There are two ways to return accountable funds:

- bring the money to the institution’s cash desk, and then the cashier will independently deposit the amount into the institution’s account;

- transfer the debt yourself.

Let's look at how to properly process the return of imprest amounts to a current account; we'll show the accounting entries in the table.

IMPORTANT!

In order for employees to independently return money directly to the current account of a government agency, secure this possibility in the accounting policy or in a separate local act. For example, in the provision on settlements with accountable persons.

Registration of funds disbursement for reporting

In order to release money to the account, either an order from the manager or an application from the employee certified by the manager must be issued.

Sample order from a manager for reporting

Sample application for reporting

The basis for issuing money must indicate:

- FULL NAME. and the position of the employee to whom the money is given.

- Purpose of issuance.

- Amount.

- The period for which funds are issued.

Based on the specified document, the accountant will either issue cash from the cash register or transfer it to the employee’s card.

Compensation of employee expenses in the interests of the organization

Often in an organization there is a need to compensate an employee for amounts that were not given to him in advance, but were spent from his personal funds for the needs of the company.

The Labor Code defines “compensation” as monetary payments established to reimburse employees for costs associated with the performance of their labor or other duties (Article 164 of the Labor Code of the Russian Federation).

Company expenses, if there is a business purpose and documentary evidence, can be recognized as tax expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Compensation to an employee for expenses incurred is not his income and is not subject to personal income tax and insurance contributions (Letter of the Ministry of Finance of the Russian Federation dated 04/08/2010 N 03-04-06/3-65).

The legislation does not regulate the procedure for compensating the expenses of employees who used personal funds in the interests of the organization. The organization itself must establish a procedure for compensation of such costs in a local regulatory act (LNA). It is advisable to provide in the LNA:

- purposes for which acquisitions can be made for the organization from personal funds;

- the circle of persons who can make payments in the interests of the organization from personal funds;

- the procedure for providing compensation for expenses incurred;

- application form for reimbursement of expenses;

- documents that must be attached to the application for compensation of expenses.

Since no advance was issued for expenses incurred by the employee, the amount cannot be considered accountable, and it is not appropriate to use account 71.01 “Settlements with accountable persons” (Instructions for using the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n).

In this case, it is better to use account 73.03 “Settlements for other operations” (working chart of accounts 1C). This account allows a balance of both debit and credit, therefore, the organization’s debt to the employee can be reflected in such an account.

More details How to reflect the acquisition of goods and materials by an employee for personal funds if the money was not reported?

The most typical cases of settlements with accountable persons are discussed in the publications:

- Advance report for business trip for cash

- Advance report for business trip (corporate card)

- Advance report on the purchase of electronic services from a foreigner

- Business trip: trip abroad, payments in foreign currency

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

How to report for accountable money

After the day before which the report was issued, the employee must either report on the expenditure of money or return the unspent amounts. The employee must submit an advance report to the accounting department after the deadline for issuing money on account, no later than three working days. If the return date occurred during the employee’s absence (vacation or business trip), then the report must be submitted within three days after returning to work.

The company can approve the advance report form independently, providing it with all the mandatory details named in Article 9 of Law 402-FZ, or you can use the form approved by the State Statistics Committee in Resolution No. 55 dated 01.08.2001.

Advance report form

Along with the advance report, the employee must provide documents confirming the expenses incurred.

Is it possible to return accountable funds to a current account?

Current legislation does not prohibit employees from returning accountable amounts to the employer’s bank account. However, in order to avoid disputes with tax authorities, it is necessary to establish in an internal regulatory document the possibility of reporting persons returning unspent funds to the company’s current account or to record such a return option in an application (order) for the issuance of advance amounts.

To identify the transfer, the employee making the transfer must indicate in the payment purpose that he is returning the accountable amounts.

And yet, the optimal way to return accountable funds, eliminating any disagreements with controllers, is to the enterprise’s cash desk.

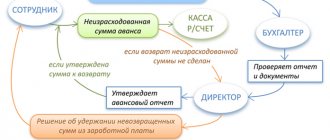

How to recover accountable funds from the director

There is often a situation where the head of a company does not report in a timely manner for the amounts taken into account.

Unreturned accountable money, from the point of view of tax authorities, must be classified as employee income and personal income tax must be calculated from it (clause 8 of the Federal Tax Service Letter No. SA-4-7/23263 dated December 24, 2013).

With the consent of the employee, unreturned money may be collected from his salary. One month is allotted for this from the expiration date for which the report was issued (Article 137 of the Labor Code of the Russian Federation). If the employee does not agree with the withholding, or the collection period has expired, the disputed amounts can be recovered through the court. This must be done within the usual limitation period established by Article 196 of the Civil Code of the Russian Federation, that is, three years.

Reasons

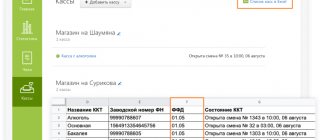

Since 2015, accountable amounts can be issued not only to employees of the organization, but also to persons with whom a civil contract has been concluded. The operation is carried out on the basis of an application. This rule applies to all persons without exception. Based on this document, a settlement settlement is issued. In the application you must indicate the amount, period of issue, date and put your signature.

Accounting of imprest amounts

In accordance with the Chart of Accounts, accounting of settlements with accountants is kept on account 71. The debit of the account reflects the employee's debt for funds received.

When the report is approved, the accountable amounts are written off from the credit of account 71 to the debit of the corresponding accounting accounts. Accounting entries

| Contents of operation | Debit | Credit |

| A report was issued to the employee | 71 | 50, 51 |

| Advance report submitted | 10, 20, 25, 26, 44, 60, 76, 91 | 71 |

| Return of unspent accountable amounts | 50, 51 | 71 |

Do not give out money from prohibited sources

You can issue money on account only from cash proceeds.

The new rules for cash payments prohibit the issuance of money to accountants from other sources (Central Bank Directive No. 5348-U dated December 9, 2019). For example, due to borrowed funds received at the cash desk, and even due to returned accountable amounts. They must first be handed over to the bank. Previously, returned accountable amounts could be given to another employee for reporting purposes and even as a salary. Now the advance returned by the accountant must be handed over to the bank. If you do not do this, you will violate the rules of cash payments (see letter of the Central Bank dated July 9, 2021 No. 29-1-1-OE/10561). Violation entails a fine of 40,000 to 50,000 rubles. under Part 1 of Article 15.1 of the Administrative Code.

It is allowed to issue loans only to microfinance and some other specialized organizations, for example, consumer cooperatives (clause 1 of the Guidelines).

Issue cash on account only from revenue. If it is not there, you need to withdraw money from your bank account. You can also switch to non-cash payments with subordinates.

Hold

If the money issued for reporting is not returned on time, an entry is made in accounting Dt 94 Kt 71 or Dt 70 Kt 71 - the accountable amounts are withheld from the salary.

Withholding occurs within a month after the expiration of the period for returning accountable amounts based on the manager’s order to withhold. The employee must be familiar with the order and give written consent to withhold the amount (Rostrud Letter No. 3044-6-0 dated 08/09/2007). Insurance premiums are charged on amounts not returned and not withheld from wages; personal income tax is not charged.

It is necessary to collect accountable funds from the director in a manner similar to all employees and described in the article.

Let's sum it up

- Registration of accountable money begins with an application from the accountable person or an order (instruction) from the employer.

- Based on this document, cash is issued from the cash desk or current account after the execution of payment documents (payment order or payment order).

- To report for spent accountable funds, the employee must collect supporting documents and fill out an advance report.

- If documents on accountable amounts are drawn up with errors or an advance report is not submitted, and the advance issued against the report is not returned, tax risks arise.

If you find an error, please select a piece of text and press Ctrl+Enter.

What to consider in 2021

When accepting an advance report, take into account changes in the design of cash receipts and BSO - the required details include information about the name of the buyer (organization or individual entrepreneur) and his tax identification number.

When making settlements with accountable persons in 2021, taking into account the latest changes, remember:

- If the accountable person has been given a power of attorney to purchase goods and services in the interests of the organization and he has presented it to the seller, then the seller is obliged to reflect this data in the issued cash receipt.

- If the seller is unable to reliably establish that an individual is acting in the interests of a particular organization, then he is not required to comply with this requirement for issuing a check. In this case, the buyer for the seller is the individual himself, and the cash receipt is issued in the usual manner.

Determining the amount of advance for a business trip

The amount of the advance is determined independently by the organization, taking into account the duration of the business trip, the norms of expenses for renting housing, daily expenses, as well as the cost of travel to the destination and back. The amount of daily allowance and standards must be specified in a collective agreement or in the local regulations of the organization.

Currently, the daily allowance is set at 700 rubles for trips within Russia and 2,500 rubles for trips abroad. Please note that the organization has the right to set the amount either less or more than the established amounts. The question is about additional taxes on daily allowances, so if these amounts are exceeded, income tax will be charged to the employee.

What happens if the daily allowance is less than 700 rubles? Daily allowances can be set in a smaller amount; the organization has such a right. The established norms do not oblige them to be adhered to; the established value affects taxation. However, you should take a reasonable approach to determining the amount of daily allowance, because an employee leaves on a train to perform the organization’s tasks, and not of his own free will, and setting small amounts means that he will have to spend his personal money on food, travel, etc.

Read more about how to send an employee on a business trip under the new rules here.

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

What law governs cash transactions?

The procedure for conducting cash transactions has changed several times. At the time of writing, Bank of Russia Directive No. 3210-U dated March 11, 2014 is in effect. The directive approved a new procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation by legal entities (except for banks), as well as a simplified procedure for conducting cash transactions by individual entrepreneurs (IP) and small businesses. When conducting cash transactions, recipients of budget funds are guided by Directive No. 3210-U, unless otherwise specified by a regulatory legal act regulating the procedure for conducting cash transactions by recipients of budget funds. The document was registered with the Ministry of Justice of Russia on May 23, 2014 (No. 32404) and published in the “Bulletin of the Bank of Russia” No. 46 (1524) dated May 28, 2014. Directive No. 3210-U came into force on June 1, 2014, with the exception of the requirements for software and hardware for accepting Bank of Russia banknotes, which will be in effect from January 1, 2015. From the date of entry into force of Directive No. 3210-U, Bank of Russia Regulation No. 373-P dated October 12, 2011 “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation” became invalid.