Where to pay insurance premiums in 2017

The most important thing is that next year the procedure for paying contributions will not change. And the changes will affect, in particular, the fact that tax authorities will become recipients of payments. In this case, the exception will be deductions for injuries. They should still be made to the Social Fund. insurance.

Thus, in 2021, all such payments, except for contributions for injuries, should be transferred through the Federal Tax Service.

Another innovation for next year is that contributions must be transferred separately, depending on their purpose. That is, transfer a fixed amount to compulsory medical insurance, another - in case of possible temporary loss of ability to work, as well as in connection with pregnancy and motherhood. The third is for pension insurance. These provisions are contained in Article 431 of the Tax Code of the Russian Federation (clause 6).

Individual entrepreneurs will continue to make contributions to compulsory insurance not only for themselves, but also for hired workers (if any). Where to pay insurance premiums for individual entrepreneurs ? They do this to the nearest territorial Federal Tax Service. That is, at your place of residence.

Also see “FSS explained the procedure for transferring insurance premiums to the Federal Tax Service.”

What details should I use to transfer contributions regulated by the Tax Code of the Russian Federation?

Regarding where to transfer insurance premiums in 2021 and how to draw up payment documents, the Federal Tax Service, which received contributions under control, gave many clarifications. The main issues addressed by these clarifications were:

- BCC for payment at the border 2016-2017;

- BCC for contributions 2020, which have become a full-fledged budget payment;

- payer status in the payment document.

“Limit” contributions (i.e., accrued in 2021 and paid in 2021) are paid by indicating special (interim) BCCs in the payment document. Such BCCs, like any budget payment, begin with the numbers 182, and differ from their final version, corresponding to accruals made starting in 2021, by the value present in the 16th or 17th digit of the code.

The BCCs used for “boundary” contributions for accrued payments to employees are as follows:

- 18210202010061000160 - for payments to the Pension Fund;

- 18210202101081011160 - for payments to the Compulsory Medical Insurance Fund;

- 18210202090071000160 - for payments to the Social Insurance Fund.

Their updated version, used for contributions assessed since the beginning of 2017:

- 18210202010061010160 - for payments to the Pension Fund;

- 18210202101081013160 - for payments to the Compulsory Medical Insurance Fund;

- 18210202090071010160 - for payments to the Social Insurance Fund.

Individual entrepreneurs, when making payments for contributions paid for 2021 in 2017, also use intermediate codes:

- 18210202140061100160 - for payments to the Pension Fund of the Russian Federation with income up to 300,000 rubles;

- 18210202140061200160 - for payments to the Pension Fund for income exceeding 300,000 rubles;

- 18210202103081011160 - for payments to the Compulsory Medical Insurance Fund.

The individual entrepreneur transfers accruals made after 2021 according to the final BCC:

- 18210202140061110160 - for payments to the Pension Fund (this code has become uniform since 2021 for fixed payments and contributions accrued on income over 300,000 rubles);

For details, see the publication “KBK - fixed payment to the Pension Fund in 2021 - 2021 for individual entrepreneurs for themselves.”

- 18210202103081013160 - for payments to the Compulsory Medical Insurance Fund.

The solution to the issue of indicating the payer status turned out to depend on the technical capabilities of the banks. They had difficulties accepting payments with status “14” for execution, which characterizes the person making payments to individuals. Therefore, if technical problems arise with banks, it is recommended that employers-legal entities indicate status “01” in the payment document, and individual entrepreneurs paying contributions for employees are allowed to use status “09”, which is indicated when an individual entrepreneur transfers contributions for himself (letters from the Federal Tax Service of Russia dated 15.02 .2017 No. ZN-3-1/ [email protected] , dated 02/08/2017 No. ZN-4-1/ [email protected] , dated 02/03/2017 No. ZN-4-1/ [email protected] ).

In other aspects, the payment document issued when paying contributions is no different from the one usually generated for the transfer of taxes. The recipient, as with taxes, will be listed as the Federal Tax Service Inspectorate.

In November 2021, the Tax Code of the Russian Federation introduced a provision on the admissibility of paying tax payments for a third party. Since 2021, this possibility has also been applied to the payment of insurance premiums, which have begun to comply with the rules of the Tax Code of the Russian Federation. The payer status indicated for such payment must correspond to the status of the person for whom the payment is made.

Where and how does the “isolation” make contributions?

In 2021, the procedure for making contributions to the relevant authorities for separate divisions of companies has been changed. Paragraph 11 of Article 431 of the Tax Code suggests that now all such structures will independently make insurance contributions at their location. You will need to transfer funds in the same way - through the Federal Tax Service.

The letter of the Federal Tax Service dated September 14, 2016 No. BS-4-11/17201 states: organizations will be required to notify the inspectorate in advance about separate divisions empowered to make payments and issue rewards to individuals.

In addition, from 2021, “isolated companies” are no longer required to have a separate balance sheet from the enterprise in order to be able to deduct insurance premiums through the tax authorities. This condition has disappeared.

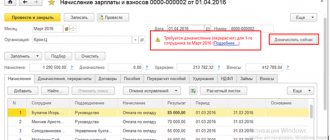

Samples of payment orders

When paying insurance premiums for employees in 2021, enter code 14 in the “Payer Status” field. Individual entrepreneurs in relation to contributions for themselves enter code 09. At the same time, in order to pay insurance premiums for January 2021, which are transferred to the Federal Tax Service, be sure to indicate the new BCC .

| Type of contributions | KBK for January 2021 |

| Pension | 182 1 0210 160 |

| Medical | 182 1 0213 160 |

| Social | 182 1 0210 160 |

As for the contributions “for injuries” that are sent to the Social Insurance Fund, the BCC for contributions for January 2021 remained the same - 39310202050071000160. We will provide samples of payment orders for each type of insurance.

Pension contributions

Medical fees

Social contributions

Contributions for traumatism

Read also

15.01.2021

Where to pay insurance premiums in 2021

What about the year 2016?

Employers make the following contributions to the Pension Fund:

- intended for pension insurance;

- intended for compulsory medical insurance.

Funds are deposited through the regional branch of the Pension Fund of the Russian Federation.

The Social Insurance Fund receives the following contributions:

- on social media insurance related to temporary disability;

- in connection with pregnancy and childbirth;

- transfers “for injuries”.

These funds are also paid to the branch located in the region of registration of the employer.

As for businessmen, regarding where to pay individual entrepreneur contributions , everything stated above remains relevant for them. That is, pension contributions and compulsory medical insurance are transferred to the Pension Fund, and all others - to the Social Insurance Fund. In this case, the entrepreneur is obliged to make payments at the place of his registration.

Changes in tax base

The rules for calculating the amounts of contributions to the Social Insurance Fund, pension and medical contributions remain practically unchanged. All benefits and existing tariffs remain in effect. As before, payments and other remuneration in favor of individuals accrued in accordance with employment and civil law contracts remain a taxable object.

The taxable base, as before, is calculated separately for each individual on an accrual basis from the beginning of the year. The maximum amount of the base for contributions in case of temporary disability and in connection with maternity is also preserved. The reduced rate for pension contributions in relation to payments accrued in excess of the limit will also remain.

In this area, the only change will affect the daily allowance. At the moment, daily allowances fixed in a local regulation or collective agreement are completely exempt from insurance premiums. From January 1, according to paragraph 2 of Art. 422 of the Tax Code of the Russian Federation, only amounts up to 700 rubles for business trips within the country and amounts up to 2,500 rubles for foreign business trips will be exempt from contributions.

At the same time, the rules for determining the tax base for income in kind will change. Until January 1, the database included the prices of goods, works and services specified in the contract. Now, according to Art. 105.3 of the Tax Code of the Russian Federation, the price will be determined based on market prices. And in accordance with paragraph 7 of Art. 421 of the Tax Code of the Russian Federation, VAT is not excluded from the taxable base.

The listed changes do not apply to insurance premiums in 2021 “for injuries”. Daily allowances are completely exempt from them, and income in kind is taken into account in the taxable base at the contractual value.

Payments from “isolations” in 2021

In 2021, such divisions of companies are not required to deal independently with insurance premiums. All payments are made by the organization to which they belong.

However, the exception is separate divisions with separate balance sheets. According to Part 11 of Article 15 of the Law on Insurance Contributions No. 212-FZ, they independently deduct contributions.

Also see “Deadline for payment of insurance premiums: 2021”.

Read also

03.11.2016

Fines for violations

From 2021, violations that are related to insurance premiums (except for “injuries”) will be fraught with the imposition of fines by the Federal Tax Service. It should be borne in mind that all sanctions provided for violations of tax laws will also be used in relation to contributions. For example, if the policyholder did not provide a calculation of contributions, he will be fined on the basis of Article 119 of the Tax Code of the Russian Federation, and for violation of the rules for accounting for the base of contributions, sanctions of Article 120 of the Tax Code of the Russian Federation will be applied.

For violations related to insurance premiums for injuries, employees of the Social Insurance Fund will, as before, be punished. The new edition of the Law on Compulsory Social Insurance against Accidents at Work contains all types of FSS sanctions. For example, for refusing to provide documents for verification, on the basis of Article 26.31 of the above law, the policyholder faces a fine of two hundred rubles (for each document not provided).

The pension fund has the right to apply two types of sanctions:

1. For failure to provide annual information about the length of service - 500 rubles (for each insured person).

2. For violation of the procedure for submitting reports in the form of electronic documents - 1,000 rubles.

These rules are contained in the new version of Article 17 of the Law on Personalized Accounting.

Report submission deadlines

This year, due to the transfer of powers to the Federal Tax Service, accountants will have to submit several types of reports.

Find out how to get a microloan “Zanachka”. Do you need to get a microloan with a bad credit history online? See here.

These include:

- Payment to the tax service (once a quarter: 05/2/17 first quarter, 07/31/17 second six-month quarter, 10/30/17 third nine-month quarter);

- 4-FSS in the Social Insurance Fund (once a quarter) on paper for the 1st quarter until 04/20/17, by email - until 04/25/17, for the 2nd quarter on paper until 07/20/17, and in electronic form - until 07/25/17, for 9 months in paper form - until 10/20/17, by email - until 10/25/17;

- SZV-M reports are submitted to the Pension Fund of the Russian Federation on a monthly basis based on the results of the previous month by the 15th;

- SZV-STAZH to the Pension Fund of the Russian Federation – annually (for 2021 it is sent until 03/31/17, and for the current year until 03/01/18).

Examples: pay insurance premiums with or without kopecks 2021

Example No. 1.

For the month of July, employees of the State Budgetary Educational Institution DoD SDYUSSHOR "ALLUR" were accrued wages and vacation pay in the amount of 1,500,000 rubles. There are no non-taxable income in the accrued amount. Electricity taxation is carried out according to generally established tariffs. Let's calculate the amount of payments to the budget:

- OPS: 1,500,000 × 22% = 330,000.00 rubles;

- Compulsory medical insurance: 1,500,000 × 5.1% = 76,500.00 rubles;

- VNiM: 1,500,000 × 2.9% = 43,500.00 rubles;

- FSS NS and PZ = 1,500,000 × 0.2% = 3,000.00 rubles.

Consequently, in July, GBOU DOD SDUSSHOR ALLYUR makes payments without kopecks. But this payment format is not associated with rounding!

Example No. 2. Accrued wages for August at the State Budgetary Educational Institution of Children's and Youth Sports School "ALLUR" amounted to 102,653 rubles due to the majority of employees being on vacation. CA calculations for August will be as follows:

- OPS: 102,653 × 22% = 22,583.66 rubles;

- Compulsory medical insurance: 102,653 × 5.1% = 5235.30 rubles;

- VNiM: 102,653 × 2.9% = 2976.94 rubles;

- NS and PZ: 102,653 × 0.2% = 205.31 rubles.

As a result, for August, a budgetary institution is obliged to pay the budget in rubles and kopecks. There are no exceptions in this case.

Can payments to the Pension Fund of Russia be rounded in 2021? It is possible, but only in a big way. For example, when calculating for August, a budgetary institution will transfer not 22,583 rubles and 66 kopecks, but exactly 22,584 rubles. The result is an overpayment of 34 kopecks. This method of payment is not prohibited, but it is not necessary to round payments up.

IMPORTANT!

You cannot round down the amount according to the SV! This will lead to the formation of debts, penalties and fines.

Summarize. The company, deciding how to pay insurance premiums to the Pension Fund of Russia - with or without kopecks in 2021, or in favor of other types of insurance coverage, can make calculations without kopecks, rounding up payments. However, representatives of the Federal Tax Service do not encourage this method of payment.

Reporting form

From January 1, tax structures will be in charge of all insurance premiums, in connection with which a new reporting form will be introduced, which will replace RSV-1 for the Pension Fund and will significantly simplify 4-FSS for the Social Insurance Fund.

Among accountants, the new type of reporting is called a “single reporting form”, since the form contains all the information about the various variations, combining them together.

The following persons are now required to maintain reports:

- Organizations with their own separate divisions;

- IP;

- Individuals who are not entrepreneurs;

- The main founders of farms.

Also, a single calculation form is submitted by all those who have insured persons:

- Employees carrying out activities on the basis of an employment contract;

- The general director is the sole founder;

- Executors under civil contracts.

Limit value of the base for calculation

Specific rates of insurance premiums in 2021 are established for the entire calendar period. Changes occur when the limit established by law is exceeded (GD of the Russian Federation dated November 29, 2016 No. 1255):

- for compulsory health insurance, a limit of 755,000 rubles per insured person is set;

- for VNiM - 876,000 rubles;

- not established for compulsory medical insurance.

The size of the limit is set in full thousands. For example, in August 754,400 rubles were accrued, round up to exactly 754,000. If the amount is 875,550 rubles, then 876,000.

Let's look at a specific example.

| Month | Amount of charges (rubles) |

| January | 100 000,00 |

| February | 100 000,00 |

| March | 100 000,00 |

| April | 100 000,00 |

| May | 200 000,00 |

| June | 10 000,00 |

| July | 150 000,00 |

| August | 150 000,00 |

| TOTAL | 910 000,00 |

Exceeding the limit for OPS occurs in July (760,000.00 rubles), and for VNiM - in August (910,000.00 rubles). From this moment, reduced rates for insurance premiums for compulsory health insurance are established in 2020. The rate is reduced from 22% to 10%, and for VNiM - from 2.9% to 0%.

20 Oct 2021 | Articles | Accountant | 22 351 | votes: 8

From 2021, the Federal Tax Service will administer insurance contributions to the Pension Fund of Russia, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund. The Pension Fund of Russia will continue to accept personalized reporting, and the Social Insurance Fund will continue to check social insurance expenses.

In connection with the transfer of contributions under the control of tax authorities, the composition of reporting will change significantly, a new type of fine will be added, innovations will appear in determining the taxable base for contributions, and a number of other innovations will occur, which we will discuss in this article. All changes related to the transfer of insurance premiums to the Federal Tax Service were introduced by Federal Laws No. 243-FZ and No. 250-FZ.

Federal Law No. 243-FZ dated July 3, 2016 provides for the following:

- in January 2021, the Tax Code will be supplemented with Chapter 34, which is called “Insurance premiums.” It includes articles 419 to 432, which set out the rules for calculating and paying contributions;

- The first part of the Tax Code of the Russian Federation has been changed. The essence of the amendments boils down to the following: all the basic principles that apply to taxes will also apply to insurance premiums from 2021.

Federal Law No. 250-FZ dated July 3, 2016 introduces a number of amendments reflecting the transfer of control over contributions from funds to tax authorities. These amendments, among other things, provide for the following changes that will occur from January 1, 2021:

- Federal Law No. 212-FZ of July 24, 2009 on insurance premiums will no longer be in force;

- A new version of the Federal Law dated April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system” will come into effect;

- A new version of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” will come into force;

- A new version of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” will come into effect.

Taxable object, taxable base and amount of insurance premiums

The rules by which you need to calculate the amount of pension, medical contributions, as well as contributions to the Social Insurance Fund (except for contributions for injuries) will remain virtually unchanged. Thus, the taxable object will continue to be payments and other remuneration in favor of individuals accrued under employment and civil law contracts. The taxable base, as now, will be determined separately for each individual on an accrual basis from the beginning of the year. The maximum base for contributions in case of temporary disability and in connection with maternity will also remain. For pension contributions, a reduced rate will remain in relation to payments accrued in excess of the limit. All tariffs and benefits will remain the same.

The only innovation is provided for daily allowances. Now the entire amount of daily allowance fixed in the collective agreement or in a local regulation is exempt from these contributions. From January 2021, it will be possible not to pay insurance premiums only for an amount of no more than 700 rubles for domestic business trips, and for an amount of no more than 2,500 rubles for foreign business trips. This is enshrined in paragraph 2 of Article 422 of the Tax Code of the Russian Federation.

There will also be clarification on how to determine the taxable base for income in kind. According to the current rules, the base includes the cost of goods, work or services specified in the contract. Starting next year, the price will have to be determined according to the rules of Article 105.3 of the Tax Code of the Russian Federation, that is, based on market prices. It is separately stipulated that VAT is not excluded from the taxable base (clause 7 of Article 421 of the Tax Code of the Russian Federation).

With regard to contributions “for injuries” everything will remain the same. Daily allowances will be released in full, and income in kind will be taken into account in the database at negotiated prices.

Payment of insurance premiums

The deadline for transferring insurance premiums will not change. As now, the last date of payment will be the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation). It will still be necessary to keep records of contributions and transfer them to the budget in rubles and kopecks.

For “injury” contributions, the payment deadline will also remain the same, namely no later than the 15th day of the month following the month for which these contributions were accrued.

What reports to submit to the Federal Tax Service?

Starting from 2021, insurance premium payers will begin to report not only to the funds, but also to the tax authorities. For this purpose, a single quarterly calculation is being introduced, which will replace several existing forms at once: RSV-1, RSV-2, RV-3 and 4-FSS. Policyholders will submit a single calculation to the Federal Tax Service no later than the 30th day of the month following the billing or reporting period (Clause 7, Article 431 of the Tax Code of the Russian Federation). Companies and individual entrepreneurs with an average number of employees of more than 25 people are required to submit calculations in electronic form via telecommunications channels. All other payers of contributions will be able to report on paper (clause 10 of Article 431 of the Tax Code of the Russian Federation).

It is important that the total amount of pension contributions in the calculation coincides with the amount of contributions for each insured person. Otherwise, such calculation is considered invalid. There is no need to report contributions to the tax authorities for 2021 and earlier periods.

What reports should be submitted to funds from 2021

Reporting to funds will remain the same, but will be somewhat different. In addition to the abolition of the forms RSV-1, RSV-2, RV-3 and 4-FSS, which was mentioned above, other innovations will appear.

The deadline for submitting the monthly form SZV-M will change. Now it is supposed to be submitted to the Pension Fund no later than the 10th day of the month following the reporting month. In 2021 and beyond, this form must be submitted no later than the 15th day of the month following the reporting month (new edition of clause 2.2 of Article 11 of the Law on Personalized Accounting).

In 2021, a new annual report will appear in which you need to indicate information about your experience. The deadline for submission is no later than March 1 of the year following the reporting year (new edition of clause 2 of the Law on Personalized Accounting). Information for 25 people or more is submitted to the Pension Fund in electronic form via telecommunication channels. Information for a smaller number of insured persons can be submitted on paper.

Starting next year, you will have to report to the Social Insurance Fund only for contributions “for injuries.” The deadlines for submission will be the same as for 4-FSS: in the case of electronic reporting - no later than the 25th day of the month following the reporting one, and in the case of “paper” reporting - no later than the 20th day of the month following the reporting one. As now, policyholders with an average number of more than 25 people will be required to report electronically via the Internet, all others will be able to submit reports on paper (new edition of clause 1 of the Law on Mandatory Social Insurance against Accidents at Work).

The above innovations do not apply to reporting for 2016 and earlier periods. Primary and updated calculations for these periods should be submitted to the funds using current forms and formats.

Reimbursement of social insurance expenses

In 2021, employers will still have the right to reimburse benefits (except for the first three days on a “non-maternity” ballot) from the Social Insurance Fund. The policyholder will be able to transfer contributions minus benefits. If the amount of contributions turns out to be less than the amount of benefits, then the difference is allowed to be offset against the payment of contributions in subsequent periods, or to request the missing funds from the Social Insurance Fund.

The expenses will be checked as follows. Tax authorities, having received a single quarterly calculation from the policyholder, will transfer the information to the territorial body of the Social Insurance Fund. Inspectors from social insurance will verify the accuracy of the declared expenses by conducting a desk or on-site inspection. They will report the results to the tax authorities. If the result is negative, the Federal Tax Service will send the policyholder a demand for payment of the missing contributions. If the audit result is positive, the expenses will be accepted, and the tax office, if necessary, will offset or return the difference between contributions and expenses.

The above algorithm will be applied until December 31, 2018 inclusive. And not everywhere, but only in regions that have not yet joined the pilot project for paying benefits directly from the Social Insurance Fund. Starting from January 2021, the reimbursement procedure will become a thing of the past, since all regions without exception will begin to receive benefits directly from social insurance.

Contribution checks

Starting from January 2021, tax officials will conduct desk and on-site audits of contributions (except for contributions for injuries). Moreover, employees of the Federal Tax Service will check the correctness of the calculation and payment of contributions according to the same rules by which they now check the calculation and payment of taxes. The verification of expenses for compulsory social insurance, as before, will be carried out by the FSS. Thus, the same period can be checked twice: first time by the tax office, second time by social insurance.

The pension fund will control only personalized reporting, namely the SZV-M form and new annual information about the length of service. The transition period rules are as follows. Reviews of contributions (except for “injury” contributions) scheduled in 2017 and beyond, but relating to 2021 and earlier periods, will be carried out by the funds. Having discovered violations and arrears, fund employees will report them to the tax authorities, and they will take appropriate measures.

Control of contributions “for injuries” for all periods without exception will remain with the Social Insurance Fund.

Fines

Starting from 2021, tax authorities will begin to punish violations related to contributions (except for contributions for injuries). Moreover, all sanctions provided for tax violations will also apply to contributions. In particular, for failure to submit a calculation of contributions, the policyholder will be fined on the basis of Article 119 of the Tax Code of the Russian Federation, for a gross violation of the rules for accounting for the base of contributions - on the basis of Article 120 of the Tax Code of the Russian Federation, etc.

FSS employees will continue to be punished for violations related to “injury” contributions. The types of sanctions are listed in the new edition of the Law on Compulsory Social Insurance against Occupational Accidents. For example, for refusing to provide documents for verification, the policyholder will be fined 200 rubles. for each document not submitted (Article 26.31 of the said Law).

The pension fund will be able to apply two types of sanctions: for failure to provide annual information about the length of service (500 rubles for each insured person), and for violation of the procedure for submitting reports in the form of electronic documents (1,000 rubles). This is spelled out in the new version of Article 17 of the Law on Personalized Accounting.

Refund of overpaid insurance premiums

In January of next year, policyholders will retain the right to a refund of overpayments on premiums, but it will be the tax authorities who will return it, not the funds. The refund procedure will be the same as for taxes, but a new condition will appear. If overpaid pension contributions are reflected in personalized reporting, and the Pension Fund of the Russian Federation posted them to personal accounts, the tax authorities will not return the overpayment. This rule is enshrined in the newly created paragraph 6.1 of Article 78 of the Tax Code.

Excessively paid contributions “for injuries” will be returned by the Social Insurance Fund. In the new edition of the Law on Compulsory Social Insurance against Accidents at Work, Article 26.12 will appear, which provides an algorithm for offsetting and returning overpayments. This algorithm is similar to that applied to other contributions.

Blocking accounts

It is not entirely clear whether employees of the Federal Tax Service will be able to block the current account of the policyholder if he does not submit the payment for contributions. From the new wording of paragraph 11 of Article 76 of the Tax Code of the Russian Federation it follows that the blocking rules apply to contribution payers. However, in paragraph 3 of Article 76 of the Tax Code of the Russian Federation, which lists all acceptable grounds for blocking, payment of contributions not submitted on time is not listed.

It is possible that legislators will soon eliminate this contradiction. If this does not happen, then disputes will most likely arise between tax authorities and policyholders, which will be resolved in court.

What will change for separate divisions?

Significant innovations are provided for organizations and individual entrepreneurs that have opened separate divisions. Currently, it is necessary to pay insurance premiums and submit reports at the location of the unit only if it has its own current account and a separate balance sheet.

Starting next year, the requirement to have an account and balance will be abolished. This means that in 2021 and beyond, separate divisions located in Russia and calculating remuneration and other payments in favor of individuals will begin to transfer insurance premiums (except for contributions for injuries) and submit settlements at the place of their registration. This is stated in paragraph 11 of Article 431 of the Tax Code of the Russian Federation.

Also, from 2021, policyholders will have a new obligation - to report to the Federal Tax Service at the location of the parent organization that the Russian division is vested with the authority to calculate payments and rewards to individuals. This must be done within one month from the date of vesting of powers (newly created sub-clause 7, clause 3,4, article 23 of the Tax Code of the Russian Federation). True, the new obligation applies only to units that began making payments to individuals in 2017 and later. If the reward was accrued before, no messages need to be made.

There are no changes to “injury” contributions. Simply put, segregated units in 2021 and beyond will only pay and report these fees if they have an account and balance.

What changes await individual entrepreneurs?

Citizens who work for themselves will continue to pay fixed payments for health insurance. Premiums for temporary disability and maternity insurance will remain voluntary for them. As now, they will not pay “injury” contributions. There is one change regarding pension contributions. It applies to entrepreneurs who received income over 300,000 rubles. As now, they will add 1% of the amount of income exceeding the established limit to the fixed amount of contributions. Information about income, as now, will be received by inspectors from tax returns. But they will cancel the rule according to which, in case of failure to submit a declaration, auditors charge contributions in the maximum amount. In other words, starting next year, a failed declaration will not result in an increase in insurance premiums “for oneself” for individual entrepreneurs.

As for reporting, there are not many changes. Entrepreneurs will still not submit payments for fixed contributions. But for the heads of peasant (farm) households, new deadlines are provided. They will submit payments no later than January 30 of the year following the billing period (currently the deadline for submission is the last day of February).

Updated BCC for insurance premiums in 2021

From the beginning of 2021, new BCCs will be introduced for the payment of insurance premiums, because contributions will be transferred not to funds, as was previously the case, but to the tax office. As soon as the name of the recipient changes, it will be necessary to indicate the name of the Federal Tax Service.

In order to prepare for changes in advance, it is necessary to reconcile payments with funds at the end of the year, after which you must transfer the arrears or write an application for overpayment.

Starting from 2021, all data regarding payments will be transferred to the Federal Tax Service. While this information is available in the tax authorities’ database, some time will pass. If you don’t want to deal with payments, then it’s better to go to the Federal Tax Service with no debts or overpayments on contributions.

Tips for accountants

Tip #1

. It is necessary to eliminate all possible errors in accruals by the end of 2021.

Experts advise performing the following operations at the end of each month:

- Check the accounting of contributions subject to contributions;

- Check which amounts were not included in the database;

- Pay attention to whether the correct tariffs are used;

- Check for errors in calculations;

- Check the reflection of accruals in accounting.

If an error is found on any of the items, it must be corrected immediately. In this case, it is necessary to correct the entries in the corresponding individual accounting cards. If it is still necessary to recalculate contributions, then you need to submit a clarification in writing, as well as an information letter, which will detail the descriptions of the amendments made to the document.

Tip #2

. Each payment to the funds should be monitored.

Tip #3

. Experts also advise taking the time to review recent reports to funds according to their methodology.

Tip #4

. You should also remember to submit clarifications, without waiting for a signal from the inspectors to arrive.

Tip #5

. It is necessary to reconcile the records on personal accounts.

Tags: 4 FSS pension fund RSV-1 insurance premiums FSS FSS FFOMS fine

votes: 8