Source/official document: Resolution of the Board of the Pension Fund of the Russian Federation 01/16/2014 No. 2p Where to submit: To the Pension Fund at the place of residence, from January 1, 2021 - to the tax office Delivery method: Paper or electronic Frequency of delivery: Once a quarter at the end of the 1st quarter, half a year, 9 months and one year. Must be submitted by: A paper copy of the report must be submitted no later than 02/15/2017. For electronic reporting, the deadline for submission is slightly extended; it can be submitted no later than 02/20/2017. Penalty for late submission: The minimum fine is 1000 rubles, and the maximum is 30% of the amount of insurance payments accrued over the last 3 months.

Document name: Form RSV-1 2016 Format: xls Size: 245 kb

Print Preview Bookmark

Save to yourself:

Pass RSV-1 online and correctly

Calculation form for 2021

Since 2021, the administration of insurance premiums has come under the control of the Federal Tax Service. This is provided for by Federal Law dated 07/03/16 No. 243-FZ and Federal Law dated 07/03/16 No. 250-FZ.

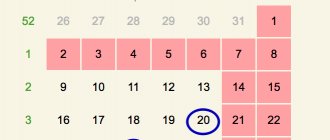

In connection with such a transfer, from 2021, contribution payers will begin to report not only to the funds, but also to the tax authorities. For these purposes, information on insurance premiums was combined into a single calculation of insurance premiums, approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. This calculation, in fact, contains information from forms 4-FSS, RSV-1 and RSV-2. Persons making payments to individuals submit a new calculation for insurance premiums no later than the 30th day of the month following the expiring year or reporting period. For the first quarter of 2021, this form must be submitted no later than May 2. See “A new form for calculating insurance premiums has been registered since 2021.”

However, there is no need to use the new form of calculation of insurance premiums for reporting for 2021. To report for 2021, policyholders must use the RSV-1 PFR form, approved by Resolution of the PFR Board dated January 16, 2014 No. 2p.

In addition, keep in mind that the RSV-1 calculation for 2021 must be submitted to the territorial division of the Pension Fund of Russia, and not to the tax office.

RSV-1 section 1

Section 1 is mandatory for all policyholders. It is handed over, including by those whose calculation does not contain indicators, that is, the activity was not carried out or there were no payments to employees. In this case, dashes are placed in place of the indicators.

Section 1 summarizes the indicators of all other sections of the RSV-1, including the amounts of contributions not only to the Pension Fund, but also to the Compulsory Medical Insurance Fund, so it is better to fill it out last, when all other parts of the report are ready.

Section III of the Procedure for filling out the RSV-1 PFR form (approved on January 16, 2014 by resolution of the PFR Board No. 2p) contains the relationships between the lines of section 1 and the indicators of other sections that must be observed when preparing the report. Let's analyze filling out section 1 for each of its lines:

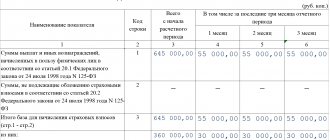

Line 100 shows what debt or overpayment of premiums was owed by the policyholder at the beginning of the year. The indicators of all columns of line 100 of the report for 2021 must correspond to the indicators of the same columns of line 150 of the report for 2015.

Please note that if in the report for 2015 in column 4 line 150 there was an overpayment, then in the report for 2021 in column 3 line 100 we take the sum of the values in columns 3 and 4 lines 150 for 2015, while in column 4 there cannot be minus value.

Line 110 – contributions accrued for the entire 2016 are equal to the sum of the indicators in line 110 of the RSV-1 for 9 months of 2021 and line 114 of the annual report. Also, line 110 must be equal to the amount of contributions from sections 2.1, 2.2, 2.3 and 2.4 of the annual report. If during the year the right to apply a reduced tariff arises or is lost, these ratios will not be met.

Lines 111, 112, 113 reflect contributions for the last three months: the period October-December for the DAM-1 report for 2016.

- The indicator in column 3 of each of these lines is equal to the sum of lines 205 and 206 of subsection 2.1, in columns 4, 5 and 6, respectively.

- Column 6 for each line corresponds to the sum of lines 224 of subsection 2.2, column 4, 5 or 6, and lines 244, 250, 256,262, 268 of subsection 2.4, column 4, 5 or 6 with base code “1”.

- Column 7 for each line: the sum of lines 234 of subsection 2.3 (column 4, 5 or 6), and lines 244, 250, 256, 262, 268 of subsection 2.4 (column 4, 5 or 6) with base code “2”.

- Column 8 reflects contributions to compulsory medical insurance; its value for each line corresponds to the value of lines 214 (column 4, 5 or 6) for all tariffs.

Line 114 summarizes the indicators of lines 111, 112 and 113.

Line 120 reflects recalculations and is filled in in the following cases:

- in the reporting period, an audit of the Pension Fund of the Russian Federation revealed violations, and additional amounts of contributions were accrued according to the act, or excessively accrued insurance premiums were identified,

- the policyholder himself identified incomplete data reflection or found errors leading to an underestimation of the taxable base and contributions for past periods.

- In columns 3, 4 and 5, line 120 is equal to the value of columns 6, 8 and 10 in the final line of section 4.

- In column 6, line 120 is equal to the value of column 11 in the final line and the sums of all lines in column 13 with the base code “1” of section 4.

- In column 7, line 120 is equal to the value of column 12 in the final line and the sums of all lines in column 13 with the base code “2” of section 4.

Line 121 – from line 120, the amount of recalculation of contributions accrued from exceeding the maximum base is allocated. In 2016, the base for contributions to the Pension Fund at a rate of 22% is 796,000 rubles, everything above this amount is subject to a 10% tariff. There is no base limit for contributions to the Compulsory Medical Insurance Fund in 2021.

Columns 3 and 4 correspond to columns 7 and 9 on the final line of section 4.

Line 130 sums the values of lines 100, 110, and 120 of section 1.

Line 140 reflects the payment of contributions from the beginning of the year. Its value is equal to the amount of contributions transferred in the previous reporting period and for the last quarter, that is, the sum of lines 140 of the calculation for 9 months and 144 of the annual calculation. In line 140, the indicator in column 4 cannot exceed the indicator in column 4 of line 130.

Lines 141, 142 and 143 are the amounts paid in the last quarter. In calculations for 2021, we reflect payment in October, November and December, respectively.

Line 144 summarizes the contributions paid for the last quarter on lines 141, 142 and 143.

Line 150 summarizes all of Section 1, reflecting overpayments or unpaid contributions at the end of the year.

To do this, subtract line 140 from line 130. In this case, column 4 of line 150 cannot be with a minus if there is no negative value in column 4 of line 120.

If you fill out the wrong form

As 2021 begins, there may be some confusion when using the contribution reporting form. And it is possible that some accountants will fill out the calculation of insurance premiums for 2021 using a new form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. However, keep in mind that the tax office will not accept the calculation of contributions for 2021 on the new form. The fact is that the Federal Tax Service simply does not have the authority to accept and verify calculations for 2021. And the new form of unified calculation is applied only from reporting for the 1st quarter of 2017.

Accordingly, another situation is possible: the accountant will submit to the Pension Fund a calculation of insurance premiums using a new form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. The Fund, in turn, will also refuse to accept the settlement. Therefore, it is important to take into account the calculation of insurance premiums for 2021:

- must be submitted using the “previous” form RSV-1, approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551;

- RSV-1 for 2021 is submitted exclusively to the Pension Fund of Russia (despite the fact that since 2021, insurance premiums are controlled by tax authorities).

Read also

03.11.2016

Why are monthly reports introduced?

Accountants may have a reasonable question about why the Pension Fund decided to collect personalized information about employees on a monthly basis, given that this information (except for the Taxpayer Identification Number) is submitted as part of the quarterly report RSV-1. To clarify this issue, let us recall the current procedure for calculating the old-age insurance pension.

In general, the insurance pension can be determined using the following conditional formula (Article , Law No. 400-FZ):

Pension amount = PB x C + PV

PB - the sum of all pension points (the law uses the term “individual pension coefficient”); C - the cost of one pension point on the day the pension was assigned; FV - fixed payment.

The value of the pension point is reviewed twice a year. As of February 1, this indicator is indexed to the inflation rate for the past year, and from April 1, it is established by the law on the PFR budget for the next year (clauses 21 and 22 of Article 15 of Law No. 400-FZ). From February 1, 2016, the cost of a pension point will be increased by a factor of 1.04 (clause 1, article 5 of the commented Law No. 385-FZ).

As for the fixed payment to the insurance pension, it also increases annually from February 1 by the consumer price growth index for the past year (clause 6 of Article 16 of Law No. 400-FZ). From February 1, 2021, the indexation coefficient of the fixed payment will be 1.04 (clause 1, article 6 of the commented Law No. 385-FZ). In addition, the government of the Russian Federation has the right to decide on additional indexation of the size of the fixed payment from April 1 (clause 7 of article 16 of Law No. 400-FZ). For more information about the composition of the insurance pension, see “Pension 2015: how much you can earn in old age.”

From February 2021, working pensioners (including those registered under civil law contracts) will receive an insurance pension without taking into account planned indexations of the value of the pension point and a fixed payment to the insurance pension. This is stated in the new Article 26.1 of Law No. 400-FZ. It is the fact that pensioners are working that Pension Fund employees plan to track based on monthly reporting, which policyholders will submit starting in April 2021. At the same time, as follows from the commented law, information will have to be provided for all employees, regardless of their age and whether they have the right to a pension.

Note that the “freezing” of planned indexations does not cancel the possibility for working pensioners of increasing insurance pensions from August 1 based on pension points earned in 2015 (clause 3, part 2, article 18 of Law No. 400-FZ). That is, only indexation is “frozen”, which is carried out by the state and which is not related to how many points the pensioner “earned” over the past year (for more information about pension indexation, see “On the strategy for the long-term development of the pension system of the Russian Federation (Tatiana Bandyuk’s blog)”) .

Will the pensions of individual entrepreneurs be indexed?

The PFR website states that if a pensioner belongs to the category of self-employed people, that is, is an individual entrepreneur, notary, lawyer, etc., then such a pensioner will be considered working if he is registered with the PFR as of December 31, 2015.

Elena Kulakova, an expert at “Kontur.Otchet PF” (on the Online Accounting forum she writes under the nickname KEGa) believes that Pension Fund officials could equate individual entrepreneurs who receive a pension with working pensioners based on the norm of Article 26.1 of Law No. 400-FZ. Paragraph 1 of this article states that indexation is not due to pensioners who carry out not only work, but also “other activities during which they were subject to compulsory pension insurance in accordance with Federal Law dated December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance” In Russian federation". And in paragraph 1 of Article 7 of the commented Law No. 385-FZ it is noted that the fact of carrying out other activities is established on the basis of information about registration as an insurer in the Pension Fund of the Russian Federation.

According to Article 6 of the Federal Law of December 15, 2001 No. 167-FZ, policyholders for compulsory pension insurance are, among other things, individual entrepreneurs. Thus, we can conclude that the planned indexation of insurance pensions is “frozen” for all retired entrepreneurs who will be registered with the Pension Fund as policyholders on December 31, 2015. We also note that although in the message on the Pension Fund website entrepreneurs are mentioned only as self-employed people (along with lawyers, notaries, etc.), this does not mean that the ban on indexation of insurance pensions applies only to individual entrepreneurs who do not have employees. Retired entrepreneurs who are employers are also deprived of such indexation. An individual entrepreneur (with or without employees) does not have to submit monthly information to the Pension Fund.

Note that if an individual entrepreneur is registered with the Pension Fund, but does not conduct business activities and does not receive any income from it, then he still will not be able to count on indexation of the insurance pension. The right to indexation will arise only after the entrepreneur is deregistered with the Pension Fund of Russia (remember that the fund deregisters an individual entrepreneur after he loses this status and a record about this appears in the Unified State Register of Individual Entrepreneurs). At the same time, it is most likely not necessary to submit an application for termination of activities using the form posted on the fund’s website. However, this cannot yet be stated unequivocally.

Section 2: Amounts of payments and contributions

Section 2 summarizes the amounts of accrued remuneration (payments) and insurance premiums. It consists of the following subsections:

- 2.1 “Calculation of insurance premiums according to the tariff” - must be generated by everyone;

- 2.2 “Calculation of insurance premiums at an additional tariff” - group if there are workers employed in hazardous industries;

- 2.3 “Calculation of insurance premiums at an additional rate” - generalize if there are workers employed in heavy production.

Section 2 also reflects temporary disability benefits and “children’s” benefits (at the birth of a child, for registration in the early stages of pregnancy, for pregnancy and childbirth and for caring for a child up to 1.5 years old). The amount of benefits paid in subsection 2.1 of the calculation for the 4th quarter of 2021 is shown in lines 201, 211 of subsection 2.1 (as part of non-taxable payments). However, if your region is participating in the FSS pilot project, then benefits are not required to be reflected in Section 2. See “Participants in the FSS pilot project.”

Here is an example of filling out Section 2.1, which is mandatory for everyone. Please note: if from January to December 2021 insurance premiums were calculated at only one rate, subsection 2.1 must be completed once. If contributions were calculated at different rates, create a subsection for each rate.

Control ratios

Next, we present the control ratios on the basis of which the programs of the Pension Fund of the Russian Federation will begin to check the calculation of DAM-1 for the 4th quarter of 2016.

| Section 1 value | What is equal to |

| Line graphs 100 | Columns of line 150 of section 1 of RSV-1 for 2015 |

| Line 110 column 3 | The sum of lines 205 and 206, column 3 of all subsections 2.1 |

| Line 110 column 8 | The sum of lines 214 columns 3 of all subsections 2.1 |

| Line 120, column 3 (if this line is filled in) | Line “Total conversion amount”, column 6, section. 4 |

| Line 120, column 8 (if this line is filled in) | Line 120, column 8 (if this line is filled in) |

Next, you can complete the RSV-1 calculation for the fourth quarter of 2016.

Read also

22.06.2017