What are the regulations governing the letting of real estate?

The main legal act regulating the legal relations in question will be the Civil Code of the Russian Federation. Some of the rules related to the topic are stated in the following acts:

- Tax Code of the Russian Federation.

- Federal Law “On State Registration of Real Estate”.

The last of these documents can be called “accompanying”; they reveal details:

- How does the registration process work?

- what percentage of tax is established when receiving income from the rental of real estate.

But the largest number of rules governing rental issues is contained in the Civil Code of the Russian Federation .

You can find out what the lease of non-residential premises is and how transactions are formalized in this material.

Individual as a lessor?

After the property owner is convinced that he does not face any obstacles due to the lack of individual entrepreneur status, and he is ready to start searching for his first tenant, similar doubts may arise and slow down the process again, but not about himself, but about the other party to this agreement.

If his position is absolutely legal from the point of view of the law, then what requirements are imposed by the civil code on his partner? Does he have the same freedom regarding his status, or can only a legal entity registered as an individual entrepreneur acquire the right to use someone else’s premises? What else do you need to know about the features of this type of legal relationship?

Can an individual be a lessor?

As noted, ownership can be expressed in the disposal of property. That is, the Civil Code of the Russian Federation does not prohibit individuals from renting out non-residential premises.

Tenants can be:

- individuals;

- legal entities;

- municipalities and the state, under certain conditions.

In a word – almost all subjects of civil law. Meanwhile, it must be remembered that activities related to the systematic receipt of profit are regarded by the state as entrepreneurial . In this case, the entity that is engaged in business must be registered with the tax authorities in a certain way:

- as an individual entrepreneur;

- as a founder of a legal entity.

Theorists put forward the opinion that leasing non-residential premises can be called entrepreneurship only in cases where:

- the contract is concluded for a long term;

- there is an established circle of contractors using non-residential premises.

In practice, courts are not inclined to go into detail. If the competent authorities become aware that an individual. a person rents out his non-residential premises to someone for money, then they try to bring this person to justice : administrative or even criminal, if, say, major damage is caused to the state. Thus, if you plan to make a living by renting out real estate, then it is better to register as an individual entrepreneur.

However, many successfully engage in rental activities illegally. Nothing new: “In Russia, the severity of laws is compensated by the optionality of their implementation.” If the tax authorities are interested in the lessor, then he will need to prove that renting out real estate is a special case. Making a profit on an ongoing basis was not part of the plan.

Where to keep workers without an office

Do I need an office for an individual entrepreneur if he has employees? Many entrepreneurs specializing in providing services do without office space. Some private specialists register as an individual entrepreneur only to gain experience. Working from home has become very common today.

Chapter 49.1 of the Labor Code on remote workers prescribes the conditions under which workers who carry out their activities from home can be hired. In order to legally formalize such employment, experts recommend indicating in the contract that this is a remote worker.

Also, individual entrepreneurs have the right not to enter into employment agreements with their employees, but to hire them as temporary or one-time contractors and conduct business relations as with counterparties. For example, if an individual entrepreneur is engaged in advertising on the Internet, then he does not necessarily need to hire programmers or specialists in the field of Internet marketing.

For each order received from clients, it is enough to find an appropriate specialist, who can later be registered as a counterparty. But hired specialists need to be registered. Expenses for employees will be taken into account by the tax service only if they are documented.

When carrying out repair and construction work, an individual entrepreneur can also use the labor of specialists without having an office. But if the business activity is quite extensive, then maintaining office equipment and documentation at home will be problematic.

On video: Official freelancing

Where can a “physicist”-landlord find a client?

You can use standard methods of searching for clients:

- place an ad in a newspaper;

- post information on social networks;

- publish information about the availability of vacant non-residential premises on popular bulletin boards: “Avito”, “Yula” and so on.

You can post advertisements at bus stops and entrances. The degree of effectiveness will, of course, vary. In general, finding clients is more a matter of marketing rather than jurisprudence. You need to have a good idea of which individuals are looking for non-residential premises.

Since 2015, and maybe earlier, the topic of “mini-warehouses” has become popular, when people store things they don’t really need, which they hate to throw away or can only be used in season, not on the balcony, but in some kind of “storage cell” . Someone may need a room to fulfill their creative needs. For example, a person may want to start an unofficial club for radio-controlled model enthusiasts.

You need to understand why physical. a person may want to rent the premises. From here, draw conclusions about where you can find potential clients.

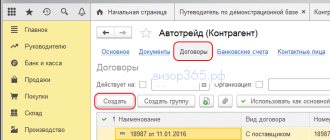

You can shift the task of finding a tenant onto the shoulders of a realtor . To do this, you need:

- contact the appropriate agency;

- enter into a contract.

Judging by current practice, the owner of non-residential premises does not lose anything in this case. As a rule, realtors collect money from tenants, not from landlords .

On the other hand, people who want to rent non-residential premises try to find an option without intermediaries so as not to pay extra money. Therefore, if a realtor takes up the matter, there is a risk that they will be looking for a client for a very long time.

How to choose?

If there is no end to those wishing to rent a property, then you can select one or more tenants using the following criteria:

- The person’s plans must include harmless activities that he wants to carry out in the rented premises. Obviously, it is better to choose a tenant who will store potatoes on the premises than one who plans to hold music rehearsals twice a week.

- The tenant must be solvent. For example, one is ready to pay rent 3-4 months in advance. Another asks to wait even with a small deposit. Obviously, you need to choose the first candidate.

- Subjective opinion: it is worth concluding an agreement with a tenant who is always in touch and lives nearby. It happens that the owner urgently needs to get into his non-residential premises, but the tenant has left somewhere, did not leave the keys, and does not answer the phone.

Responsibility of the parties

The State Code does not impose liability on the landlord with regard to activities on his personal space after transferring it for use to another individual or legal entity.

Even if the tenant uses the premises provided to him on an illegal basis, only he and other subjects of illegal activities will bear all the penalties . In such situations, the rightful owner is exempt from all charges.

In the case of absolute non-involvement in the crimes of temporary owners in the area they rent, the very identity of the official manager of this premises is not in danger.

How to create a favorable price for the parties?

The Civil Code of the Russian Federation gives serious freedom to the parties to transactions on many issues, including the issue of determining the price of the contract. Thus, the amount of the rent will depend entirely on how the parties determine it . The landlord can name his price. Tenant - agree, refuse or ask for a price reduction.

Obviously, when it comes to pricing, it is necessary to focus on the market. If you set the rent too high, it will be difficult to find a landlord. Even if someone agrees to pay a high price, after a while, this person will look for ways to terminate the contract in order to rent a similar premises cheaper.

If the price is too low, there will be no end to customers. But you won’t be able to earn much. Therefore, it seems best to set the price so that it is slightly lower than that of competitors.

Look around the room

Check what:

— Inspect the floor, walls and ceiling. Look for cracks and paint marks.

— Turn on the air conditioners. Check that they work and do not stall under a layer of dust.

— Connect to Wi-Fi and check the connection speed.

— Look at the outlets and consider whether extension cords will be needed. Imagine how to arrange tables and seat employees.

- Meet your neighbors. Find out what they do: perhaps they organize holidays or acting classes, but silence is important to you. Ask about the landlord.

Tell your landlord's representative about any shortcomings. Until everything is fixed, do not enter the premises - according to the law, responsibility will be on you - Art. 612 of the Civil Code of the Russian Federation. The formal way is to write down the deficiencies in the act and name the deadline for elimination.

Example: the tenant did not report the defects immediately

The company rented an office in a business center. We inspected the premises in a hurry, signed the deed and moved in. The heat came in June. It turned out that the air conditioners did not work. The tenant asked to have the equipment repaired, but the administration refused.

The company asked the court to terminate the contract. The court refused: when the tenant took over the premises, he should have noticed the problem and written about it in the deed. Once he signed the act, which says that there are no claims, there is nothing to demand from the court.

Case No. A40-176187/18.

How can the owner conclude an agreement?

The algorithm of actions is approximately the following:

- We need to find a client. This has already been discussed in this article.

- It is necessary to make a presentation of the premises.

Attention: One of the grounds for terminating a lease agreement is the identification of defects in the property that the tenant could not notice during inspection, but which led to difficulties in using the premises.Therefore, it is better to tell about all the defects of the property at once.

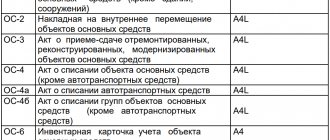

- Legal examination of documents.

The tenant must present a passport. Theoretically, in practice it is unlikely that the lessor may require a certificate from a psychoneurological and narcological dispensary to ensure that the counterparty is legally competent. The landlord must confirm that the property belongs to him. To do this, you must present legal documents. You also need to prove that third parties do not have the right to non-residential premises. A fresh extract from the Unified State Register of Real Estate provides answers to all questions. - Next, the parties discuss all the terms of the transaction, put their signatures under the text of the document and the transfer deed.

- The last stage is state.

registration of the agreement, in accordance with the requirements of Art. 609 of the Civil Code of the Russian Federation. Meanwhile, registration is not always necessary. According to the position of the Supreme Arbitration Court, promulgated at the beginning of the 2000s, it is not subject to the state. registration of a lease agreement for buildings and structures, if it is concluded for a period of up to a year. The court expresses the following opinion: non-residential premises are not a building, but it is an object that is directly connected with it. Therefore, registration is also not necessary for the above-mentioned duration of the contract.

The position is controversial, but already generally accepted.

Read more about how to correctly conclude a lease agreement for non-residential premises in our article.

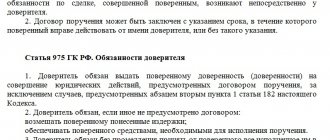

What do the parties need to consider when concluding a transaction?

The most important thing is to write down all the necessary points regarding the rules for using non-residential premises. Very often, disputes arise because some points are not specified. For example, conflicts arise regarding the implementation of repairs, payment or non-payment for the cost of inseparable improvements made, the list of works or actions that can be carried out on the premises.

Content

The document must reflect the following information:

- Passport details of the parties and their representatives, if the transaction is not executed in person.

- Description of the property, indicating all its characteristics, including area and address.

- Information about the rental period. This will be discussed further below.

- Amount of rent, payment procedure.

- Additional terms and conditions.

Validity

According to Art. 610 of the Civil Code of the Russian Federation, if the lease agreement does not indicate its validity period, then it is considered to be indefinite . However, such an agreement is not subject to registration.

How long can the agreements be valid for?

- Up to 12 months – no need to contact Rosreestr or MFC.

- Over 12 months - you need to go through the procedure of state registration of the lease agreement.

The most convenient option is to submit documents to the nearest MFC.

Tax

In accordance with Art. 224 of the Tax Code of the Russian Federation, the income tax for individuals - citizens of the Russian Federation in the country is 13% . Some people think it’s not enough, others think it’s a lot. From 10,000 rubles you need to give 1,300 rubles to the state.

There is an opinion that it is better to rent out non-residential premises as an individual entrepreneur. The tax will indeed be less. For example, if you work on a patent taxation system, you can give the state an amount calculated using the following formula:

Patent = 6% × PD/12 × M , where:

- PD - estimated income for the year.

- M is the number of months for which a patent is issued.

But there are also disadvantages. An individual entrepreneur must make regular contributions to the pension fund, Social Insurance Fund and Compulsory Medical Insurance Fund. The amount turns out to be quite large - more than 20 thousand rubles.

We recommend that you familiarize yourself with other useful materials on our website about renting non-residential premises. Read about how non-residential premises are rented by a legal entity and the specifics of renting from an individual entrepreneur.

Coordinate repairs with the landlord

Do not repair anything before signing the contract. What if the landlord, according to the contract, does not pay for inseparable improvements or refuses to work with you at all.

After signing the contract and the acceptance certificate for the premises, obtain the landlord’s consent to make repairs. It is important to receive compensation for everything that remains in the premises after you. The best thing is to agree on the design project, redevelopment project and estimate. Let the landlord review them against his signature. In all other cases, the lessor has the right to refuse compensation - Art. 623 Civil Code of the Russian Federation.

There are two cases:

— Repair costs reduce the rent.

— The lessor pays after termination of the contract.

In any case, keep receipts and contracts with contractors.

Deal Features

At all stages of drawing up a lease agreement, individuals and legal entities have equal rights, but when the moment of mandatory deduction to personal income tax arrives, the difference finally becomes noticeable. The amount of taxation is determined as follows:

- if you have an officially registered individual entrepreneur status, the amount will be 6% of the revenue received;

- in cases where the landlord is an individual not registered as an individual entrepreneur, the demand from him will be more than twice as high, namely: 13%.

In conclusion, it is worth noting that obtaining permission for a real estate lease transaction does not mean exemption from close attention to the use of its area in the future. Even if the terms of the proposed cooperation are frankly questionable, the chances of approval for its legal implementation are quite high.

For example, the object of the agreement is non-residential premises, but the tenant does not have the status of an individual entrepreneur and, accordingly, the rights to commercial activities. Despite the absence of complaints at the stage of formalizing the agreement, supervisory authorities may become suspicious of the honesty of such persons, which in turn will lead to more frequent inspections on their part, and if they identify a violation, they will also impose penalties of varying degrees of severity.

Graduated with honors from the Faculty of Law. Since 2006, she has specialized in controversial issues related to inheritance and donation.

If you have questions in the field of accounting, taxation, law or personnel and you need an answer based on the legislative framework with links to primary sources, feel free to contact us. Experienced practitioners will prepare a response with justification and conclusions regarding your question.