Receiving a bill of exchange from the buyer

When receiving a bill of exchange as payment for goods (work, services), when calculating VAT, please take into account:

- the amount of debt paid by the bill;

- interest or discount on the bill (if provided).

Determine the moment at which VAT must be charged on the cost of goods (work, services) paid for by bill of exchange.

VAT must be charged for payment to the budget in relation to all transactions recognized as an object of taxation, the moment of determining the tax base of which relates to the corresponding tax period (clause 4 of Article 166 of the Tax Code of the Russian Federation).

The moment of determining the tax base for the purpose of calculating VAT is the earliest of the following dates:

- day of shipment (transfer) of goods (performance of work, provision of services);

- day of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services).

This is stated in paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

Thus, VAT must be accrued for payment to the budget either on the day of shipment (transfer) of goods (performance of work, provision of services), or on the day of their payment - depending on which of these events occurred earlier.

If the goods were shipped (work performed, services provided) before the transfer of the bill of exchange, calculate VAT at the time of shipment (fulfillment, provision). At the same time, make the following entry in accounting:

Debit 90-3 (91-2) Credit 68 subaccount “VAT calculations”

– VAT is charged on sales proceeds.

For more information on how to calculate VAT on sales proceeds, see How to calculate VAT on the sale of goods (works, services).

If the bill of exchange was received before the goods were shipped (work performed, services provided), the procedure for calculating VAT will depend on which bill of exchange was received: the buyer’s (customer’s) own bill of exchange or a third party’s bill of exchange.

Is it necessary to reflect losses from the repayment of a bill of exchange in VAT and profit declarations?

In the situation under consideration, the organization pays for the purchased goods with a third party bill of exchange, and the bill is not interest-bearing, and its acquisition and disposal occur at par without a discount. That is, the transfer of a bill of exchange does not pursue the goal of obtaining economic benefits. In other words, in this case, the bill of exchange is a means of payment both during acquisition and disposal. In our opinion, in the situation under consideration, the transfer of a third party’s bill of exchange as payment for goods cannot be considered as a VAT-free transaction. However, following this position may lead to claims from the tax authorities.

Buyer's own bill

The buyer’s (customer’s) own bill of exchange, received before the shipment of goods (performance of work, provision of services), is not considered receipt of payment (including advance payment (partial payment)). In this case, VAT will be charged only when one of the following events occurs:

- actual payment has been received on your own bill of exchange;

- own bill of exchange is transferred to a third party;

- goods (work, services) have been shipped (performed, provided).

This procedure follows from paragraph 1 of Article 154 and paragraph 1 of Article 162 of the Tax Code of the Russian Federation. This is explained by the fact that your own bill only confirms the obligation to pay the resulting debt (Article 815 of the Civil Code of the Russian Federation) and (or) delays the date of payment (Article 823 of the Civil Code of the Russian Federation). Until the buyer's own note is paid (or transferred to a third party), the payment obligation is considered outstanding.

Attention: some courts recognize that, having received the buyer's own bill of exchange as an advance, the seller must charge VAT. Subsequently, if the contract is terminated and the seller returns the bill, he will have the right to deduct the VAT paid on the advance payment. Such conclusions are contained, in particular, in the resolution of the Federal Antimonopoly Service of the Moscow District dated May 30, 2013 No. A40-85003/12-20-462.

Bill of exchange for accounting purposes: what is it?

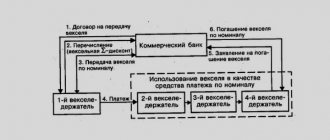

Transactions with bills of exchange have become widespread in business practice due to the fact that bills of exchange, in fact, are instruments of multifunctional use: both as a commodity and as a financial instrument. A bill of exchange, as an object of civil rights, can be used, for example:

- As a means of formalizing loan (credit) relationships.

In practice, settlement schemes have become widespread in which the buyer issues his own bill of exchange as a way to secure a commercial loan (in the sense of Article 823 of the Civil Code of the Russian Federation). - As property, the subject of a civil transaction.

The fact is that, in accordance with the provisions of Art. 143 of the Civil Code of the Russian Federation, a bill of exchange is a type of security, and securities, in turn, are classified by civil law as property (Article 128 of the Civil Code of the Russian Federation). This property of a bill of exchange is used in transactions involving bills of exchange of third parties.

In fact, countless copies have been broken precisely on the use of a bill of exchange as the subject of a civil transaction, and here’s why: even before the introduction of the Tax Code, the tax authorities recognized the bill of exchange as an instrument for settlements. In particular, the letter of the Ministry of Taxes of Russia dated February 25, 1999 No. 03–4–09/39 “On value added tax” contains the statement that “a bill simultaneously combines the properties of a security, a debt obligation and a means of payment.”