Deductions

According to Art. 1005 of the Civil Code of the Russian Federation, under an agency agreement, one party (agent) undertakes

Manufacturing overhead and administrative expenses exist in companies that produce products. General economic issues take place

In what cases is it necessary for the Seller or Contractor to draw up an advance payment (partial payment) from the buyer?

What is included in daily travel expenses When a worker is sent on a business trip, he is retained

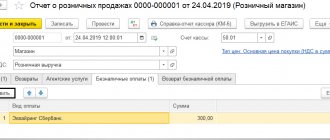

An acquiring agreement is concluded between the acquiring bank and the organization or entrepreneur receiving payment for their goods

Deadline for filing the 3-NDFL tax return The 3-NDFL tax return is submitted to the tax authority at the place of residence

Where and when should the PM-1 auto cargo report be submitted? All small enterprises, with the exception of microbusinesses, carrying out

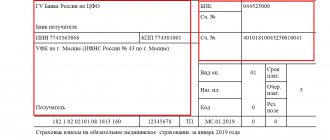

Payments for insurance premiums are a document by which the payer instructs the bank to make a transfer

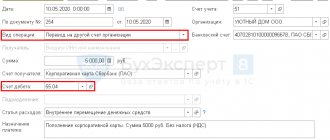

Accounting for settlements with accountable persons - postings Requirements for registration of cash transactions, including

Deductions for children under personal income tax in 2021: changes, sizes and provision Children's taxes