Home — Articles

- Deductions for goods, works, services and imports

- Deductions for fixed assets

- Deductions for entertainment expenses

- Deductions for returning goods

- Deductions on adjustment invoices

- Deductions from advances When deductions cannot be transferred

The taxpayer has the right to transfer VAT deductions to later reporting periods (quarters) within three years. Such a maneuver may be advisable, for example, in order to avoid the amount of tax to be reimbursed in the declaration. For example, to avoid VAT reimbursement in the declaration or exceeding the safe share of deductions in the region. Regulatory authorities believe that the three-year rule does not apply to all deductions. This is confirmed by the first official explanations on this topic. Thus, the Ministry of Finance is against the transfer of advance VAT deductions (letter dated April 9, 2015 No. 03-07-11/20290). We looked at various transfer situations and showed them with specific examples.

Deductions for goods, works, services and imports

Note! Deductions can be transferred to any quarter, not necessarily to the nearest one. For example, if you did not claim a deduction in the first quarter, you can do so in the third or fourth quarter, and not just in the second quarter.

A company can declare VAT deductions within three years after registering goods, works or services (clause 1.1 of Article 172 of the Tax Code of the Russian Federation). Consequently, invoices for purchased goods, works or services can be registered in the purchase book not only in the quarter when the right to deduction arose, but also later. The same rules apply to VAT, which a company pays when importing goods (Clause 1, Article 172 of the Tax Code of the Russian Federation).

From paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation, we can conclude that the three-year period must be counted from the date on which the company accepted the goods for registration. During this period, it is safer not only to register the invoice in the purchase book, but also to submit a declaration with deferred deductions. The law does not say that the three-year period is extended for the period of submission of the declaration. This means that if you submit reports beyond three years, there is a risk that the tax authorities will refuse the deduction.

Example 1. In which quarters is it safe to claim VAT deduction on a supplier invoice?

The company purchased the goods and registered them on June 8, 2015. The cost of goods is 236,000 rubles, including VAT - 36,000 rubles. An invoice from the supplier also arrived in June. Consequently, the company has the right to accept tax deductions in the second quarter. But at the end of this quarter, the amount of deductions exceeded the accrued VAT. To avoid tax refunds, the company did not reflect this invoice in its declaration for the second quarter.

Three years from the date of acceptance of goods for registration in this case expire on June 8, 2021. This means that the company has the right to claim a deduction in the amount of 36,000 rubles. in the VAT return:

- for the third or fourth quarter of 2015;

- for any quarter of 2021 or 2021;

- for the first quarter of 2021.

You can also transfer deductions for those invoices for which the company did not declare deductions in 2014. The organization has the right to register such invoices in the purchase book in 2015. It is not necessary to submit an update for 2014.

The Federal Tax Service confirmed to us that in such a situation the buyer should not have any difficulties with deductions. Even though the supplier charged VAT in 2014, and the buyer claims a deduction in 2015. After all, the program will not compare deductions on invoices drawn up before 2015 with the tax accrued by the supplier. Of course, tax authorities will control such deductions, but in a different way. For example, claims are possible if, according to inspectors, the supplier is an unscrupulous taxpayer. Then the tax authorities can request invoices, primary documents and other documents from the buyer.

Note! It is safe to transfer the entire deduction amount from the invoice; splitting it is risky

According to the Ministry of Finance of Russia, it is possible to divide the deduction even for one invoice into several quarters (letter dated April 9, 2015 No. 03-07-11/20293). That is, the company can defer not the entire deduction, but only part of it. But these clarifications have not yet been posted on the nalog.ru website as mandatory for tax authorities. But specialists from the Federal Tax Service of Russia think differently - a company has the right to partially register an invoice in the purchase book only in certain cases. For example, if the supplier ships goods in stages against an advance payment and claims VAT deduction from the advance payment. Therefore, the safe option is to not spread the deduction on one invoice across different quarters.

In what cases do they resort to transferring VAT deductions?

Of course, it is more profitable for an enterprise to claim a tax refund immediately after accepting the acquired asset for accounting, since deduction amounts that are extended over time and “frozen” are always a diversion of working capital from the business, and ultimately a loss of profit.

However, a company may postpone the deduction for practical reasons - so as not to attract the attention of the Federal Tax Service. Announcing large amounts of compensation means a decrease in budget revenues. There are situations when the amount of VAT refundable in a reporting year exceeds the accrued tax, for example, when a company acquires expensive property, which is accompanied by the formation of an impressive deduction. It turns out that the budget becomes a debtor of the enterprise, and when a company declares VAT, inspectors of the Federal Tax Service check the statements with special attention, because it is no secret that many fraudulent schemes are built precisely on the presentation of fictitious invoices to reduce tax.

There is a concept of a safe share of VAT deduction. This is determined by the appendix to the order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/333, the amount of deductions relative to the amount of accrued tax for the year. The Federal Tax Service states: if at the end of the year the share of deductions exceeds 89%, the enterprise becomes a potential target for inspection. Therefore, it is better for the company to stick to a safe level of tax refund amounts.

Another reason for transferring the deduction is the buyer’s late receipt of documents from the supplier.

Deductions for fixed assets

The company that acquired fixed assets has the right to defer deductions for them. The Ministry of Finance confirms. At the same time, partially claiming a deduction on an invoice for fixed assets, equipment for installation and intangible assets is risky. The Russian Ministry of Finance believes that the company does not have the right to do this (letter No. 03-07-11/20293). Officials explain their conclusion by saying that, by law, such deductions must be declared after the asset has been registered in full (Clause 1, Article 172 of the Tax Code of the Russian Federation).

This can be argued, since the specified norm does not prohibit partial deductions. And companies managed to prove in court that the deduction from one invoice for a fixed asset can be divided between quarters (resolution of the Federal Antimonopoly Service of the Volga District of October 13, 2011 in case No. A55-26765/2010). But if the company wants to avoid a dispute, it is not worth splitting the deduction in such a situation.

Example 2. In what period can you safely claim a deduction for a fixed asset?

On March 5, 2015, the company purchased equipment and recorded it in account 01 “Fixed Assets”. The cost of the equipment is 590,000 rubles, including VAT - 90,000 rubles. In the declaration for the first quarter of 2015, the accountant did not declare a deduction for this fixed asset. The three-year period from the date of equipment registration expires on March 5, 2021. This means that the company has the right to reflect the deduction in the VAT return:

- for the II, III or IV quarter of 2015;

- for any quarter in 2021 or 2021.

Consultation with the Ministry of Finance. You have the right to transfer deductions for fixed assets Anna Lozovaya, Head of the Indirect Taxes Department of the Department of Customs and Tariff Policy of the Ministry of Finance of Russia Deductions for entertainment expenses

VAT deduction on purchased goods can be claimed within three years from the date of acceptance of these goods for registration (clause 1.1 of Article 172 of the Tax Code of the Russian Federation). This rule also applies to those goods that the company will use as fixed assets. Therefore, the deduction for fixed assets can be postponed. That is, declare not in the quarter in which the necessary conditions for the deduction are met, but later. At the same time, in relation to fixed assets, the deduction for one invoice must be declared in full. It is impossible to split the tax indicated in the invoice into several tax periods (letter of the Ministry of Finance of Russia dated April 9, 2015 No. 03-07-11/20293).

As it was before

In the recent past, officials had a unequivocal opinion - it is prohibited to divide the VAT deduction for one invoice into different periods. Such conclusions can be found, for example, in letters of the Ministry of Finance dated December 9, 2010 No. 03-07-11/483, dated October 13, 2010 No. 03-07-11/408 and others. At the same time, the department’s specialists referred to the fact that such a procedure is not provided for by tax legislation. Indeed, Articles 171 and 172 of the Tax Code, devoted to deductions, did not contain rules directly allowing for the “scattering” of VAT deductions.

However, the majority of arbitration courts reasoned differently: firstly, the legislation does not directly prohibit deductions for partial applications, and, secondly, this does not lead to non-payment of tax. Therefore, the arbitrators in most cases recognized the splitting of the VAT deduction as legal. Similar conclusions are given, for example, in the Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 12, 2013 No. F05-15985/12, as well as in many others.

Deductions for entertainment expenses

VAT deduction on entertainment expenses can be claimed on the date of approval of the advance report. However, the company has the right to deduct tax only on expenses within the limits established for income tax (clause 7 of Article 171 of the Tax Code of the Russian Federation). Therefore, it is better to register invoices for such expenses in the purchase book at the end of the quarter, when the company calculates the standard.

But perhaps in the next quarter excess expenses will fit into the limit. Then the balance of the deduction that the company was unable to declare in the last quarter can be reflected in the current purchase book (letter of the Ministry of Finance of Russia dated November 6, 2009 No. 03-07-11/285). But you can only carry forward deductions for excess expenses during the calendar year. After all, such expenses cannot be taken into account next year. Accordingly, it will no longer be possible to claim a deduction for them.

Note. The company has 1 calendar year to claim a deduction for excess entertainment expenses

Example 3. How to carry forward the deduction for entertainment expenses to the next quarter

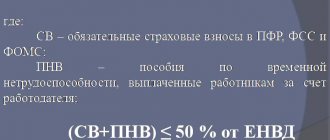

In the first quarter, the company paid entertainment expenses in the amount of 84,960 rubles, including VAT - 12,960 rubles. Labor costs for this period amounted to RUB 950,000. The standard for entertainment expenses is 38,000 rubles. (950,000 ₽ × 4%). This means that the company can claim VAT in the amount of 6,840 rubles. (38,000 ₽ × 18%).

In the second quarter, the company did not hold any entertainment events. Labor costs for the half-year amount to RUB 1,975,000. The standard for entertainment expenses is RUB 79,000. (RUB 1,975,000 × 4%). Thus, the limit exceeds the amount of entertainment expenses excluding VAT - 72,000 rubles. (84,960 – 12,960). Consequently, the accountant has the right to register invoices for entertainment expenses in the purchase book for the second quarter in the amount of 6,120 rubles. (12 960 – 6840).

Postpone the deduction so as not to attract attention

The more deductions a taxpayer declares, the less VAT he will pay to the budget. If there are more deductions than the output VAT, refundable VAT will be generated, and then the budget will owe the company, and not vice versa. For example, if an organization purchased expensive equipment, and a large amount of VAT was generated for deduction.

Tax authorities do not like such situations. When they see from the declaration that there are a lot of deductions, they begin to suspect that the company is using fraudulent schemes (for example, buying fictitious invoices to reduce VAT). And they check the declaration with particular passion. You need to be prepared for the fact that they will ask questions, find fault, and demand explanations and documents. They may even call the director to a committee meeting and demand a reduction in the share of deductions. We described in this article how to determine a safe percentage of deductions.

Example

The organization bought expensive equipment, and there were few shipments in the current quarter. As a result, VAT was generated for reimbursement. At the same time, the organization enters into multimillion-dollar contracts, under which large amounts of shipments are expected in the coming months, which means there will be a lot of outgoing VAT. The organization decides not to deduct VAT on equipment this quarter, but to reduce the VAT of future quarters at the expense of it.

This is done not only out of fear of the tax authorities, but simply because for some organizations it is more convenient to transfer savings to later than to receive money now and pay large amounts of VAT later.

Deductions for returning goods

The supplier has the right to deduct VAT from the cost of goods returned by the buyer (clause 5 of Article 171 of the Tax Code of the Russian Federation). Such a deduction can be claimed within a year after the goods are returned (clause 4 of Article 172 of the Tax Code of the Russian Federation).

If the buyer has already accepted the goods for registration, then when returning them he must issue an invoice to the supplier. Based on this document, the supplier will claim VAT deduction from the cost of the returned goods. If the buyer does not accept the goods for registration and returns part of the products, then the supplier himself issues an adjustment invoice for its cost. And then registers it in the purchase book (letter of the Ministry of Finance of Russia dated August 10, 2012 No. 03-07-11/280).

Perhaps the buyer returned the entire batch of goods that were not accepted for registration. Then you can register a shipping invoice in the purchase book (letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-07-15/8473). Similar rules apply if the buyer applies a simplified tax or UTII and does not have to issue invoices.

Example 4. In which quarter can the supplier claim a deduction from the cost of returned goods?

The buyer returned the goods received to the supplier under simplified conditions in March 2015. The supplier did not claim a deduction from the cost of these goods in the first quarter. Therefore, this deduction can be claimed in the II, III or IV quarter of 2015. To do this, an invoice for the shipment of these goods must be registered in the purchase ledger.

However, in practice, it is usually more profitable for the supplier to immediately declare such a deduction rather than defer it to subsequent quarters. After all, when shipping goods, he charged VAT on sales. And if you do not immediately declare a deduction from the returned shipment, then this tax will have to be transferred to the budget.

Deductions on adjustment invoices

When a supplier gives a discount to a buyer, he can deduct VAT based on the adjustment invoice. Such deductions can be claimed within three years from the date of drawing up the adjustment invoice (Clause 10, Article 172 of the Tax Code of the Russian Federation).

Example 5. In which quarter should I declare a deduction on an adjustment invoice?

In March 2015, the supplier shipped goods to the buyer in the amount of RUB 1,593,000, including VAT - RUB 243,000. In April, the supplier provided a 10 percent discount on these products. In this regard, on April 28, the accountant drew up an adjustment invoice in the amount of 159,300 rubles, including VAT - 24,300 rubles. The company has the right to claim a deduction on this invoice in the amount of RUB 24,300. in the second quarter. Or in any subsequent period within three years. That is, in the declaration:

- for the third or fourth quarter of 2015;

- for any quarter of 2021 or 2021;

- for the first quarter of 2021.

However, as in the case of returning goods, it is more profitable for the supplier to immediately reduce the tax rather than transfer the deduction to subsequent periods. After all, the supplier has already charged VAT on the original, not the reduced cost of the goods. Therefore, it is in his interests to reduce revenue by the discount amount. If the cost of goods increases, the buyer claims a deduction in the same manner.

How to count the three year period

When determining the period, you need to start from the date of acceptance of goods and services on the invoice. The right to claim a deduction remains until the end of the quarter in which the three-year period expires.

Note!

You may lose your deferred VAT tax credit if you leave it until the last minute.

The fact is that the declaration is submitted within 25 days after the end of the quarter, and these 25 days are already outside the quarter in which the three-year period expires. While the quarter in which the deadline expires, you have the right to a deduction, but as soon as it ends, you lose it. Tax authorities think so, and the Supreme Court supported them (Decision of the Supreme Court of the Russian Federation dated September 4, 2018 No. 308-KG18-12631 in case No. A32-32030/2017). It is safer to claim the deduction in the penultimate quarter.

Example

The organization accepted materials for accounting in February 2021, but did not use the deduction. The three-year term expires in February 2019. February is the first quarter. This means that she can claim the deduction until the end of the 1st quarter of 2021. To avoid losing your deduction, it is better to declare it in the 4th quarter of 2021. If this is not possible and the deduction is needed precisely in the 1st quarter of 2021, you must submit the declaration on the last day of the quarter, but not outside it. This way there will be more chances to defend the deduction.