Currently, overpayments are offset only for taxes of one type. This means that overpayments on federal taxes can only be offset against federal taxes, on regional taxes - on regional taxes, and on local taxes - on local taxes. Which taxes relate to federal, regional and local are indicated in paragraph 7 of Art. 12 Tax Code of the Russian Federation, art. art. 13-15 Tax Code of the Russian Federation.

As for the return of overpayments, at present, in order to receive money into a current account, it is enough not to have tax debts of the same type.

To what tax payments from October 1, 2021 can an overpayment of tax be offset?

You can send overpayments of taxes (clauses 4, 5, Article 78 of the Tax Code of the Russian Federation):

- towards upcoming tax payments;

- to pay off debts on taxes, penalties, and fines.

It can be offset against any tax, regardless of whether it is federal, regional or local. It can also be offset against penalties and fines related to any type of tax (Clause 1, Article 78 of the Tax Code of the Russian Federation).

The exception is personal income tax. Its overpayment cannot be offset against future personal income tax payments. But you can apply such an overpayment towards future payments for other taxes. Basis - clause 1, 14 art. 78, paragraph 9 of Art. 226 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated 02/06/2017 N ГД-4-8/ [email protected] (we believe that these clarifications can be used with the amendment that after the repeal of paragraph 2 of clause 1 of Article 78 of the Tax Code of the Russian Federation from 01.10. 2020 for offset it is not required that the type of offset taxes match).

If the circumstances of tax calculation have changed

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Actual circumstances related to the calculation of tax may change: price, shipment volume, etc. This often happens in construction: the volumes and prices of work specified in the acts may change even after several years.

The reason for this may be either the settlement of disputes between the customer and the contractor, or the completion of construction if it has been delayed.

How to offset tax overpayments

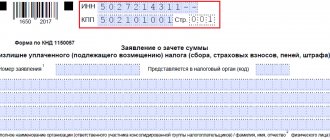

To offset the overpayment against future payments, submit an application to the inspectorate in the approved form (clause 4 of article 78 of the Tax Code of the Russian Federation).

Application for offset of tax overpayment sample

We recommend that you check your data with the tax authority before submitting an application to offset the overpayment. To do this, you can request a certificate of the status of settlements with the budget or a reconciliation report. The fact is that if the inspection reveals discrepancies with the amounts that you indicated in the application, it will still offer to carry out a reconciliation first.

If the overpayment arose due to an error in the declaration, then first submit an updated declaration in which the error was corrected (clause 1 of Article 81 of the Tax Code of the Russian Federation). After that, submit an application for credit. The inspectorate will offset the overpayment to pay off arrears of taxes (penalties, fines) independently.

However, you can submit an application for offset in this case yourself (clause 5 of Article 78 of the Tax Code of the Russian Federation).

Where does the overpayment come from?

Overpayment can occur for various reasons:

- Error when calculating tax. Such mistakes, as a rule, are made by taxpayers who keep their own records: they incorrectly calculated the tax base, forgot to apply tax deductions or benefits, or chose the wrong tax rate.

- An error occurred when filling out a payment order , for example, the BCC or tax amount was incorrectly indicated.

- Seasonality of business . Let’s say that during the year the organization made advance payments for income tax, but by the end of the year the revenue fell and at the end of the year the tax amount was less than the amount of advances paid.

- Tax paid twice . This happens when the payer transferred the tax (fines, fines) late, but the payment has not yet been displayed in the budget settlement card. And the tax authority once again writes off the same amount of tax (penalties, fines).

- If an organization or individual entrepreneur is on the list of activities “affected” by the coronavirus , this applies to taxes paid in 2021. The tax office independently recalculates tax amounts, and if the taxpayer paid taxes in the previous order, an overpayment will arise.

Many individual entrepreneurs and small business managers do their own accounting and calculate taxes. But monitoring a business and keeping records at the same time is difficult.

If you are not confident in your own abilities or are looking for a reliable specialist, try accounting outsourcing . This means that your accounting, accounting and solving current issues (invoicing, reconciliation) will be handled by a whole team of professionals. You can control the work using an online service, which allows even a beginner to understand whether records are being kept correctly and that nothing has been forgotten.

Moreover, you can choose what you need - only personnel records and payroll, a personal accountant or a full-fledged back office.

Within what period can the inspectorate itself offset the overpayment of taxes to pay off the arrears?

The inspection may carry out offsets within the time limits for forced collection of arrears, penalties, and fines. If these deadlines are missed, the tax authority does not have the right to independently offset the arrears (Determination of the Constitutional Court of the Russian Federation dated 02/08/2007 N 381-O-P, Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 07/30/2013 N 57 (clause 32), Presidium of the Supreme Arbitration Court of the Russian Federation dated 15.09. 2009 N 6544/09).

If the inspection has missed the deadline for the undisputed collection of arrears, penalties, fines, then it has the right to carry out such an offset only if there is a court decision on this (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 9, 2008 N 8689/08).

Let's give a clarification

When preparing an application for a tax refund or credit, pay attention to whether the overpayment is reflected in the personal account (budget settlement card). To do this, you can carry out a joint reconciliation with the Federal Tax Service (clause 5.1, clause 1, article 21, clause 11, clause 1, article 32, clause 3, article 78 of the Tax Code of the Russian Federation).

If the reconciliation does not show an overpayment, then at the same time as the application, you must submit an updated tax return and reflect the excess payment of tax in it. Such clarifications were given by the Constitutional Court of the Russian Federation.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

As the judges pointed out, it is impossible to return overpaid taxes from the budget until the fact of overpayment has been established. And it can be established when a company clarifies tax obligations declared in previously filed tax returns.

So, without clarification, in most cases there is no reason to even talk about overpayment. This means there is no point in applying for a refund.

If you submit an application for a refund without a corrective declaration, the Federal Tax Service has the right to refuse the refund. Moreover, such a statement does not interrupt the three-year period for the return of the overpayment (Decision of the Constitutional Court of the Russian Federation dated March 26, 2020 No. 815-O).

Additionally, it should be taken into account that the mere fact that the inspection accepted the “updated statement” and even reflected the information from it on the personal account does not mean that the taxpayer has the right to a refund of the overpayment. Here are the nuances here:

- Tax authorities cannot refuse to accept an updated declaration, even if it is submitted after the expiration of the period allotted for the return or offset of the overpayment (clause 42 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 3 (2020), approved by the Presidium of the Supreme Court of the Russian Federation on November 14, 2020 ).

- If the “clarification” is accepted, it is necessary to conduct a desk audit (Article 88 of the Tax Code of the Russian Federation). If these declarations are correct, the new obligations will be reflected in the Budget Payment Card.

Therefore, if deadlines are already running out, you must submit an application for a refund simultaneously with the “clarification” so that the tax authorities do not have a formal reason to refuse a refund.

If the deadline has already passed, then filing a corrective return only makes sense if you plan to return the tax through the court.

How can an organization apply to offset tax overpayments?

You need to submit an application for offset of the overpayment to the inspectorate within a limited time. You can do this in one of the following ways (clauses 4, 5, Article 78 of the Tax Code of the Russian Federation):

- in paper form - in person (through a representative) or by mail;

- in electronic form - via TKS or through the taxpayer’s personal account.

Submit your application to the inspectorate at your place of registration. And if there are separate divisions, you can submit it both at the place of registration of the EP and at the place of registration of the organization. This follows from paragraph 7 of Art. 78, paragraph 1, art. 83 Tax Code of the Russian Federation.

Where should I go to offset or refund taxes, penalties, and fines?

As a general rule, you need to contact the tax authority at the place of registration (i.e., place of registration).

Difficult cases:

see in more detail: different taxes (registration at the place of business, etc.)

If an entrepreneur is registered with several tax inspectorates (at the place of business, at the location of the real estate), it is better to send the application to the tax authority where the overpayment was identified - this is the opinion of the Ministry of Finance. Although the Federal Tax Service in some cases believes that the taxpayer has the right to independently choose which tax office it is more convenient for him to contact.

see in more detail: change of tax office (error of the “old” Federal Tax Service)

If an error is discovered after a change in tax office, all applications are submitted at the place of current tax registration.

Some confusion may arise if there was a tax change during the period when the issue of credit/refund was “in process.” For example, an entrepreneur filed an application and changed the Federal Tax Service before the tax authorities made a decision. In such a situation, the tax authority at the old place of registration must complete the issue - this is not spelled out in the Tax Code of the Russian Federation, but follows from judicial practice.

If the tax authority made a decision on the “old” registration, and the entrepreneur challenged it in court, the court may oblige the tax inspectorate to fulfill the obligation to return/offset, both at the old and new place of registration (from the court’s point of view, the tax authorities are centralized system).

You can also return/set off the overpayment in court.

At the same time, for overpaid amounts, it is necessary to first contact the tax authority; if a refusal is received or a decision is not received at all, it is necessary to file a complaint with a higher authority and only after that - to the court.

Regarding excessively collected taxes, you can go directly to the court, but you can also first send an application to the Federal Tax Service.

How long does it take for the inspectorate to make a decision to offset tax overpayments?

The time frame for making a decision on offset depends on whether the inspection conducted a desk audit and whether violations were discovered during it.

If the inspection conducted a desk audit and found no violations, the period is 10 working days. They are not counted immediately after completion of the inspection, but after another 10 working days have elapsed from one of the following dates (clause 6 of article 6.1, clauses 4, 5, 8.1 of article 78 of the Tax Code of the Russian Federation):

- the date following the end of the inspection, if the inspection completed it within the prescribed period;

— the date when the inspection must be completed under clause 2 of Art. 88 of the Tax Code of the Russian Federation - if the inspection verified the declaration longer than the required period.

If the inspection conducted a desk audit and revealed violations

, the period is 10 working days from the date following the day the decision came into force based on the results of the desk audit (clause 6 of article 6.1, clauses 4, 5, 8.1 of article 78 of the Tax Code of the Russian Federation).

If a desk audit was not carried out

, the inspection must make a decision to offset the overpayment within 10 working days from the date of receipt of your application or signing of a joint reconciliation report, if such a reconciliation was carried out (clause 6 of article 6.1, clauses 4, 5 of article 78 of the Tax Code of the Russian Federation) . We recommend that you apply for a credit in advance - at least 10 business days before the upcoming tax payment deadline for which you plan to apply the overpayment.

The inspection must inform you about the decision made within five working days after its adoption (clauses 2, 6, article 6.1, clause 9, article 78 of the Tax Code of the Russian Federation). The inspectorate can deliver such a message to you or your representative personally against receipt, by TKS or in another way (Clause 9 of Article 78 of the Tax Code of the Russian Federation).

If the inspectorate itself offsets the overpayment

on account of tax arrears (penalties, fines), then such a decision must be made within 10 working days from the next day after (clause 2, 6, article 6.1, clause 5, article 78 of the Tax Code of the Russian Federation):

— detection of overpayment;

— signing a reconciliation report jointly with you, if one was carried out;

— entry into force of a court decision (for example, if the overpayment was confirmed by the court).

The overpayment was excessively collected by the Federal Tax Service

If the reason for the overpayment is the excessive collection of VAT by the fiscal service, then the payer does not need to submit an updated declaration to return the funds. The taxpayer's procedure in this case is as follows:

- Receiving confirmation of excessively collected funds from the Federal Tax Service (letter from the Federal Tax Service, court decision, etc.).

- Reconciliation of mutual settlements with the Federal Tax Service, signing of the relevant act.

- Submitting an application for refund of overpayment (indicating code 2 – overcharged amount).

The refund period in this case corresponds to the general procedure and is 30 calendar days from the date the payer submits an application to the Federal Tax Service.

What to do if the inspection refused the test or carried it out late

You can appeal the refusal to offset to a higher tax authority, and then to the court (Article 137, clauses 1, 2 of Article 138 of the Tax Code of the Russian Federation).

As a general rule, the period for appeal is one year from the moment you learned or should have learned about a violation of your rights (Clause 2 of Article 139 of the Tax Code of the Russian Federation).

The period for going to court is three years from the day when you learned or should have learned about a violation of your right to offset (clause 79 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57). If the inspection does not carry out the offset in a timely manner, then no interest is accrued on the offset amount. You can only appeal the inaction of the inspectorate in the manner indicated above.

Is the 3-year period interrupted by a reconciliation report with the Federal Tax Service?

Art. 203 of the Civil Code of the Russian Federation contains a rule on the termination of the limitation period in the event of actions that are assessed as recognition of a debt. One of these actions is the signing of a reconciliation report.

There are no official explanations from the Ministry of Finance or the Federal Tax Service regarding the reconciliation report with the Federal Tax Service. And the courts have 2 points of view:

- signing a reconciliation report with the Federal Tax Service does not affect the statute of limitations (resolutions of the Federal Antimonopoly Service of the Moscow District dated December 30, 2013 No. F05-16324/2013, the Central District dated December 19, 2013 No. A23-1227/2013, the Ural District dated August 16, 2013 No. F09-8107 /13, Volga District dated 08/07/2013 No. A55-30105/2012);

- the date of signing the reconciliation report with the Federal Tax Service is recognized as the day when it became known about the presence of an overpayment (resolution of the Federal Antimonopoly Service of the Moscow District dated December 25, 2013 No. F05-16362/2012, West Siberian District dated October 30, 2013 No. A75-10138/2012, Central District dated July 11 .2013 No. A48-1772/2012, North-Western District dated 05/13/2013 No. A56-33073/20).

Statute of limitations

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The statute of limitations for refunding overpaid taxes plays an important role. It interests all citizens and all organizations that have transferred too much money to the state. How quickly should a taxpayer make a refund request?

The statute of limitations for such appeals in Russia is 3 years. This means that a refund of overpaid taxes is allowed within 36 months.

More precisely, the countdown begins:

- from the moment of filing a tax return with the Federal Tax Service - in case of overpayment of VAT, as well as if you want to return advances for the year;

- after depositing money into the state treasury - if there is an overpayment due to errors.

As soon as 3 years have passed, the citizen loses the right to a refund of overpaid tax. It will be credited towards new payments. There is nothing difficult to understand about this. It is recommended not to delay this process and apply for tax overpayments as soon as possible.

New obligation for organizations paying transport and land taxes

As you know, starting with reporting for 2021, organizations will not submit returns on transport and land taxes.

Fill out and submit land, transport and “property” tax declarations for 2019 for free via the Internet

The inspectors will calculate the tax amounts themselves. The resulting value will be indicated in the message that the Federal Tax Service will send to the organization. If the company does not agree with the calculations, it will be able to send explanations and (or) documents confirming the right to a benefit, a reduced rate, etc., to the inspectorate within 10 days. Tax officials will study the objections and either reject them or recalculate the tax downward. For more information about this, see “Amendments to the Tax Code of the Russian Federation on “property” taxes: cancellation of declarations on transport and land taxes, new rules on benefits for individuals.”

The law under comment introduced an additional obligation for organizations paying transport and land taxes. If the Federal Tax Service does not send a message about the calculation of these taxes, the company itself will have to notify the tax authorities about the presence of objects subject to transport and land taxes.

The report must be submitted to any tax office (at the taxpayer's choice) once - before December 31 of the year following the expired tax period. This document must be drawn up for each plot of land and each vehicle. The message must be accompanied by copies of documents confirming the state registration of the vehicle or the title document for the land plot.

Organizations that previously sent an application to the Federal Tax Service for benefits on these taxes in relation to a particular object are exempt from this obligation. In such a situation, there is no need to submit a notification about the presence of this taxable object (new clause 2.2 of Article of the Tax Code of the Russian Federation).

Those who, contrary to the new rules, do not notify tax authorities about the availability of a vehicle or land plot, face a fine under Article 129.1 of the Tax Code of the Russian Federation. The sanction amount is 20% of the amount of unpaid tax.

The corresponding changes will take effect from January 2021. Thus, if an organization does not receive a message about the accrual of transport or land taxes for 2021, it will have to notify the inspectorate about the availability of transport or land by December 31, 2021. Otherwise, the company will be fined.

New debt collection rules

According to the current rule, inspectors are given two months after the expiration of the period specified in the request for payment of tax (contribution, fee, penalty, fine) to make a decision on debt collection.

Moreover, the period allotted for making such a decision does not depend on the amount of debt and how long ago it arose. After the commented amendments come into force, a special collection procedure will apply for small amounts of debt.

Automatically generate payments for arrears based on requirements from the inspection

Tax authorities will not collect debts until their total amount exceeds 3,000 rubles. When this happens, the Federal Tax Service will be able to make a decision on collection within two months from the date of the excess. If the tax authorities miss this deadline, the decision will be considered invalid.

There is an exception to this rule. As soon as three years have passed since the end of the period specified in the earliest of the outstanding demands for payment, inspectors will have the right to collect, even if the total amount of the debt did not exceed RUB 3,000. In this case, the tax authorities have two months from the expiration of the specified three-year period to make a decision on collection (new edition of clause 3 of Article of the Tax Code of the Russian Federation).

The corresponding changes will take effect from April 1, 2020.

Position of YOU

For what? And then how long should it take to process a refund to the taxpayer?

The Supreme Arbitration Court of the Russian Federation is of the opinion that the overpayment arises as a result of a tax return filed by a citizen or organization. To make the right decision about a refund, careful due diligence is necessary. Especially in relation to legal entities.

We are talking about a desk audit. Then the refund period for overpaid taxes will be increased to 4 months. The tax authorities allot about 3 months for a desk audit. Plus a month allotted for transferring money to the applicant.

Only after this period will the taxpayer be able to appeal the decision made by the tax authorities.

Exchange of tax documents through MFC

The Tax Code has introduced rules regulating the procedure for transmitting and receiving certain tax documents through multifunctional centers for the provision of state and municipal services (MFC).

Thus, through the MFC it will be possible to submit:

- application for tax registration or deregistration (new edition of clause 5.1 of Article of the Tax Code of the Russian Federation; comes into force on April 1, 2020);

- notification of the selection of a separate division for registering the organization for tax registration (if several OPs are located in the same municipality, the cities of Moscow, St. Petersburg and Sevastopol in territories subordinate to different tax authorities) (new edition of clause 5.1 of Article of the Tax Code of the Russian Federation; comes into effect effective from April 1, 2021);

- notification of the implementation (termination) of activities to provide services to an individual for personal, household and (or) other similar needs (new edition of clause 5.1 of Article of the Tax Code of the Russian Federation; comes into force on January 1, 2021);

- a document confirming that the tax agent sent a notification to a foreign citizen or stateless person about the registration of this person for tax purposes (new edition of clause 5.1 of Article of the Tax Code of the Russian Federation; comes into force on April 1, 2021);

- a document granting transport tax benefits (new edition of clause 3 of Article 361.1 of the Tax Code of the Russian Federation; comes into force on October 29, 2019);

- notification of the selected land plot in respect of which a tax deduction is applied (new edition of clause 6.1 of Article 391 of the Tax Code of the Russian Federation; comes into force on October 29, 2021);

- notification of selected objects of taxation with personal income tax in respect of which a tax benefit is provided (new edition of clause 7 of Article 407 of the Tax Code of the Russian Federation; comes into force on October 29, 2019).

The date of submission of a document will be considered the day when the person brought the document to the MFC. This day will be recorded in a receipt or other paper confirming the fact of presentation (new clause 1.1 of Article 1 of the Tax Code of the Russian Federation; comes into force on October 29, 2019).

Through the MFC you will be able to receive:

- tax notifications, if the taxpayer has written a corresponding application (new edition of clause 4 of Article 2 of the Tax Code of the Russian Federation; comes into force on October 29, 2021);

- certificate of tax registration of an individual (new edition of clause 5.1 of Article of the Tax Code of the Russian Federation; comes into force on April 1, 2020);

- a document confirming the consideration by tax authorities of information (except for declarations) submitted by individuals to the Federal Tax Service through the multifunctional center. To receive such a document from the MFC, a written application from an individual is required (new edition of clause 8 of Article of the Tax Code of the Russian Federation; comes into force on October 29, 2021);

- a document containing information about an individual that constitutes a tax secret. To obtain such a document from the MFC, the written consent of the individual is required (new edition of clause 8 of Article of the Tax Code of the Russian Federation; comes into force on October 29, 2021).

The date of receipt of any of the listed documents at the MFC will be considered the day following the day when this document was received from the tax office at the multifunctional center (new edition of clause 4 of Article of the Tax Code of the Russian Federation; comes into force on October 29, 2021).

Also in the first part of the Tax Code of the Russian Federation there will be a provision according to which individuals will be able to submit personal income tax declarations through a multifunctional system. At the request of the taxpayer, an MFC employee will put a mark of acceptance and the date of acceptance on the copy of the declaration. The day of submission of the declaration will be considered the day when it was accepted by the MFC (new edition of clause 4 of Article 4 of the Tax Code of the Russian Federation; comes into force on January 1, 2020).

Submit tax reports for free and respond to the requirements of the Federal Tax Service via the Internet

Duration of review

What is the deadline for refunding overpaid tax upon application? How quickly must the tax authorities conduct an audit and transfer the excess payment to the taxpayer's account?

This period is prescribed at the legislative level. The Tax Code of the Russian Federation states that the period for consideration of an application for a refund of overpaid tax is no more than 10 days.

During this period, the tax authorities will decide on the transfer of funds, after which they will be transferred to the taxpayer. As mentioned above, the period during which overpaid funds will be transferred is 30 days.

Experts believe that the established deadlines for the return of overpaid taxes (for legal entities and ordinary citizens) are short. They need to be increased. The Supreme Arbitration Court of the Russian Federation believes that the period for considering an application for a refund of overpaid taxes should be increased.

Algorithm of actions

In fact, everything is much simpler than it might seem at first glance. Refund of overpaid taxes (the time frame allotted for this operation will be presented below) provides a simple algorithm of actions to implement the task.

- Prepare a certain package of documents. They will be discussed a little later.

- Write an application for a refund.

- Apply the collected documents to the Federal Tax Service at the place of registration. Submit the application with the prepared papers and wait for the decision of the tax authorities.

That's all. No more manipulations are needed. Simple, fast, clear. What else do you need to remember about the process you are studying?

When does it make sense to apply for a refund?

Based on all of the above, we can come to the conclusion that a refund of overpaid taxes (the deadlines for applications will be indicated later) does not always need to be processed. After all, extra money can be used as an advance for upcoming taxes, but only within the limits of the same payments.

That is, if personal income tax is overpaid, the balance of the amount is allowed to be credited only to personal income tax for the next year, and nothing else. This is normal.

Experts assure that it only makes sense to issue a refund of overpaid tax:

- with a significant overpayment;

- if a citizen/organization has ceased to be a taxpayer in a particular area.

Thus, it is not always necessary to think about the implementation of the task. But if you want to issue a return, you will have to take into account many features of the process.

Without application

What will happen in this case? There is nothing to be afraid of. It is not at all necessary to issue a refund of overpaid taxes immediately after discovering an error. The timing of public requests for this request can be called flexible. They allow you to think carefully about a decision.

If there is an overpayment of taxes, but there is no application for a refund, then the excess amounts will be counted within the limits of the same payment in the new tax period. In effect, the person will have to pay less than usual in taxes in the future.