The compulsory insurance system for individuals has been operating in Russia for a long time. Employers pay contributions for employees, and individual entrepreneurs pay for their own insurance.

The transferred amounts are used to pay pensions, create savings in the accounts of insured persons, and provide medical and social security to citizens. The state strictly controls the timely and full payment of insurance premiums for employees and individual entrepreneurs. After the Pension Fund's work in collecting insurance payments was considered unsatisfactory, this function was transferred to the Federal Tax Service.

Insurance premiums are growing every year; read about the changes that occurred in 2021 here.

Free tax consultation

Where are insurance premiums sent?

In 2021, transferred insurance premiums are sent to:

- for compulsory pension insurance (OPI);

- for compulsory social insurance in case of temporary disability and in connection with maternity (VNiM);

- for compulsory health insurance (CHI).

Also in 2021, employers must make insurance contributions to the Social Insurance Fund “for injuries” - for compulsory social insurance against industrial accidents and occupational diseases (Federal Law No. 125-FZ of July 24, 1998, hereinafter referred to as Law No. 125-FZ).

Calculation of contributions using the combined tariff formula

Let's look at the calculation of pension contributions for individual entrepreneurs with income in 2019 exceeding 300,000 rubles.

Example 3

Individual Entrepreneur E.T. Krasilnikov applies a general taxation system and works without the involvement of hired labor. Its performance indicators in 2019:

- income - 5,638,339 rubles;

- expenses - 4,060,788 rubles.

Thus, to calculate contributions to compulsory pension insurance, the income of individual entrepreneur E.T. Krasilnikov (reduced by the amount of expenses) amounted to 1,577,551 rubles. (5 638 33 – 4 040 788).

Since RUB 1,577,551 exceeds 300,000 rubles, E. T. Krasilnikov needs to apply the formula to calculate the amount of contributions to the compulsory pension insurance for 2019:

SWOPS = 29,354 + 1% × (1,577,551–300,000) = RUB 42,130.

Get acquainted with various calculation formulas using the articles:

- “By what formula and how to calculate profitability?”;

- “Financial stability coefficient (balance sheet formula)”;

- "Financial leverage ratio - formula for calculation."

How are insurance premiums calculated in 2021?

In 2021, insurance premiums are calculated taking into account 3 main components:

- accruals in favor of individuals;

- limits on the taxable base for insurance premiums;

- insurance premium rates.

Amounts not subject to insurance premiums in 2021 are given in Article 422 of the Tax Code of the Russian Federation.

In 2021, the tax base for contributions has not changed. To calculate the base, you must first add up all payments that relate to the object of taxation. The list of such payments is listed in paragraph 1 of Article 420 of the Tax Code of the Russian Federation. For example, salary and vacation pay.

Then you need to subtract non-taxable payments from the resulting value. For a list of such payments, see Article 422 of the Tax Code of the Russian Federation. For example, state benefits, financial assistance in the amount of up to 4,000 rubles. in year.

What happened before

Since 2010, after the abolition of the unified social tax, the concept of a maximum size has been defined. This is the basis for calculating insurance premiums at the established rate for the Pension Fund and the Social Insurance Fund. For the Compulsory Medical Insurance Fund there is no limit on the size of the base.

For the Pension Fund of the Russian Federation and the Social Insurance Fund, a maximum size of the base has been established for 2021, based on the average salary in the country, increased by 12 times, taking into account increasing factors for the previous year 2021 (clause 5 of Article 421 of the Tax Code of the Russian Federation) and for the Pension Fund of the Russian Federation the amount is 1,021,000 rubles . and for the Social Insurance Fund - 815,000 rubles. The same article of the Tax Code of the Russian Federation provides for increasing coefficients for 2019-2021. For the self-employed population (including individual entrepreneurs, lawyers, notaries) from 2010 to 2021, the base for calculating insurance premiums was the size of 1 minimum wage, depending on its size at the beginning of the year and the formula: 1 minimum wage x 26% x 12 months, the fixed amount was calculated payment for the year, where 26% is the tariff for employers established by Article 425 of the Tax Code of the Russian Federation (previously the tariff in Law No. 212-FZ) on a general basis (until 2021, the general tariff is 22% of Article 426 of the Tax Code of the Russian Federation).

But from 2018-2019, in connection with the increase in the minimum wage to the level of the subsistence level in the country, the size of the financial contribution for individual entrepreneurs and other persons in this category was “untied” and the clarified Article 431 of the Tax Code of the Russian Federation established a specific maximum contribution amount for this category for 2018-2020. G. no more than 8 times the established fixed payment amount. Tariffs and procedure for payment/accounting of current insurance contributions to the Federal Tax Service in 2017-2018. for various categories of payers.

The basic rate of insurance contributions for employers is set at 34%, where 26% is for compulsory insurance in the Pension Fund of the Russian Federation within the established amount of the base for calculating insurance premiums, 2.9% is for compulsory social insurance in the Social Insurance Fund within the established amount of the contribution base, 5.1% - for compulsory medical insurance in the Compulsory Medical Insurance Fund without establishing the specified limit (Article 425 of the Tax Code), but until 2021, Article 426 of the Tax Code is in force, where:

- for the Pension Fund of the Russian Federation for compulsory security the general tariff is 22% plus 10% if the maximum size of the base is exceeded;

- for the Compulsory Medical Insurance Fund - for compulsory medical insurance the tariff is 5.1% without establishing a maximum base size;

- for the Social Insurance Fund - for compulsory social insurance in case of temporary disability and in connection with maternity within the established limit of the base for calculating insurance premiums for this type of insurance - 2.9% and compulsory social insurance in case of temporary disability in relation to payments and other remunerations in favor of foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists), within the established maximum base for calculating insurance premiums for this type of insurance - 1.8%.

Reduced tariffs are established by art. 427 of the Tax Code of the Russian Federation (confirmation according to the new edition of OKVED). Additional tariffs are established by art. 428 of the Tax Code of the Russian Federation, depending on the hazard class determined based on the results of the special assessment of working conditions (special assessment of working conditions carried out in accordance with Law No. 426-FZ no later than December 31, 2018 by all employers (for class 4 - dangerous - 8.0%, for class 3 - harmful from 2% to 7% depending on the subclass, for class 2 - permissible and class 1 - optimal - 0%) Before the SOUT, based on the results of certification of workplaces of the same article of the Tax Code of the Russian Federation, a tariff of 6% or 9 is established % depending on the hazard class.

General insurance premium rates in 2021

| Type of contributions | Base in 2021 | Rate within the base | Rate over base |

| Pension contributions (PFR) | Not known yet | 22% | 10% |

| For social insurance in case of temporary disability and maternity (FSS) | Not known yet | 2.9% | |

| Medical (FFOMS) | Not installed | 5.1% | |

Note that until 2021, it was planned to apply the tariff of insurance contributions for compulsory pension insurance for the period 2017 – 2021 in the amount of 22% and its increase from 2021 to 26%. However, from January 1, 2021, the pension rate is fixed at 22% indefinitely. Reason: Federal Law dated August 3, 2018 No. 306-FZ.

Reports to extra-budgetary funds for 2021

Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p approved three reporting forms and one accompanying explanatory form for them.

Since the new year, some adjustments have been made to the forms. And these changes must be taken into account, since reporting for 2021 must be done using new forms approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P:

- SZV-STAZH

The updated form must be submitted by March 1, 2021. No changes have been made to completing this form. However, in section 3 in column 14, the title was expanded with the following wording: “information about the periods counted in the insurance period of the unemployed.”

The form includes all employees who received monetary rewards from which insurance premiums were paid. That is, employment contracts, civil contracts, and copyright contracts are taken into account.

If one employee in the reporting year was registered as a full-time employee, was also on leave without pay, took sick leave, etc., then all these periods, in accordance with personnel orders, must be reflected in the SZV-STAZH form, since this affects for calculating the employee's pension.

The accompanying document EDV-1 to the SZV-STAZH form is prepared automatically and does not cause any problems. It removed the line “Other incoming documents” from section 3 “List of incoming documents”.

- SZV-KORR

Using this form, previously submitted information is corrected if the company, independently or as a result of checking the PF, has discovered any errors (for example, some periods were not taken into account in the length of service). An accompanying EFA-1 document is also being prepared for this form.

- SZV-ISH

This form is presented for periods that expired before January 1, 2017, and actually serves to correct errors of previous periods. Form EDV-1 is also filled out for it.

It is worth noting some changes that have occurred in correcting errors in the SZV-M form.

On October 1, 2021, Order of the Ministry of Labor No. 385n dated June 14, 2018 came into force, which amended the Instructions on the procedure for maintaining records and clearly regulated the algorithm for correcting errors in the SZV-M form. It lies in the fact that the Pension Fund, having discovered an error, is obliged to notify the payer of insurance premiums within five days that an authorized person has identified false information. The company, in turn, undertakes to correct the error within five calendar days for the insured person for whom it was identified. If the payer manages to do this within five days, then no fines are applied to him.

That is, the Instructions now clearly indicate that updated information is provided only for those insured persons in respect of whom an error warning was received.

There is another significant innovation, which is associated with the application of sanctions in the event of self-identification and correction of errors. Previously, if the company itself identified an error and eliminated it before it came to the attention of the Pension Fund, there were no grounds for a fine. Now sanctions are not applied if two conditions are simultaneously met: the policyholder independently discovered an error in the previously submitted information and corrected it before the Pension Fund found out about it, and the erroneous information was accepted by the Pension Fund.

Tariffs for foreigners in 2021

Next, we list the tariffs of insurance premiums that apply to foreigners (stateless persons) temporarily staying in Russia who are not highly qualified specialists (HQS), with the exception of citizens of the EAEU.

| Pension contributions (PPS) | 22% - within the limits of the base for calculating contributions; |

| 10% - above it | |

| Social contributions (VNiM) | 1.8% - within the limits of the base for calculating contributions; |

| 0% - above it | |

| Medical contributions (CHI) | not insured |

Below in the table we present the tariffs for 2021 for foreigners (stateless persons) permanently or temporarily residing in Russia who are highly qualified specialists (HQS).

Payments not subject to contributions

First of all, income that is not subject to insurance premiums includes amounts that are not subject to taxation.

For example, payments and rewards that were received by a person under a gift, lease, loan and sale agreement. Contributions do not accrue for dividends either, since taxes are not paid on them.

The legislation also lists several other payments for which insurance premiums are not calculated:

- Benefits for temporary disability, BIR, child care.

- Daily payments.

- Material assistance, the amount of which does not exceed 4,000 rubles per employee.

Reduced insurance premium rates in 2021: changes

For certain organizations, for example, those operating under special tax regimes, engaged in certain types of activities (IT sector), residents of special economic zones, participants in the Skolkovo project and other categories, special reduced contribution rates are provided in 2021.

Most simplifiers (organizations and individual entrepreneurs) are required to apply a general tariff of 30 percent from 2021, since the preferential transition period has ended. The reduced rate of 20 percent was left only to non-profit and charitable organizations on the simplified tax system. They can use the benefit for six years – from 2021 to 2024. For all other simplified types of activities, from 2021 the burden of contributions will increase by one and a half times (compared to the preferential tariff).

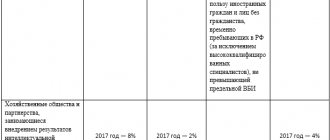

Reduced insurance premium rates in 2021: rate table

| Category of beneficiaries | Tariffs in 2018 | Tariffs in 2019 |

| Companies implementing the results of intellectual activity Companies operating in technology-innovation, tourist and recreational zones | Pension Fund – 13% Social Insurance Fund – 2.9% Compulsory medical insurance – 5.1% | Pension Fund – 20% Social Insurance Fund – 2.9% Compulsory medical insurance – 5.1% |

| IT companies | Pension Fund – 8% Social Insurance Fund – 2% Compulsory medical insurance – 4% | Pension Fund – 8% Social Insurance Fund – 2% Compulsory medical insurance – 4% |

| Simplified companies with preferential activities Pharmacies on UTII IP on a patent | Pension Fund – 20% FSS – 0% Compulsory medical insurance – 0% | Basic rates: Pension Fund – 22% (10% above the limit) Social Insurance Fund – 2.9% Compulsory medical insurance – 5.1% |

| Non-profit and charitable organizations simplified | Pension Fund – 20% FSS – 0% Compulsory medical insurance – 0% | Pension Fund – 20% FSS – 0% Compulsory medical insurance – 0% |

| Skolkovo residents | Pension Fund – 14% FSS – 0% Compulsory medical insurance – 0% | Pension Fund – 14% FSS – 0% Compulsory medical insurance – 0% |

| Residents of special economic zones | Pension Fund – 6% Social Insurance Fund – 1.5% Compulsory medical insurance -0.1% | Pension Fund – 6% Social Insurance Fund – 1.5% Compulsory medical insurance – 0.1% |

Last news

It is stipulated that in 2021 - 2021, a tariff of 22% (within the established limit of the base) and 10% (above the established limit) will be applied to most policyholders. Previously (before amendments) Art. 425 of the Tax Code of the Russian Federation provided for the preservation of current tariffs only for contributions to compulsory medical insurance (5.1%) and social insurance (2.9%). Payment of contributions to compulsory health insurance was planned to change from 2021, the tariff was supposed to be raised to 26%.

Also, in accordance with the new interpretation of Art. 427 of the Tax Code of the Russian Federation, reduced insurance premiums are paid only within the established limit of the base for the corresponding type of insurance. Reduced contributions are not paid above the limited base. For the IT sector, preferential tariffs (general - 14%) have been extended until the end of 2023.

In addition, amendments were made to Art. 105.14 Tax Code of the Russian Federation. The list of controlled transactions between related parties includes transactions where at least one of the parties is a research corporate center specified in the Law “On Innovation”, which applies VAT exemption Art. 145.1 Tax Code of the Russian Federation.

Additional insurance premium rates in 2019

Employers pay additional insurance premiums from the salaries of employees who work in harmful and dangerous conditions. Tariffs depend on the results of a special assessment or their absence (clause 3 of Article 428 of the Tax Code of the Russian Federation). If a special assessment of working conditions was not carried out and classes of working conditions as of 2021, then apply the following additional tariffs:

| Who pays | Pension insurance contribution rate, % |

| Organizations and entrepreneurs that make payments to employees engaged in work specified in paragraph 1 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (according to List 1, approved by Resolution of the Cabinet of Ministers of the USSR of January 26, 1991 No. 10) | 9,0 |

| Organizations and entrepreneurs who make payments to employees engaged in work specified in paragraphs 2–18 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ (approved lists of professions, positions and organizations in which work gives the right to early retirement old age) | 6,0 |

If a special assessment of working conditions was carried out, then additional tariffs are distributed by class:

| Working conditions | Pension insurance contribution rate, % | Base |

| class – dangerous subclass – 4 | 8,0 | clause 3 art. 428 Tax Code of the Russian Federation |

| class – harmful subclass – 3.4 | 7,0 | |

| class – harmful subclass – 3.3 | 6,0 | |

| class – harmful subclass – 3.2 | 4,0 | |

| class – harmful subclass – 3.1 | 2,0 | |

| class – valid subclass – 2 | 0,0 | |

| class – optimal subclass – 1 | 0,0 |

If a labor assessment was not carried out, then the additional rate will be equal to: 6% for payments for the work specified in clause 1, part 1 of Art. 30 of the Federal Law of December 28, 2013 No. 400-FZ and 9% for payments for work specified in paragraphs. 2-18 hours 1 tbsp. 30 of the Federal Law of December 28, 2013 No. 400-FZ.

How to save on your tariff?

See how timely confirmation of the company’s main activity affects the rate.

Example 1

StroyProekt LLC received revenue last year in the following amount (by type of activity):

* The specialists of StroyProekt LLC took the occupational risk class from the appendix to the Order of the Ministry of Labor dated December 30, 2016 No. 851n.

** The rate of contributions “for injuries” is indicated in accordance with Art. 1 of the Law of December 22, 2005 No. 179-FZ.

Conclusion: the main activity of StroyProekt LLC is construction design - OKVED 41.10 (largest share of revenue: 31.24%). The insurance premium rate is 0.2.

No later than April 15, 2020, StroyProekt LLC should send the necessary papers to the Social Insurance Fund to confirm the main type of activity.

Find out how the Social Insurance Fund feels about postponing reporting deadlines from the publication.

Example 2

Let's change the conditions of example 1: StroyProekt LLC did not confirm the main type of activity.

As a result, the fund’s specialists independently established the insurance premium rate “for injuries” for StroyProekt LLC, choosing the maximum rate - 1.2.

Conclusion: the absence in the Social Insurance Fund of documents confirming the main activity of StroyProekt LLC has led to a situation where the company will have to pay contributions in an amount 6 times higher than the “confirmed” tariff.

Insurance contributions from the self-employed population

Self-employed citizens are individuals who are engaged in private practice and individual entrepreneurs who are required to make contributions to the fund, regardless of whether they have employees or whether they have received any income.

For this category of payers, several types of tariffs are provided:

- With incomes of less than 300,000 rubles, you will have to pay for pension insurance according to the formula 12 months * equal to the minimum wage * 26%.

- If a person’s income exceeds 300,000 rubles, then in addition to the basic payment for pension insurance, the payer must transfer 1% of the amount exceeding the minimum threshold.

- Contributions for compulsory medical insurance are fixed and do not depend on the amount of income received: 12 months * by the minimum wage * by 5.1%.

The law provides for several situations in which a person may be exempt from paying contributions:

- Completion of emergency service.

- BIR leave.

- Holiday to care for the child.

Responsibility for individual entrepreneurs

If an individual entrepreneur does not make payments within the time limits specified by law or does not transfer them in full, he may be held liable in the form of a fine.

The penalty is 20% of the amount not transferred to the funds. If such non-payment was made intentionally, the fine increases to 40%. Most often, territorial authorities apply only penalties to such a violator, but only if the payment was made within a short period of time and the amount of the debt turned out to be small.

Penalties are accrued regardless of what exact penalties were applied to the debtor. The accrual is made in the amount of 1/300 of the refinancing rate.

Increasing limits: table

The maximum values of the base for insurance premiums are increased every year. Let's compare the values for recent years in the table.

| Year | Maximum base for pension contributions | Maximum base for social contributions |

| 2017 | 876,000 rub. | RUB 755,000 |

| 2018 | RUR 1,021,000 | RUB 815,000 |

| 2019 | RUB 1,150,000 | RUB 865,000 |