Let's define the concept

A registration number is a numeric or alphanumeric designation assigned to a document when it is registered.

The registration number of the goods declaration (DT) in accordance with the requirements of the “Instructions for filling out customs declarations and customs declaration forms” (approved by the CCC Decision No. 257 of May 20, 2010) consists of three elements:

- Code of the customs authority that registered the document.

- Registration date: day, month, last two digits of the year.

- The serial number of the declaration, which is assigned by the customs authority. Each new calendar year begins with one.

These three elements are separated by the “/” character, and no spaces are allowed between them. It would seem that everything is simple and clear.

Rules for filling out a new invoice, sample fields

- Since strict accounting is maintained, these documents must have serial numbers. They may be supplemented with trustee indices after the dividing line. The date uses a digital format.

- If there are no corrections, a dash is placed in this field.

- If an invoice is issued for actually completed operations, “no” is entered in the advance payment field. When receiving funds for upcoming deliveries, “yes” is indicated, and dashes are entered in the consignor and consignee fields.

- You must indicate the currency used for payment. It must be the same for all units included in the form.

- Indicate the dates, document nos., recording the receipt of funds for goods and materials, services, and work in the field “to the settlement and payment document.”

- The list of seller data depends on the status. There are various requirements for individual entrepreneurs and organizations. The individual entrepreneur enters his full name, tax identification number, address and entrepreneur registration certificate. Legal entities indicate the name, checkpoint, tax identification number, personal information of the manager and chief accountant. If the seller is engaged in sending cargo, “he” is written in the shipper field. When sending cargo to another legal entity, its data is filled in.

- The buyer and consignee fields are filled in similarly.

- The invoice may include prices with or without VAT. There are rules for choosing these options.

- The table indicates the nomenclature data of inventory items, services or works: names, codes, symbols, volumes or quantities, prices and amounts. If an imported product is included in the invoice, you must fill in the codes and short names of the manufacturing countries. In addition, it is necessary to enter customs declaration numbers.

- Two invoices are issued, since the seller keeps one for himself, the other is to be issued to the buyer.

Why does the question arise

The fact is that now taxpayers enter detailed information in column 11 of the invoice: the registration number of the goods declaration, and in addition to it, through “/”, the serial number of the goods in this declaration.

They are guided by the letter of the Federal Tax Service of Russia dated August 30, 2013 No. AS-4-3/15798, which states that the customs declaration number should be considered the registration number indicating the serial number of the goods through “/”. Since this statement is true for the “Customs Declaration Number,” it is unclear how the column called “Customs Declaration Registration Number” will be filled out. What information in column 11 of the invoice will be considered correct and sufficient for the Federal Tax Service to accept the document without question?

Transfer of goods for own needs

Situation: how to draw up an invoice when transferring goods for own needs to a structural unit of the organization? Expenses for the purchase of goods do not reduce the tax base for income tax.

Prepare an invoice according to the general rules. Only in line 4 “Consignee and his address”, line 6 “Buyer”, line 6a “Address”, line 6b “TIN/KPP of the buyer”, put dashes.

In general, the transfer to a structural unit of goods, the acquisition costs of which are not taken into account when calculating income tax, is subject to VAT. This means that it is necessary to draw up an invoice (subclause 2, clause 1, article 146, clause 3, article 168 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated June 16, 2005 No. 03-04-11/132).

Please format your invoice like this:

Issue an invoice within five days from the day the goods are transferred to the structural unit. If you ship goods from the warehouse constantly, then an invoice can be issued for all goods transferred during the tax period. This follows from paragraph 3 of Article 168 of the Tax Code of the Russian Federation. Such clarifications are also found in letters of the Ministry of Finance of Russia dated July 18, 2005 No. 03-04-11/166, and the Ministry of Taxes of Russia dated May 21, 2001 No. VG-6-03/404.

In the invoice, indicate: the price of the transferred goods and accrued VAT. In line 4 “Consignee and his address”, line 6 “Buyer”, line 6a “Address”, line 6b “TIN/KPP of the buyer”, put dashes. For the rest, fill out the invoice in the general manner. With regard to filling out previous forms of invoices, similar explanations were contained in the letter of the Ministry of Finance of Russia dated July 5, 2007 No. 03-07-11/212.

Register the issued invoice in the sales book in the period when the goods were transferred (clauses 2–3 of Section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

An example of drawing up an invoice when transferring goods for own needs to a structural unit of the organization. Expenses for the purchase of goods are not taken into account when calculating income tax by an organization.

Alpha LLC produces pasta. The organization has a kindergarten on its balance sheet, to which part of the products is regularly transferred. Production costs of transferred products are not taken into account when calculating income tax.

In the second quarter of this year, Alpha transferred the following types of products to its structural division (kindergarten):

- 10 packs of pasta No. 3 – price 30 rubles. per pack;

- 10 packs of pasta No. 5 – price 40 rubles. per pack.

On the cost of the transferred products, Alpha’s accountant charged VAT at a rate of 10 percent (subclause 1, clause 2, article 164 of the Tax Code of the Russian Federation). The total amount of VAT payable to the budget was 70 rubles, including:

- for pasta No. 3 – 30 rubles. (300 rubles × 10%);

- for pasta No. 5 – 40 rubles. (400 rub. × 10%).

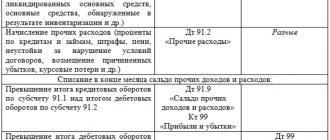

The following entries were made in accounting:

Debit 29 Credit 43 – 700 rub. – a batch of products was transferred to a structural unit (kindergarten);

Debit 91-2 Credit 68 subaccount “VAT calculations” – 70 rubles. – VAT payable to the budget has been accrued;

Debit 99 Credit 68 subaccount “Calculations for income tax” – 14 rubles. (RUB 70 × 20%) – reflects a permanent tax liability for expenses not taken into account when taxing profits.

The Alpha accountant drew up an invoice for the cost of the transferred pasta and registered it in the sales book.

Summary invoices

Situation: How can an intermediary issue a “summary” invoice and register it in the invoice journal?

“Consolidated” invoices have the right to be issued to customers (principals, principals) by intermediaries (commission agents, agents) who purchase goods (work, services) for them from several sellers or performers (paragraph 6, subparagraph “a”, paragraph 1, section 2 Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In addition to intermediaries, the right to issue “consolidated” invoices can be used by forwarders who are not themselves involved in the transportation of the customer’s goods, but are exclusively engaged in organizing such transportation. They can fill out invoices in the manner established for commission agents (agents) purchasing goods (work, services) on their own behalf (letter of the Ministry of Finance of Russia dated January 10, 2013 No. 03-07-09/01, dated November 1, 2012 No. 03-07-09/148).

“Consolidated” invoices reflect the data of invoices that intermediaries (forwarders) receive from third parties (sellers, carriers) involved in executing orders from customers. Based on these invoices, customers can deduct VAT amounts presented to them (through intermediaries) by the contractors.

The “consolidated” invoice can include data from invoices that were issued to the intermediary by different contractors, but on the same day (paragraph 6, subparagraph “a”, paragraph 1, section 2, appendix 1 to the Decree of the Government of the Russian Federation dated 26 December 2011 No. 1137). If invoices were issued to the contractor on different days, he will have to generate several “consolidated” invoices with different dates for the customer. Determine the date of the “consolidated” invoice in accordance with your chronology. That is, the date of issuance of the “consolidated” invoice may differ from the date indicated in the invoices received from the contractors (letter of the Ministry of Finance of Russia dated March 16, 2015 No. 03-07-09/13799).

Do not include the intermediary fee in the specified invoice. The intermediary issues a separate invoice for the amount of his remuneration and registers it in the sales book. The intermediary must give the second copy of the invoice for the amount of remuneration to the customer. This follows from the provisions of paragraph 20 of Section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The deadlines for issuing “consolidated” invoices are not established by law. But since the principal (principal) accepts VAT for deduction at the end of the quarter, then these invoices should be issued before the end of the next quarter.

When preparing a “consolidated” invoice, take into account the special order of filling out some lines (columns):

| Line (column) | What to indicate to the intermediary (forwarder) |

| Line 1 | Date of invoices issued to the intermediary by sellers (executors). The intermediary indicates the number of the “consolidated” invoice in accordance with its chronology |

| Line 2 | Full or abbreviated names and names of sellers (executors) who issued invoices to the intermediary (through the sign “;”) |

| Line 2a | Addresses of sellers (executors) who issued invoices to the intermediary (through the sign “;”) |

| Line 2b | TIN and KPP of sellers (performers) who issued invoices to the intermediary (through the sign “;”) |

| Line 3 | Full or abbreviated names of shippers and their addresses (through the sign “;”). If the shippers are sellers, rewrite the data from line 2 |

| Line 4 | Full or abbreviated names of consignees and their addresses indicated in invoices issued to the intermediary by sellers (executors) |

| Line 5 | Numbers and dates of payment orders for the transfer of money by an intermediary to sellers (performers) (through the sign “;”) |

| Line 6 | Name of the customer (client) |

| Line 6a | Customer (client) address |

| Line 6b | INN and KPP of the customer (client) |

| Box 1 | Names of goods (works, services) for each seller (performer). These indicators are taken from invoices issued by sellers (executors) to the intermediary. They need to be reflected in separate positions |

| Columns 2–11 | Data from invoices issued by sellers (executors) to the intermediary. Data for each of them must be reflected in separate positions |

| Other columns | Relevant indicators (units of measurement, cost, VAT rates and amounts, etc.) for each product (work, service) |

The intermediary must register invoices received from sellers (executors) and “summary” invoices issued to the customer in the invoice journal.

When registering in part 1 of the invoice register, the intermediary indicates:

- in column 10 - the name of the seller (performer) from whom the intermediary purchased goods (work, services) for the customer;

- in column 11 - INN and KPP of the seller (performer).

This follows from subparagraphs “k”–“l” of paragraph 7 of the Rules for maintaining a log of invoices, Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

In addition, in column 12 of part 1 of the invoice journal, the intermediary must indicate information about invoices received from sellers (executors) (subclause “m” of clause 7 of the Rules for maintaining the invoice journal of Appendix 3 to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

The intermediary records the invoices themselves received from sellers (executors) in part 2 of the invoice journal. This requirement also applies to intermediaries who are not VAT payers (clause 3.1 of Article 169 of the Tax Code of the Russian Federation). The intermediary does not register such a document in the purchase book. This follows from the provisions of paragraph 11 of Appendix 3 and paragraph 19 of Section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

The same registration procedure is used by developers who issue consolidated invoices to investors. Including in relation to invoices received from contractors before October 1, 2014 (the date of changes to the accounting journal form). This was stated in the letter of the Federal Tax Service of Russia dated August 17, 2015 No. GD-4-3/14435.

If an intermediary purchases goods (work, services) through a sub-commission agent (subagent), in Part 2 of the invoice journal, he must register the invoice issued by the sub-commission agent (subagent). At the same time, in column 10 of the journal the name of the sub-commissioner (subagent) is indicated, in column 11 - his INN/KPP, and in column 12 - code “1”.

This follows from subparagraphs “k”–“m” of paragraph 11 of the Rules for maintaining a log of invoices, Appendix 3 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Situation: how can a developer issue a “consolidated” invoice if the construction is financed by several investors?

If the construction is financed by several investors, the developer must issue a “consolidated” invoice to each of them.

At the same time, you need to fill out “consolidated” invoices based on the share of participation of each investor in the construction. The legitimacy of this approach is confirmed by the letter of the Ministry of Finance of Russia dated October 18, 2011 No. 03-07-10/15 and the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 26, 2012 No. 1784/12.

It should be noted that, unlike “consolidated” invoices issued by intermediaries (forwarders), “consolidated” developer invoices may include data from several invoices issued by contractors on different days.

An example of preparing a consolidated invoice by a developer. The construction is financed by several investors

JSC "Alfa" (developer) entered into an agreement for the construction of an office building No. 18 dated June 24, 2015. The investors under this agreement are JSC "Proizvodstvennaya" and LLC "Torgovaya", according to the agreement, finances 60 percent of the construction cost, "Hermes" - 40 percent .

For the construction of the facility, Alpha attracted two contractors: Stroyfed JSC and Stroycity LLC. The cost of the work performed by each of them amounted to 5,900,000 rubles. (including VAT – RUB 900,000). The total cost of work performed by contractors amounted to RUB 11,800,000. (including VAT – RUB 1,800,000).

Construction was completed on January 13, 2021. In the same month, before the completion of construction, the contractors issued invoices to Alfa for the cost of the work performed. To issue "consolidated" invoices to investors, Alpha's accountant allocated construction costs to investors in proportion to their contributions.

The cost of contract work and VAT amounts that Alpha, as a developer, transfers to investors are:

- “Master” – RUB 7,080,000. (RUB 11,800,000 × 60%), including VAT – RUB 1,080,000. (RUB 1,800,000 × 60%);

- “Hermes” – 4,720,000 rubles. (RUB 11,800,000 × 40%), including VAT – RUB 720,000. (RUB 1,800,000 × 40%).

Upon completion of construction, Alpha issued a “consolidated” invoice dated January 14, 2021 No. 186 to “Master” and a “consolidated” invoice dated January 14, 2021 No. 188 to “Hermes”. The invoices were accompanied by copies of invoices received from the contractors.

Realization of property rights

Situation: how to issue an invoice when exercising property rights? An organization that is a participant in shared housing construction has assigned the right to claim an apartment in an unfinished building to a citizen.

Charge VAT and draw up an invoice in the same manner as when selling property rights to organizations. Article 169 of the Tax Code of the Russian Federation does not provide for any specifics in the preparation of invoices when assigning rights of claims to individuals.

Fill out lines 1–2b, 5–7 of the invoice in the general order.

In lines 3–4, put dashes (subparagraphs “f” and “g” of paragraph 1 of the Rules, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In column 1, indicate the name of the property right. For example, “Assignment of the right to claim an apartment” (subparagraph “a”, paragraph 2 of the Rules, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In columns 2–4, fill in dashes (subparagraphs “b”, “c”, “d” of paragraph 2 of the Rules, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In column 5 you need to indicate the difference between the cost at which the organization sells the property right to an apartment and the amount of expenses for its acquisition (clause 3 of article 155 of the Tax Code of the Russian Federation, subclause “e” of clause 2 of the Rules approved by the Decree of the Government of the Russian Federation dated 26 December 2011 No. 1137).

In column 6 write “Without excise tax” (subparagraph “e” of paragraph 2 of the Rules approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

According to paragraph 4 of Article 164 of the Tax Code of the Russian Federation, the transfer of property rights to an apartment is subject to VAT at the calculated rate of 18/118. Indicate this rate in column 7 (subparagraph “g”, paragraph 2 of the Rules, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

Calculate the amount of tax you will present to the buyer. Do this based on the value of the property right, taking into account tax (column 5) and the estimated rate of 18/118 (column 7). Indicate the amount received in column 8 (clause 3 of article 155 of the Tax Code of the Russian Federation, subparagraph “z” of clause 2 of the Rules approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In column 9, indicate the value of the property right.

Place dashes in columns 10–11.

An example of filling out an invoice for the assignment of rights of claim to an individual by an organization that is a participant in the shared construction of an apartment

Torgovaya LLC is a participant in the shared construction of an apartment. The amount paid by Hermes for the apartment under construction was 3,000,000 rubles. In September of this year, Hermes ceded the right to claim the apartment to A.S. Petrov. for 3,300,000 rub.

The Hermes accountant calculated the tax amount as follows:

(3,300,000 rub. – 3,000,000 rub.) × 18/118 = 45,763 rub.

The agreement on the assignment of the right of claim was registered in November. Therefore, the Hermes accountant issued an invoice to Petrov and charged VAT payable in the fourth quarter.

Receiving interest

Situation: how to issue an invoice for the amount of interest received under a trade credit agreement?

Issue an invoice in one copy according to the general rules.

Interest received under a trade credit agreement is included in the base for calculating VAT. Therefore, on the day you receive the money, draw up an invoice in one copy and register it in the sales book (subclause 3, clause 1, article 162 of the Tax Code of the Russian Federation, clause 18, section II, appendix 5 to the resolution of the Government of the Russian Federation of December 26, 2011 No. 1137).

An example of calculating VAT and drawing up an invoice for the amount of interest received under a trade credit agreement

On January 9, Torgovaya LLC (lender) provided a commodity loan for a month to the borrower Alfa LLC in the form of 1000 kg of granulated sugar worth 20 rubles/kg excluding VAT. In accordance with the terms of the agreement, on January 31, Alpha must return 1000 kg of granulated sugar of similar quality. As payment for the loan provided, the borrower must pay the lender 1000 rubles.

On January 31, Alpha transferred 1,000 kg of granulated sugar to Hermes (the entire volume of trade credit) and transferred 1,000 rubles to its bank account.

In the Hermes working chart of accounts (approved as an appendix to the accounting policy), account 76 “Settlements with various debtors and creditors” provides a subaccount “Settlements with the borrower” (for accounting for settlements under a trade credit agreement).

The transfer of property under a trade credit agreement is subject to VAT. Moreover, the tax base in this case will be the cost of the goods transferred (Article 154 of the Tax Code of the Russian Federation). Sugar is subject to VAT at a rate of 10 percent (clause 2 of Article 164 of the Tax Code of the Russian Federation). In relation to interest on a loan, VAT is charged on the amount that exceeds the amount of interest calculated based on the refinancing rate (subclause 3, clause 1, article 162 of the Tax Code of the Russian Federation).

To determine the tax base for VAT on the amount of interest on a trade loan, the Hermes accountant determined the amount of interest accrued for 23 days (from January 9 to January 31, 2014), based on the refinancing rate.

In the period from January 9 to January 31, the refinancing rate is 8.25 percent. The amount of interest calculated based on the refinancing rate was: 22,000 rubles. × 8.25%: 365 days. × 23 days = 114 rub.

The difference between the actual amount of interest on a trade loan (1000 rubles) and the amount of interest calculated based on the refinancing rate (114 rubles) is 886 rubles.

The amount of VAT on interest received under a trade credit agreement is: 886 rubles. × 10/110 = 81 rub.

For the amount of interest on the trade loan, the Hermes accountant wrote out an invoice in one copy and registered it in the sales book (clause 18 of section II of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

The Hermes accountant made the following entries in the accounting.

January 9:

Debit 76 subaccount “Settlements with the borrower” Credit 41 – 20,000 rubles. (1000 kg × 20 rubles) – reflects the transfer of sugar under a trade credit agreement;

Debit 76 subaccount “Settlements with the borrower” Credit 68 subaccount “Settlements for VAT” - 2000 rubles. (RUB 20,000 × 10%) – VAT is charged when transferring goods on credit;

Debit 58-3 Credit 76 subaccount “Settlements with the borrower” – 22,000 rubles. (RUB 20,000 + RUB 2,000) – reflects the amount of the issued trade loan.

January 31:

Debit 41 Credit 76 subaccount “Settlements with the borrower” – 20,000 rubles. – 1000 kg of sugar returned;

Debit 19 Credit 76 subaccount “Settlements with the borrower” – 2000 rubles. – VAT is taken into account on the cost of the returned goods based on the borrower’s invoice;

Debit 76 subaccount “Settlements with the borrower” Credit 58-3 – 22,000 rubles. – the return of the trade credit is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 2000 rub. – the amount of VAT is accepted for deduction based on the borrower’s invoice;

Debit 76 subaccount “Settlements with the borrower” Credit 91-1 – 1000 rubles. – interest was accrued under the commodity loan agreement within the time limits established by the agreement;

Debit 51 Credit 76 subaccount “Settlements with the borrower” – 1000 rubles. – the amount of interest was received as a fee for using a trade loan;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 81 rubles. – VAT is charged on interest on a trade loan exceeding the refinancing rate.

Federal Tax Service opinion

The Department believes that in this case, adjusting the name of the column does not entail a change in its content; the information must be filled out as before: registration number of the DT and then through “/” the serial number of the product in this DT in the following form:

Part 1 - eight characters: customs post code;

Part 2 - six characters: date of registration of the motor vehicle;

Part 3 - seven characters: DT serial number;

Part 4 - three characters: the serial number of the product in the DT.

At the same time, according to the clarifications of the Ministry of Finance dated February 18, 2011 (letter No. 03-07-09/06), if column 11 of the Federation Council contains incomplete information about the DT number (there is no serial number of the goods) and such an invoice is not prevents the tax authorities from identifying the main terms of the transaction, this is not a basis for refusing a VAT deduction. In other words, the absence in column 11 of the serial number of the goods according to the declaration is not considered an error. To date, no additional recommendations or clarifications have been received from government agencies regarding otherwise entering information in column 11 of the invoice.

What the Federal Tax Service order No. MMB-7-3/ [email protected] requires to be reflected in section 11

Information from the invoice journal (hereinafter referred to as the journal) falls into sections 10 and 11 of the VAT declaration in the event that a company or individual entrepreneur issues and/or receives invoices when performing intermediary duties (clause 5.1 of article 174 of the Tax Code of the Russian Federation).

Similar situations arise when fulfilling commission agreements, fulfilling the developer’s duties and in some other cases. The declaration form was approved by order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/ [email protected] From the report for the 4th quarter of 2021, it is necessary to use its updated form - as amended by the Federal Tax Service order dated August 19, 2020 No. ED-7-3/ [email protected] You will find a sample of filling out a new VAT return in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

As for section 11, clause 50 of the procedure for filling out the declaration establishes several basic rules for filling it out:

When filling out the sheets of section 11, the following conditions must be met:

KZL r.11 = KZZH,

Where:

KZL r.11 - number of completed sheets of section 11;

CPJ - the number of entries in Part II of the invoice journal.

How to fill out Part 2 of the invoice journal (line-by-line explanations and example), see ConsultantPlus. Trial access to the system can be obtained for free.

Technical side of the issue

The structure and format of the field “Registration number of the customs declaration” in the electronic document has not been subject to any changes since 10/01/2017. It allows you to enter from 1 to 29 characters. Thus, the electronic invoice format allows for a DT number in either four or three parts.

In Diadoc in printed form, which, we recall, is not a legally significant document, the name of column 11, in accordance with the new edition of Resolution No. 1137, will be changed to “Registration number of the customs declaration.” It will reflect the value that was entered when generating the electronic invoice.

Specifics and structure of section 11

Section 11 of the VAT return is distinguished by one important specific property, which significantly distinguishes it from the sections of tax returns familiar to taxpayers. It does not have the usual scheme for calculating the taxable base and there are no lines for calculating the final tax amount, which are typical for most tax reports.

Its purpose is to present data of a purely reference and informational nature. The structure of this section is presented below:

Example of filling out section. 11 VAT declaration from ConsultantPlus The Alpha organization (commission agent), under a commission agreement with Beta LLC (committent), on its own behalf, bought goods from the Gamma organization (seller). When shipping the goods, the seller issued an invoice dated January 27, 2020 N 15-19 to the Alpha organization for the amount of 120,000 rubles, including VAT - 20,000 rubles. Alpha LLC will register the invoice in part 2 of the log of received and issued invoices and fill out section. 11 declarations in the following order. You can view the entire example in K+. Trial access to the system is provided free of charge.

As can be seen from the structure of the section, special codes are required to fill it out (among other things). We will continue to get to know them further.

Currency information

In line 7, indicate the digital code and name of the currency according to the All-Russian Currency Classifier OK (MK (ISO 4217) 003-97) 014-2000. This must be done also for non-cash settlements under the contract. For example, here is the information written in this line:

- “Russian ruble, 643” – if the price (tariff) is determined in Russian rubles and kopecks;

- “US dollar, 840” – if the price (tariff) is determined in US dollars and cents;

- “euro, 978” – if the price (tariff) is determined in euros and euro cents.

You can issue an invoice in a foreign currency only if both the prices and settlements under the contract are expressed in foreign currency. If prices are expressed in currency or conventional units, and calculations are carried out in rubles, then in line 7 indicate “Russian ruble, 643”.

This follows from the provisions of paragraph 7 of Article 169 of the Tax Code of the Russian Federation and subparagraph “m” of paragraph 1 of Appendix 1 to Resolution of the Government of the Russian Federation of December 26, 2011 No. 1137.

Attention: the buyer will be denied a deduction if the incorrect code and currency name are indicated on the invoice. Tax inspectors classify this as an error. It does not allow you to correctly determine the cost of goods (works, services, property rights) and the amount of VAT claimed. This was stated in the letter of the Ministry of Finance of Russia dated March 11, 2012 No. 03-07-08/68.

How to present data in a document?

The principles for indicating the name and code on the invoice are identical for all countries. In column 10 it is possible to write both the full and short name, but this information must be exactly consistent with the OKSM data in the country name sections. For example, the full name for the USA is “United States of America”, the short name is “United States”. No other options - America, USA, States, etc. - not indicated.

Below we provide examples of this data for states that most often participate in import-export relations with the Russian Federation.

- Russian Federation. The name can be specified briefly - Russia, code - 643.

- People's Republic of China. Short name – China, code 156.

- Germany. The short and full names are identical. Country code 276.

- USA. Short name - United States, code 840.

- Italian Republic. Short name – Italy. Code 380.

- Japan. The short and full names are identical. Code 392.

Where can I find out information?

To determine the code, you need to refer to the OKSM table - the All-Russian Classifier of Countries of the World. The information is presented in three sections:

- country name;

- its digital code;

- letter identification.

For an invoice you only need the name of the state and a digital code.

The OKSM table is freely available on the Internet, so it is not always an official document and, as a result, does not exclude the possibility of errors. More reliable information about country of origin codes can be obtained by contacting the Tax Service.