Home / Constitutional

Back

Published: 01/31/2020

0

11

- 1 When can (should) be recalculated wages?

- 2 Who cannot be recalled from vacation

- 3 How to write a vacation review

- 4 Refusal to recalculate vacation pay 4.1 ORDER

- 4.2 For payment

- 4.3 For recalculation

- 8.1 Sample

When is it possible (necessary) to recalculate wages?

Since the legislation does not precisely define the deadlines for submitting this document, the employer has the right to establish its own internal rules. Vacation pay must be transferred to the employee three days before the start of the vacation, so he must write an application for its issuance at least four to five days before the vacation. If the employee writes a statement later, the employer has every reason to delay the payment of benefits.

For payment First of all, each employee is required to write an application for payment of vacation benefits. It is on the basis of this document that he will be able to go on an annual vacation, receiving his average earnings for this.

https://www.youtube.com/watch{q}v=S66etsX78Mc

If vacation pay is not paid for more than a few days due to the fault of the employer, then in this case you can safely contact the prosecutor’s office or the labor inspectorate, which will conduct an inspection of the company. Based on its results, material, criminal or administrative liability will be applied to the employer and persons responsible for the timely transfer of benefits.

Financial liability means that the employee will be paid compensation for each day of delay in vacation pay. Administrative liability involves the payment of fines, and their size will depend on how often such delays occur and who is to blame for them. Criminal liability is applied in complex cases when vacation pay is not transferred for several months.

Since the terms of remuneration are mandatory information for inclusion in an employment contract, any changes to the salary must have a basis.

The basis for recalculating wages upward is:

- carrying out indexation in the organization;

- underpayment of the due amount due to a calculation error;

- increasing the employee's salary by agreement of the parties.

The salary is recalculated downward if the employee has a debt to the company. In this case, deductions are made in accordance with Art. 137 of the Labor Code of the Russian Federation.

Another reason for reducing wages may be a change in organizational working conditions (Article 74 of the Labor Code of the Russian Federation) or a direct indication in the law (for example, for federal civil servants).

In practice, recalculation upward is most often done in connection with indexation in the organization and the acquisition by an employee of a certain status / length of service, for which an incentive bonus is awarded.

For example, according to paragraph 5 of Art. 50 of the Law “On State...” of July 27, 2004 No. 79-FZ, for civil service experience of up to 5 years, the bonus is 10%, from 5 to 10 years - 15%, etc.

In the HR and accounting departments of enterprises, they may not immediately notice that an employee’s work experience has exceeded 5 years, and award him a salary that is less than it should be. Then the employee has the right to write an application for recalculation, and based on it (the application), additional accrual will occur in the next billing period.

Let's get back to indexing.

Despite the uncertainty of the provision on salary indexation by employers representing private capital (Article 134 of the Labor Code of the Russian Federation), its implementation is an obligation (definition of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O, letter of Rostrud dated April 19, 2010 No. 1073-6-1) .

The procedure for salary indexation is specified in the local act; it includes the frequency and size of the increase.

The employer can focus on changes in the cost of living, the consumer price index, inflation and other values.

Recalculation of wages for the previous period will be carried out if the employer is overdue for indexation.

Additional accrual is carried out for all months when the old salary was paid, and interest for late payment is added to it in accordance with Art. 236 Labor Code of the Russian Federation.

An employee who discovers an underpayment of wages has the right to apply to the manager for a recalculation.

The application is drawn up in a standard manner, it indicates:

- name of company;

- Full name of the General Director;

- Full name of the applicant employee;

- request to recalculate for a certain period of work;

- basis for recalculation;

- date, signature.

The time for consideration of such an application by the Labor Code of the Russian Federation is not established; this is done within a reasonable time.

In response to the application received, the employer gives a reasoned refusal or issues an order to recalculate wages.

There is no unified form for an order for an upward recalculation, but such a document typically contains:

- name of the organization, if the order is not issued on letterhead;

- date and order number;

- a brief statement of the situation, the basis for issuing the order;

- Instructing an accountant or other responsible person to make a recalculation;

- Full name of the general director, his signature.

If recalculation is made downwards, you need to pay attention to the following points:

- Reducing your salary is possible only in situations strictly defined by law.

- The salary reduction is made by deductions for unearned advance payments, travel allowances, vacation days, due to a calculation error (Part 2 of Article 137 of the Labor Code of the Russian Federation).

- The employee's written consent to deductions from wages must be obtained.

- If, due to the fault of the employee, there was a failure to comply with labor standards or downtime, the conclusion of the labor dispute commission must first be obtained, which confirms these facts.

- If the enterprise is planning organizational events, as a result of which the salary will be reduced, then 2 months before their start, all employees must be notified and their signatures must be collected.

We offer for your reference a sample order for deduction from salary, since this situation is most often encountered in the work of an enterprise: Sample order for deduction from salary.

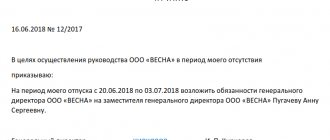

After consent to recall the employee from vacation has been received, it is necessary to issue an order also in any form. It must indicate the reason for the recall, the date the vacationer returns to work, as well as the period when the employee will be given the unused part of the vacation. The employee must be familiarized with this order against signature.

Order for recall from vacation (sample)

Personal income tax

An employee’s salary and vacation pay are his income subject to personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation).

The employing organization, performing the duties of a tax agent, is obliged to calculate and withhold the calculated amounts of personal income tax from the employee’s specified income upon their actual payment (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation).

When receiving income in the form of wages, the date of actual receipt by the employee of such income is recognized as the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement (contract) (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The date of actual receipt of income in the form of vacation pay is defined as the day of payment of vacation pay, including their transfer to the employee’s bank account (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

When paying income to a taxpayer in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation).

The tax rate for each of the specified types of income of an employee who is a tax resident of the Russian Federation is set at 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not define any special procedure for calculating personal income tax in the event of an employee’s early recall from vacation.

However, if the payment of vacation pay and the employee’s recall from vacation fall within two reporting periods, then there are official explanations according to which in such a situation the tax agent organization recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax (Letters of the Federal Tax Service of Russia dated October 24, 2013 N BS-4-11/190790, dated 04/09/2012 N ED-4-3/ [email protected] ).

Thus, according to tax authorities, when an employee is recalled from vacation, the organization (tax agent) recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax.

Previously accrued vacation pay amounts and the corresponding tax amounts are reversed, and wages are calculated for the days actually worked and the tax is calculated.

Who cannot be recalled from vacation

There are several categories of employees for whom a call from vacation is not applicable under any circumstances. These include:

- workers under 18 years of age;

- pregnant women;

- workers engaged in work with harmful and/or dangerous working conditions (Article 125 of the Labor Code of the Russian Federation).

By the way, persons combining work and study cannot be called back from additional study leave.

Next we will talk about how to recall an employee from vacation.

Insurance premiums

Vacation pay and wages are accrued to the employee as part of the employment relationship.

Therefore, the amounts of wages and vacation pay paid to an employee under an employment contract are recognized as subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as compulsory social insurance from accidents at work and occupational diseases (clause 1, clause 1, article 420 of the Tax Code of the Russian Federation, clause 1, article 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases "(hereinafter referred to as Law No. 125-FZ)).

The organization calculates and pays insurance premiums based on the results of the calendar month based on the base for their calculation from the beginning of the billing period (calendar year) to the end of the corresponding calendar month and the rates of insurance premiums minus the amounts of insurance premiums calculated from the beginning of the billing period to the previous calendar month inclusive.

This follows from paragraph 1 of Art. 421, paragraph 1, art. 423, paragraph 1, art. 431 Tax Code of the Russian Federation, paragraph 2 of Art. 20.1, paragraph 1, 9 art. 22.1 of Law No. 125-FZ.

How to write a vacation review

Recall from leave due to production needs must be properly documented.

Where to start{q} Since an employee has the right to refuse early termination of leave, it seems logical if the employer first obtains the employee’s consent to interrupt his leave. An offer to an employee to come to work is drawn up in any form.

Notice of withdrawal from vacation

Right on such a proposal, the employee can indicate that he agrees to go to work on a certain date and when he wants to use the rest of the vacation. Or a separate document can be drawn up in any form.

Application for recall from vacation (sample)

Refusal to recalculate vacation pay

https://www.youtube.com/watch{q}v=pX4Bp8tzFVg

Attention

SAMPLE To (position of the head of the organization, his full name) from (your position and full name) APPLICATION From _ to _ 2012 (start and end dates of vacation) in accordance with order No. (find out it in the HR department) I was granted another paid leave. In accordance with Art. 136 of the Labor Code of the Russian Federation, payment of vacation pay must be made to me no later than three days before it starts.

However, as of (date of writing the application), I still have not been paid vacation pay. As a result, I cannot fully relax with my family. Considering the above, I demand that you pay me vacation pay.

Also according to Art. 236 of the Labor Code of the Russian Federation, I demand to immediately pay me interest in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation on the delayed amount for each day of delay. If my demand is not met, I will be forced to seek protection of my rights from the State Labor Inspectorate.

Based on the application, the responsible persons must draw up an order for a specific employee to go on vacation, which will be transferred to the accounting department for calculating vacation benefits. Legal grounds All citizens of the Russian Federation working on the basis of an employment contract have the right to annual paid leave, during which they will receive their average salary (Article 114 of the Labor Code of the Russian Federation).

This right is defined in the Constitution of the Russian Federation, and is described in more detail in the Labor Code of our country. In addition, there are additional Decrees of the Russian Government (for example, No. 922), which clarify certain points, for example, the duration of vacation for certain categories of citizens. Application for vacation pay Application for vacation pay is written a few days before the start of the vacation.

Annual paid leave is based on actual time worked. But labor legislation does not prohibit granting leave in advance, that is, until the employee has the corresponding right. The employee will have to work “advance” vacation days.

If he quits without working the period for which he has already used vacation, the question arises of returning the previously accrued amount of vacation pay.

Article 137 of the Labor Code of the Russian Federation gives organizations the right to return overpaid vacation pay by deducting from the salary given to the employee upon dismissal. But you need to remember the restrictions provided for in Article 138 of the Labor Code of the Russian Federation. It follows from this rule that the amount of deductions cannot be more than 20 percent of the salary.

If the overpaid vacation pay exceeds 20 percent of the accrued salary or the employee’s last salary is not enough to withhold the overpayment, he will have to obtain his consent to return the entire amount of the debt. To do this, you need to obtain a statement from the employee in which he confirms that he does not dispute the grounds and amount of the deduction.

Note. When calculating the amount to be withheld, you need to take into account the average daily earnings on which vacation pay was previously calculated. It is impossible to determine average daily earnings based on the billing period preceding the day of dismissal. Indeed, with this approach, it may turn out that more (or less) will be withheld from the employee than the amount of vacation pay that he received.

In some situations, the employer will not be able to exercise its right to withhold at all. For example, an employee who is on maternity leave for up to three years resigns. In this case, by the time of dismissal, she will not have a salary from which overpaid vacation pay could be withheld. Accordingly, the company will not be able to apply Article 137 of the Labor Code of the Russian Federation.

Lawyers' opinions are divided on whether an employer can recover from an employee the entire amount of overpaid vacation pay through the court. Some believe that there is an appropriate legal basis for this. Experts refer to the order of the Ministry of Health and Social Development of Russia dated 03.03.05 No. 190 (hereinafter referred to as order No. 190), which invalidated paragraph 2 of the Rules on regular and additional leaves (approved by the NCT of the USSR on 04.30.1930 No. 169).

This clause stipulated that if the employer, who has the right to withhold, was actually unable to make it at all or partially (for example, due to insufficient amounts due to the employee during the calculation), he loses the right to further recover the amount of the overpayment in court. And since this norm has been abolished, it means that the company has the right through the court to demand from the employee the return of unearned vacation pay if he refused to do so voluntarily.

But there is also the opposite opinion. The fact is that the Russian Ministry of Justice returned order No. 190 without consideration. In addition, the Labor Code of the Russian Federation does not provide for a mechanism for filing a claim in court to recover amounts not withheld upon dismissal. And finally, Article 1109 of the Civil Code of the Russian Federation states that wages and other sums of money provided to an individual as a means of subsistence are not subject to return as unjust enrichment, in the absence of dishonesty on his part or an accounting error.

ORDER

11/27/2012 N 75-k

An application for vacation pay is written a few days before the start of the vacation. Since the legislation does not precisely define the deadlines for submitting this document, the employer has the right to establish its own internal rules.

If the employee writes a statement later, the employer has every reason to delay the payment of benefits.

For payment

First of all, each employee is required to write an application for payment of vacation benefits. It is on the basis of this document that he will be able to go on an annual vacation, receiving his average earnings for this.

Compiling this type of application is as simple as possible, since the employee is only required to indicate the details of the head of the company, his name and position, and then submit a request for leave based on the company’s internal documents (schedule for all employees).

After this, an order will be issued, after which the employee will be transferred to the accounting department and the vacation pay will be transferred.

Vacation pay to part-time workers is paid in accordance with the general procedure.

What is vacation pay{q} See here.

For recalculation

In some cases, employees have the right to recalculate benefits.

The reason for this may be various situations:

- early departure from vacation, as a result of which the employee plans to use the remaining days of rest later;

- wage indexation, as a result of which the average citizen’s salary increases;

- incorrect calculation of vacation pay, as a result of which a smaller amount was transferred to the employee.

In any of these situations, the employee must initially write a statement addressed to the manager, requesting a recalculation of the payment due to him.

In the document, the citizen must also indicate the reason on the basis of which this action will be carried out.

Six months after the start of work with a specific employer (and sometimes earlier - by agreement of the parties or on the basis of Part 3 of Article 122 of the Labor Code of the Russian Federation), the employee receives the right to his first annual leave. According to Art. 115 of the code, the duration of paid leave cannot be less than 28 days.

Leave provided in advance upon dismissal before working for 12 months gives the employer the right to withholding for leave upon dismissal. After all, vacation pay is calculated for the entire period, i.e., for 28 days, which are due to the employee once a year, but in this case the year was never worked out, although the vacation has already been used.

Read us on Yandex.Zen

Yandex.Zen

The employer may withhold excess paid vacation pay for vacation received in advance from the resigning employee’s salary, with the exception of a few cases. So, according to para. 4 hours 2 tbsp. 137 of the code, deduction upon dismissal for leave provided in advance cannot be made if the employee quits due to:

- refusal to transfer to another job for medical reasons or because the employer does not have such an opportunity;

- reduction of staff at the employer or its liquidation, as well as a change of owner, which led to the dismissal of the company’s management;

- reinstatement by decision of the court (labor inspectorate) of an employee who previously worked in this position;

- conscription for military service (including alternative);

- recognition of an employee as incapacitated for medical reasons;

- the occurrence of force majeure, recognized by the Russian government as such and not allowing further continuation of work;

- death of the individual employer.

If at least one of the above grounds occurs, the employer does not have the right to withhold vacation pay upon dismissal. If an employee quits for other reasons, then the employer has every reason to make a deduction for the vacation used from his salary upon dismissal. Retention, in accordance with Part 3 of Art.

If we talk about deduction for unused vacation upon dismissal, then it is not made, since vacation pay in this case was not paid to the employee. Moreover, before dismissal, the employee is provided with appropriate compensation, calculated according to the rules on regular and additional leaves, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169 (hereinafter referred to as the Rules).

According to Art. 28 of the Rules, compensation is paid:

- For the entire vacation, if the employee worked for 11 or more months or worked for more than 5.5 months and was dismissed due to the liquidation of the employer company, conscription for military service, or recognition as unfit for medical reasons.

- Proportional to actual time worked.

Review from vacation in personnel documents

- in column 10 “Note”, note that a certain number of vacation days are transferred to another period;

- in column 8 “Bases (document)” indicate the order for recall from vacation, its number and date;

- in column 9 “Date of intended vacation” reflect the dates to which the unused part of the vacation is transferred.

In the time sheet, the days when the employee was on vacation are marked with the letter code “OT” or the digital code “09”. And the days when the employee was already working (after recall) - with the letter code “I” or the digital code “01”.

The fact of recall from vacation must also be reflected in the employee’s personal card - form No. T-2 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1). In column 4 of Section VIII of the card, you must indicate the number of days that the employee actually took off on vacation. In this case, column 7 “Grounds” must indicate the details of orders for the employee’s leave and recall from leave.

If vacation is from the 1st day, what is the month of accrual?

Sometimes this decision is dictated by production needs, and sometimes by the employee’s own desire. In this case, a transfer of vacation is processed; it is necessary to recalculate the vacation pay accrued and paid to the employee.

And the days that the employee did not use must be provided to the employee at a later date. The payment amount will be different, as the billing period will change.

If the transfer is carried out within a month, then recalculation is not carried out, since the original data for the calculation does not change. If the transfer is carried out to another month or even year, then it is necessary to calculate the amount of vacation pay for days of rest that fell on sick leave and return this money to the organization.

How exactly the amount of vacation pay will be returned in this case is decided between the employee and management individually. The result obtained will be the indexation coefficient, taking into account which vacation pay must be recalculated. Vacation pay is indexed only in the event of a massive increase. In isolated cases, vacation payments are not recalculated. The billing period is twelve months. This time does not include the time the employee is on vacation, business trip, sick leave, or failure to complete work as a result of the organization’s downtime. An increase in salary leads to changes in the payments that depend on it. Therefore, vacation pay must be adjusted whenever tariff rates change. The opposite situation, when the salary is reduced, does not lead to the need for recalculation. Read more about the recalculation of vacation pay when salaries increase.

Registration procedure

Paid leave is issued annually, based on the schedule adopted by the company. All employees have the right to use all vacation at once or divide it into parts (Article 125 of the Labor Code of the Russian Federation).

The law determines that one part cannot be less than fourteen days.

As for additional leave issued for hazardous work or living in unfavorable areas, it can be used either in the current year or added to the next leave.

However, it is legally allowed to combine vacations only for two years. If the employee has not used additional days during this period, they are automatically written off and he will no longer be able to use them.

In order to receive vacation pay, the employee only needs to write an application; the employer has no right to demand other documents from him, since he himself has access to them (work book, employment contract, employee vacation schedule).

Based on the application, the responsible persons must draw up an order for a specific employee to go on vacation, which will be transferred to the accounting department for calculating vacation benefits.

Income tax: accrual and payment of vacation pay

The amount of wages accrued for working days falling on unused vacation days is included in labor costs on the basis of clause 1 of Art. 255 of the Tax Code of the Russian Federation and is recognized as an expense in the month of accrual of this amount (clause 4 of Article 272 of the Tax Code of the Russian Federation).

The corresponding insurance premiums are other expenses associated with production and sales, the date of which is the date of accrual of insurance premiums (clauses 1, 45, clause 1, article 264, subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

The amount of vacation pay due to an employee is, for tax purposes, a labor expense (Clause 7, Article 255 of the Tax Code of the Russian Federation).

Such expenses are recognized as expenses on a monthly basis based on accrued amounts (clause 4 of Article 272 of the Tax Code of the Russian Federation).

The corresponding insurance premiums relate to other expenses associated with production and sales (clauses 1, 45, clause 1, article 264 of the Tax Code of the Russian Federation).

The date of expenses in the form of insurance premiums is the date of their accrual (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

The moment of recognition in tax accounting of any expenses, except non-operating ones, depends on whether they relate to direct or indirect expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation).

The organization determines the list of direct expenses independently, and all other amounts of expenses, with the exception of non-operating expenses, relate to indirect expenses (paragraph 9, 10, paragraph 1, article 318 of the Tax Code of the Russian Federation).

At the same time, from the wording of the Tax Code of the Russian Federation it follows that direct costs are expenses directly related to the production process (paragraph 10, paragraph 1, Article 318 of the Tax Code of the Russian Federation) (see Letter of the Federal Tax Service of Russia dated February 24, 2011 N KE-4-3/ [email protected] “On the procedure for distributing, for profit tax purposes, costs of production and sales into direct and indirect ones”).

Thus, if the employee is not associated with the production process, then for tax purposes the amount of the employee’s vacation pay and the amount of the corresponding insurance contributions can be qualified as indirect expenses and taken into account in full during the period of their accrual (clause 2 of article 318, paragraph 3 of article 314 Tax Code of the Russian Federation).

If the employee is associated with the production process, then for tax purposes the amount of the employee’s vacation pay and the amount of the corresponding insurance premiums are qualified as direct costs directly related to the production of goods (performance of work, provision of services) and are taken into account as follows:

- Direct costs are distributed among work in progress and products manufactured in the current month (work performed, services rendered)

- Direct expenses refer to the costs of the current reporting (tax) period as products (works, services) are sold, in the cost of which they are taken into account in accordance with Article 319 of the Code.

- If an organization has direct expenses related to work in progress, balances of finished products and goods shipped but not sold, then until the sale of products and these goods occurs, these amounts of direct expenses are not taken into account in the income tax base.

Legal grounds

All citizens of the Russian Federation working on the basis of an employment contract have the right to annual paid leave, during which they will receive their average salary (Article 114 of the Labor Code of the Russian Federation).

This right is defined in the Constitution of the Russian Federation, and is described in more detail in the Labor Code of our country.

In addition, there are additional Decrees of the Russian Government (for example, No. 922), which clarify certain points, for example, the duration of vacation for certain categories of citizens.

Results

The procedure for recalculating vacation pay due to an employee’s illness depends on whether the vacation will be postponed or extended, as well as on whether the calculation period for determining average earnings and the duration of the vacation changes. It is not permitted to withhold overpayment of vacation pay without the employee's consent.

Find out also how to properly arrange leave followed by dismissal.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to write{q}

You must write an application for payment or recalculation of vacation pay, as well as in case of delay in benefits, on a blank A4 sheet of paper.

This can be done manually or by typing text on a computer. In this case, the color of the paste does not matter much, so both blue and black are allowed. It is also not clearly defined whether the document should be filled out in capital letters or block letters. The font and size of the printed version are also not important.

Sample

The application for vacation pay, a sample of which you can see below, is filled out quite simply. It is written in the name of the head of the company, whose name and position are indicated in the header of the application. After this, write the name of the employee planning to go on vacation.

The text of the application itself must include the terms of paid vacation.

In cases where there is a delay in vacation pay, the employee must also first write an application addressed to the employer before contacting the labor inspectorate.

In it, he must notify of the violation of his right to paid leave, and also indicate the possible consequences, that is, appeal to higher authorities if the problem is not eliminated in the near future.

If the employee’s consent is obtained, then the employer needs to prepare an order on the basis of which changes will be made to personnel documents.

- standard details - date, place of preparation, title of the document, title, details of the organization (the organization’s letterhead can be used);

- the reason for drawing up the order - for example, due to production needs;

- ordering the HR specialist to interrupt the employee’s vacation and formalize his return to work;

- an order to provide unused days at a time convenient for the employee;

- order to recalculate vacation pay;

- an order to accrue wages from the moment the employee starts work, according to the wages established for him;

- document basis - an employee’s statement of consent;

- manager's signature.

The reason for the recall is usually production necessity, sick leave for a partner, a large influx of clients, or expansion of production.

The concept of production necessity can mean a wide category of reasons when the organization present cannot cope with work tasks with its own resources, for which a vacationer is called to work ahead of schedule.

Below are examples of how you can issue an order.

Mistakes that are made when filling out a document

Most often, when filling out an order, a specialist may make the following mistakes:

- spell the name of the organization incorrectly;

- do not put down or write the wrong date for drawing up the document;

- do not indicate the registration number;

- make corrections with a simple pencil or a pen of a different color;

- write the text in illegible handwriting;

- make a lot of corrections in the document;

- make spelling mistakes;

- write the amount of money incorrectly;

- artificially age a document;

- erase the text.