Manufacturing overhead and administrative expenses exist in companies that produce products. General economic ones take place in any organization. Accounting for general production and general business expenses is organized on the basis that they are indirect. Let's look at both in more detail. General production expenses include those costs that cannot be attributed to the cost of a specific product. For example, general production expenses include:

- salaries and deductions from them for employees serving production: foremen and shop managers, workers repairing technological equipment, etc.;

- depreciation of fixed assets and intangible assets used in production;

- payments for premises, machines, and equipment rented for production;

- security and cleaning of industrial premises;

- costs necessary to operate the equipment involved in production: gas, fuel, electricity, etc.

Other production costs include insurance payments, taxes, fees, warranty payments, shortages of valuables, production downtime, etc.

Definition

Manufacturing overhead costs are costs directly related to production activities. The main distinguishing feature from direct costs of manufacturing products is that the amounts cannot be attributed to a specific type of product. General production expenses may include costs for:

- depreciation deductions;

- equipment maintenance;

- payment for utility services;

- rent of industrial premises;

- wages for workers involved in the service process;

- other expenses.

Although costs are not directly related to any type of product, they must be taken into account when calculating production costs.

What is considered OCR?

According to the Instructions for the application of the Chart of Accounts (pr. 94n of the Ministry of Finance), the following can be legally classified as OMR:

- remuneration for the AUP of the central office with contributions to the Funds;

- depreciation of fixed assets, intangible assets used in the management process;

- rental payments if buildings for non-industrial purposes are used under a lease agreement;

- expenses for maintaining non-industrial buildings, including payments to utility services;

- labor protection costs;

- payment for business trips of the AUP;

- entertainment expenses;

- office, banking, expenses, auditor services, etc.

Regulatory acts currently do not contain an exhaustive list of environmental protection measures. The main feature that allows costs to be classified in this category is the fact that they are not directly related to the production of goods, work or provision of services.

On a note! When deciding whether to consider expenses general production or general economic, for example, if an organization has a branch, it is advisable, in addition to the ratio of its costs directly to the production process, to evaluate such a factor as the participation of the responsible persons of the branch in the production of products (management of the organization as a whole). In certain cases, the territorial distance of the division (branch) from the company’s central office plays a role.

The concept of general expenses

The activities of any enterprise are necessarily connected with the functioning of its various departments. A production workshop cannot operate on its own without management and control employees. The products must then be stored and sold, which requires other personnel and premises. All this leads to the formation of costs that seem to be far from the production process, which are combined into the group of general business expenses.

They may include amounts necessary for:

- covering administrative and management expenses;

- remuneration for employees employed outside production;

- depreciation and repair of general purpose fixed assets;

- payment for rent of non-production premises;

- covering other expenses of a similar nature.

General business expenses are also written off to the cost of manufactured products in accordance with the rules of the enterprise's accounting policy.

Characteristics of overhead costs

General production and general business expenses are combined into a group of indirect costs that arise in the course of the enterprise's activities. It is difficult to trace the ratio of their amount to types of products and production time, so they are written off by the method of allocating costs in proportion to a given indicator.

General production and general business expenses are taken into account, highlighting separate cost items and departments (shops). This allows you to control the distribution of funds and identify the most expensive objects to maintain and manufacture.

Overhead costs in accounting data

General and general production expenses in total terms are reflected in synthetic accounts 25 and 26. Both accounts do not have a balance at the end of the month, since they serve to collect and distribute the costs of main production. The amounts are written off to account 20, making entries Dt 20 Kt 25/26. Some enterprises (for example, those providing intermediary services) account for all administrative and general business expenses on account 26, without using account 20.

Analytical accounting is also kept for accounts 25 and 26. Sub-accounts are opened for each workshop, as well as for individual items of general business expenses. When filling out, the accountant is based on data from primary documentation and other forms of accounting registers developed by the enterprise. Additionally, statements No. 12 and 15 are maintained to account for general production and general business expenses.

Typical entries for the debit of accounts 25, 26

Accounting for overhead costs includes collecting information about cost items for maintenance, servicing and fulfilling the needs of main and auxiliary production. Using account 26 pursues the same goals, only the amounts of administrative and management expenses are recorded. Over a certain period, the necessary information is collected in the debit of accounts 25 and 26.

In this case, the following postings Dt 25/26 can be made:

- Kt 02, 05 – depreciation of fixed assets and intangible assets has been accrued;

- Kt 70 – wages accrued to general production (administrative) personnel;

- Kt 69 – social benefits accrued. payments to employees involved in servicing workshops (management employees);

- Kt 76 – general production (general business) expenses include payment of utility bills;

- Kt 10 – materials were sent for the maintenance of production (administrative) facilities.

In addition to the account assignments discussed, others can be used. The main thing is not to violate the principle of double entry and follow the rule of an active account: credit in debit, write-off in credit.

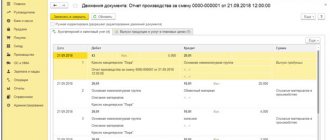

Loan transactions: write-off of overhead costs

The instructions for using the standard chart of accounts say that collective synthetic accounts 25 and 26 must be closed at the end of the month. This requirement means that all debit amounts are charged to account 20 (or 90 for general expenses). The accountant will record entries like:

- DT “Main production” CT “Overhead production expenses” – the amounts of general production expenses incurred for the needs of the main production shops are written off;

- Dt “Service production” Kt “Overhead production costs” – the amounts of overhead costs for remuneration of personnel of service production are attributed;

- DT “Auxiliary production” CT “General production expenses” – expenses for utility bills for auxiliary production facilities are written off;

- DT “Main production” CT “General business expenses” – general business expenses were included in the actual production cost;

- Dt “Cost of production” Ct “General expenses” – the amounts of administrative and managerial costs are written off to the cost of production.

Depending on which account the data from the debit turnover of general business expenses is credited to, the full or production cost of the products is formed.

Distribution and write-off of chemical equipment

General business expenses in production at the end of the accounting period must be distributed, since they are indirect in nature. If an organization produces one type of product, all technical and chemical works are transferred to the costs of this type of product entirely, i.e. we can say that they are “distributed” to him in full. If there are several types of products, then chemical and chemical works are distributed among them proportionally.

The distribution base can be:

- remuneration of production workers;

- direct production costs;

- revenue from product sales;

- volume of products produced, etc.

The organization independently decides on the choice of the distribution base for chemical equipment and consolidates it in its accounting policies. One of the most common is the distribution by wages of workers employed in production.

An example of the distribution of industrial and technical support by base - by wages in production

Distribution of OHR = OHR of the period/production payroll by period, where “period” is usually “year”, but the previous quarter and half-year can be taken.

Distribution of chemical and chemical protection by types of products A, B, C:

OHR (A) = K * FOT (A), OHR (B) = K * FOT (B), OHR (C) = K * FOT (C).

Calculation: Let there be a small business entity whose non-production costs are minimized compared to production costs. The amount of OCR for the period amounted to 200,000 rubles. Payroll for production for the period is 600,000 rubles, for products A - 300,000, B - 200,000, C - 100,000 rubles. We get:

- To distributor OHR = 200000 / 600000 = 0.3333.

- OHR (A) = 0.3333 * 300000 = 100000.

- OHR (B) = 0.3333 * 200000 = 66667.

- OHR (C) = 0.3333 * 100000 = 33333.

Total: 200000.

Knowing the volume of products produced by type, it is possible by dividing the total amount of costs by type by the number of units of the corresponding product to calculate the OCR per unit of product.

Calculations are carried out similarly for other distribution bases selected by the organization.

OCR is written off in three ways:

- Using account 20 “Main production”, transferring accumulated costs to the debit of this account from credit 26 “OKhR”, as mentioned above: for one type of product in full, or using distribution by type of product.

- Using account 90, sub-account “Sales”. Costs are thus written off by organizations and firms providing various services (accounting support, consulting, etc.) and conducting non-production activities.

- Using the so-called direct costing method. Its essence lies in the division of costs: on account 20 all production expense items are collected, which are then subject to write-off for products, and on account 90 the full amount is written off for O&R (see PBU 10/99, paragraph 2, paragraph 9).

Question: Can RSO, when writing off general business expenses monthly to production cost accounts, distribute them among the objects of calculation (types of services provided) using established coefficients, and not in proportion to the amount of direct costs for these services? What should be stated in the accounting policy for accounting purposes? View answer

Production cost

Costs arising in connection with the maintenance or maintenance of production facilities can be attributed to the final result in proportion to the amount specified by the accounting policy. The distribution of overhead costs aims to calculate the cost per unit of production at the exit from the workshop, taking into account all the costs of the industrial cycle.

The distribution of general production and general business expenses when using this method occurs in different ways: from account 25 the amounts are written off to the 20th account, and from 26 to 90. Thus, administrative, managerial and other overhead expenses in terms of general business expenses are not included in the production cost, but relate directly to the financial result.

This is one of the methods that can be applied in an enterprise. Production cost indicators allow you to analyze the profitability of a particular workshop and regulate the amount of costs for the production of certain types of products.

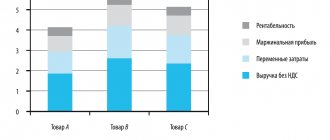

Direct and indirect costs: distribution by product type

Let us recall that the division of costs, direct and indirect costs, depends on industry characteristics, production organization and the adopted method of cost accounting (costing).

At first glance, it may seem that it is not at all difficult to distribute direct costs by type of product. The main thing is to establish a correspondence between the products produced and the direct costs incurred. However, if several types of products are produced in one workshop using the same equipment using the same materials, it is not so easy to distribute direct costs. In this case, direct costs are distributed in proportion to the standards developed by employees of the technological and planning departments.

The process of allocating indirect costs in production can occur in two stages. At the first stage, indirect costs are distributed according to the place of their occurrence, in particular between workshops, divisions or departments. At the second stage, they are redistributed by type of product. An important point in this process is determining the distribution base (indicator). For example, to distribute administration salaries, the number of employees can be used as such a base, for heating and electricity - the area of the premises, for water supply - the area of the premises or the number of employees, for sales and marketing costs - direct costs. In any case, the distribution of indirect costs should not require much effort and calculations.

The method of distributing indirect costs between types of products, works and services must be enshrined in the accounting policies of the organization.

We will show how different methods of distributing indirect costs can affect the financial result and its reflection in the financial statements.

Example 1

In September 2014, Uyut LLC produced 300 chairs of type A and 250 chairs of type B. Direct costs for the production of chairs A amounted to 225,000 rubles, and for the production of chairs B - 425,000 rubles. The amount of indirect costs is 120,000 rubles. In the same month, Uyut LLC sold 200 chairs A and 100 chairs B.

Let's distribute indirect costs in two ways. In the first case, we will take direct costs as the distribution base. In the second case, we distribute indirect costs evenly per unit of production.

First way

Amount of indirect costs:

- for chairs A - RUB 41,538. ;

- for chairs B - RUB 78,462. .

Cost per unit of production:

- chair A — 888 rub. ;

- chair B - 2014 rub. .

Cost of sales:

- chairs A - RUB 177,600. (888 rub. x 200 pcs.);

- chairs B - RUB 201,400. (RUB 2014 x 100 pcs.).

Total cost of sales - 379,000 rubles.

Second way

Amount of indirect costs:

- for chairs A - RUB 65,455. ;

- for chairs B—RUB 54,545. .

Cost per unit of production:

- chair A — 968 rub. ;

- chair B - 1998 rub. .

Cost of sales:

- chairs A - RUB 193,600. (968 rub. x 200 pcs.);

- chairs B - RUB 199,800. (RUB 1,998 x 100 pcs.).

Total cost of sales - 393,400 rubles.

Thus, the cost of sales in the first and second cases differs by 14,400 rubles. (RUB 393,400 – RUB 379,000). Consequently, the financial result reflected in the financial statements will also be different. In this example, when indirect costs are distributed in proportion to direct costs, sales revenue (profit) will be greater than when indirect costs are distributed evenly per unit of production.

Cost and taxation

In order not to create additional registers for tax accounting purposes, it is better to account for overhead costs at the full production cost. The method involves writing off to the debit of account 20 both general production and general business expenses. The accountant’s choice of a method for attributing indirect costs to the cost of products should be based primarily on the provisions of the enterprise’s accounting policy.

General production expenses (account 25) and expenses for general business needs, together with data from account 20, make up the bulk of the cost of manufactured products. The data is used both for the purposes of accounting and analysis of the financial activities of the enterprise, and for tax service data.

Direct expenses from the trade organization

Goods purchased by a trading organization are accounted for at the cost of acquisition on account 41 “Goods”. These costs are direct.

In accordance with paragraph 13 of PBU No. 5/01, trade organizations can include transportation costs as part of sales expenses and reflect them on account 44 “Sales expenses.” In this case, transportation costs accumulated on account 44 are distributed monthly between the goods sold and the balance of goods in the warehouse. The amount of direct expenses related to the balance of goods in the warehouse is established based on the average percentage for the current month, taking into account the carryover balance at the beginning of the month.

The procedure for calculating the specified amount is as follows.

The amount of direct expenses attributable to the balance of goods in the warehouse at the beginning of the month and incurred in the current month is determined.

The cost of goods sold in the current month and the cost of the balance of goods in the warehouse at the end of the month are established.

The average percentage is calculated as the ratio of the amount of direct costs (data from point 1) to the cost of goods (data from point 2).

The amount of direct expenses related to the balance of goods in the warehouse is determined. It is equal to the product of the average interest and the cost of the balance of goods at the end of the month.

The amount of direct transportation costs attributable to the goods sold is written off from account 44 to the debit of account 90.

The procedure for reflecting transportation costs for the delivery of goods to the warehouse of a trading organization must be approved in the accounting policy.

Let's look at an example of how to distribute transportation costs in accordance with the algorithm described above.