Purchasing goods from individuals is not such a rare occurrence. Often, companies buy something they need from their founders, managers or other employees. But sometimes it is profitable to purchase a car, a computer, the necessary equipment, spare parts, building materials, etc. from some third parties. And some organizations cooperate with individuals regularly. Take, for example, buyers of agricultural products - most of them are shops, catering establishments and food manufacturers. What are the features of such transactions?

Main

Some people think that purchasing from an individual by a legal entity is prohibited, but this is not so. Why? After all, it will not be possible to issue a check or invoice!

It can be done differently. For this type of transaction it is not necessary to draw up an agreement. The parties themselves decide on this issue, but we still recommend documenting the operation. First of all, such a measure will avoid many problems and provide a guarantee that the transaction will be completed.

As for payment, a purchase from an individual by a legal entity can be paid either in cash or by transfer to a personal account in a banking organization. It is important to understand that the settlement amount is not limited by anything, since the law allows payments to individuals in any amount.

Possible payment options and restrictions

There is no payment limit for a cashless transaction. Restrictions are established only when paying in cash in the amount of 100 thousand rubles.

Non-cash payments go through banks, so it is allowed to use payment orders, letters of credit, checks, and collection payments.

In a non-cash transaction, the contract must indicate when the buyer will be considered to have fully fulfilled his payment obligation:

- when the money was credited to the seller’s current account or correspondent account;

- when the money was debited from the correspondent account of the buyer's bank.

If this is not specified in the contract, then it will be considered that the buyer has paid for the transaction when the money is received in the correspondent account of the seller’s bank.

What the law allows

Below we will provide documents for the purchase from an individual by a legal entity, but for now let’s talk about which transactions can be carried out with individuals and which cannot.

There is a law “On the contract system in the field of procurement”, according to which, in addition to enterprises, individual entrepreneurs and organizations, an individual can act as a bidder.

Procurement in such a situation can be carried out under Article 93 of Federal Law-44 or in a competitive way, that is, through an auction or competitions. A prime example is citizens who are hired as tour guides or teachers for a short period of time.

The only restriction is that individuals are not eligible to participate in bidding aimed at SONPOs and SMPs. How can I find out about such participants? This point must be specified by the customer in the procurement documents.

Another indicator is the difference between applications. We are speaking:

- About the surname, patronymic and first name, as well as the place of residence of the supplier. Usually the name of the enterprise and its legal address are written in this place.

- About documents that prove identity. As a rule, an extract from the Unified State Register of Legal Entities should be located here.

- Only participating enterprises must indicate the IIN. Individuals are exempt from this.

It is important to understand that when a legal entity makes a purchase from an individual, the cost of the goods is reduced by personal income tax. It is not only possible, but also necessary to pay attention to all these points so that problems do not arise in the future.

Without VAT deduction, but with concessions

Individuals are not VAT payers (clause 1 of Article 143 of the Tax Code of the Russian Federation), and therefore do not present tax to the purchasing organization, which it could take as a deduction.

For companies on OSN, this is a definite minus. The same cannot be said about the “income simplifiers,” for whom such a deduction is unnecessary (unlike, by the way, their “income-expenditure” colleagues, who write off “input” VAT as expenses (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation)) .

Keep in mind: it is impossible to determine the tax by calculation method in order to subsequently accept it as a deduction for such purchases (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 29, 2007 No. F08-2109/2007-875A).

If the company subsequently sells this property, it will have to charge VAT on its sale price (subclause 1, clause 1, article 146, clause 1, article 154 of the Code). However, there are two exceptions to this rule, when a company calculates tax on the inter-price difference (that is, on the sales price of products including VAT minus the price of its purchase from citizens) using calculated rates - 10/110 or 20/120. Thanks to such a preference, the organization will pay much less tax.

The first case is the sale of agricultural products and products of their processing (except for excisable goods) purchased from “physicists” from the List approved by Decree of the Government of the Russian Federation of May 16, 2001 No. 383 (clause 4 of Article 154 of the Tax Code of the Russian Federation).

note

Purchases from entrepreneurs with special regimes are not subject to this provision of the Code (see letter of the financial department dated December 7, 2006 No. 03-04-11/234, Resolution of the Federal Antimonopoly Service of the Volga District dated December 3, 2013 No. A12-6633/2013) .

Please note - according to financiers, this benefit is applicable only when the company resells the mentioned products.

If a company purchases it, then processes it, and then sells the finished product, then the tax base is determined based on the full cost of what is sold, that is, in the usual manner (letter of the Ministry of Finance of Russia dated July 11, 2021 No. 03-07-14/43942).

Some judges also think the same (see decisions of the Federal Antimonopoly Service of the West Siberian District dated June 8, 2009 No. F04-2975/2009 (6522-A03-42), Central District dated October 8, 2008 No. A36-528/2008) . However, the majority of arbitrators have a different point of view - they allow processors of raw materials to use the benefit (resolutions of the Administrative Court of the East Siberian District dated July 30, 2015 No. 02-3273/2015, FAS Ural District dated May 8, 2009 No. F09-2751/09 -C2, as well as determinations of the Supreme Arbitration Court of the Russian Federation dated December 11, 2007 No. 15613/07 and August 9, 2007 No. 8061/07). So the company’s chances of defending its position are very good.

Important

If a company purchases products from citizens of one locality, it is impossible to combine all these purchases in a single document, according to lawyers.

After all, each such transaction is bilateral, which means that separate contracts (purchase acts) must be drawn up with all sellers. Example 1. VAT on the purchase and sale of agricultural products

The company purchased 145 kg of potatoes from an individual at a price of 15 rubles. per kg, after which she sold it at a price of 27 rubles. per kg including tax. Potatoes are named in List No. 383. Thus, when selling these products, the tax base is equal to 1,740 rubles. ((27 rub. – 15 rub.) × 145 kg). The amount of VAT payable, based on the provisions of sub-clause. 1 clause 2 and clause 4 art. 164 of the Tax Code of the Russian Federation, amounted to 158.18 rubles. (RUB 1,740 × 10/110).

Basic documents

A purchase from an individual by a legal entity is accompanied by a package of papers, without which the transaction simply will not be carried out. What are these documents? Let's see.

- The act of acceptance and transfer of property.

- Act SP-40. Used if animals are purchased.

- Procurement act in form OP-5.

- Acceptance certificate. Needed if you buy scrap metal.

It is important to remember that there should always be two acts.

By the way, you can draw up a deed yourself using an individual sample. In such a situation, you need to make sure that the form contains all the necessary details. Let's talk about them.

Required details

The purchase of goods from an individual by a legal entity must be formalized using acts. These documents must include standard details. What are we talking about?

- Title of the paper.

- Date the document was signed.

- Contents of the document.

- Name of the business or organization.

- Quantity and unit of measurement.

- Signatures of both parties.

Based on this paper, the company will accept the cost of the goods as an expense, which is necessary if the taxation system involves paying the difference between expenses and income.

When and why is a decision of the founders necessary?

A major transaction requires additional documents from all founders - decisions. A major deal is:

- For a limited liability company - purchase or alienation of real estate worth 25% of the price of the entire property of the company.

- For a unitary enterprise - the purchase price is more than 10% of the company's authorized capital or more than 50 thousand times the minimum wage.

Collective

If there are more than two participants in the LLC, you need to organize a meeting and draw up appropriate minutes. It will be considered a solution.

The document must indicate:

- date, start and end time of the meeting;

- place;

- agenda;

- participants;

- object data;

- buyer;

- transaction amount;

- payment procedure and terms.

The rules for drawing up minutes of general meetings of an LLC are established in Art. 181.2 of the Civil Code of the Russian Federation.

Sole founder

The law does not establish the form of this document. It is drawn up according to the general rules of decisions for LLC founders. Difference: the text must indicate that the participant in the transaction approves it.

Documents for payment

The purchase of goods from an individual by a legal entity is also carried out for money. And there are two payment methods: cash and bank transfer. The latter option must be confirmed using a payment order.

But cash payments are worth considering in more detail. For an enterprise or organization, there are two ways of settlement with an individual:

- Issuing money from the cash register. In this case, a cash receipt order is issued, but not always. For example, individual entrepreneurs do not have to do this.

- Issuing cash to an employee of an enterprise on account. Once the employee pays the seller, he will be required to prepare an advance report. But the latter is not served without everything; a document is attached to it, which contains a note about payment for the goods.

When is a procurement act issued?

If it is planned to purchase equipment from an individual by a legal entity or we are talking about some kind of value, then it is necessary to draw up a procurement act. The latter can act as a primary contract, or it can become an independent document. This is due to the form of the contract, which can be different.

The document will come into force only after signature of both parties.

There is an already developed template in the OP-5 form that you can use. Alternatively, a company can develop a template on its own.

Apartment purchase

How does a legal entity purchase real estate from an individual? The procedure is not so different from the standard one for purchasing real estate.

First of all, you need to remember that a legal entity can buy an apartment or premises either from the same legal entity or from a private person. The law allows both options.

The legal entity will be a commercial organization with the status of JSC, LLC, CJSC. The purchase of an apartment from an individual by a legal entity can be carried out for the following purposes:

- Investment. People buy an apartment to invest money and resell it in the future. In this case, the apartment is not the main asset.

- Commercial. The apartment is the main asset and accounting is maintained for it.

The difference from a standard transaction is that it is necessary to obtain consent from the owner of the enterprise for a major acquisition. By the way, a major transaction is one that exceeds a quarter of the value of the organization’s assets.

"Profitable" dangers

The purchase of goods, raw materials, supplies, and fixed assets from individuals is reflected in tax accounting in the same manner as the purchase of these valuables from an organization. In this case, the primary equipment must be in perfect condition, and the costs must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). Otherwise the company will have problems.

Make sure that procurement documents contain complete and accurate information. If it turns out, for example, that individuals did not live at the listed addresses, and passports with the data specified in the acts were not issued to sellers, the company may well pay (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 11, 2006, October 4, 2006 No. F03- A73/06-2/3360).

Verify the seller's identity. A case from life - in the primary application for purchasing products from a private person, there was information from the passport of a completely different citizen, which he had lost several years ago. Moreover, this man himself was serving a sentence in a correctional colony at the time of the transaction and denied his involvement in these business operations. As a result, the company lost expenses, despite the fact that the goods were actually purchased by it, capitalized and subsequently sold (Resolution of the Federal Antimonopoly Service of the Volga Region dated August 9, 2012 No. A12-22472/2011, upheld by the Determination of the Supreme Arbitration Court of the Russian Federation dated December 19, 2012 No. VAS-16290/12).

It is also necessary to ensure that all procurement documents contain the signatures of sellers. Of course, there are examples of court decisions in which companies, in the absence of such autographs, still managed to prove the fact of purchase of products (Resolution of the Federal Antimonopoly Service of the Volga District of August 7, 2009 No. A57-14214/2008, etc.).

However, wasting time, energy and tempting fate is not a pleasant experience.

We immediately warn against forging sellers’ signatures in such a situation. The deception may well be revealed with the help of a handwriting examination, and then - goodbye to expenses (Resolutions of the Federal Antimonopoly Service of the North-Western District dated June 15, 2009 No. A52-5063/2008, FAS North Caucasus District dated May 6, 2009 No. A53-17846 /2008).

The auditors will certainly suspect something is wrong even if the volume of products purchased from “physicists” goes beyond all reasonable limits.

For example, the Federal Antimonopoly Service of the Volga-Vyatka District, in Resolution No. A31-9242/2005-15 dated May 14, 2007, came to the conclusion that the procurement acts contained unreliable information. After all, the company purchased an unrealistic amount of mushrooms from four individuals every day - from 2.5 to 10 tons. As a result, the company lost its “profitable” expenses.

How the transaction is carried out

The purchase of premises by a legal entity from an individual follows the standard procedure.

- The participants discuss important aspects of the transaction.

- A preliminary purchase and sale agreement is signed and an advance or deposit is made.

- The participants sign the main agreement.

- The buyer and seller go through the procedure of state registration of the transfer of ownership rights.

- The final payment is due under the sales contract.

- Participants sign an act of acceptance and transfer of real estate.

The seller is required to have a certain package of documents, which must already be ready at the time of sale.

This:

- Passport.

- A certificate of title or other document that establishes ownership.

- An extract from the register confirming the absence of encumbrances.

- Documents that explain how the owner came to own title. This includes a privatization agreement, a purchase and sale agreement or a will.

- Explication of the premises and technical plan from the BTI. These papers confirm the absence of undocumented redevelopments.

- An extract from the house register, which shows that there are no registered persons in the apartment.

- Extract from the Unified Housing Document or financial and personal account. With its help, the seller confirms that there are no debts on utility bills.

- If necessary, consent from the guardianship authorities to the transaction. This will be necessary if the owners include persons under guardianship or minors.

Sometimes the seller attaches a power of attorney for the provision of interests to the existing package. This happens in situations where the transaction is carried out by an authorized representative.

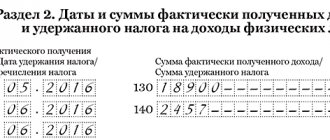

Taxation

After the transaction is concluded, you need to pay tax when selling real estate by a legal entity. This can be quite a large amount.

In general, you need to pay two taxes - income tax (calculated on the amount of the company’s profit from the transaction) and VAT - in the amount of 20%.

The amount of tax in real estate purchase and sale transactions is affected by:

- Residential or non-residential real estate.

- The legal entity is registered in Russia or abroad.

When buying and selling residential real estate, tax is paid only on profits; VAT is not required. If the object of the transaction is non-residential premises, VAT is paid along with income tax.

When selling real estate by an individual, the transaction is subject to ordinary personal income tax.

Some nuances

When purchasing property by an individual from a legal entity and vice versa, it is necessary to devote a lot of time to the purchase and sale agreement. When drawing up, the requirements of the Civil Code of our country must be taken into account. The contract must clearly define the property, describe the parties to the sale and purchase, and contain the cost of the transaction. The last requirement is very important, because if there is no information about the price, the contract will be declared invalid.

In addition, the document must reflect all persons registered in the apartment, the obligations and rights of the parties, the presence of housing and communal services debts and encumbrances, and the conditions for terminating the contract.

In addition, during the preparation of documents, the seller will have to write an application for alienation, and the buyer for taking ownership. You should not ignore the state duty, as this is a necessary contribution. For legal entities it is equal to 22 thousand rubles. The amount is relevant for each region and is enshrined in the Tax Code.

Registration of a completed transaction

After the agreement is signed, it is necessary to register the transaction in the Unified State Register of Real Estate. This can be done either at the Rosreestr authorities or through the city’s MFC.

To do this you will need to provide:

- The contract itself.

- Receipt for payment of state duty. For citizens it is equal to 2,000 rubles, for organizations – 22 thousand.

- Statement of the established form.

- A copy and original of the power of attorney if the transaction is conducted through intermediaries.

REFERENCE: After the documents have been submitted, you need to wait - and after the registration period expires, the right will be recorded in the Unified State Register of Real Estate.

Buying a car

Transactions between an individual and a legal entity can be not only for real estate or goods. Often, a car is purchased from a legal entity by an individual and vice versa. Let's talk about whether there are any differences from the standard procedure.

There are no fundamental differences observed during the transaction, but there are some nuances. If you don't know about them, the seller or buyer can get themselves into trouble.

- Checking the seller for legal purity.

- Minor differences in the execution of the transaction.

It is important to check the seller directly, and not the car, for legal purity before making a transaction. Why do this? A legal entity may have unfulfilled obligations for which the company is liable with all its property. A car is directly related to the property of an enterprise or organization.

If a person buys such a car and does not check the seller, over time the rights to the car may be claimed by other legal entities that were creditors.

To check an enterprise or organization, it is enough to obtain an extract from the Unified State Register of Legal Entities. It can be analyzed for inconsistencies or suspicious information.

It is also necessary to check whether the legal entity has tax debts and whether it is legally capable. To do this, you can use the tax service website.

It is necessary to find out whether the company is considered bankrupt. You definitely need to do this, because you are taking a risk and parting with a considerable amount.

As for the specifics of the transaction, there are several of them.

- Representation of a legal entity.

- Making payment.

- Preparation of documents.

First of all, before concluding a transaction, you need to make sure that the representative has a power of attorney to sell the car. The document must be on company letterhead and certified by a notary. Only in this way does a document drawn up allow one to hope for the purity of the transaction.

The set of documents for sale is standard, but there are some nuances. For example, all fields for individual owners must contain information about the company. Moreover, it is also important to check the presence of a seal and the signature of a representative of the legal entity.

Please note that the DCT must contain a link to a power of attorney certified by a notary. It must correspond to the one that the representative of the legal entity has in his hands.

To avoid problems in the future, try to deposit money into the company’s cash register. The latter must be equipped with a cash register. After the operation is completed, the cashier is obliged to issue the buyer a cash receipt order certified by the seal of the legal entity.

Why difficulties arise

An individual entrepreneur is an ordinary person who told the state that he is engaged in business. The law does not divide his property into two parts: for business and personal life. Everything that a simple guy Denis has, individual entrepreneur Denis Aleksandrovich Emelyanov also has.

This is where the difficulties begin. Property is common, but the responsibilities of an individual entrepreneur and an ordinary person are different. Denis pays the simplified tax system as an entrepreneur and personal income tax as a simple guy. To calculate taxes without errors, you need to correctly determine the status of the property.

We are buying a plot

Above, we have already talked about how a legal entity purchases materials from an individual. The time has come to talk about purchasing a plot of land.

What do you need to know about the procedure for purchasing land from an individual by a legal entity? Now we'll tell you.

The entire procedure revolves around the purchase and sale agreement. It contains both the seller's and buyer's details. Everything seems to be clean, but it’s not.

Before a legal entity agrees to a transaction, it must be aware that there are certain risks. We are talking about:

- Difficulty in verifying the legal purity of the acquired land.

- The risk of land seizure during the registration process by government authorities.

- The presence of encumbrances that do not allow certain actions to be performed with the site.

- Inflated cost of land.

How to check documents? Unlike the purchase of an operating system from an individual by a legal entity, there are a lot of subtleties here.

In order not to fall for the tricks of scammers, it is enough to independently collect documents that will help discover hidden information.

First you need to make copies of these land documents. Please note that the authentic registration certificate is protected by a hologram and watermarks. To check the document you need to contact the federal registration service. If the seller has nothing to hide, then he will give the document without any problems.

It is also necessary to check the land by cadastral number. This is done on the Rosreestr website using the public card of the federal registration service.

It is worth ordering an extract for the site from the federal registration service. It will show whether there are encumbrances on the land, arrest and who is the owner of the site.

If you are afraid that you cannot handle it yourself, entrust the inspection to a real estate agency.

Scheme: Purchase of property from an individual

Author Degtyarev V.A. – General Director of United Management Company LLC, www.pnpb.ru

Purchasing property from an individual is a way to reduce income tax without paying personal income tax and the unified social tax

The essence of the scheme: An individual sells goods (materials) to an organization that are used for production purposes.

As a result, an individual has the right to receive tax-free income of up to 125 thousand rubles in a calendar year. In this case, the organization will be able to take such expenses into account for the purposes of calculating income tax.

Fundamental possibility of the circuit

According to clause 1 of clause 1 of Article 220 of the Tax Code of the Russian Federation, an individual has the right to a property tax deduction in each tax period if he receives income of up to 125 thousand rubles from the sale of his property.