Almost all companies carry out settlements with suppliers and contractors. These calculations must be properly organized and taken into account.

Question: How to reflect in the accounting of a production organization that has a territorially separate branch allocated to a separate balance sheet, payment by the parent organization for production services provided to the branch, if the costs of payment for services form the cost of production of the branch, and settlements with suppliers and contractors are transferred by the branch to the balance sheet of the parent organization ? The cost of production services provided to the branch and forming the cost of production of the branch amounted to 600,000 rubles. (including VAT RUB 100,000). The provision of services is confirmed by an acceptance certificate for the services provided. The organization uses the accrual method of tax accounting. View answer

Accounting for payments to suppliers - a minimum of theory

If we talk about the essence of working with suppliers, we will say just two words - we buy and we pay. The details of this area are revealed in situations that arise when we buy or pay. For example.

We buy materials, goods, fixed assets, and services from suppliers. And if material assets came with additional amounts for transportation, then how to take them into account? And if it turns out that the delivery is defective, there is a shortage. How to proceed here?

The supplier may say that we owe him a certain amount, but we have a completely different amount in our accounts. What to do? Here you cannot do without reconciliation of mutual settlements. And that is not all.

The supplier to whom we owe formed a new company and transferred our debt to it. what should we do in this case?

You see, there are many different situations. But they are simple and with the correct understanding of the essence, you can easily guess what kind of wiring is needed.

In addition, these situations are rare cases for small enterprises. In general, there is nothing difficult or scary. Read the articles on the site, take part in practical classes and, in a very short time, you will understand everything. Well, now let's continue.

Why factoring and not credit?

Everyone chooses the calculation tool that is convenient for them. But there are several reasons in favor of factoring.

- The factoring market has already formed, but continues to grow. New factors are emerging.

A joint study by the National Credit Ratings (NCR) agency and the Association of Factoring Companies (AFC) shows that the total portfolio of the Russian factoring market at the end of 2021 reached a record amount of 808 billion rubles. Compared to 2021, it increased by 32%.

The factoring portfolio continues to grow faster than other business finance segments, including SME lending and microloans.

Experts note the steady penetration of factoring into the economy as a tool for managing receivables.

- It does not take much time to launch the factoring mechanism.

If the scheme has already been worked out and the buyer has already actively participated in such a scheme, then launching factoring with a new supplier actually does not require serious time and effort.

Everything happens easier, faster and more profitable than if the supplier turned to the bank for another loan.

- The mechanism allows us to maintain the same supply volumes and ensure their continuity.

Factoring makes it possible to increase turnover - for example, to participate in a new purchase with a large limit. With deferred payment this is not a problem.

Primary documents for supplier accounting

The payments to suppliers section works in two directions: “we buy something from suppliers” and “we pay for purchases.” For each direction we have our own primary documents.

1. Primary documents from the supplier to us

Agreement

One of the very first documents is a purchase and sales agreement, which is concluded between companies. However, it may not exist, but firms cooperate. In practice, I noticed that when the tax office checks our company and draws attention to the lack of an agreement, then our company concludes one with the supplier.

In any case, the contract is insurance for each participant, supplier and our company, against any unpleasant affairs of one or the other. For example , a supplier supplied or provided us with something. Or, we paid the supplier in advance so that he would supply/bring us, for example, goods. And the supplier just “forgot” about us. In general, a contract is a legal document that describes the obligations of two parties and the consequences for failure to comply.

Invoice from supplier

The second document from the supplier is an invoice for payment, which indicates what exactly we are buying, how much it costs and bank details. This document does not have any legal force, but only provides background information. In this case, such a document serves as the basis for payment. Those. If our company decides to pay, then the basis for payment will indicate the account details: number such and such, from the number of such and such, from the counterparty of such and such, for such and such an amount.

Expense invoice, or Certificate of service, work performed

The supplier presents these documents to our company as the final result: goods and materials were delivered, service was provided, work was completed. The signature and seal of these documents on our part confirms our consent. And these documents already have legal force.

Supplier invoice

The supplier attaches this type of document to the Invoice, Certificate of Service or Work Completed. This document is issued by those supplier companies that pay Value Added Tax (VAT). This document repeats the contents of the Invoice for payment, the Invoice, and the Acts. But the main point of an invoice is to show how much VAT is included in the total amount of goods/services invoiced (we’ll talk about VAT in other articles).

2. Primary documents in our company

Making a purchase

As you understand, our company needs to prepare documents for the purchase. Regardless of what we buy: materials, goods, fixed assets, services, we draw up a document of the appropriate type “Receipt/Purchase of something”. If required, we register the supplier's invoice.

Making a payment

For our part, we pay the supplier. To decide which primary documents we will use, we need to decide How we will pay: Cash or Non-cash (Cash or non-cash). Once we decide, all we have to do is select the documents we need.

Examples of primary documents for accounting settlements with suppliers

What is electronic factoring

The transition of companies to remote work has affected the development of online services. And factoring was no exception. Today, the concept of electronic factoring is increasingly used. In fact, these are electronic factoring platforms that allow all participants to conduct a transaction without personal presence, from home. As a result, the interaction between supplier, factor and buyer is greatly simplified.

Ready-made scripts are already “hardwired” into electronic services. They allow you to quickly check transaction information and eliminate the risks of fraud. The process becomes transparent and reliable. And in factoring, this is a very important factor that determines high requirements for documents and participants.

It is not enough to approach the factor with the request “this buyer owes me money, pay me, and then he will pay you back.” The factor must be sure that:

- there really is a debt;

- the goods have been shipped;

- the goods have been received by the buyer;

- the buyer has no complaints about the quality of this product;

- the goods are accepted by the buyer in full;

- the buyer is willing to pay for it.

Electronic platform tools help factors check everything and quickly make a decision on financing. Once the factor has received the signed documents, financing is carried out within two hours.

Interaction of the supplier settlement area with other accounts

I suggest you do the task yourself. From what you have read now, worked through the previous articles, write down the main accounting accounts with which account 60 interacts. If you can do it from memory, that’s great. If not yet, open the chart of accounts and try to choose. If you carefully studied the previous materials, then I’m sure you won’t need a chart of accounts.

Answers are available only to subscribers!

If you are subscribed to blog updates by email, enter the access code from the last mailing letter. To receive an access code, subscribe to blog news.

Payment through an accountable person

An accountable person can also purchase goods: Debit .01 Credit 50.

The employee was given funds in the amount of 8,000 rubles from the organization’s cash desk. for the purchase of materials. The employee reported for the amount of 7,850 rubles, submitting an advance report and checks.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| .01 | 50.01 | Money was given to an employee to purchase goods from the cash register | 8000 | Account cash warrant |

| 10.01 | .01 | Goods received from employee | 7850 | Advance report |

| 50.01 | .01 | The remaining funds were returned to the cash register | 150 | Receipt cash order |

Chart of Accounts for Accounts Payable Account

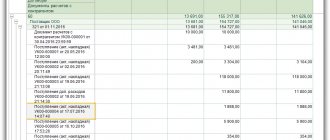

Now it’s time to look at the chart of accounts and look at the 60 account, at its characteristics and think about what this gives us.

As you can see, accounting account 60 “Settlements with suppliers and contractors” has several subaccounts and subaccounts. For us now the scores of 60.1 and 60.2 are of interest. Why?

Because these two sub-accounts divide the information into “Asset” and “Liability”, look at the letters A and P. The information is divided in such a way that our debts to the supplier must necessarily be on account 60.1 (because “P”). But if we pay in advance, i.e. If we give an advance, then we must already indicate 60.2.

If we have a debt to the supplier, and we pay a little more, then we will first close 60.1, and the rest will go towards an advance, i.e. at 60.2.

Now another independent task. Write what the debt on accounts 60.1 and 60.2 will be called.

Answers are available only to subscribers!

If you are subscribed to blog updates by email, enter the access code from the last mailing letter.

To receive an access code, subscribe to blog news. Let's continue reading the account characteristics

— The balance on account 60.1 will go to the liability side of the balance — The balance on account 60.2 will go to the balance sheet asset

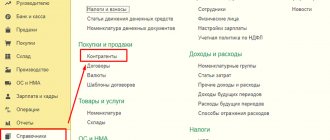

The subconto “Counterparties” will allow you to select a specific company name in the posting.

The “Agreements” subconto will allow you to select in a posting a specific contract of the counterparty within the framework of which the business transaction takes place.

These subaccounts and subcontos predict to us that in SALT for account 60 we will see the situation regarding counterparties and their agreements: who owes whom, how much, under what agreement. What we won't see is exactly why.

Offsetting homogeneous claims

The standard creditor payment operation was discussed in the examples above. Now let's look at another possible option for covering obligations. Set-off of a counterclaim of the same type is provided for in Art. 410 of the Civil Code of the Russian Federation. So, if both parties owe each other, then the obligations of the counterparties can be reduced by the amount of the smaller debt. There are also cases when offset is not possible. They are established by art. 411 Civil Code of the Russian Federation:

- if at least one claim is a claim for compensation for harm to life or health;

- about maintenance throughout life;

- about alimony;

- upon expiration of the limitation period;

- other cases provided for by law or agreement of the parties.

There is no special primary document for offset purposes. However, it must be in writing.

Depending on the circumstances of the offset, different VAT rules may apply to the transaction. To avoid mistakes, get a free trial access to K+ and look at the Ready-made solution.

Example 3

purchased 340 kg of nuts from Belka LLC for 700 rubles. per kg, totaling 238,000 rubles. (incl. VAT RUB 39,666.67). As of the date of purchase, Belka LLC had an unpaid debt to Sladkiy Mir in the amount of RUB 170,700. for preparing New Year's gifts for employees and contractors. The parties signed a settlement agreement for this amount. The accountant recorded the following entries in the accounting of Sweet World LLC.

| Operation description | Dt | CT | Amount, rub. |

| Revenue from the sale of gifts to Belke LLC is reflected | 62.1 | 90.1 | 170 700 |

| 340 kg of nuts accepted for accounting | 10.1 | 60.1 | 198 333,33 |

| VAT reflected | 19 | 60.1 | 39 666,67 |

| The offset of mutual claims with Belka LLC is reflected | 60.1 | 62.1 | 170 700 |

| The remaining debt has been paid | 60.1 | 51 | 67 300 |

Additionally

In trading or manufacturing enterprises, the supplier accounting accountant is closely associated with the warehouse operation. The accountant cooperates with the storekeepers. Storekeepers directly accept purchased goods and materials, check defects and quantities, and only then submit the supplier’s primary documents with their mark to the accounting department.

If necessary, claims are made to the supplier, a demand for the return of part of the money paid, or an additional payment.

An accountant and a warehouseman take inventory of the warehouse, where they compare accounting records and actual data in the warehouse. The results of the inventory, and this most often means shortages, surpluses, and re-grading, are documented in their own primary documents and accounting entries.

Strengthen your knowledge

How to start using factoring

First you need to choose a factoring company or factor and agree with him on the terms of financing the contract.

When the corresponding agreement is concluded, the buyer should be notified that you have switched to the factoring system and are cooperating with the factor, therefore, upon expiration of the deferment, payment must be transferred using new details.

The supplier will receive the amount stipulated in the contract, but minus the service fee charged by the factor.

Normative base

All operations performed by an accountant must comply with regulations. These acts are documents establishing the methodology and accounting procedures. The company's accounting must comply with International Accounting Standards. Let's consider all other regulations governing calculations:

- Federal Law “On Accounting” No. 402. The law contains rules for regulating accounting and its maintenance. The act states that all accounting provisions must comply with regulatory documents.

- Tax Code of the Russian Federation. Based on the code, receivables, the fulfillment of which is impossible, are classified as non-operating expenses.

- Civil Code of the Russian Federation. Approves the need to carry out any transactions with counterparties on the basis of a previously concluded agreement. It also establishes the deadline for collecting receivables.

- Order of the Ministry of Finance dated April 27, 2012. Also regulates accounts receivable.

- Accounting chart of accounts and instructions for its use. Establishes the need to include accounts receivable as other expenses.

Settlements with contractors and suppliers are also regulated by local regulations of the company itself. These acts must not contradict the law.