Any receipt of an object of fixed assets (F), whether it be a purchase, gratuitous transfer or acquisition in exchange, entails the mandatory determination of a depreciation group, which is assigned based on the useful life of the property. It is during this period that the cost of the property gradually becomes part of the company's costs. Write-off of accrued depreciation amounts is carried out in one of four ways that are relevant for accounting established in the accounting policy of a particular enterprise.

Shock absorption groups

When registering, PF objects are assigned to a specific depreciation group. There are 10 of them in total; they are listed in the OS Classification by depreciation groups. The main criterion for combining units of property into any of the depreciation categories is the useful life (USI) of the object. It is determined by enterprises for each PF facility, based on the expected useful period, operating conditions and regulations governing the use of the property.

SPI is the main criterion for classifying an asset into one of the presented depreciation groups.

| Group | SPI property |

| 1 | From 1 year to 2 years |

| 2 | From 2 to 3 years |

| 3 | From 3 to 5 years |

| 4 | From 5 to 7 years |

| 5 | From 7 to 10 years |

| 6 | From 10 to 15 years |

| 7 | From 15 to 20 years |

| 8 | From 20 to 25 years |

| 9 | From 25 to 30 years |

| 10 | Over 30 years |

According to the general rules, the organization depreciates the received asset over the period of fixed income, determined by the Classifier (see table). If the company cannot find an object on the list, then the deadline is set based on the specifications of the asset or the manufacturer’s recommendations. If the asset is manufactured in a company, then the company’s specialists independently develop recommendations confirming the effective life of the asset. They are drawn up in any form. This may be an order from the manager or another document defining the PPI of the asset. Let's consider the characteristic features of property classified in each depreciation group.

Fourth group of classification of fixed assets

- OKOF

- Shock absorption groups

- Fourth group

Property with a useful life of more than 5 years up to 7 years inclusive.

Determination of depreciation group and useful life using the OKOF code:

| Code OKOF | Name | Note |

| Building | ||

| 210.00.00.00.000 | Buildings (except residential) | buildings made of film materials (air-supported, pneumatic frame, tent, etc.); mobile all-metal; mobile wood-metal; kiosks and stalls made of metal structures, fiberglass, pressed plates and wood |

| Facilities and transmission devices | ||

| 220.23.61.12.191 | Fences (fences) and reinforced concrete barriers | |

| 220.41.20.20.300 | Constructions of fuel and energy, metallurgical, chemical and petrochemical enterprises | exploration well |

| 220.41.20.20.302 | Overhead power line | on untreated wood supports |

| 220.41.20.20.316 | Gas well for exploratory drilling | |

| 220.41.20.20.327 | Interfield oil pipeline | |

| 220.41.20.20.723 | Communications facilities | wooden masts |

| 220.41.20.20.901 | Technological pipelines | except for internal and external pipelines |

| 220.42.22.1 | Utility buildings for power supply and communications | mobile power plants; electrical power units |

| cars and equipment | ||

| 320.26.30.1 | Communication equipment, radio or television transmission equipment | |

| 320.26.30.11.190 | Other communication equipment transmitting with receiving devices, not included in other groups | modems/multiplexers; DSLAM multiplexer, media converters; transponders; session border controllers (SBCs); firewalls; amplifiers; station and linear units of compaction equipment; regenerators; electronic subscriber terminals; telephone fax machines; digital mini-PBXs (rural, institutional, remote); WiFi hotspots |

| 330.26.51.43 | Instruments for measuring electrical quantities without a recording device | for measuring or checking the quantitative characteristics of electricity |

| 330.26.51.66 | Instruments, instruments and machines for measurement or control, not included in other groups | equipment for assessing the quality of cementation |

| 330.26.52 | Watches of all kinds | special watches and time instruments (marine and aviation watches, chronometers, stopwatches, chronoscopes, chronographs, time counters, time relays); instruments for monitoring watches, components and parts of watch mechanisms; mechanical wrist watches, mechanical pocket watches, table watches, wall watches, floor watches, alarm clocks; electro-mechanical and electronic watches |

| 330.26.70.21 | Sheets and plates of polarizing material; lenses, prisms, mirrors and other optical elements (other than optically untreated glass), whether or not mounted, other than elements for photographic and cinema cameras, projectors or photographic enlargers, or equipment for reducing image projection | |

| 330.27.90.70.000 | Electrical signaling devices, electrical equipment for safety or traffic control on railways, tramways, highways, inland waterways, parking areas, port facilities or airfields | except for fixed assets included in other groups |

| 330.28.13.11.140 | Concrete pumps | |

| 330.28.13.12 | Other reciprocating positive displacement pumps for pumping liquids | electric heaters |

| 330.28.21.13.129 | Other induction or dielectric heating equipment, not included in other groups | ovens and burners |

| 330.28.22.11.190 | Lifts not included in other groups | forklifts |

| 330.28.22.14.159 | Self-propelled machines and trolleys equipped with a crane, others, not included in other groups | |

| 330.28.22.18 | Lifting, transporting and other loading and unloading equipment | mobile scraper belt conveyors; pneumatic conveying devices |

| 330.28.22.18.180 | Loading and unloading equipment for rolling mills, not included in other groups | lifts, electric cars |

| 330.28.22.18.270 | Equipment for loading blast furnaces | conveyor filling machines; head mixers; lined buckets; containers, molds, trolleys and other machines and mechanisms for loading and transportation |

| 330.28.23 | Office machines and equipment, excluding computers and peripheral equipment | |

| 330.28.23.13.140 | Ticket printing machines | equipment for selling railway tickets |

| 330.28.29 | Other general purpose machinery and equipment, not included in other groups | electric motors for electric drilling rigs; crane electric motors |

| 330.28.30.31.129 | Other plows, not included in other groups | |

| 330.28.30.39 | Other agricultural machines for tillage | |

| 330.28.30.8 | Other agricultural machinery and equipment | except for fixed assets included in other groups |

| 330.28.41.1 | Laser metal processing machines and similar types of machines; machining centers and similar types of machines | |

| 330.28.49.12.116 | Specialized woodworking machines | |

| 330.28.49.12.119 | Other woodworking machines | equipment for sharpening and preparing wood-cutting tools; specialized machines; woodworking equipment for furniture production |

| 330.28.9 | Other special-purpose equipment | technological equipment for trade and public catering enterprises |

| 330.28.91.11.120 | Buckets for metallurgical production | vacuum buckets |

| 330.28.92.12.130 | Drilling machines | excavators, bulldozers, scrapers and graders, ditch diggers, sewer cleaners and others |

| 330.28.92.12.190 | Other tunneling machines | bitumen pumps |

| 330.28.92.26.110 | Self-propelled single-bucket excavators | |

| 330.28.92.30.150 | Machines for spreading mortar or concrete | |

| 330.28.92.40.110 | Machines for sorting, screening, separating or washing soil, stone, ore and other minerals | cone separators |

| 330.28.92.40.131 | Concrete and mortar mixers | |

| 330.28.92.40.140 | Equipment for agglomerating, molding or casting solid mineral fuels, ceramic compositions, uncured cement, gypsum materials or other mineral products in powder or paste form | |

| 330.28.94.14.130 | Tufting machines | |

| 330.28.96.10.110 | Equipment for processing rubber and plastics, not included in other groups | |

| 330.28.96.10.120 | Equipment for the production of rubber and plastic products, not included in other groups | machines and units for assembling hoses; lines for assembling and restoring tires and for rubber footwear, installations and units for various industries; lines and units for the production of extruded latex products |

| 330.28.99.12.111 | Phototypesetting machines | |

| 330.28.99.12.115 | Typesetting machines | |

| 330.28.99.12.116 | Line casting machines | |

| 330.28.99.12.129 | Other equipment for the production of printing plates | |

| 330.28.99.3 | Special purpose equipment not included in other groups | specialized technological lines, installations and units for various industries (equipment for the pipeline industry, cable industry, local industry, equipment for installation and repair of power plants and electrical networks) |

| 330.29.10.59.116 | Concrete pumps | technological equipment for concrete mixing plants, concrete mixing plants |

| 330.30.99.10 | Other transport vehicles and equipment not included in other groups | garage and gas station equipment |

| 330.32.50 | Medical instruments and equipment | except for equipment for the production of medical equipment and prosthetic products |

| 330.32.50.50 | Medical products, including surgical, other | medical and surgical equipment |

| Means of transport | ||

| 310.29.10.24 | Other vehicles for transporting people | small class passenger cars for disabled people |

| 310.29.10.30.111 | City buses | especially large buses (bus trains) with a length of over 16.5 to 24 m inclusive |

| 310.29.10.30.112 | Long distance buses | |

| 310.29.10.30.119 | Other buses | medium and large buses up to 12 m long inclusive |

| 310.29.10.30.120 | Trolleybuses | |

| 310.29.10.4 | Vehicles, freight vehicles | trucks, road tractors for semi-trailers (general purpose vehicles: flatbeds, vans, tractors; dump trucks) |

| 310.29.10.5 | Special purpose vehicles | hearses |

| 310.29.10.59.113 | Concrete trucks | |

| 310.29.10.59.120 | Timber trucks | |

| 310.29.10.59.130 | Vehicles for public utilities and road maintenance | |

| 310.29.10.59.150 | Vehicles for emergency services and police | |

| 310.29.10.59.230 | Vehicles for transporting petroleum products | |

| 310.29.10.59.250 | Vehicles for transporting liquefied hydrocarbon gases at pressures up to 1.8 MPa | |

| 310.30.20.33.115 | Dump cars (dump cars) | broad gauge |

| 310.30.99.10.000 | Other transport vehicles and equipment not included in other groups | except for fixed assets included in other groups |

| Industrial and household equipment | ||

| 320.26.30 | Communication equipment | furniture for cable and wire communications enterprises |

| 330.26.51 | Equipment for measurement, testing and navigation | testing equipment |

| 330.26.51.32 | Tables, drawing machines and other instruments for drawing, marking or mathematical calculations | |

| 330.28.99.12.119 | Other typesetting equipment | |

| 330.32.50.30 | Medical furniture, including surgical, dental or veterinary furniture; | |

| Cattle working | ||

| 510.01.43.10 | Horses and other live equine animals | |

| 510.01.44.10 | Camels and other animals of the camelid family, live | |

| Perennial plantings | ||

| 520.00.10.08 | Other cultivated resources of plant origin, repeatedly producing products, not included in other groups | plantings of perennial berry crops, except strawberries |

Office equipment: what applies to it

→ → Update: June 26, 2021

One of the areas of application of the All-Russian Classifier of Fixed Assets is accounting in institutions. According to OKOF, the accountant must determine the asset code and reflect it on the appropriate account.

Contained the term “office equipment”. What relates to it was deciphered in the grouping with codes 14 301 0000 – 14 301 0440. We will consider further what the situation is after the new classifier comes into force.

In the OK 013-94 classifier, the concepts of computer and office equipment are separated. They are both included in the “Machinery and Equipment” section, but each has its own subsection.

However, when referring to all equipment of the organization that does not relate to machines, machine tools, mechanisms, etc. and is intended for use in the process of administrative management or in the process of engineering work, it is customary to use the term “office equipment”.

This concept includes computers, printers, scanners, telephones, calculators, shredders, copying equipment, fax machines, projectors and other office tools. Equipment for drawing work, plotters, laminators, hole punchers, mechanical pencil sharpeners, stamps, brochure makers and others are added to the list, calling it “small office equipment.”

The confusion of the two concepts occurs due to the fact that auxiliary equipment for computer technology, such as a scanner, barcode reader, printer, display, electronic graphic board, drawing machine, etc., according to the rules of the OK 013-94 classifier, are taken into account together with the computer as a single object of classification. In fact, each of them can be used independently, without connecting to computer technology. This situation arose due to the obsolescence of the specified classifier.

But an accountant, when deciding what applies to office equipment in accounting, must be guided by regulatory documents.

Therefore, until 2021, the following should be classified as office equipment:

- pneumatic delivery device, etc. autonomous office equipment.

- telephones (wired and cellular),

- banknote counters and detectors,

- shredders,

- conference equipment (microphones, projectors, screens, etc.),

- calculators,

- automated telephone exchanges ensuring the operation of offices,

- typewriters,

- duplicating equipment (not connected to the computer),

- copying equipment (not connected to the computer),

According to the same standards, the following cannot be classified as office equipment:

- printers and MFPs connected to a computer,

- tablets,

- communicators,

- smartphones, etc.

This division is determined by information from the subsection “Means of mechanization and automation of managerial and engineering labor,” which allows us to determine what belongs to office equipment. The list of what should be considered computer technology is given in the subsection “Electronic computing technology.” According to the OK 013-94 classifier, both of these types of equipment belong to information equipment.

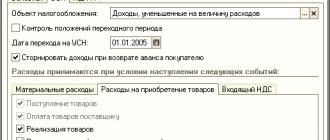

Features of calculating depreciation on the simplified tax system

Income

Due to the fact that the entity uses the simplified taxation system “Income”, it is not given the right to reduce the calculated tax by the amount of expenses made, including depreciation.

However, they are required to keep full accounting records. Therefore, for acquired fixed assets, they must, for accounting purposes, establish a depreciation method and write off their price based on it.

Income minus expenses

In such a situation, for accounting purposes, it is also necessary to choose one of four methods, and based on it, write off a share of the cost of the fixed assets. In addition, entities using the simplified tax system received the right to determine the amount of depreciation once for the entire year, rather than calculating it monthly.

However, many accountants are confused - is it possible to include the amount of a certain depreciation as an expense?

It must be remembered that the composition of expenses for the simplified tax system “Income minus expenses” is strictly fixed in the Tax Code, and the compiled list does not contain the concept of depreciation.

However, when purchasing an OS, business entities can take its price into account in expenses during the current reporting period, writing it off in equal shares every quarter. The main condition for this is that the operating system must be paid to the supplier and used to conduct business.

Based on this, we can say that depreciation in tax accounting of the simplified tax system “income minus expenses” is carried out using an accelerated method during the period of acquisition of fixed assets.

If an object was purchased in the first quarter, then each quarter is written off up to 1/4 of its cost, in the second - 1/3 starting from the quarter of purchase, in the third - 1/2. Fixed assets purchased in the fourth quarter are immediately taken into account as expenses in full on the last day of the quarter.

Attention! Writing off fixed assets for tax accounting does not eliminate the need to determine depreciation in accounting.

OKOF for computers and peripheral equipment

OKOF is a detailed code with a complex structure assigned to homogeneous elements of non-current property. A complete list of them is contained in the All-Russian Classifier of Fixed Assets (the abbreviation stands for this).

These sets of figures are needed to facilitate control over working capital, streamline the process of calculating depreciation on them, and record transactions occurring with fixed assets in primary documents and reporting.

Now there is a new edition of the list of ciphers established by the Order of the State Standard of Ukraine dated December 12, 2014. No. 2018-st. Until 2017, a different list was used; it was put into effect by Decree of the State Standard of the Russian Federation dated December 26, 1994 No. 359.

Important!

Equipment that was registered during the period when the “old” list of codes was in force is not required by law to be transferred to new codes before it is deregistered. However, such a need may still arise. And for this, there are so-called transitional keys, which show the correspondence between old and new codes.

By the way, sometimes reverse translation is necessary (new ciphers into old ones). This is due to the fact that preferential property is determined by the relevant Government Resolutions, in which the list of fixed assets has not been adjusted taking into account the changed OKOF. Accordingly, when identifying units of non-current assets with new codes that can be used to obtain a preference, you have to use transitional keys to find out what code they would have been assigned if the 1994 edition of the list was still in effect.

Problems often arise with determining the OKOF of a computer and peripheral equipment.

Typically, a computer consists of many components: screen, system unit, keyboard, mouse, printer, scanner. When purchasing this equipment necessary for the work of each organization, the question arises: to take it into account as a whole or in parts. Especially if the components are purchased at different times and their service life varies.

The explanatory letter of the Ministry of Finance dated 06/02/2010 No. 03-03-06/2/110 makes this point transparent. Recognized as depreciable in accordance with

Art. 256. According to the Tax Code of the Russian Federation, property (in this case, a personal computer) is taken into account as a single object of fixed assets if the components included in its composition cannot be used as independent means of labor.

As we understand, the keyboard, mouse, printer and other PC components do not work individually. It turns out that these computer elements must be taken into account all together, one OKOF at a time. For convenience in accounting, it is recommended to assign a single service life to these components - as a rule, this is 2-3 years. Another option is not prohibited (different service life for individual components), but it may raise unnecessary questions and claims from regulatory authorities and create other difficulties associated with accounting.

The new Classifier for computers (and peripheral equipment) provides the following code: 320.26.2.

Transition keys

As mentioned above, transition keys are a table in which correspondences are established between OKOFs from the old and new editions of the list.

Translation of codes for equipment may be necessary in one direction or the other (not only from old to new, but also from new to old).

In particular, the transition key regarding office equipment looks like this.

As you can see, the “old” Classifier provides greater detail on computers and their components. In the “new” list, this group of equipment is united by one code.

Subgroups 320.26.2 in OKOF

The code provided for designating computers has 4 subgroups. They detail the equipment intended for processing and outputting information according to various significant characteristics. These are the subciphers:

- 320.26.20.11 – intended for PCs whose weight does not exceed ten kilograms. This is computer equipment in the form of MacBooks, tablets, electronic diaries, etc.

- 320.26.20.13 – machines equipped with processors and components for receiving and outputting data.

- 320.26.20.14 – equipment, the purpose of creation and acquisition of which is automatic processing of entered information.

- 320.26.20.15 – computer equipment, the housing of which includes devices for storage and (or) input/output.

Every time an organization purchases new digital equipment, the accountant independently chooses which OKOF corresponds to it. It is under this code that accounting and control of incoming office equipment will be carried out.

By what OKOF is a computer monitor taken into account?

A computer monitor is a component of a PC that cannot independently generate income for an enterprise, since it simply does not function separately from other computer components. And participation in the formation of profit is one of the main conditions for classifying equipment as depreciable property (along with a period of use exceeding a year and an initial cost of 40 thousand rubles in accounting and from 100 thousand rubles in tax accounting).

So, in accordance with the standards of PBU 6/01, the screen must be taken into account as part of the computer assembly. After all, the monitor is its integral part, one of the components that, together with others, ensures the functioning of the equipment. In this case, code 320.26.2 applies.

However, the law does not prohibit the accounting of some components of non-current property as separate items of fixed assets if their useful life periods differ (for example, clarifications on this point are contained in Letter of the Ministry of Finance of Russia dated July 14, 2017 N 02-05-10/44839).

It turns out that the monitor can be taken into account under OKOF 330.28.23.23 “Other office machines”. This is the second depreciation subgroup, which assumes a service life of two to three years.

Useful life of property for depreciation purposes

Depreciation depends on such characteristics of the fixed asset as the initial price and useful life.

The original price is the cost incurred to purchase the specified OS.

Useful time is the period during which the object will be used to generate income. This concept comes from the Tax Code of the Russian Federation in order to correctly determine income tax.

According to the rules, it is established by each subject independently at the moment of starting to use the product. During this, it is imperative to take into account the OS classifier. The period may subsequently change as the enterprise may improve and modernize the facility. But the new period must be determined within the existing depreciation group.

At this time, a new classifier is in effect, which came into effect in 2021.

The process of establishing the time of use is carried out in several stages.

Attention! First, the OS group is established according to the OS classifier to which the object belongs. In reality, it may turn out that the object cannot be included in the considered grouping. Then the service life should be determined.

To do this, you should take into account the technical documentation included with the OS. After this, you need to record the resulting operating time in the facility’s inventory card.

Office equipment and what it includes

› However, when mentioning all equipment of the organization that does not relate to machines, machines, mechanisms, etc. and is intended for use in the process of administrative management or in the process of engineering work, it is customary to use the term “office equipment”.

This concept includes computers, printers, scanners, telephones, calculators, shredders, copying equipment, fax machines, projectors and other office tools. Equipment for drawing work, plotters, laminators, hole punchers, mechanical pencil sharpeners, stamps, brochure makers and others are added to the list, calling it “small office equipment.” This situation arose due to the obsolescence of the specified classifier.

But an accountant, when deciding what applies to office equipment in accounting, must be guided by regulatory documents. Therefore, until 2021, the following should be classified as office equipment:

- conference equipment (microphones, projectors, screens, etc.),

- shredders,

- typewriters,

- automated telephone exchanges ensuring the operation of offices,

- banknote counters and detectors,

- copying equipment (not connected to the computer),

- duplicating equipment (not connected to the computer),

- calculators,

- pneumatic delivery device, etc. autonomous office equipment.

- telephones (wired and cellular),

According to the same standards, the following cannot be classified as office equipment:

- communicators,

- printers and MFPs connected to a computer,

- smartphones, etc.

- tablets,

Its standards also contain a subsection that includes information equipment. But the term “office equipment” is excluded from it, and computers and peripheral devices for them are separated into a separate subsection.

However, the list of what previously belonged to office equipment remains.

It has been added to the group in edited form

“Other machinery and equipment, including household equipment, and other objects”

under code 330.28.23. Therefore, starting from 2021, the answer to questions about what office equipment is and what belongs to it is mainly determined by the list in the classifier of fixed assets, marked with this code. Internal documents To minimize the likelihood of claims from tax authorities, establish the obligation to ensure normal working conditions for employees, in particular, equipping premises with an air conditioning system in: - internal labor regulations; — regulations on labor protection; -instructions on labor protection and safety precautions; - collective agreement.

The documents must refer to the norms of the Labor Code and SanPiN discussed above. Insuring yourself to the maximum If you want to insure yourself to the maximum, you can measure the temperature in the office premises.

To do this, go through the following steps: 1. Issue an order to create a commission to measure temperature and draw up a protocol on the measurement results.

2. Select a day for measurements. In fact, each of them can be used independently, without connecting to computer technology.