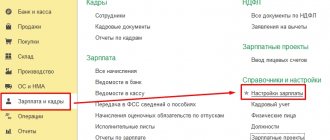

Deductions

An employee sent on a business trip must be provided with the main travel document - a travel certificate.

Part-time work does not entail any duration restrictions for employees

Rosstat is engaged in a statistical study of the economic state of the business segment, for which it maintains relevant statistics. Accounting

Home / Taxes / What is VAT and when does it increase to 20 percent?

The personal income tax return (form 3 personal income tax) is submitted to the tax office

When it comes to the traveling nature of work, for some reason everyone immediately imagines drivers. Certainly,

Pilot project of direct payments from the Social Insurance Fund - what is it? Pilot project for payment

11/26/2020 Here you will find an application for the distribution of property tax deductions between the owners of the apartment (room,

Who pays and for what? VAT stands for value added tax. Accrued when

Dismissal by agreement of the parties presupposes the existence of an agreement between the parties to the employment relationship. Despite the similarities