Are you an employer with employees? In this case, you have to cooperate with the Pension Fund on a monthly basis. Close communication is also inevitable if you had employees in the year for which you are reporting to government agencies. The Pension Fund accumulates specific information about all employed citizens, and the obligation to update accounting data lies with the employer.

- In what form should this information be submitted?

- How often should this be done?

- Which authority should I provide information to?

In the new year, serious changes in legislation will come into force, which will require entrepreneurs and accountants to change their established habits. What exactly awaits them regarding personalized accounting, we will understand in this material.

How is personalized accounting carried out?

To enter this system, namely to form their future pension, every citizen must register in the individual accounting system of the Russian Pension Fund. The entire period of each person’s working life, the system records all the data that is necessary for a future pension: length of service, all places of work with specific periods and the amount of contributions sent to the pension fund for a future pension, as well as earned pension points.

Even if the future pensioner changed jobs throughout his entire career, or worked part-time, all information was received by the pension fund in the form of individual information. All this information is kept strictly confidential. Currently, the Pension Fund registers absolutely every Russian citizen, including children, teenagers, foreigners and stateless persons. Each person registered in the OPS system receives an individual insurance number with a personal account (SNILS).

SNILS is an identifier of information about an individual in the individual personalized accounting system. All information provided is confidential information. They are stored in compliance with all rules governing the collection, storage, processing and protection of personal information. This information can only be obtained by the insured person himself and only by contacting the Pension Fund in person.

Codes with decryption

Many employees of organizations and individual entrepreneurs who are required to submit reports on insurance premiums to the Pension Fund have difficulty determining the code of the insured person. In addition, such encoding is often considered unnecessary. However, each line of documents submitted to the Federal Tax Service has practical significance for the regulatory authority.

The thing is that insurance premium rates are not the same for different categories of workers . For example, there are basic tariffs that are the same for everyone. However, individual policyholders have certain benefits when paying premiums.

In addition, a fairly large number of foreign citizens work in Russia on a permanent and temporary basis. Accordingly, for this category of workers there are also provisions that differ from the base rate.

Accordingly, the category code of the insured person makes it possible to determine the citizenship of the employee, the availability of certain benefits when calculating insurance premiums, as well as the grounds for applying a tariff different from the basic one.

Many people responsible for submitting reports on insurance premiums are wondering where they can find out what codes should be indicated in the DAM form. A complete list of codes is contained in documents published by the Federal Tax Service of Russia.

Their current nomenclature for mid-2021 contains Order of the Federal Tax Service of Russia No. MMV-7-11 / [email protected] dated September 18, 2019 , namely Appendix No. 7 to the Procedure for filling out the calculation form for insurance premiums approved by this order.

Attention! Interested parties can familiarize themselves with the document on the website of the Federal Tax Service, when visiting the tax office, as well as in online versions of reference and legal systems, for example, in “Consultant Plus” or “Garant”.

The nomenclature of codes that was established by the Resolutions of the Board of the Pension Fund of the Russian Federation in certain periods was declared invalid, and therefore they cannot be used when filling out the DAM for the Federal Tax Service.

Below we will discuss in detail the currently used encodings of the status of insured persons in accordance with the latest current order of the Federal Tax Service.

HP

This code designation is the most common. It can be deciphered as “hired employee.” As follows from the decoding, HP is issued for employees with whom the organization or individual entrepreneur has an employment relationship.

In addition, this applies to both employees for whom insurance premiums are paid at the base rate, and personnel who work in special conditions associated with increased health risks. For the latter, the employer pays increased amounts. However, in the calculation they are calculated according to the HP code, as well as employees working under normal conditions.

This letter designation is used by payers of contributions using the simplified tax system, UTII and the general taxation system.

The HP code is entered only if contributions calculated according to the general tariff are paid for employees.

ODIT

The code abbreviation ODIT is assigned to persons who are engaged in activities in the field of modern technologies related to the transmission and storage of information. Some clarification is needed here.

Companies whose activities include information technology can use the services of individuals who perform work on the development of computer programs, databases, and so on. Regardless of the nature of their contractual relationships, organizations are required to pay insurance premiums on remunerations and payments to these individuals. Accordingly, when submitting the DAM for these persons, this code is indicated as such.

The taxation regime applied by organizations does not affect the category of the insured person. It should be noted that the ODIT code is not assigned to employees who are not directly involved in information technology work in the company.

ICS

Decoding the ICS code sounds like “Innovative. This letter designation marks individuals who have contractual relations with organizations that are official participants in the project for the implementation of R&D, development and commercialization of Skolkovo research work.

However, since 2021, activities have been launched to create other innovative scientific and technological centers, the list of which is growing. Accordingly, the ICI code is also entered by organizations participating in such projects when calculating insurance premiums for individuals who have contractual relations with them.

Important! The procedure for creating innovation centers and the participation of organizations in relevant projects is regulated by Federal Law No. 216-FZ of July 29, 2021.

ASB

The ASB code is indicated when submitting a report for insured individuals who receive wages and other remuneration for their activities in non-profit organizations that have the appropriate state registration as an NPO and carry out activities in the field of social services for citizens. In addition, this encoding is used by non-profit organizations involved in the field of mass sports.

Also, the ASB code is entered in the report by charitable foundations , including for persons for whom insurance premiums are transferred from remuneration provided for in civil law contracts.

This code in the DAM is indicated only by those NPOs and charitable organizations that apply a simplified tax system, regardless of its chosen form.

BSEC

The BSEC code is indicated by employers who pay contributions for medical, pension and social insurance for individuals who, by the nature of their activities in the organization, are crew members of river and sea vessels. In this case, the specifics of the activity of the vessel or the organization itself does not matter. The abbreviation itself stands for “ship crew member.”

The members of the ship's crew should be understood as the command staff and the ship's crew. If the ship is a passenger ship, then the crew also includes persons who are engaged in direct service to passengers, regardless of the nature of the labor relationship with its owner.

It is important to note that the BSEC code is assigned only to crew members of those ships that, in accordance with current legislation, are registered in the relevant Russian register.

Cattle

The KRS code is assigned to citizens who work in organizations in the Crimea and the city of Sevastopol.

It should be noted here that, in accordance with the legislation, the territory of these constituent entities of the Russian Federation is recognized as a special economic zone, where more favorable conditions for conducting economic activities apply.

So, among other things, this also applies to the special procedure for calculating tax payments and insurance premiums. In other words, economic entities registered in Crimea and Sevastopol have benefits when calculating the base of insurance premiums for their employees.

It has been established that the regime of a special economic zone on the territory of these two subjects of the Federation will be valid until 2040. However, if necessary, it can be extended, but such a decision must be reflected in the norms of federal legislation.

TOP

The abbreviation “TOR” stands for “territory of rapid socio-economic development”.

It should be understood as a part of the territory within a particular subject of the Russian Federation, on which a special legal regime is introduced that is favorable for the implementation of economic activity. Today there are dozens of such territories in the Russian Federation.

Companies that are interested in doing business under simplified conditions can become residents of one or another ASEZ, which gives them the right to certain benefits and concessions. Thus, the rate of insurance premiums for them is significantly lower than it is established on a general basis.

Accordingly, the insured persons for whom contributions are paid by residents of these preferential economic zones have the code designation TOP, which is indicated in subsection 3.2 of the form for calculating insurance premiums.

SPVL

This code designation is given to persons for whom funds are paid for medical, pension and social insurance, working in organizations recognized as residents of the free port of Vladivostok.

The definition of the latter should be discussed in more detail. In accordance with federal legislation, the free port zone of Vladivostok should be understood as a part of the territory of the Primorsky Territory, which has a special law enforcement regime that is favorable for economically active activities.

Subsequently, individual municipalities of other subjects of the Federation located in the Russian Far East were also included in the territory of the free port of Vladivostok, including:

- Sakhalin region;

- Khabarovsk region;

- Kamchatka Krai;

- Chukotka Autonomous Okrug.

In the territories belonging to the free port zone, its residents enjoy benefits on fiscal payments, as well as on the payment of insurance premiums. At the same time, residents in this case can be both commercial organizations in the form of a legal entity and individual entrepreneurs.

KLN

Under the code designation KLN, insured persons are noted in the report who receive monetary rewards for performing work from insurance premium payers who are residents of a zone that has a special law enforcement regime on the territory of the westernmost subject of the Federation - the Kaliningrad region.

The Kaliningrad region is a unique region of the Russian Federation. Due to the fact that it is, in essence, the only exclave, that is, it does not have a land border with other territories of the country, a special legal regime operates here, suggesting additional benefits for organizations, enterprises and other economic entities. In addition, the Kaliningrad region is completely surrounded (except for the sea) by the territories of EU member states, which implies active international cooperation.

Organizations and individual entrepreneurs in this Baltic region have certain tax breaks, as well as a reduced tariff for paying insurance premiums. That is why Kaliningrad payers indicate the corresponding code in the DAM form for their employees.

ASM

Insured persons who are involved in the production of animated audiovisual products are indicated in the report under the code ANM.

Here we should dwell in more detail on what audiovisual products are. Federal Law No. 77-FZ of December 29, 1994 establishes that cinema, audio recordings, video materials, and photographic materials are recognized as audiovisual products. In this case, the carrier of the product does not matter for its definition as such.

Animated audiovisual production is essentially animation.

Thus, the insured persons, who are designated in the report by the ANM code, are citizens engaged in the production of cartoons and animated series , as well as the sale of their products.

It should be noted that insurance premiums are paid by organizations for these individuals, regardless of the type and type of contractual relationship between them.

SAR

The SAR code can be deciphered as “special administrative region”. It should be understood as special zones of the territory of individual regions.

Federal Law No. 291-FZ of August 3, 2021 introduced this concept into circulation. According to its norms, a special administrative region refers to territories with the most favored economic status for economic entities on Russky Island in the Far East and on Oktyabrsky Island in the Kaliningrad Region.

At the same time, not all employees of organizations are indicated under the SAR code, but only those who are members of the ship’s crew. In other words, sailors.

That is, benefits on insurance premiums apply in these territories only to ship crew members. However, it should be taken into account that the Primorsky Territory (a significant part of it) and the Kaliningrad region are themselves special economic zones. Accordingly, the remaining insured persons are also assigned a special code.

VZHNR

The VNZHR code is also extremely common . It denotes employees from among the citizens of foreign states who have been granted temporary asylum, employees for hire in organizations and registered individual entrepreneurs.

Payers of insurance premiums for foreigners who are temporarily in the territory of our country can apply any tax regime - general, simplified tax system, UTII, and so on.

In accordance with tax legislation, insurance premiums for foreigners are paid only if the employee himself is an insured person in the social insurance, compulsory health insurance and compulsory medical insurance systems.

However, it should be taken into account that foreign citizens who carry out their activities remotely while outside our country are not insured persons, therefore the corresponding contributions from their income are not paid to the Federal Tax Service, and they do not appear in the calculation itself.

VZHIT

The code designation VZHIT is used to identify in the DAM insured persons who have foreign citizenship, who have received temporary asylum in the territory of the Russian Federation, from whose payments contributions are paid by Russian organizations conducting their main activities in the field of information technology.

Activities in the field of information technology should be understood as the development and implementation of computer programs and databases on any material or electronic medium.

Attention! The status of a foreign person in this case does not matter.

VZhTS

The VZHS code designates insured persons from among foreigners who are in Russia in accordance with the norms of the Federal Law of February 19, 1993 “On Refugees”, from whose income contributions are paid by organizations participating in the Skolkovo state project.

In accordance with the Federal Law of September 28, 2010, the innovative one was created in order to attract residents carrying out activities in the field of innovative scientific and technical developments and research, as well as the commercialization of their results.

Economic entities participating in the Skolkovo project have a number of concessions in taxation and payment of other mandatory payments, including insurance premiums.

In addition, the VZhTS code is used when filing DAM for insured persons from among foreigners by organizations that are participants in projects of innovation and technology centers.

The latter, in accordance with Federal Law No. 216-FZ of July 29, 2017, refers to a set of economic entities whose work is aimed at carrying out scientific and technical activities.

These organizations also have benefits related to the payment of taxes and other mandatory payments.

VZSB

The VZHSB code is used to designate foreign citizens insured in the compulsory insurance system, who are in Russia for the period of provision of temporary asylum, for whom mandatory payments are made by non-profit organizations whose activities are aimed at medical and social services for the population, as well as the implementation of statutory goals in the field of art , culture and mass sports.

In addition, the VZHSB code in the calculation is indicated by charitable organizations that transfer insurance premiums for foreigners if they have income not related to their statutory activities.

It should be noted that these non-profit organizations must make tax payments within the framework of the simplified taxation system. This is true for all types of similar organizations.

VZhES

The code designation VZhES identifies citizens insured in the OPS and Compulsory Medical Insurance systems who, being foreigners or stateless persons, are crew members of ships registered in the corresponding Russian registry. The legal status of foreign persons designated by this code is regulated by the Federal Law “On Refugees”.

It should be noted that current Russian legislation provides for fairly strict rules regarding the minimum crew size and requirements for it.

Thus, responsible persons from among the command staff and the ship's crew must have the qualifications corresponding to their position, and the number of crew members must be sufficient to ensure that the working hours on the ship are strictly observed, and they are not allowed to be overloaded with certain duties.

Foreign citizens who are members of the crews of Russian ships have the same rights and bear the same responsibilities as citizens of the Russian Federation in accordance with the Labor Code of the Russian Federation, the Merchant Shipping Code of the Russian Federation and other legal acts.

VZhKS

This code designation is for insured citizens of foreign countries who have received temporary asylum on the territory of the Russian Federation , for whom compulsory insurance premiums are paid by organizations and companies located and duly registered in the territory of the city of Sevastopol and the Republic of Crimea.

By virtue of Federal Law No. 377-FZ dated November 29, 2014, a special legal regime operates on the territory of these constituent entities of the Federation, providing preferential taxation, as well as economic benefits for business entities. Part of the preferences in accordance with this regulatory act involves a reduction in the basic tariff for the payment of insurance premiums.

The special legal regime in the territory of Crimea and Sevastopol is valid for 25 years after the entry into force of the legal act (from January 1, 2015).

VZhTR

If the payer of insurance premiums, that is, an organization or individual entrepreneur, is a resident of a territory of rapid socio-economic development, the legal regulation of which is carried out by the norms of the relevant federal law, then he has the right to apply a preferential tariff for their calculation.

The VZhTR code is entered by such organizations in calculations for individuals who have received temporary asylum in the Russian Federation . It should be noted that the form and type of work performed by a foreigner is not of fundamental importance. The defining feature in this case is only the fact that the organization is a resident of a priority development area.

VZHVL

The VZHVL code in the calculation is assigned to citizens of persons with foreign citizenship located on the territory of the Russian Federation on the basis of the Federal Law “On Refugees”. Moreover, in their calculations it is indicated only by those organizations that are duly registered as residents of the free port of Vladivostok.

Reference! The free port of Vladivostok is not limited to just the seaport of the city of Vladivostok. It includes a significant part of the Primorsky Territory of the Russian Federation, the city of Petropavlovsk-Kamchatsky, Vaninsky and Sovetsko-Gavansky districts of the Khabarovsk Territory, the cities of Korsakov and Uglegorsk of the Sakhalin Region, as well as the city of Pevek of the Chukotka Autonomous Okrug.

Residents of the free port of Vladivostok, among other things, have the right to receive tax benefits and other economic preferences . The same applies to relaxations in the payment of mandatory payments, including in terms of insurance premiums for their employees.

VZHKL

The code designation VZHKL is given to those insured persons from among foreigners and stateless persons who have temporary asylum on the territory of the Russian Federation, for whom insurance premiums are paid by organizations registered in the Kaliningrad region of Russia.

The Kaliningrad region, due to its unique geographical location, has been a territory since 2006 that has a special legal regime that provides maximum favorable conditions for the economic activities of business entities. First of all, the creation of a special economic zone on the territory of this region is necessary to attract foreign investors, taking into account the border status of the subject of the Federation.

The special legal regime in the Kaliningrad region implies certain relaxations for organizations in terms of paying taxes and other obligatory payments.

VZHAN

The VZhAN code is assigned to insured persons who, being foreigners, have received temporary asylum on the territory of the Russian Federation. Moreover, this designation is indicated in the report only by those organizations that produce animated audiovisual products.

It should be added that the VZhAN code is assigned to foreigners who are in the country on the basis of the Federal Law “On Refugees” by organizations that not only produce animated audiovisual products, but also sell their own.

VZHAR

The designation VZHAR in the calculation submitted to the tax office in 2020 is given to persons from among foreign citizens who arrived in Russia to obtain temporary asylum, and who are crew members of ships for whom insurance premiums are paid by organizations recognized as participants in special administrative entities in the Kaliningrad region and Primorsky Krai.

VPNR

Legal entities and individual entrepreneurs indicate the VPNR code in the RSV when paying insurance premiums for their employees with whom they have an employment relationship. Moreover, this code is entered only if the employees of organizations and individual entrepreneurs themselves are citizens of foreign countries. This code designation is one of the most common.

VPIT

The VPIT code is indicated by those organizations that operate in the field of information technology and pay insurance premiums for persons who are in the country temporarily and do not have citizenship of the Russian Federation.

VPCS

Organizations that are participants in the Skolkovo project, as well as other projects to create innovation and technical centers, paying insurance premiums for foreigners, indicate the code of the insured person VPCS in the corresponding calculation.

VPSB

In this way, insured persons are identified from among citizens temporarily staying on the territory of the Russian Federation, for whom contributions for compulsory insurance are paid by non-profit organizations with a socially oriented orientation, as well as charitable foundations, provided that these NPOs use a tax regime such as a simplified taxation system.

VPES

The VPES code is indicated in calculations for persons who are foreign citizens who are members of the crews of ships registered in the relevant register, when paying contributions for compulsory state insurance for them.

VPKS

There are insured persons temporarily located in the territory of the Russian Federation, for whom contributions are paid by organizations conducting their main activities in the territory of Crimea and the city of Sevastopol.

VPTR

The VPTR code is indicated by organizations that were residents of territories of rapid socio-economic development when submitting payments for citizens of foreign countries.

VPVL

This code is assigned to insured persons from among foreigners for whom contributions are paid by residents of the special economic zone of the free port of Vladivostok.

VPKL

The code is indicated in calculations when paying contributions for compulsory insurance of foreign citizens by economic entities registered in the Kaliningrad region.

VPAN

The VPAN code is entered in the DAM as a designation of the category of payers from among foreigners by organizations whose field of activity is the production and sale of animated audiovisual products.

VPAR

The VPAR code is prescribed in reports to designate the category of citizens of foreign states temporarily staying in the territory of the Russian Federation from among the crew members of sea and river vessels of the organization who are residents of special administrative regions in the territory of the Kaliningrad Region and Primorsky Territory.

Rights and obligations of participants in the insurance system

The activities of the insurer are regulated by Law N167-FZ, according to which the rights of the insurer:

- conduct inspections of policyholders and demand that identified violations be eliminated;

- exchange confidential information with the tax office;

The insurer’s responsibilities are to establish the fact of pension payments, their recalculation and payment. For all obligations of pension funds, the state acts as a guarantor to citizens.

The rights of policyholders include:

- information support from the insurer directly on pension insurance issues;

- payment of additional contributions to the funded part of the pension for their employees;

The responsibilities of the policyholder are to correctly register citizens, as well as timely transfer of pension insurance contributions to the pension fund.

Rights of insured persons:

- access to data on insurance premiums transferred for him;

- implementation of insurance coverage from the budgetary funds of the pension fund in a decent form;

- freely manage pension savings.

The responsibilities of the insured persons include the timely provision of documents to the insurer, which contain correct data. Based on this data, pension benefits are assigned and paid. If the insured persons experience any changes that may affect pension payments, they are required to provide this information to the insurer.

Data in section 3 of the new calculation

The section of the DAM report form is filled in with information regarding the personalized data of employees, that is, insured persons.

Thus, subsection 3.1 states the following:

- Full name of the person;

- TIN;

- SNILS;

- Date of Birth;

- floor;

- details of the identity document.

Subsection 3.2 must contain information about the amounts of payments that were made to pay insurance premiums for a specific insured person.

So, here is the following:

- amount of payments (per month);

- basis for calculating insurance premiums.

In addition, if necessary, fill in information about the payment of funds at an additional tariff, if it is accrued.

In the same subsection, payer category codes must also be indicated. Moreover, they must be registered for each period in which the insured person received income.

Changes in personalized accounting

The responsibilities of the policyholder, as before, include the monthly provision of individual information on insured persons to the Pension Fund of the Russian Federation. This information is formed based on the data maintained by the organization’s accounting department, as well as on the basis of personnel records. Since 2021, the main insurance premiums have been transferred to the tax authority, however, the main control of personalized accounting continues to be exercised by the Pension Fund of the Russian Federation. In particular, the Pension Fund continues to accept reports.

Those. Now you will have to submit a report on insurance premiums to both the Pension Fund and the tax authority.

Changes-2017

In 2021, the Federal Tax Service will take under its jurisdiction all issues related to insurance premiums, and, naturally, to pensions. This change in responsibility initiated significant changes in the filing deadlines and presentation of personalized accounting for employers. Legislative basis – the entry into force on January 1 of the Federal Law of July 3, 2016 No. 250-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain legislative acts (provisions of legislative acts) of the Russian Federation.”

Submission of the report to the Pension Fund and the Federal Tax Service

The SZV-M form has undergone major changes in individual accounting. This form is also submitted to the Pension Fund of the Russian Federation, monthly, but not before the 10th day of the month following the reporting month, as before, but before the 15th. In particular, the Pension Fund must submit information on the insurance experience of the insured persons. This information is submitted once a year, before March 1 of the year following the reporting year.

And no later than 20 days after the end of the quarter, registers of insured persons for whom additional insurance contributions have been paid for the funded part of the pension are submitted. In order to prepare a correct report, you need to use a specially prepared program, which is posted on the Pension Fund of Russia website; the check, as before, should be carried out using the CheckPFR program of the latest available version.

Let's now consider what kind of reporting now needs to be submitted to the tax authority. You only need to submit a quarterly report on insurance premiums to the Federal Tax Service by the 30th day of the month following the reporting period.

| Name | Organ for presentation | Deadlines |

| Unified calculation of insurance premiums (including individual information) | Inspectorate of the Federal Tax Service | Until the 30th day of the month following the reporting period |

| SZV-M | Pension Fund | Until the 15th day of the month following the reporting month |

| Personalized accounting information for the year | Pension Fund | Until March 1 of the year following the reporting year |

Basic forms when filling out individual accounting information (NZP resolution dated January 11, 2017):

- “Information on the insurance experience of the insured persons (SZV - EXPERIENCE);

- “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV-1)”;

- “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”;

- “Information on earnings, income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).”

Why is this type of accounting needed?

All employees of an organization who have received insurance from the Pension Fund of Russia have an individual personal account there, the number of which (SNILS) is permanent. The general part of this account contains personal data and information regarding work experience.

Periodic changes are possible in this data: a person moves, improves his qualifications and, accordingly, his salary, and sometimes changes his personal data. Therefore, information must be constantly monitored and, if necessary, updated.

Therefore, the employer is obliged to submit relevant information about all its employees to the supervisory and control authorities at the frequency specified in legislative acts.

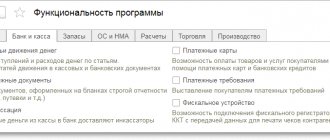

Reporting Methods

Currently, you can submit a report either by printing it on paper or electronically. However, there are some restrictions. So, if the average headcount of an organization or individual entrepreneur is equal to 25 people or less, then the report on insurance premiums can be submitted on paper, otherwise the report is submitted only in electronic form.

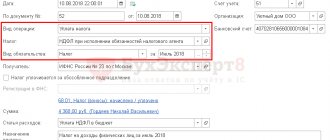

Example of filling out the SZV-M form

It is necessary to pay attention to the correctness of filling out the form; currently it is permissible not to indicate only the middle name of the insured person and the Taxpayer Identification Number (TIN), if the employee did not provide it.

The policyholder's details are filled in:

- name of the organization or individual entrepreneur (briefly) that provides the information;

- registration number of the organization or individual entrepreneur;

- TIN and checkpoint (if there is one) of the organization or entrepreneur;

- reporting period – serial number of the reporting month and reporting year;

- type of form, depending on whether the form is being submitted for the first time or repeatedly;

- full last name, first name and patronymic of the person by whom the form is being filled out, INN (if available) and individual SNILS number.

What sections should be included in the zero contribution sheet?

In the absence of payments in favor of individuals under employment contracts, civil process agreements, copyright, etc. and, accordingly, in the absence of digital indicators for insurance premiums, policyholders must include the following sections in the calculation:

- title page;

- Section 1 indicating code 2 in the “Payer Type” field - without any attachments to it;

- section 3 with zeros and dashes.

This is directly indicated in the order of filling out the calculation (clause 4.2) and is confirmed by the Ministry of Finance (see letter dated 10/09/2019 No. 03-15-05/77364).

Until 2021, there were more mandatory sheets. Subsections 1.1 and 1.2 of Appendix 1 to Section 1 and Appendix 2 to Section 1 were also required (letters of the Ministry of Finance dated April 16, 2019 No. 03-15-05/27074, dated February 13, 2019 No. 03-15-06/10549, Federal Tax Service dated November 16. 2018 No. BS-4-21/ [email protected] ). Now you can do without them.

The title page contains the details of the policyholder (TIN, KPP, name/full name, OKVED code, telephone numbers), and the tax authority accepting the settlement (code). It also reflects whether the original form or the corrective one is submitted (if necessary, the adjustment number), the reporting period and the year to which it relates.

All data is certified by the signature of an authorized person indicating the date of preparation or submission of the report.

Section 1 with all the subsections and appendices we have indicated will contain zeros on all lines with summative and quantitative indicators and dashes on the remaining familiarities. It is best to register the BCC in the fields provided for this in order to avoid problems with the generation of electronic reporting.

For a sample of filling out the zero ERSV, see ConsultantPlus, having received a free trial demo access to the reference and legal system using the link below:

We will tell you what information needs to be entered into section 3 of the zero calculation in the next section.

Sample filling

To determine which sections of the report to fill out, use our cheat sheet.

How to fill out the EFA-1 report for 2021:

| Main report | Main report view | Chapter | ||||

| 1 | 2 | 3 | 4 | 5 | ||

| SZV-STAZH | Initial, contains information about persons entitled to early pension assignment | + | + | + | — | + |

| In all other cases | + | + | + | — | — | |

| SZV-ISH | Contains information about persons entitled to early pension assignment | + | + | + | + | + |

| In all other cases | + | + | + | + | — | |

| SZV-KORR | Corrective | + | + | + | — | — |

| Canceling | + | + | + | — | — | |

| Special | + | + | + | + | — | |

Since the SZV-KORR and SZV-ISH reports are used less and less, we will provide a sample of filling out the inventory for the SZV-STAZH form.

What is the liability for failure to submit a zero report on insurance premiums?

In general cases, failure to submit or delay in sending a contribution calculation may result in the imposition of various sanctions by the tax authorities. But what happens if you don’t submit a zero calculation on time? Will a person be able to do without a fine in this case, since there are no charges involved? Answer: no, he can’t. The fine will be mandatory, the tax authorities will simply impose it in the minimum amount - 1000 rubles, as provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation.

Taking into account the above, an organization that does not pay any remuneration to individuals, like all others, must report to controllers on time. In addition, if you are more than 10 days late in submitting your report, the tax authorities will block the organization’s account—they have the right to do so.