The prospect of extending the upcoming New Year holidays with another well-deserved vacation can be both pleasing and saddening. For some, this is an excellent reason to go on a trip, visit friends, family and loved ones, complete long-pending tasks, take care of their appearance, health, self-education, etc. Others understand that the long New Year holidays will make them really miss their favorite job and their friendly work team and professional achievements. Be that as it may, the employer himself often insists that an employee go on vacation during the New Year period: they say that the line has arrived according to the schedule and nothing can be done about it. Meanwhile, there are many nuances in this matter, knowledge of which will help you turn your forced vacation from an annoying misunderstanding into a real jackpot. Let's consider the features of calculating the number of vacation days taking into account the New Year, the rules for calculating vacation pay and other important points together with lawyer Ekaterina Antonova.

Registration - how is it extended if it includes the January holidays?

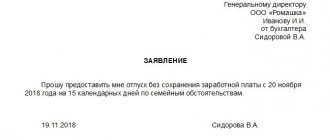

Holidays at the beginning of the year are included in vacation at the legislative level and for this the employee does not need to write any additional applications or forms other than the main application for vacation. A correctly formulated application for leave is your guarantee of the full use of well-deserved rest and due payments.

How to write an application correctly?

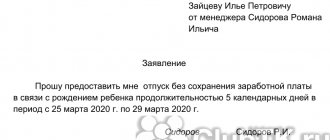

The application is written by the employee in any format convenient for him: manually or on a computer. A typical application must contain the following elements:

- A cap . In the upper right corner you write the name and position of the person to whom you are sending the application - your manager (most often the general director or deputy for personnel matters). Below you write who it is from - your full name, department and position.

- Title "statement" . It is written with a lowercase letter, under the heading and located in the center of the page.

- Text . It is written in any form, unless otherwise specified by the company’s internal requirements. Required items: type of vacation, start date and duration in days.

- Date , signature and transcript of the employee’s signature.

- The signature of the immediate supervisor is not accepted without approval.

An unspoken rule: when compiling, indicate not the dates, but the duration. In this case, all non-working holidays will be taken into account.

Consider, as an example, two seemingly identical statements:

- “I ask you to provide another paid leave from December 29, 2017 to January 12, 2018.” In 2021, the New Year holidays approved by the Ministry of Labor fell from 12/30/2017 to 01/08/2018. Thus, the employee will be paid on the days from December 29, and from January 9 to 12. The employee must return to work on January 13.

- “I ask you to provide another paid leave from December 29, 2019 for 14 calendar days.” In this case, all 10 holidays (from 12/30/2017 to 01/08/2018) will be counted as non-working holidays, and the vacation will be extended by 10 days. In this case, the employee must return to work on January 23.

Do you feel the difference? In both cases, you had a standard vacation of 14 working days, but with the careful inclusion of January holidays, in the second case it was extended.

Conclusion: you should always indicate the number of days of your vacation, not the dates . Non-working days, sick leave - all these days are not included in your vacation and are automatically extended.

During January holidays, vacation is extended by the number of non-working holidays approved by the Ministry of Labor. This figure ranges from 9 to 12 business days. So, for example, in 2021 this figure was 10 days.

Calculation system

Now let’s see what kind of vacation pay an employee who goes on vacation during the New Year holidays will receive.

How many days will be paid?

What data is needed for calculations to understand how payment is structured on holidays? An employee who goes on vacation in January will be paid vacation pay for all days established by law. But, as was said, vacations are not included in vacation - and, accordingly, are not paid. Therefore, even if the employee actually rested longer, he will only be paid for 28 days, if for him, according to Art. 115 no longer duration specified.

Formula

To calculate vacation pay for January, you need to use the formula:

NW x 28 , where:

- SZ – average daily earnings;

- 28 – vacation days.

In turn, average earnings are calculated based on the previous 12 months. To do this, all salaries and bonuses are summed up and divided first by 12 (the number of months), and then by 29.3 - the average number of days in a month.

When are funds paid?

Another difficulty is related to when exactly vacation pay should be paid if the employee goes on vacation immediately after the end of the New Year holidays (in 2021 - from January 9). What does the law say?

Art. 136 indicates that payment must be made no later than 3 days before the vacation begins. However, the Code does not indicate that days must necessarily be working days. Letter of Rostrud dated July 30, 2014 No. 1693-6-1 directly emphasizes that these days are calendar days.

Therefore, even if the accounting department does not work on holidays, and there is no one to make the transfer or issue cash, this is the problem of the employer, not the employee. He must have the money no later than January 6, and how this will be done is up to the company management.

A reasonable way out of this situation is to pay before the New Year holidays: Art. 136 sets a deadline, but does not prohibit paying vacation pay earlier.

How to calculate vacation pay?

Now let’s talk about how the amount payable is calculated if an employee’s vacation falls on the New Year holidays.

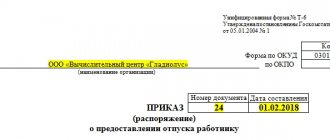

In any case, vacation pay is paid for the calendar days specified in the application and order approved on the basis of this application. Holidays falling during the vacation period are not included in the payment and are paid separately - according to the schedule established by the company.

How to calculate the amount of vacation pay?

The general calculation formula is as follows:

Amount of vacation pay = Amount of average daily earnings * Number of calendar days of vacation

The amount of average daily earnings is calculated by the ratio of the average accrued wages for the billing period to the average monthly number of days (usually this figure is 29.3). January has the smallest number of working days of the year, and accordingly, the salary for 1 working day is the highest. Payment for 1 shift with a shift work schedule is calculated according to the same principle.

Duration of holidays in 2020

According to the provisions of Art. 112 of the Labor Code of the Russian Federation, the New Year holidays officially include the following non-working days:

- from January 1, 2, 3, 4, 5, 6 and 8 – official New Year holidays;

- January 7 – Christmas.

Depending on the subject of the Russian Federation, other additional days off may be assigned, for example, religious non-working days. This dispositive norm is specified in paragraph 7 of Art. 4 Federal Law No. 125 of September 26, 1997

In accordance with the approved production calendar, New Year's celebrations in 2021 will last from the 1st to the 8th - exactly the same as last year 2021.

December 31, 2021 is Tuesday, the pre-holiday day, when the time spent in the service of the working population of Russia is officially reduced by exactly 1 hour. After long celebrations, citizens will have to work for a couple of days, after which they will again be able to take a “time out”: the 11th and 12th fall on Saturday and Sunday, which is very opportune.

Note! Since 4.01. and 5.01. fall on Saturday and Sunday, these days will be moved to March 1 and May 4. That is why in the spring, as has been observed for many years now, citizens will have additional days off.

Payment term

According to Article 136 of the Labor Code of the Russian Federation, the employer must pay vacation pay to the employee no later than three calendar days before the start of the vacation . The fact that your vacation begins on a non-working day is not a reason for late payment. For example, in 2021 such days are set from 12/30/2018 to 01/08/2018.

If an employee goes on vacation from 01/09/2018, the last working day in this case will be 12/29/2018. Vacation pay must be paid no later than this day.

Is it possible to take a vacation for the New Year and will it be paid?

“Cases of employees taking leave during the New Year are not uncommon, and the law allows this, however, on the condition that the start of such leave will not coincide with the New Year holiday,” explains Ekaterina Antonova. — So, for example, although there are no restrictions in the Labor Code of the Russian Federation when choosing the date from which a person goes on vacation, an employee cannot take vacation from January 1. In this case, it should start on a working day - for example, December 31. Such leave will be paid like any other: the only exception will be leave without pay in accordance with the employee’s application.”

Our expert also draws attention to the fact that, according to Article 122 of the Labor Code of the Russian Federation, an employee’s right to leave for the first year of employment arises only after completing six months of continuous work with a specific employer. That is why vacation from the first day is the legal right of any employee, with the exception of vacation from January 1.

Piecework and shift work

As mentioned above, those workers who work on a shift schedule do not have special privileges. For them, any official day off or holiday can be a working day, but with a different pay .

Most often, if such a period occurs, it is paid double . A similar rule applies to those employees who work piecework. They may receive additional pay for working on weekends and holidays.

You can read more about piecework wages here.

The procedure for incentives and their payments is regulated by a collective agreement or local acts of the enterprise. They must be drawn up in accordance with Article 112 of the Labor Law.

For employees who work in shifts or have piecework wages, vacation pay is calculated according to a special scheme. , all payments that the employee received during the reporting period, that is, over the last year, are necessarily .

In this case, all allowances that the employee received as compensation for working on holidays must be added.

As for vacation for employees who work in shifts or rotating shifts, unlike those who work a five-day work week, they do not have the opportunity to extend their rest period.

Regardless of what day the vacation ends, the employee needs to go to work. However, if this day is a holiday, you can count on double pay.

So that HR department employees and accounting workers can accurately record holidays, weekends and other special days, you should use a production calendar . This document contains important data that may be needed by both a personnel officer and an accountant, and an employee who is planning his vacation.

Results

Companies should remember that if vacation falls on holidays, such holidays should be excluded from the duration of the vacation. These days remain with the employee for the future. Weekends, including those postponed from holidays, are not excluded, but are taken into account in the count of vacation days used.

However, this rule only applies to regular annual and additional leave. If a specialist takes a vacation at his own expense or a study leave, then it does not matter whether they fall on holidays or not. You need to take as much time off as was allowed in advance.

Is it worth taking

Knowing how to calculate vacation in January and vacation pay, draw a conclusion about how beneficial it is for you personally to relax in the first month of the year. But from a financial point of view, it is unprofitable for employees, especially if you leave for less than a month.

To understand why it is more profitable to take a “break” in any month except the beginning of the year, let’s look at how the cost of a working day differs in January and February. For a day of work in the first month, the employer pays 2,764.71 rubles, and in the second - 2,473.68 rubles, that is, 300 rubles more. less. You may not feel the difference because you always get the same amount, but you work a different number of days every month. In January you will have to work only 17 days on salary, and in February – already 19. And for a vacation day you always receive the same amount - 1604.1 rubles. (for our example). So choose: either rest longer, or get more.

About the author of the article

Lidia Ivanova I am the editor-in-chief of the Sashka Bukashki website. More than 15 years of experience working with legal information.

Vacation start days

The vast majority of people sincerely believe that vacation should begin exclusively on Monday and end on Friday. Moreover, many HR employees also think so. This is not entirely true, but the apparent contradiction inherent in the Labor Code serves as a reason for doubt. Upon closer examination of Articles 110 and 120 of the Labor Code of the Russian Federation, it becomes clear that they do not contain any contradictions.

- Art. 110 states that every employee has the right to an uninterrupted 42 hours of rest. The mistake is that personnel officers automatically consider Saturday a day off, while only Sunday has such status in the Labor Code (Article 111). Some companies may practice the so-called. "floating day off" And it falls either on Saturday or Monday. Consequently, there are no obstacles to granting leave from Tuesday.

- Art. 120 finally establishes the obligation of the employer, if a subordinate wishes to provide him with leave in calendar (this is the key word) working days. There is no prohibition on determining the date of vacation on specific days, since the employer does not have the right to dispose of the days off of its employees. However, any disputes regarding the start of vacations can be easily avoided by drawing up a vacation schedule in which the start of vacation will always be Monday. Subordinates, as a rule, never argue with this.

Only disabled family members can receive a state survivor's pension. What is an urgent pension payment and how can I get it? Detailed information on this issue is in our article.

You can read about a possible increase in the retirement age in the Russian Federation here.

Rest or receive compensation

In general, payment for unused vacation occurs upon dismissal of an employee. However, if the employee wishes, compensation can be paid instead of vacation. But there are limitations.

Firstly, you cannot completely replace vacation with cash payments. Compensation is possible only for unused days remaining from previous years or for additional vacation time. It is prohibited to replace the required 28 days of the current year with compensation.

Secondly, the law does not allow replacing any number of vacation days for employees of certain categories:

- pregnant women;

- minors;

- employed in hazardous industries;

- customs officers;

- police officers;

- employees of other government bodies, if this is expressly stated in internal regulations or legislation.

If an organization pays compensation instead of basic leave, it may be fined.

Vacation at your own expense, additional and study leave on holidays

If a holiday falls on an employee’s regular annual leave, then, as already mentioned, such a day should be deducted from the duration of the employee’s vacation. But what if the holiday fell on some other type of vacation?

As follows from the Labor Code of the Russian Federation, employees whose working conditions differ in some way from the standard (for example, involve a special nature of work or are associated with factors that negatively affect the health of a specialist), in addition to annual leave, are entitled to additional leave (Articles 116–119 of the Labor Code RF). Their purpose is to compensate the employee for damage caused by specific working conditions. But at its core, this is the same paid leave that must be provided by the company every year.

Important! With regard to additional vacations, the rule is similar to the case with simple annual vacation: holidays are deducted from them, but weekends (including postponed ones) are not (Article 120 of the Labor Code of the Russian Federation).

If an employee goes on unpaid leave at his own expense, then this rule does not apply to him. Vacation at your own expense is provided for the number of days that the employee requires; the company does not pay vacation pay for it, and therefore there is no point in extending it for holidays that fall out.

But, for example, educational leave for employees who decide to get a higher education must be paid by the employer (Article 173 of the Labor Code of the Russian Federation). Does this mean that holidays falling on such a vacation should not be taken into account in its duration?

Based on labor legislation, it can be argued that this rule does not apply to study leave. Clause 14 of the Decree of the Government of the Russian Federation “On the calculation of the average salary” dated December 24, 2007 No. 922 directly states that in the case of educational leaves, the company must pay for all days specified in the certificate of call from the educational institution, including holidays falling on vacation. This means that all holidays that fall on study leave are also considered days off.

ConsultantPlus experts explained in detail how to pay for holidays that fall during study leave. If you don't have access, get a free trial online.

Features for regional events

Each city additionally holds its own events during which citizens do not work. On the basis of Federal Law No. 125, based on requests from religious enterprises, it is allowed to establish religious holidays. For example, in the Stavropol Territory, All Souls' Day is celebrated on May 7, and in the Irkutsk Region, on February 5, residents celebrate Sagaalgan.

The possibility of extending annual leave for these days is provided only by regional regulations, so citizens will have to study these documents on their own. In some cities, such days are considered non-working days, but if this day off falls on vacation, then employers may not increase the rest period provided.