In practice, there is often a need to conduct an in-depth analysis of non-cash transactions in order to determine the amounts, sources of income and directions for writing off funds for specific periods of time.

The successful solution of the task becomes possible thanks to the preparation of the 51 account card.

What such a card is, what information it contains, how it is filled out - all these questions require more detailed study.

How to generate the Account Card report in 1C 8.3

You can generate the Account Card report in 1C 8.3 from the section Reports → Standard reports → Account Card:

Select the period for which you want to generate a report; check; if necessary, indicate the organization and Form:

Legal aspects

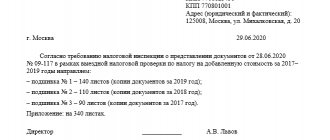

Art. 31 of the Tax Code of the Russian Federation defines a set of forms that the Federal Tax Service has the right to request - these are documents that serve as the basis for calculating taxes and confirm their accuracy, as well as the timeliness of payments. The right to demand them from the enterprises subject to inspection is determined by Art. 93 of the Tax Code of the Russian Federation, and information about the work of the company being inspected may be requested from its partners or other persons (Article 93.1 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not provide an exact list of documents required to be submitted; it only states that taxes are calculated on their basis (Clause 6, Article 23 of the Tax Code of the Russian Federation). The list of documents that inspectors have the right to request is open. However, this does not mean that the Federal Tax Service can refer to the need for any documents, and the company automatically has an obligation to submit them.

The following are considered to confirm tax accounting information (TA) and are mandatory for submission to the Federal Tax Service (Article 313 of the Tax Code of the Russian Federation):

3) calculations of the tax base.

The accounting card is not included in this list, but often the Federal Tax Service requires it along with other accounting forms.

Account card analysis

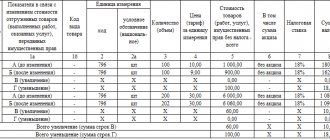

Let's analyze the resulting report using an example:

- In the first column we see: what date was the movement on the account - 06/30/2016;

- In the second - what document caused the movement on the account: receipt document No. 0у00-000011 dated June 30, 2016;

- Next, which goods arrived and to which warehouse: paper clips arrived at the warehouse - Warehouse Store No. 2;

- In the next column - from whom the goods came - LLC "Knopka";

- We also see information: for what amount and in what quantity the goods were capitalized - 4,237.29 rubles. in the amount of 500 pcs.;

- Next, what account does the torn account correspond to – account 60.01;

- And in conclusion we see the current balance;

- The information in the other two lines of the report is similar to what we just looked at:

By clicking on any of these lines, we will go to the original source, that is, the receipt document. We see that the information from the document is reflected in the report. Each line in the document corresponds to a line in the report:

If necessary, in 1C 8.3 you can make changes to the receipt document. After making changes, click Post and Close and return to the report. Click the Generate button and see the changed data.

In the final line of the report we see the turnover for the period and the balance at the end of the period:

What it is?

As you know, accounting account 51 refers to the cash section (Section V) , which is part of the Chart of Accounts, approved by a special regulatory act of the Ministry of Finance of the Russian Federation (we are talking about order No. 94n dated October 31, 2000).

A characteristic feature of account 51 is the fact that it is used as an active synthetic accounting account, which records all incoming and outgoing transactions made in Russian rubles with non-cash funds of the organization.

The receipt (credit) of non-cash money in rubles at the organization's bank account is always recorded by the accountant under debit 51.

Report settings Account card in 1C 8.3

Using the Show Settings button:

You can make the necessary report settings:

If you select monthly frequency, the report will display turnover for each month included in the period and for the period as a whole:

On the Picks tab, you can select a specific warehouse or specific item for which you want to view movement. Select the type of comparison from the drop-down list:

Let's generate a Report on the item Staples:

As we can see, the report reflected the movement only in the Staples nomenclature. On the Indicators tab, you need to select the indicators that should be displayed in the report. By default, accounting data and quantities are displayed:

If you only need quantitative indicators, then uncheck the BU (accounting data) checkbox. And we will see the following data:

And the last tab, Design, allows you to change the appearance of the report. You can select a design option from the list provided, for example Sea. We will see the following option:

You can add your own settings to the proposed design options in 1C 8.3.

For example, we want to highlight the debit movement of the item Staples with a certain color. To do this, use the Add button, then Condition, select Analytics Dt in the available fields and indicate Contains paper clips. Select Design, then select a color:

And we get the following version of the report:

By clicking the Print button, you can print the Account Card report to a printer, and you can also use the button to send the report by email from 1C 8.3:

How to send documents to buyers and suppliers by email directly from the 1C 8.3 program is discussed in the next article.

To understand where which documents and reference books are located in 1C 8.3 Accounting, what actions the program takes automatically and which you will have to do yourself, how to customize the program “for yourself”, what procedure for drawing up documents and regulatory reporting operates in the program - discussed in detail at our course on working in 1C 8.3 . For more information about the course, see the following video:

Please rate this article:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

What it is?

As you know, accounting account 51 refers to the cash section (Section V), which is part of the Chart of Accounts, approved by a special regulatory act of the Ministry of Finance of the Russian Federation (we are talking about order No. 94n dated October 31, 2000).

It is designed to record the receipt, expenditure and balance of non-cash money in the bank account of a business entity.

A characteristic feature of account 51 is the fact that it is used as an active synthetic accounting account, which records all incoming and outgoing transactions made in Russian rubles with non-cash funds of the organization.

The receipt (deposit) of non-cash money in rubles on the bank account of the organization is always recorded by the accountant under debit 51. The expenditure (write-off) of non-cash money in rubles from the bank account of the company is always reflected by the accountant under credit 51.

The corresponding transactions are generated on the basis of a bank account statement, to which supporting documents are usually attached (payments, checks, collection orders, other papers). The bank statement and its annexes are considered primary documentation.

Balance account 51 shows the actual cash balance in the company's bank account.

Analytical accounting of account 51 may provide detailing of transactions and balances for each of the current accounts opened by the organization in different financial institutions.

A detailed picture of the movement and balances of money in the bank current accounts of a business entity for certain periods of time can be obtained by generating and analyzing the card.

For this card, the following information is taken into account and systematized, characterizing the dynamics of non-cash money in a r/account for a specific time period:

- balance recorded at the beginning of the analyzed period;

- debit turnover (receipt of money);

- credit turnover (spending money);

- balance recorded at the end of the analyzed period.

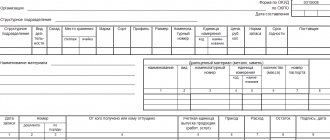

Filling procedure

Account card 51 is a table that indicates data on balances and cash movements for a specific account of an organization for a certain period of time.

It is noteworthy that this table mentions the primary documents that justify each incoming or outgoing transaction.

This card is filled out by entering the following information into the table:

- name of the business entity;

- name of the card indicating the accounting period;

- initial balance (debit balance) of non-cash funds;

- for each incoming and outgoing transaction, the period, confirming document, debit analytics, credit analytics, correspondence of the necessary accounts, the amount of the transaction are separately indicated, and the change in the current balance of non-cash funds caused by the corresponding transaction is also reflected;

- total debit/credit turnover 51;

- the final balance (debit balance) of non-cash funds.

Download free sample and form

Account card 51. Accounting period – 01/11/2019

Description

The famous wooden abacus, shown in the picture below, was widely used in the USSR during the first two-thirds of the twentieth century, mainly for addition and subtraction operations. How did cashiers and accountants use these Russian accounts? Let's figure it out. If you know how to use accounts, then you can go straight to the description of more complex operations.

In the initial position, in “zeroed” accounts, all dominoes are aligned to the right (as shown in the figure). Each row of dominoes represents a digit of a number, the ones being above the four dominoes. Above units are tens, hundreds, etc., below are quarters, tenths and hundredths. With this arrangement, it is convenient to count money where quarters are used (for example, 25 kopecks). The central dominoes are highlighted in black (for convenience).

Set of numbers. If we want to set a number on the abacus (in order to perform arithmetic operations with it in the future), then we simply need to move the required dominoes to the left. For example, to dial the number “3251.5” we move 2 quarters (or 5 tenths), 1 unit, 5 tens, 2 hundreds and 3 thousand.

But gaining numbers is just the beginning. To truly use a wooden abacus means to perform arithmetic operations.

Subtraction

Subtraction on an abacus is done in exactly the same way as addition, from top to bottom. Only if there are not enough dominoes in a row, you need to leave (10-x) dominoes in this row, where x is the number of missing dominoes, and in the row above you need to remove one domino (move it to the right). Below, see an example of how to correctly calculate the difference on Russian accounts (121 – 98 = 23):

Division

Division on Russian accounts is a rather complicated procedure. Using an abacus for this is sometimes simply irrational. If the example is convenient, let’s say you need to divide 280 by 2, then really, you just need to move half of the dominoes from each row to the right and then you get 140. But other examples, for the most part, require complex algorithms and good development of attention and short-term memory.

We also recommend reading:

- Storytelling

- Zero. This important nothing

- Visuospatial Corsi test: description and application

- Is it possible to count in your head and remember, like Daniel Tammet?

- How to teach a child to count quickly in his head

- Rabbit problem

- Mnemonics: numbers

- Number search problem

- Mental arithmetic

- Concentration and attention span

- Continue the number line

Key words:_D1001, _D1067, 1Mnemonics, 2Cognitive science