Article 427 of the Tax Code of the Russian Federation establishes the conditions for the application of reduced insurance premium rates for payers paying benefits to individuals and carrying out the types of activities listed in this article. In subparagraph 5 of paragraph 1 of Art. 427 of the Tax Code of the Russian Federation separately lists preferential types of activities for “simplified people”. However, the use of reduced tariffs is still fraught with risks for insurance premium payers. And with the adoption of subsequent amendments, these risks only intensified.

Among the payers of insurance premiums entitled to reduced insurance premium rates are organizations and individual entrepreneurs using the simplified tax system, whose main economic activity according to OKVED is, for example, repair of cars, household products, construction, furniture production - in total there are more than 60 on the list types of activities.

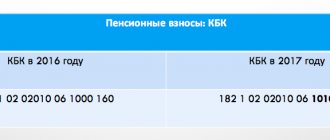

Let us recall that during the period of validity of the now repealed Federal Law of July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ), reduced tariffs and the conditions for their application were established in Art. 58 of this law. The same article also provided a list of preferential types of activities. To apply the reduced tariff, the payer of insurance premiums was required to receive at least 70% of the income from one of the types of activities listed in the mentioned list. After the entry into force of Chapter 34 of the Tax Code of the Russian Federation “Insurance Contributions”, this benefit from Law No. 212-FZ “migrated” to subparagraph. 5 p. 1 art. 427 of the Tax Code of the Russian Federation, and the requirement to comply with the 70 percent limit is in paragraph 6 of Art. 427 Tax Code of the Russian Federation.

Reduced tariff for paying insurance premiums

All information on preferential or reduced rates is in Art. 427 Tax Code of the Russian Federation. It describes in great detail exactly what activities of the payer may give him the right to use the benefit and what other conditions must be met for this.

For clarity, we have collected in one table the types of activities that give the right to benefits and indicate their size.

What is included in the base for calculating contributions and after what amount the rate for contributions changes, read the article “Limit amounts for calculating insurance premiums in 2017.”

This might also be useful:

- Fixed payments for individual entrepreneurs on UTII in 2021

- The amount of insurance premiums for compulsory health insurance and compulsory medical insurance for individual entrepreneurs in 2021

- Fixed payments for individual entrepreneurs in 2021 for themselves

- Insurance contributions to the Social Insurance Fund for individual entrepreneurs in 2021

- Health insurance premiums in 2021

- Individual entrepreneur insurance premiums for employees in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Calculation of insurance premiums and conditions for applying a reduced tariff

Reduced insurance premium rates can only be applied if certain conditions are met. Their full list is described in subsection. 4-10 p. 1 tbsp. 427 Tax Code of the Russian Federation.

For example, for charitable organizations, a necessary condition for receiving benefits is (subclause 8, clause 1, article 427 of the Tax Code of the Russian Federation):

- application of the simplified tax system;

- charity must correspond to the goals stated in the charter of the enterprise.

Calculation of insurance premiums for 2021 at a reduced rate occurs in the same manner as for standard rates.

The payer must recalculate contributions from the beginning of the year if he has lost the right to use benefits before the end of the year.

The exception is enterprises whose activities are listed in subparagraph. 10–13 p. 1 art. 427 Tax Code of the Russian Federation. They do not require recalculation - they simply do not apply the reduced tariff from the 1st day of the month in which the benefit is lost.

Features of the Tax Code of the Russian Federation

The Tax Code of the Russian Federation is compiled with the inclusion of articles in the following areas:

- types of tax payments levied on citizens and organizations;

- grounds for the purpose and collection of tax contributions;

- principles of establishing, introducing and abolishing taxes;

- rights and obligations of payers;

- forms and methods of monitoring the implementation of tax legislation;

- liability for dishonest fulfillment of established requirements;

- peculiarities of the procedure for appealing illegal actions of representatives of state regulatory authorities.

The eleventh section of the document is devoted to issues of payment of insurance premiums.

How to apply a reduced tariff when calculating insurance premiums on the simplified tax system?

Enterprises using the simplified tax system have an advantage over others. In this case, it is the simplified tax system that is one of the conditions for using a reduced tariff if the company carries out the activities listed in paragraphs. 1, 5, 7, 8 tbsp. 427 Tax Code of the Russian Federation.

In addition to the Tax Code of the Russian Federation, preferential activities must comply with the assigned OKVED. The directory is approved by the Ministry of Economic Development and is included in the standardization system of the Russian Federation (Rosstandart order “On the adoption and implementation of the All-Russian Classifier of Types of Economic Activities [OKVED2] OK 029-2014 [NACE rev. 2]” dated January 31, 2014 No. 14-st [ed. dated March 20, 2017]).

A complete list of current codes is posted on the website of the Russian Ministry of Economic Development.

How to take advantage of the benefits under the simplified tax system, read the material “Benefits on insurance premiums under the simplified tax system in 2017.”

Features that SMEs need to take into account when calculating contributions.

Probably, the practice of using reduced tariffs for insurance premiums by SMEs will reveal ambiguous, controversial issues inherent in this option for calculating premiums. But this will take some time.

For now, we will focus on two obvious features.

Firstly, the conditions for applying reduced rates are the same for all regions. The mechanism for calculating insurance premiums using reduced tariffs established by Law No. 102-FZ does not provide for any adjustments to the minimum wage - for example, to regional coefficients, other allowances. It is general: the defining moment for it is the division of the taxable base (the amount accrued for the month) into two parts, namely the minimum wage and the amount exceeding it.

Secondly, any clarification regarding the fact that the month for which the accrual is made is worked out in full, in Art. 5 and 6 of Law No. 102-FZ were not done. Therefore, even if the month for which wages are paid is not fully worked by the employee (for example, in the case of vacation or hiring and dismissal in the middle of the month), the employer must still use the general mechanism for calculating insurance premiums using reduced tariffs. After all, the norms of Law No. 102-FZ talk about the final remuneration for the calendar month as such.

Example 2

In May 2021, the company employee worked only 10 days. For these days, he received a salary of 27,054 rubles.

The difference between the minimum wage and the accrued salary was 14,924 rubles. (27,054 - 12,130).

The organization calculated insurance premiums for April for this employee as follows:

- contributions from the minimum wage amounted to 3,639 rubles. (RUB 12,130 x 30%).

- contributions from the excess amount - 2,239 rubles. (RUB 14,924 x 15%), of which RUB 1,493. for OPS (10%), 746 rub. on compulsory medical insurance (5%).

The total amount of contributions is 5,878 rubles. (3,639 + 2,239).

General tariffs for contributions from employee salaries in 2021 (no benefits)

The total percentage of contributions to the funds remains the same compared to the previous year - 30%, of which:

- 22% to the Pension Fund

- 2.9% to the Social Insurance Fund

- 5.1% to the Health Insurance Fund

| Fund | Base limit* for calculating contributions in 2021 | Bid |

| Pension Fund | not installed yet | 22% |

| not installed yet | 10% | |

| FFOMS | No limit base | 5,1% |

| FSS | not installed yet | 2,9% |

| not installed yet | 0% |

* The maximum base is established by a decree of the Government of the Russian Federation...

Features of filling out the DAM in 2021.

The procedure for filling out the DAM and its form was approved by Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] (hereinafter referred to as the Procedure). And for obvious reasons, it does not take into account the peculiarities of filling out the calculation by SMEs, which are allowed to apply reduced insurance premium rates from 04/01/2020.

In this regard, these persons should pay attention to the Letter of the Federal Tax Service of Russia dated 04/07/2020 No. BS-4-11/ [email protected] , which provides explanations regarding the completion of the DAM for the first half of 2021 by SMEs.

What did the tax authorities explain?

- Before making appropriate changes to Appendix 5 to the Procedure regarding the addition of the necessary tariff codes, payers of insurance premiums - SMEs applying the 10% tariff on contributions to compulsory health insurance in relation to payments in favor of insured persons, determined based on the results of each calendar month, indicate the code for reflection in the DAM insurance premium payer tariff “20”.

- Until appropriate changes are made to Appendix 7 to the Procedure regarding the addition of category codes of the insured person, the above-mentioned policyholders, when filling out subsection. 3.2.1 “Information on the amount of payments and other remuneration accrued in favor of an individual,” section. 3 “Personalized information about insured persons” indicates the category codes of the insured person:

- “MS” – individuals, from whose payments and remunerations, determined based on the results of each calendar month, SMEs calculate insurance premiums;

- “VZhMS” - persons insured in the OPS system from among foreign citizens or stateless persons, foreign citizens or stateless persons temporarily residing (temporarily staying) in the territory of the Russian Federation, who have been granted temporary asylum in accordance with Federal Law of February 19, 1993 No. 4528- 1 “On refugees”, from whose payments and rewards, determined based on the results of each calendar month, SMEs calculate insurance premiums;

- “VPMS” - foreign citizens or stateless persons (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the Legal Status of Foreign Citizens in the Russian Federation”) temporarily staying in the territory of the Russian Federation, with payments and remunerations which, determined based on the results of each calendar year, SMEs calculate insurance premiums for small and medium-sized businesses.

Is there a reduction in the rates of contributions for injuries?

Law No. 102-FZ has not made any changes to Law No. 125-FZ regarding the tariffs for contributions for injuries.

At the same time, according to Art. 2 of Law No. 102-FZ The Government of the Russian Federation for the period from 04/01/2020 to 12/31/2020 is vested with the authority to change the deadlines for paying these contributions, submitting reports on them, as well as to change the rules for administering these contributions[8].

By Decree of the Government of the Russian Federation dated April 2, 2020 No. 409, the deadline for payment of insurance premiums for injuries calculated from payments and other remuneration in favor of individuals has been extended for micro-enterprises operating in sectors of the Russian economy that have been most affected by the coronavirus:

- for March – May 2021 – for six months;

- for June – July 2021 – for four months.

For your information:

The list of affected industries (and their corresponding OKVED codes) was approved by Decrees of the Government of the Russian Federation dated 04/03/2020 No. 434 and dated 04/10/2020 No. 479, it includes:

- air and road transportation, airport activities;

- culture, organization of leisure and entertainment;

- physical education and health activities and sports;

- tourism activities;

- hotel business;

- catering;

- additional and non-state education;

- activities for organizing exhibitions and conferences;

- activities to provide household services to the population;

- activities in the field of film screening;

- activities in the field of health care – dental practice.

And, apparently, this list is not final.

Buh-Ved.RU

Useful articles » Article 427 of the Tax Code, paragraphs 5-9, paragraph 1

Article 427.

Reduced rates of insurance contributions

1. Reduced rates of insurance contributions for payers specified in subparagraph 1 of paragraph 1 of Article 419 of this Code apply:

5) for organizations and individual entrepreneurs of individual entrepreneurs using the simplified taxation system of the simplified system, the main type of economic activity (classified on the basis of codes of types of activities in accordance with the All-Russian Classifier of Types of Economic Activities) of which are:

- food production;

- production of mineral waters and other non-alcoholic drinks;

- textile and clothing production;

- production of leather, leather goods and footwear;

- wood processing and production of wood products;

- chemical production;

- production of rubber and plastic products;

- production of other non-metallic mineral products;

- production of finished metal products;

- production of machinery and equipment;

- production of electrical equipment, electronic and optical equipment;

- production of vehicles and equipment;

- furniture manufacture;

- production of sporting goods;

- production of games and toys;

- research and development;

- education;

- health and social service provision;

- activities of sports facilities;

- other activities in the field of sports;

- processing of secondary raw materials;

- construction;

- maintenance and repair of vehicles;

- disposal of sewage, waste and similar activities;

- transport and communications;

- provision of personal services;

- production of cellulose, wood pulp, paper, cardboard and products made from them;

- production of musical instruments;

- production of various products not included in other groups;

- repair of household products and personal items;

- real estate management;

- activities related to the production, distribution and screening of films;

- activities of libraries, archives, club-type institutions (except for the activities of clubs);

- activities of museums and protection of historical sites and buildings;

- activities of botanical gardens, zoos and nature reserves;

- activities related to the use of computer technology and information technology, with the exception of organizations and individual entrepreneurs specified in subparagraphs 2 and 3 of this paragraph;

- retail trade of pharmaceutical and medical goods, orthopedic products;

- production of bent steel profiles;

- production of steel wire;

6) for taxpayers of the single tax on imputed income for certain types of UTII activities

- pharmacy organizations and individual entrepreneurs holding a license for pharmaceutical activities - in relation to payments and rewards made to individuals who, in accordance with the Federal Law of November 21, 2011 N 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation” have the right to engage in pharmaceutical activities or are allowed to carry them out;

7) for non-profit organizations

(with the exception of state (municipal) institutions) registered in the manner established by the legislation of the Russian Federation, applying a simplified taxation system and carrying out, in accordance with the constituent documents, activities in the field of social services for citizens, scientific research and development, education, healthcare, culture and art (activities theaters, libraries, museums and archives) and mass sports (with the exception of professional);

for charitable organizations

for charitable organizations

registered in accordance with the procedure established by the legislation of the Russian Federation and applying a simplified taxation system;

9) for individual entrepreneurs using the patent system of taxation of PSN

, - in relation to payments and rewards accrued in favor of individuals engaged in the type of economic activity specified in the patent (with the exception of individual entrepreneurs carrying out the types of business activities specified in subparagraphs 19, 45 - 48 of paragraph 2 of Article 346.43 of this Code);

2. For the payers specified in paragraph 1 of this article, within the established maximum value of the base for calculating insurance premiums for the relevant type of insurance, the following reduced insurance premium rates are applied:

3) for payers specified in subparagraphs 5 - 9 of paragraph 1 of this article, during 2017 - 2021, insurance premium rates for

- Pension Fund - 20.0 percent ,

- FSS - 0 percent

- FFOMS - 0 percent .

The insurance premium rates specified in this subclause apply to payers using the simplified tax system specified in subclause 5 of clause 1 of this article if their income for the tax period does not exceed 79 million rubles;

6. For payers specified in subparagraph 5 of paragraph 1 of this article, the corresponding type of economic activity provided for by the specified subparagraph is recognized as the main type of economic activity, provided that the share of income from the sale of products and (or) services provided for this type of activity is at least 70 percent of total income .

The amount of income is determined in accordance with Article 346.15 of this Code.

If, based on the results of the settlement (reporting) period, the main type of economic activity of an organization or individual entrepreneur specified in subparagraph 5 of paragraph 1 of this article does not correspond to the declared main type of economic activity , and also if the organization or individual entrepreneur exceeded the limit on income specified in paragraph two of subparagraph 3 of paragraph 2 of this article, such an organization or such individual entrepreneur is deprived of the right to apply the insurance premium rates established by subparagraph 3 of paragraph 2 of this article from the beginning of the settlement (reporting) period in which this discrepancy was made , and the amount of insurance premiums subject to restoration and payment in accordance with the established procedure.

7. The payers specified in subclause 7 of clause 1 of this article apply the reduced rates of insurance premiums provided for in subclause 3 of clause 2 of this article, provided that at the end of the year preceding the year the organization switched to paying insurance premiums at such tariffs, at least 70 percent of the total income of the organization for the specified period consists of the following types of income:

- income in the form of targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities in accordance with subparagraph 7 of paragraph 1 of this article, determined in accordance with paragraph 2 of Article 251 of this Code (hereinafter referred to as targeted receipts);

- income in the form of grants received for carrying out activities in accordance with subparagraph 7 of paragraph 1 of this article and determined in accordance with subparagraph 14 of paragraph 1 of Article 251 of this Code (hereinafter referred to as grants);

- income from carrying out the types of economic activities specified in paragraphs seventeen - twenty-one, thirty-four - thirty-six of subparagraph 5 of paragraph 1 of this article.

The amount of income is determined by the payers specified in subparagraph 7 of paragraph 1 of this article, in accordance with Article 346.15 of this Code, taking into account the requirements of this paragraph. Monitoring compliance with the conditions established by this paragraph is carried out, inter alia, on the basis of reports submitted by non-profit organizations in accordance with Article 431 of this Code.

Information on cases of non-compliance of the activities of a non-profit organization with the goals provided for by its constituent documents, identified based on the results of control carried out by the federal executive body exercising the functions of developing and implementing state policy and legal regulation in the field of registration of non-profit organizations in accordance with Article 32 of the Federal Law dated January 12, 1996 N 7-FZ “On Non-Profit Organizations” , is submitted to the tax authorities in the form of an electronic document in the manner prescribed by the agreement on information exchange.

If, based on the results of the settlement (reporting) period in relation to the specified period, the organization does not fulfill the conditions established by this paragraph, such organization is deprived of the right to apply the reduced rates of insurance premiums provided for in subparagraph 3 of paragraph 2 of this article from the beginning of the calculation period in which it was admitted non-compliance with the conditions specified in this paragraph.

When determining the amount of income of an organization to verify the organization’s compliance with the conditions established by this paragraph, targeted revenues and grants received and not used by the organization based on the results of previous billing periods are taken into account.

8. Payers specified in subparagraph 8 of paragraph 1 of this article apply reduced rates of insurance premiums provided for in subparagraph 3 of paragraph 2 of this article, subject to:

- application of a simplified taxation system;

- compliance of the activities of a charitable organization with the goals provided for by its constituent documents.

Information on cases of non-compliance of the activities of a charitable organization with the goals stipulated by its constituent documents, identified as a result of control carried out by the federal executive body exercising the functions of developing and implementing state policy and legal regulation in the field of registration of non-profit organizations in accordance with Article 32 of the Federal Law dated January 12, 1996 N 7-FZ “On Non-Profit Organizations” , is submitted to the tax authorities in the form of an electronic document in the manner prescribed by the agreement on information exchange.

If, based on the results of the settlement (reporting) period in relation to the specified period, the organization does not fulfill the conditions established by this paragraph, such organization is deprived of the right to apply the reduced rates of insurance premiums provided for in subparagraph 3 of paragraph 2 of this article from the beginning of the calculation period in which it was admitted non-compliance with the conditions specified in this paragraph.

For information

Article 419. Payers of insurance premiums

1. Payers of insurance premiums (hereinafter in this chapter - payers) are the following persons who are policyholders in accordance with federal laws on specific types of compulsory social insurance:

1) persons making payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs;