When it comes to the traveling nature of work, for some reason everyone immediately imagines drivers. Of course, as a rule, this type of work is established for them, but in fact it can be established for absolutely any employee whose work function involves traveling. The specialized literature and legislation say very little about the procedure for establishing the traveling nature of work and the preparation of reports by employees in the specialized literature and in the legislation, and some employers are at a loss in these matters. Let's find out...

What is the traveling nature of work?

The Labor Code of the Russian Federation does not contain a special article describing the traveling nature of work; what this means can be understood from some departmental regulations and clarifications of Rostrud. In particular, it is necessary to differentiate such activities from:

- business trips;

- work performed on the way;

- work that is mobile in nature.

The concept of traveling nature of work in Russian labor legislation is disclosed rather poorly. However, in practice, employers quite often have to enter into employment contracts with such a condition. At the same time, constant movement around facilities in order to perform work, located at a considerable distance from the location of the company, should leave the employee the opportunity to return to his place of residence every day.

What distinguishes these working conditions from the first point are regular business trips only within the service territory (areas) with the possibility of returning home every day. Rostrud reminded that business trips of employees whose work has been established as traveling cannot be recognized as business trips by virtue of Art. 66 Labor Code of the Russian Federation. In letter dated December 12, 2013 N 4209-TZV, officials indicated that business trips are temporary and limited to a certain period, but travel-related activities must be permanent.

As for the mobile nature of work, the Regulations on the payment of bonuses associated with the mobile and traveling nature of construction (approved by the Resolution of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated 01.06.1989 N 169/10-87), it is said that if workers perform work on objects located at a considerable distance from the permanent location of their enterprise, and actually live near these objects until the end of work processes at them, and then move to another object, then this is a mobile or rotational method. These could be geologists, builders, installers, pipe layers, and so on.

It is also important to properly differentiate work along the way. It is carried out by workers involved in the movement of the vehicle. In particular, these are:

- flight attendants;

- conductors;

- conductors in public transport;

- public transport drivers;

- sailors;

- etc.

Taxation

The Ministry of Finance of Russia indicated in its letters that reimbursement of expenses to employees whose permanent work is carried out on the road or has a traveling nature refers to compensation payments that are included in labor costs taken into account when calculating the tax base for income tax, but are not taxed Personal income tax and unified social tax.

Thus, in Letter dated August 29, 2006 N 03-03-04/1/642, the Ministry of Finance of Russia reported that the employer’s expenses associated with compensation for the expenses of employees whose work is traveling in nature can be included in labor costs, taken into account when determining the tax base for income tax. From the Letter of the Ministry of Finance of Russia dated August 29, 2006 N 03-05-01-04/252, it follows that if a collective agreement, agreement, local regulations or employment contract establishes that the work of individuals in their positions is carried out on the road or in field conditions, is traveling or expeditionary in nature, then payments aimed at reimbursement by the employer of expenses associated with business trips of these persons are not subject to personal income tax.

Letter of the Ministry of Finance of Russia dated August 21, 2006 N 03-05-02-04/130 also indicates that if a collective agreement, agreement, local regulations or employment contract establishes that the work of individuals in their positions is carried out on the road or in the field, is of a traveling or expeditionary nature, then payments aimed at reimbursing the employer for expenses associated with business trips of these persons are not subject to UST.

In other cases, payments aimed at reimbursement by the employer of expenses associated with business trips are subject to taxation in the prescribed manner.

Differences between the traveling nature of work and business trips

Let's look at the differences in the comparison table.

| Reasons for difference | Traveling nature of work | Business trip |

| Travel outside the company territory | Periodic | Episodic |

| Goals of the trip | Directly related to work activity | Carried out to carry out specific instructions |

| Pay during travel | Determined in the employment contract | Average earnings |

| Documenting | Order, regulation, collective or labor agreement | Mandatory order |

| Reimbursable expenses | For travel, daily allowances, rental of premises, other travel-related and permitted by the employer | For travel, daily allowances, rental of premises, other related to the execution of orders and permitted by the employer |

| Refund method | Either registration of an allowance or compensation based on supporting documents | In accordance with documents confirming expenses |

| Deadlines | Set for an indefinite period of time | Has specific start and end dates |

Composition of expenses

Expenses associated with the traveling nature of work include:

- travel expenses;

- expenses for renting residential premises;

- additional expenses associated with living outside the place of permanent residence (daily allowance, field allowance);

- other expenses incurred by employees with the permission or knowledge of the employer.

At the same time, payment for meals for employees with a traveling nature of work cannot be included in this list (letter of the Ministry of Labor of Russia dated March 11, 2014 No. 17-3/B-100).

How to properly document the traveling nature of work

The right to determine and approve a list of positions that will establish the traveling nature of work is granted by labor legislation to the management of the employing organization. To do this, you can approve a separate provision, another option for establishing the traveling nature of work: you can simply approve such functions in the staffing table on the basis of an order or in an employment agreement. The fact is that there is no special article in the Labor Code of the Russian Federation regulating such a procedure and rules for registering such a labor regime. The main thing is to follow the requirements of Article 57 of the Labor Code of the Russian Federation, namely: to fix in the text of the employee’s employment contract when he is employed the conditions that determine exactly how he will perform his work. And if his work schedule is established outside the company, that is, the traveling nature of the work is established, then this must be stated in the contract.

If, during employment, the traveling nature of a person’s activity is indicated, the employer may not equip a stationary workplace. Therefore, it is advisable to stipulate this also in the collective agreement, but this has its own difficulties. After all, making changes to a collective agreement requires compliance with a certain procedure, if such issues were not specified when it was initially signed. This procedure for performing labor functions can be most fully reflected in a special provision, which can be changed based on the needs of the organization. The list of positions of employees who will be traveling can be approved by a separate order from the manager. At the same time, each new employee may not be included in the list, but it is necessary to reflect the specifics of his work in the contract and order.

Vesna LLC

Saratov, st. Green, 1

Order No. 7

about establishing the driver Kamchatov N.N. traveling nature of work

July 15, 2021

In accordance with Art. 168.1 of the Labor Code of the Russian Federation and the terms of additional agreement No. 1 dated July 10, 2021 to the employment contract No. 38 dated October 1, 2021.

I ORDER:

1. Set driver Kamchatov N.N. traveling nature of work from July 22, 2021

2. Set driver Kamchatov N.N. bonus for such working conditions from July 22, 2021.

Petrov / Petrov P.P.

M.P.

The regulation specifies in detail the procedure for reimbursing such employees for their expenses and establishes document forms that allow for accounting.

Sample regulations on the traveling nature of work

A particularly important condition is to establish in the regulations a list of jobs, professions, positions that have such an order of activity. This requirement is directly enshrined in Part 2 of Article 168.1 of the Labor Code of the Russian Federation.

These are just some of the provisions of the document, the full version of which can be downloaded at the end of the article.

It is imperative to indicate travel in job descriptions or other documents defining the job responsibilities of employees. Both orders and regulations, and even more so job descriptions, must be communicated to all interested parties against signature, as defined in Article 68 of the Labor Code of the Russian Federation. Detailed recording of operating conditions in local regulations will minimize the risk of disputes between employees and employers, and if they do arise, it will make it possible to quickly resolve them in favor of the employer within the framework of legally established standards for business trips.

Difficulties in practice

When traveling for work, payment solves the following problems:

- Compensation for expenses incurred by the employee.

- Payment not only for regular work, but also for overtime work.

- Incentive payments related to the complexity of the work performed and increased workload.

In order to determine the amount of these amounts, it is not enough to rely on documents on actual expenses incurred. For example, if an employee goes to a client within the city limits, then it is convenient for him to get there using public transport. In this case, to pay, he can present tickets for it, which is not always reliable evidence (they may, for example, be from other routes).

For whom is this work suitable and for whom is it not?

It must be said that almost all citizens can work without a permanent workplace if they agree to this and have signed an employment contract. After all, the functions that they can perform not at the location of the organization can be anything: for example, a courier can deliver goods, and a sales representative can enter into cooperation agreements. Therefore, even teenagers and women can work under such conditions. There are no special conditions in this regard in the legislation.

Separate division at the employee’s location

Situation: should an organization register a separate division at the location of an employee if he works in another city? The work is traveling in nature.

The answer to this question depends on whether the organization provides the employee with a permanent workplace. The traveling nature of the employee’s work in this case does not affect the presence or absence of the obligation to register a separate unit.

As a general rule, an organization must register for tax purposes at the location of each of its separate divisions (Clause 1, Article 83 of the Tax Code of the Russian Federation).

A division is considered separate if it has two characteristics:

- territorial distance from the organization;

- the presence of at least one equipped stationary workplace.

In this case, a stationary workplace is a workplace created for a period of more than one month. This is stated in paragraph 2 of Article 11 of the Tax Code of the Russian Federation. A workplace is considered equipped if all the conditions necessary for the performance of work duties have been created for the employee. In addition, the workplace must be under the direct or indirect control of the employing organization (Article 209 of the Labor Code of the Russian Federation).

Thus, if an employment contract is concluded with an employee, but the organization does not create or equip a stationary workplace for him, then the organization does not have any grounds for tax registration at the place where the work is performed. If an organization provides an employee with a stationary workplace, then it forms a separate division, which must be registered with the tax office.

A similar point of view is reflected in letters of the Ministry of Finance of Russia dated March 1, 2012 No. 03-02-07/1-50, dated July 28, 2011 No. 03-02-07/1-265.

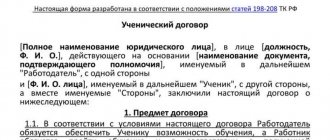

How to conclude a contract correctly

There are two types of conditions to be included in an employment contract:

- Required.

- Additional.

The traveling nature of the work is mandatory. Therefore, Part 2 of Article 57 of the Labor Code of the Russian Federation directly indicates that the contract must necessarily indicate the traveling nature of the work, if it is provided for by the employer for this position. It is advisable to clearly state in the contract the territory within which the work will be considered traveling: the city or municipality itself where the company is located, and the area around it. And although the employee must be able to return home every day, the law does not prohibit the establishment of such a territory within the entire Russian Federation. Moreover, the legislation makes it possible not to indicate such a territory in the contract, but its indication will protect the employer from recognizing a business trip as a business trip in case of questions from the inspection authorities, for example, regarding reimbursement of expenses. Example of wording in an employment contract:

The employee is assigned a traveling nature of work with a traveling territory - the city of Moscow and the Moscow region.

This must be written down in the “Subject of the Agreement” section:

The full version of the employment contract for filling out can be downloaded at the end of the article.

In addition, it is advisable for the employer to keep a special travel log or route sheets. These documents will allow you to quickly monitor all official movements of employees and confirm their feasibility in the event of an audit.

What documents will need to be completed?

The presence in the company of employees with a traveling option of work raises before the administration the issues of documenting this type of activity and compensation for expenses incurred by the employee in accordance with the law.

Options for assigning a category of work associated with constant movement (Article 168 of the Labor Code of the Russian Federation):

- contract of employment;

- agreement with the team;

- local (separate) normative act (LNA).

To properly keep track of expenses for mobile work, you must:

- introduce a condition on the type of employment in the employment contract (Article 57 of the Labor Code of the Russian Federation);

- approve the list of relevant positions and works in the contract with the team or LNA;

- provide for the conditions for documentary evidence of travel (in the contract, LNA);

- determine the amount and terms of payment of allowances (Article 168 of the Labor Code of the Russian Federation).

The establishment of allowances is the right, but not the obligation, of the enterprise administration, except in situations stipulated in legislation or industry agreements.

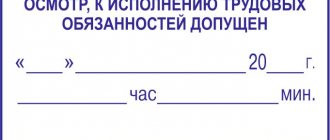

Procedure for accounting for traveling work and employee compensation

To avoid possible misunderstandings, we recommend that you specify the amount and procedure for reimbursement of employee expenses directly in the regulations or other internal regulations. Since in this case the employer does not have to issue travel documents and pay daily allowances, he must correctly account for the time worked. For these purposes, a regular time sheet can be used. In it, periods of business travel must be noted as working time. After all, such employees usually receive the usual official salary, as well as additional payments if they are established by the employment contract (Part 1, Article 129 of the Labor Code of the Russian Federation, Article 149 of the Labor Code of the Russian Federation). In addition, by virtue of Article 168.1 of the Labor Code of the Russian Federation, the company is obliged to compensate for many expenses of such employees:

- on the way;

- accommodation;

- food and other needs agreed with the employer.

All expenses must be supported by documents (checks, receipts, tickets, etc.), but there are no clear requirements for this in the legal regulations. Therefore, for such employees, a simplified procedure for submitting travel reporting can be established: a report once a week or even a month.

In addition to reimbursement of employee expenses, the legislation does not provide for other compensation for the traveling nature of work. At the same time, compensated expenses are not subject to personal income tax and insurance premiums.

Sample position

Employment contract form

Benefits of traveling employment

The traveling nature of an employee’s work has certain advantages for the company, expressed in the following points:

- Reducing document flow for business trips reduces their administration.

- It makes it easier to record working hours and calculate payments, since there is no need to maintain advance reports. This results in a more accurate assessment of the overall future labor costs.

- Labor costs are reduced. Instead of the average earnings accrued during business trips, the worker is paid his official salary. If there are additional payments to the salary, its value will be lower than the average earnings.

The company receives tax advantages due to the absence of the need to create a separate division in the locality (territory) where the company employee is employed.

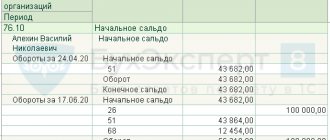

Accounting

The amount of compensation for expenses of an employee whose work is assigned to traveling is reflected in account 73 “Settlements with personnel for other operations.”

When calculating compensation, make a note:

Debit 26 (44, 08...) Credit 73

– compensation for expenses associated with the traveling nature of the work has been accrued.

Reflect the payment of compensation as follows:

Debit 73 Credit 50

– compensation was paid for expenses associated with the traveling nature of the work.

This procedure follows from the Instructions for the chart of accounts.

Income tax

The organization is obliged to reimburse expenses to those employees whose work is traveling in nature (Article 168.1 of the Labor Code of the Russian Federation). Therefore, the amount of compensation can be taken into account when calculating income tax (as economically justified expenses). In this case, the traveling nature of the employee’s work must be documented. This follows from paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Situation: under what cost item when calculating income tax can we take into account the costs of compensating expenses for employees with a traveling nature of work?

As part of other expenses associated with production and sales.

From the point of view of labor legislation, compensation to employees for expenses associated with the traveling nature of work is not included in the remuneration system, but represents a compensation payment guaranteed by law (Article 164, 168.1 of the Labor Code of the Russian Federation). Therefore, when calculating income tax, such an amount must be included in other expenses associated with production and sales (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). The validity of this approach is explained as follows.

The Labor Code of the Russian Federation distinguishes two types of compensation payments. One of them combines compensation related to special working conditions. Such payments, in accordance with Article 129 of Section VI “Payment and Standardization of Labor” of the Labor Code of the Russian Federation, are elements of remuneration. The second type of compensation is defined by Article 164 of Section VII “Guarantees and Compensations” of the Labor Code of the Russian Federation. In accordance with the provisions of this article, this type of compensation represents cash payments to employees to reimburse costs associated with the performance of their labor duties. The indicated amounts are not included in the wage system. Reimbursement of expenses to employees under Article 168.1 of the Labor Code of the Russian Federation refers specifically to this type of compensation (provided for in Section VII “Guarantees and Compensations” of the Labor Code of the Russian Federation). Therefore, these amounts should be taken into account as part of other production expenses when calculating income tax.

Similar conclusions are contained in letters of the Ministry of Finance of Russia dated October 25, 2013 No. 03-04-06/45182, dated June 14, 2011 No. 03-03-06/1/341, dated April 1, 2010 No. 03-03- 06/1/211, dated August 18, 2008 No. 03-03-05/87 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated September 10, 2008 No. ШС-6-3/643).

It is worth noting that earlier in letters dated May 7, 2008 No. 03-03-06/1/302, dated April 19, 2007 No. 03-06-06/1/250, dated August 29, 2006 No. 03- 03-04/1/642 The Russian Ministry of Finance expressed a different point of view. The financial department indicated that compensation for expenses for employees with a traveling nature of work can be taken into account when calculating income tax as part of labor costs (Article 255 of the Tax Code of the Russian Federation). Since under this cost item any accruals to employees in cash and (or) in kind are written off, including the amount of compensation (paragraph 1 of Article 255 of the Tax Code of the Russian Federation).

The organization can decide on its own which of the above positions to give preference to. If it is possible to attribute costs simultaneously to several groups of expenses, the Tax Code of the Russian Federation gives the organization the right to choose the option for their accounting. This follows from paragraph 4 of Article 252 of the Tax Code of the Russian Federation. However, in connection with the release of later clarifications from the Russian Ministry of Finance, tax inspectors will most likely be guided by them during inspections.

Advice: when calculating income tax, it is important to determine the cost item for paying the expenses of employees whose work is traveling in nature, in particular:

- for the formation of tax accounting registers for expenses (Articles 313 and 314 of the Tax Code of the Russian Federation);

- for the distribution of labor costs if they are included by the organization in direct expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation);

- to write off costs for certain types of voluntary insurance for employees to reduce taxable profit, since the limit for accounting for such costs depends on the amount of labor costs (clause 16 of Article 255 of the Tax Code of the Russian Federation).

Therefore, if, for example, an organization incurs costs for voluntary insurance of employees, then it is advisable to attribute the amount of compensation for the traveling nature of work to labor costs (Article 255 of the Tax Code of the Russian Federation).

If labor costs are included in direct expenses, then it is better to write off expenses associated with a traveling nature under the heading of other production expenses (subclause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation).

The moment at which expenses associated with the traveling nature of work are included in expenses when calculating income tax depends on the method of determining income and expenses that the organization uses.

Under the accrual method, expenses are generally recognized at the time they are accrued. It does not matter when the amount is actually paid. Such rules are established by paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

In particular, if compensation for the traveling nature of work is paid in advance (that is, the employee is given money on account), then the moment it is accrued will be the date of approval of the employee’s advance report (subclause 5, clause 7, article 272 of the Tax Code of the Russian Federation). This is confirmed by the letter of the Ministry of Finance of Russia dated June 14, 2011 No. 03-03-06/1/341.

For more information on recognizing expenses using the accrual method, see How to take into account income and expenses using the accrual method when calculating income taxes.

Using the cash method, take into account expenses only after the actual payment of compensation for the traveling nature of the work (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If expenses are not documented, they will not reduce taxable profit, and permanent differences and permanent tax liabilities will appear in the accounting of organizations applying the general taxation system (Article 252 of the Tax Code of the Russian Federation, clauses 4 and 7 of PBU 18/02).

An example of reflecting in accounting and taxation the costs associated with the traveling nature of the work of employees. The organization applies a general taxation system (accrual method)

In November, by order of the head of Torgovaya LLC, they compensated the courier A.S. Kondratiev costs a single ticket (2,400 rubles). Kondratiev’s work is traveling in nature, so for the organization such expenses are economically justified.

The organization uses the accrual method and pays income tax on a monthly basis.

The following entries were made in the organization's accounting:

Debit 44 Credit 73 – 2400 rub. – compensation for travel expenses has been accrued;

Debit 73 Credit 50 – 2400 rub. – compensation for travel expenses was issued from the cash desk.

The accountant did not accrue personal income tax, contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases for the amount of compensation.

When calculating income tax, the Hermes accountant included the amount of compensation (2,400 rubles) as expenses.

Situation: is it possible for the customer of services under an outsourcing agreement to take into account the payment of expenses associated with the traveling nature of the work of the contractor’s employees when calculating income tax?

Answer: no, you can't.

After all, the costs associated with the traveling nature of the work are reimbursed to employees by their employer (Article 168.1 of the Labor Code of the Russian Federation).

It happens that the contractor’s employees perform work or provide services on the customer’s premises. But this fact does not mean that they work for him. Their employment contracts are concluded with the employer-contractor. Only he has the right to take into account when taxing compensation for costs associated with the traveling nature of the work. This point of view is expressed by the tax service when commenting on similar situations (see, for example, letter of the Federal Tax Service of Russia for Moscow dated October 31, 2007 No. 20-12/104332.1).

Advice: the customer has the right to take into account compensation related to the traveling nature of the work of the contractor’s employees when calculating income tax. It all depends on the terms of the contract.

To take into account the payment for the contractor's employees in expenses, write down a condition regarding such compensation. If this was not initially agreed upon in the contract, then formalize the change in an additional agreement. That is, include compensation in the calculation of the price of outsourcing work or services. Such expenses will be economically justified and documented. Consider such costs as part of other costs associated with production and sales. This follows from paragraph 1 of Article 252 and subparagraph 19 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Situation: how can an air carrier reflect in accounting and tax accounting the costs of issuing visas for aircraft crews for a period of six months to two years? Crew members are assigned a traveling nature of work.

Costs for obtaining a visa for a period of six months to two years are allocated to several reporting periods. They were carried out within the framework of activities, the income from which will be received during the entire validity period of the visas, that is, over several reporting periods. Therefore, in accounting, the costs of issuing visas for aircraft crews must be distributed evenly across months during the period for which visas were issued to employees (clause 19 of PBU 10/99).

Reflect the costs of paying for visas using account 97 “Deferred expenses”. Despite the fact that such costs are not directly named as deferred expenses in the current accounting regulations, they meet the following criteria:

- the organization incurred expenses, while the counterparty did not have counter-obligations to it (otherwise, receivables are recognized, not expenses);

- these expenses do not form the cost of inventories or the production cost indicator and are not related to the sale of goods of the current period;

- expenses determine the receipt of income over several reporting periods and do not affect the financial result of the current period.

Thus, in accounting, the costs of issuing visas should be distributed evenly across months during the period for which the flight crew visa is issued, and taken into account in account 97 “Future expenses”.

In this case, the following transactions are made:

Debit 97 Credit 51

– funds were transferred to pay the costs of visas;

Debit 26 Credit 97

– expenses for obtaining visas are written off (in equal shares, monthly).

In tax accounting, costs for visas must also be recognized taking into account the principle of uniformity. At the same time, the organization must independently determine the methodology for recognizing (distributing) costs for issuing visas and consolidate it in its accounting policies for tax purposes.

This follows from paragraph 1 of Article 272 of the Tax Code of the Russian Federation.