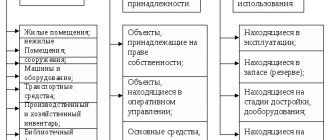

The list of property that relates to inventory and household supplies is not established by law. In practice, inventory and household supplies are understood as:

- office furniture (tables, chairs, etc.);

- means of communication (telephone, fax);

- electronic equipment (cameras, voice recorders, video cameras, tablets, video recorders, etc.);

- equipment for cleaning areas, premises and workplaces (mops, brooms, brooms, etc.);

- fire extinguishing means (fire extinguishers, fire cabinets, etc.);

- lighting;

- toiletries (paper towels, air fresheners, soap, etc.);

- stationery;

- kitchen household appliances (coolers, microwave ovens, refrigerators, coffee machines, coffee makers, etc.).

Documenting

When issuing inventory from a warehouse, a demand invoice is drawn up in form No. M-11 (instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a). In it, indicate the name of the unit to which the inventory was issued, the account number on which the costs of maintaining this unit are taken into account (for example, account 25 when transferring inventory to the equipment operation department) (clauses 97 and 98 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28 2001 No. 119n).

If inventory is released from a warehouse to an intermediate division of the organization (for example, to the administration department), then at the time of transfer it is not known how much each division of the organization will consume (for example, accounting, purchasing department). In this case, as each department spends it, it is necessary to draw up acts (reports) in any form. They should indicate the name, quantity, cost of the inventory and confirm the feasibility of its use. Based on these acts (reports), write off the cost of inventory and household supplies as expenses. This procedure follows from paragraphs 97 and 98 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Document Contents

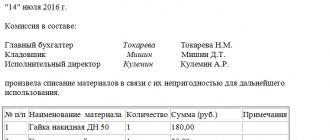

The act of writing off an instrument that has become unusable must be drawn up in accordance with the standards defined by legislative norms in the field of record keeping. In this case, you should focus on the rules and procedure for completing the forms. The document must display the following information:

- Date the paper was issued.

- Title.

- Composition of the commission.

- Text part.

- Signatures of the commission members.

- Manager's signature indicating approval.

If the write-off procedure takes time, more than one day, then the act should indicate the time period for the process and explain the reason for its duration by the need for an inventory of property. The text part requires a link with exact details to the internal administrative documentation that serves as the basis for holding the event.

After the text part of the act, signatures of the commission members are required, confirming the accuracy of the information displayed in the document. The head of the business entity approves the act with his signature on the signature stamp located in the upper right part of the sheet. If the documentation is drawn up on several pages, then the manager’s signature should only be on the first page.

Accounting

Reflect the issue of inventory in correspondence with account 25 “General production expenses”, account 26 “General business expenses” or account 44 “Sales expenses”. Simultaneously with drawing up the demand invoice in form No. M-11 or act (report), make the following entries:

Debit 25 (26, 44) Credit 10-9

– inventory was released from the warehouse.

This is stated in paragraph 93 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Tool depreciation: how to calculate

Any organization acquires materials for the company’s activities not for their own sake. And the purchased valuables will not lie dead weight in the warehouse for the director to admire. They are intended for use in production, sales or administrative purposes.

Therefore, purchased materials are subsequently consumed in production. However, in the warehouse the storekeeper or warehouse manager is responsible for them, and the materials are taken into account on account 10. When the materials leave the warehouse, the situation will change: the account and the person in charge will change.

Methods for writing off cost

Determine the cost at which inventory is written off from account 10-9 in one of the following ways:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

This is stated in paragraph 58 of the Regulations on Accounting and Reporting and in paragraph 16 of PBU 5/01.

The method for estimating the value of write-off inventory and household supplies should be established in the accounting policy for accounting purposes. Such rules are established by paragraph 73 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Security control

Since at the time of transfer to operation the cost of inventory is transferred to expenses, control over its safety should be organized. It is mandatory to control only inventory and household supplies with a useful life of more than 12 months (paragraph 4, paragraph 5 of PBU 6/01).

Situation: how to control the safety of equipment transferred for use? The cost of inventory is written off as expenses.

The organization is obliged to monitor the safety of inventory included in the materials if its useful life exceeds 12 months. This is stated in paragraph 4 of clause 5 of PBU 6/01.

Since the legislation does not regulate the procedure for accounting for inventory and household supplies transferred for operation, the organization must develop it independently. In practice, to control the movement of inventory for each department (materially responsible person), you can maintain:

- a statement of accounting of household equipment and accessories in operation for each division of the organization;

- off-balance sheet accounting.

Reflect the selected option in the accounting policy for accounting purposes.

The chart of accounts does not provide for a separate off-balance sheet account for accounting for inventory and household supplies transferred into operation. Therefore, you need to open it yourself. For example, this could be account 013 “Inventory and household supplies”.

When transferring inventory into operation, make the following entries in accounting:

Debit 25 (26, 44) Credit 10-9

– inventory was released from the warehouse for household needs;

Debit 013 “Inventory and household supplies”

– inventory transferred for business needs is taken into account.

Reflect the write-off of inventory by posting:

Credit 013 “Inventory and household supplies”

- inventory written off.

When disposing of inventory, a write-off report must be issued. There is no unified form for such a document, so develop it yourself.

The procedure for reflecting expenses on inventory and household supplies when calculating taxes depends on the taxation system that the organization uses.

What kind of document is this?

The act of write-off certifies the fact of using material assets or rendering them inoperable as a result of certain events.

It indicates the deregistration of an item that subsequently cannot be used to solve production problems. Material assets are items acquired by a business entity through its own financing of the purchase operation. They can be used to implement entrepreneurial ideas when creating products, as well as to meet the needs of the enterprise.

Write-off order

A distinctive feature of material assets is the fact of their acquisition at the expense of a business entity. One of their many varieties are tools. They are used to meet the needs of a company or to support a production process.

During operation, all tools wear out, as a result of which their further use becomes impractical, which is the reason for their write-off.

The act certifying the deregistration of material value must display information identifying it, the reason for the event, as well as the quantity and value of the items being written off. The document must reflect details that allow the document to be interpreted with a specific business entity, as well as the date of its preparation. The documentation is the basis for the accountant to issue a certificate allowing the item to be removed from the register.

Regulatory and legal sources do not provide for an approved form of the form, however, authorized bodies put forward their own requirements for its design. The standard form of the document can be taken as a sample act of writing off material assets that have become unusable. Based on it, it is recommended to develop a template that can be used by a specific enterprise in accordance with its procedure for maintaining and recording document flow.

BASIC: income tax

Inventory with a useful life of more than 12 months and an initial cost of more than RUB 100,000. included in fixed assets. When calculating income tax, write off its value through depreciation (Clause 1, Article 256 of the Tax Code of the Russian Federation).

Expenses for inventory that is not recognized as depreciable property can be taken into account as part of material costs. In this case, the organization has the right to independently determine the procedure for writing off inventory, taking into account the period of its use and other economic indicators. For example, at a time or evenly over several reporting periods (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation). If the organization uses the accrual method, reduce the tax base as the inventory is transferred into operation (clause 2 of Article 272 of the Tax Code of the Russian Federation). If the organization uses the cash method, reduce the tax base after transferring the inventory into operation and paying it to the supplier (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the costs of purchasing toiletries (paper towels, air fresheners, soap, etc.) when calculating income tax?

Yes, you can.

When calculating income tax, expenses for the purchase of toiletries can be taken into account as part of:

– material costs (paragraph 4, subparagraph 2, paragraph 1, article 254 of the Tax Code of the Russian Federation); – expenses for ensuring normal working conditions (subclause 7, clause 1, article 264 of the Tax Code of the Russian Federation).

Moreover, such costs must be economically justified and documented. The purchase of toiletries should be justified by internal documents. For example, a collective agreement may stipulate that, to ensure normal sanitary and hygienic conditions, toilet rooms are provided with paper towels, air fresheners, soap, etc.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated April 11, 2007 No. 03-03-06/1/229, Federal Tax Service of Russia for Moscow dated October 6, 2006 No. 20-12/89121.1.

Secure the transfer of household supplies from the warehouse with a demand invoice, for example in form No. M-11.

For tax purposes, such costs are not standardized. However, the organization has the right to establish internal standards for the expenditure of household supplies for the purpose of their rational use. Regulating such expenses will help you plan the costs of purchasing these accessories. In addition, this will allow you to control resource consumption and prevent abuse by employees. To approve the norms, the leader must issue an order. The consumption rate can be set based on similar costs for the previous month, quarter or other period. Record the number of supplies actually used in the report.

An example of how expenses for the purchase of toiletries are reflected in accounting and taxation

In May, Alpha LLC purchased toiletries for the needs of the office premises:

– toilet paper – 100 rolls for 1180 rubles. (including VAT – 180 rub.); – paper towels – 100 packs for 11,800 rubles. (including VAT – 1800 rub.); – liquid soap with dispenser – 100 bottles for 3540 rubles. (including VAT – 540 rub.); – air freshener – 50 cylinders for 2950 rubles. (including VAT – 450 rubles).

The total cost of purchased toiletries was RUB 19,470. (including VAT - 2970 rubles).

In June, for the needs of office space, the following toiletries were requested from the warehouse for a total amount of 1,650 rubles:

– 10 rolls of toilet paper worth 100 rubles. (10 rubles × 10 rolls); – 10 packs of paper towels worth 1000 rubles. (100 rubles × 10 packs); – 10 bottles of liquid soap worth 300 rubles. (30 rub. × 10 pcs.); – 5 cylinders of air freshener – in the amount of 250 rubles. (50 rubles × 5 points).

The transfer of household supplies from the warehouse was issued with an invoice in form No. M-11.

At the end of the month, the number of household supplies actually used was recorded in the report.

The following entries were made in accounting.

May:

Debit 10-9 Credit 60 – 16,500 rub. (RUB 19,470 – RUB 2,970) – household supplies are capitalized;

Debit 19 Credit 60 – 2970 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 2970 rub. – VAT is accepted for deduction;

Debit 60 Credit 51 – 19,470 rub. – paid for household supplies to the supplier.

June – on the date of drawing up the invoice according to form No. M-11:

Debit 26 Credit 10-9 – 1650 rub. – household supplies transferred from the warehouse are written off.

When calculating income tax in June, the accountant included in material expenses the cost of written-off toiletries in the amount of 1,650 rubles.

Situation: is it possible to take into account the costs of inventory and household supplies purchased at retail through an accountant when calculating income tax? In sales and cash receipts, the cost of materials is reflected in the total amount without decoding them by type, quantity and price.

No you can not.

In tax accounting, only those expenses can be recognized that are confirmed by documents drawn up in accordance with the requirements of the law (clause 1 of Article 252 of the Tax Code of the Russian Federation). Moreover, each such primary accounting document must contain, in particular, quantitative and cost measures (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ). A document that does not decipher the type, quantity and price of the purchased goods will not be able to confirm the expenses incurred.

At the same time, in order to recognize expenses for inventory and household supplies, in addition to the sales and cash receipt, you need to have an employee’s advance report.

Similar explanations are given in the letter of the Federal Tax Service of Russia dated June 25, 2013 No. ED-4-3/3/11515.

Advice : when calculating income tax, costs for inventory and household supplies can be recognized as expenses, even if the type, quantity and price of goods are not deciphered in cash registers and sales receipts.

This is explained as follows.

Documented expenses mean expenses that are confirmed not only by those documents that are drawn up in accordance with the law, but also by those that indirectly confirm the expenses incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Thus, an organization has the right to take into account, for the purposes of calculating income tax, expenses for inventory and household supplies on the basis of a cash register and sales receipt, even if they contain the total amount paid for all purchased goods without decoding. And at the same time there is an advance report of the employee.

Some courts take a similar position (see, for example, decisions of the Federal Antimonopoly Service of the Volga District dated October 2, 2008 No. A55-911/2008 and dated February 3, 2006 No. A55-14012/05-32).

Situation: how to take into account the costs of festive fireworks in accounting and taxation?

In accounting, reflect the costs of fireworks as part of other expenses. Such expenses cannot be taken into account when calculating income tax.

Accounting

In accounting, the costs of fireworks are other expenses (clause 11 of PBU 10/99). Consider expenses as of date:

- handing over the fireworks to the employee responsible for the event - if the organization organizes the fireworks on its own;

- or on the date of signing the act - if the fireworks display is organized by a third-party organization under a contract.

This follows from paragraph 18 of PBU 10/99.

The wiring will be like this.

When holding fireworks on your own:

Debit 10-9 Credit 76 – purchased fireworks were capitalized;

Debit 19 Credit 76 – input VAT is reflected;

Debit 10-9 Credit 19 – VAT is charged to the cost of fireworks;

Debit 91-2 Credit 10-9 – the cost of fireworks is written off as expenses.

When conducting fireworks displays by a third party:

Debit 91-2 Credit 76 – expenses for holding fireworks are reflected.

Income tax

The costs of holding fireworks cannot be taken into account when calculating income tax. Such expenses are not economically justified and are not related to production activities (clause 49 of article 270, clause 1 of article 252 of the Tax Code of the Russian Federation).

Let us note that there is a court decision in which the judges recognized the reasonableness of the costs of fireworks. Thus, in the resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 28, 2009 No. A32-15960/2008-63/209, a case was considered when an organization recognized such expenses as representative expenses. The judges supported the organization, pointing out that a specific list of expenses that are included in the concept of “expenses for official reception and service” in paragraph 2 of Article 264 of the Tax Code of the Russian Federation is not defined. Therefore, with proper documentary evidence, the organization has the right to take into account such expenses. However, there is no stable arbitration practice on this issue. In addition, paragraph 2 of Article 264 of the Tax Code of the Russian Federation states that entertainment expenses cannot be included in entertainment expenses. Therefore, including the cost of fireworks in expenses is risky. Most likely, the organization will have to prove the economic justification of such expenses in court.

VAT

Since the fireworks display is not related to activities subject to VAT, input VAT on such expenses cannot be deducted. After all, a deduction is possible only in relation to goods, works, services purchased for use in transactions subject to VAT (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation).

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online.

Where and how to get free legal advice? is provided throughout the Russian Federation. Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support.

Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation. Legal advice is provided free of charge online around the clock, regardless of weekends and holidays. The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously. Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways:

- use the online chat service;

- call the hotline.

- draw up a contact form for the feedback service;

Online legal consultation can also be carried out via email.

The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums.

This ensures that individuals and businesses can receive advice that complies with current legal provisions.

Certificates are provided

BASIS: VAT

Input VAT presented when purchasing inventory and household supplies should be deducted (clause 2 of Article 171 of the Tax Code of the Russian Federation). The exception to this rule is when:

- the organization enjoys VAT exemption;

- The organization carries out only VAT-free transactions.

In these cases, include input VAT in the cost of inventory and household supplies. This follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

If an organization carries out both taxable and non-VAT-taxable operations, distribute the input tax on the cost of inventory and household supplies (clauses 4 and 4.1 of Article 170 of the Tax Code of the Russian Federation).

Sales of inventory

Situation: how can an organization on OSNO reflect in accounting and taxation the sale of inventory worth less than 40,000 rubles. with a useful life of more than 12 months, if the costs of its acquisition were written off upon transfer to operation?

If the useful life of business equipment exceeds 12 months, then after the transfer of this property for operation, the organization is obliged to monitor its safety. To do this, you can use records of inventory and household supplies in operation or off-balance sheet accounts. (for example, account 013 “Inventory and household supplies”).

When selling inventory, the acquisition costs of which have already been written off as expenses, reflect other income in the accounting records in the amount of funds due (paragraph 6, clause 7, clause 10.1 of PBU 9/99). At the same time, write off the cost of the inventory from the off-balance sheet account (make a note about the write-off in the inventory accounting sheet). Since, when the inventory was transferred into operation, its cost was completely written off as expenses, no expenses arise when selling this property (clause 18 of PBU 10/99).

Recognize the proceeds from the sale of inventory (net of VAT) as income from sales (clause 1 of Article 249, clause 1 of Article 248 of the Tax Code of the Russian Federation). As a general rule, when selling property that is not recognized as depreciable, the organization has the right to reduce the income from the sale by the purchase price of this property (subclause 2, clause 1, article 268 of the Tax Code of the Russian Federation). Since the organization has the right to independently determine the procedure for writing off such an object, taking into account the period of its use and other economic indicators, at the time of sale, the costs of purchasing inventory can be written off in whole or in part. For example, when writing off evenly over several reporting periods. When the inventory was transferred into operation, its cost was already taken into account as expenses, so it cannot be taken into account again when calculating income tax. Take into account the underwritten amount of acquisition costs in the full amount of expenses (clause 5 of Article 252, subclause 3 of clause 1 of Article 254 of the Tax Code of the Russian Federation).

Charge VAT on the cost of the sold property (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation), and also issue an invoice to the buyer (clause 3, article 168 of the Tax Code of the Russian Federation). For more information about this, see How to issue an invoice to a buyer.

An example of how to reflect in accounting and taxation the sale of business equipment, the acquisition costs of which were charged to the costs of its transfer to operation. The organization controls the safety of inventory using off-balance sheet accounting

In January, Alpha LLC purchased a computer desk worth 11,800 rubles. (incl. VAT - 1800 rub.) for installation in the office.

According to the accounting policy for accounting purposes, fixed assets worth less than 40,000 rubles. are written off as expenses when they are put into operation and are recorded in off-balance sheet account 013 “Inventory and household supplies.” Therefore, after installing the table in the office, the Alpha accountant wrote off the cost of the table as expenses and accepted this object for off-balance sheet accounting.

In July, it was decided to update the office furniture and sell the computer desk to one of the employees. According to the purchase and sale agreement, the cost of the table was 9,440 rubles. (including VAT - 1440 rubles).

In Alpha's accounting records, the listed business transactions were reflected as follows.

In January:

Debit 10-9 Credit 60 – 10,000 rub. (RUB 11,800 – RUB 1,800) – a computer desk was posted to the warehouse;

Debit 19 Credit 60 – 1800 rub. – input VAT is reflected;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1800 rub. – accepted for deduction of input VAT on property acquired for use in activities subject to VAT;

Debit 26 Credit 10-9 – 10,000 rub. – the cost of the computer desk is written off (when transferred to the office);

Debit 013 – 10,000 rub. – a computer desk was accepted for off-balance sheet accounting, the cost of which was charged to expenses.

In July:

Debit 62 Credit 91-1 – 9440 rub. – revenue from the sale of a computer desk is reflected;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 1440 rubles. – VAT is charged on revenue;

Loan 013 – 10,000 rub. – a computer desk was written off off-balance sheet due to sale.

When calculating income tax for nine months, Alpha’s accountant:

– included in income the proceeds from the sale of the table (excluding VAT) in the amount of 8,000 rubles. (9440 rub. – 1440 rub.); – included in expenses the cost of a computer desk put into operation in January in the amount of 10,000 rubles.

Is it necessary to remove tools that are unsuitable for further use from the balance sheet of an enterprise?

All material assets of a business entity are taken into account in its financial documentation. Therefore, it is impossible to simply throw away an item that is unusable. At the first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting records.

Instruments that have become unusable must be removed from the register through write-off. The procedure is regulated by the norms of legal sources. Its competent implementation eliminates inconsistencies in various reporting forms.

In order to prevent theft of the enterprise's property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation. It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further use the tools due to their damage, as well as the amount of equipment that is subject to write-off.

simplified tax system

The tax base of simplified organizations that pay a single tax on income, expenses for inventory and household supplies are not reduced (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, expenses for the purchase of inventory and household supplies reduce the tax base.

Inventory with a useful life of more than 12 months and an initial cost of more than RUB 100,000. refers to depreciable property (clause 4 of article 346.16, clause 1 of article 256 of the Tax Code of the Russian Federation). Therefore, when calculating the single tax under simplification, the cost of inventory can be taken into account as expenses for the acquisition of fixed assets (subclause 1, clause 1, article 346.16 of the Tax Code of the Russian Federation).

If inventory is not recognized as depreciable property, the costs of its acquisition can be taken into account as part of material expenses (subclause 5, clause 1 and clause 2, article 346.16, subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation).

Input VAT on purchased inventory and household supplies is also included in expenses (subclause 8, clause 1 and clause 3, article 346.16 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account the costs of purchasing toiletries (paper towels, air fresheners, soap, etc.) when calculating the single tax? The organization applies a simplification and pays a single tax on the difference between income and expenses.

Yes, you can.

When calculating the single tax, expenses for the purchase of toiletries can be taken into account as part of material costs (subclause 5, clause 1 and clause 2, article 346.16, paragraph 4, subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). Moreover, such costs must be economically justified and documented (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation). The purchase of toiletries should be justified by internal documents. For example, a collective agreement may stipulate that, to ensure normal sanitary and hygienic conditions, toilet rooms are provided with paper towels, air fresheners, soap, etc.

A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated September 1, 2006 No. 03-11-04/2/182.