Deductions

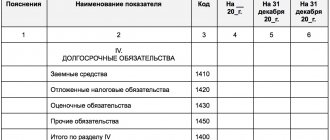

A liability is the company's debt existing at the reporting date, which arose as a result of events that occurred in

In the legislation of the Russian Federation there is neither the very concept of “time off” nor a documented form of the document

Transport costs in the estimate documentation Transport costs are the costs associated with the delivery of construction materials

Purchasing goods from individuals is not such a rare occurrence. Companies often buy

As a general rule, only those taxpayers can receive a property tax deduction when purchasing a home.

Exchange differences when conducting export-import transactions All Russian organizations are required to keep accounting records in rubles.

To create safe working conditions for workers at the enterprise, everything is based on plans, be it

Key components of the tariff system of remuneration The tariff system is the most common payment model. She

UTII is a convenient and simple tax regime used by individual entrepreneurs. When doing business, do not

According to generally accepted rules, enterprises can hope to receive a refund of previously paid VAT only after