalties and fines by only two digits. In this regard, it is very convenient to use templates for a particular collection.

Such a template is KBK 18210202140060000160. It stands for a code for an individual entrepreneur without any employees, for transferring contributions to compulsory pension insurance for oneself at a fixed rate and other payments for this contribution.

Using the template is not difficult. The main thing to remember is that the variable part is 14-17 digits. By substituting the desired combination of numbers there, you can make any payment under the OPS.

For example, if an individual entrepreneur wants to contribute the amount of the contribution to the budget, the 14-17 category is converted into the number 1110. If we are talking about a penalty for the compulsory social security contribution - 2110, and if you need to pay a fine, then - 3010.

Read more: How to properly issue a sick leave certificate

The main thing is not to mix it up, then the money will definitely reach the address.

Similar articles:

Tax rates The size of tax rates is determined by the constituent entities of the country. It is directly dependent on the following…

From the author: knowledge of the main aspects of Russian tax legislation in the real estate sector will save you from many...

Features of tax calculation Do I have to pay tax on the sale of a summer house? It depends on how long...

When you need to pay The question of taxes usually arises in three cases: when buying or selling,...

KBK 18210202140060000160 should be understood as a group of codes used by individual entrepreneurs when deducting insurance contributions for pension insurance.

Individual entrepreneurs pay insurance premiums and, in the absence of employees, what tax an entrepreneur can pay with KBK18210202140060000160 will be helped by deciphering the information encoded in it.

Let's analyze what the decoding of KBK 18210202140060000160 looks like in 2021, what tax is transferred under each code of this group and how to pay penalties and fines associated with these taxes. Let's figure out how the procedure for applying KBK 18210202140060000160 has changed in 2018-2019, what tax an individual entrepreneur can pay by indicating this code, and what KBK 18210202140060000160 will look like for paying penalties.

For individual entrepreneurs, the decoding of KBK 18210202140060000160 in 2021 is as follows:

| from fourteenth to seventeenth | reason for payment | |

| from eighteenth to twentieth | state budget income category | — insurance premiums |

| Digit p/p | Encodes | Decoding KBK 18210202140060000160 |

| from first to third | recipient/addressee of payment | — Federal Tax Service |

| fourth | group of cash receipts | - income |

| from fifth to sixth | tax code | — insurance contributions for compulsory social insurance |

| from seventh to eleventh | budget item code | — OPS |

| from twelfth to thirteenth | budget ownership |

- combine a subgroup to list individual entrepreneurs for themselves by year:

- contribution from 2021 - contribution for 2021 - contribution from income above the limit for 2016 - penalties for 2021 - fine from 2021 - pennies for 2021 - fine for 2016

The budget classification code 18210202140060000160 combines codes that differ in numbers in block 14 to 17.

Decoding the first digit from this block allows you to determine which category of payments it belongs to. Depending on the combination of the remaining numbers, you can understand for what period the tax, fine or penalty was paid under KBK 18210202140060000160 (indicating the code for this tax). The result of decoding KBK 18210202140060000160 will help the individual entrepreneur select the required option from a group of codes.

The criterion for selecting a code from a group is the fact for which period it is listed. For example, when transferring tax for 2021, you should indicate from the KBK group 18210202140060000160, a code containing digits 14 to 17 in a block of numbers, and in the name of the payment specify which contribution is being transferred.

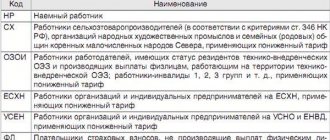

OSN | USN | UTII | Unified Agricultural Sciences | PSN | NPD | | Organizations | Entrepreneurs | with employees | without employees | Citizens

In our tables you will find the BCCs necessary to correctly fill out field 104 of payments for the transfer of taxes/contributions in 2018.

This might also be useful:

- Transport tax under the simplified tax system and OSNO in 2021

- Property tax for organizations and individuals

- Transport tax in Moscow in 2021

- Trade fee in Moscow in 2021

- Tax calendar for 2021

- Income codes in certificate 2-NDFL in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!