Calculation of insurance premiums must be submitted to the Federal Tax Service for all policyholders making payments and other remuneration to individuals. You need to report both pension contributions and social and health insurance contributions. The mathematical calculation of insurance premiums has not changed in 2021 - they are still calculated for each individual at the end of each calendar month, based on the base for calculating insurance premiums from the beginning of the billing period until the end of the corresponding calendar month and the tariffs of insurance premiums minus the amounts of insurance premiums , calculated from the beginning of the billing period to the previous calendar month inclusive (in accordance with paragraph 1 of Article 431 of the Tax Code of the Russian Federation).

Example of calculating pension contributions:

January, base = 99,999.99 calculated contributions = 99,999.99*22% = 21,999.9978, after rounding 22,000

February, base = 99999.99 + 99,999.99 calculated contributions 199,999.98*22% - 22,000 = 21,999.9956 after rounding 22,000

March, base = 99,999.99 + 99999.99 + 99,999.99 calculated contributions 299,999.97 *22% - 22,000 - 22,000 = 21,999.9934 after rounding 21,999.99

What is the purpose of calculating insurance premiums?

Based on the calculated amounts for employee insurance, these funds are transferred to the employee’s appropriate insurance account. The report indicates how much money the employer must contribute to each employee's retirement account, as well as medical contributions to the city budget. Insurance premiums are calculated from the amount of accrued wages, which is reflected in the payroll (form T-51). An accountant handles these calculations.

Object of assessment

The object of taxation is payments and other remuneration to individuals who are subject to OSS in accordance with the legislation on certain types of such insurance under contracts:

- labor and GPA

- author's order

- alienation of exclusive right

The object of taxation of contributions for those who do not make payments and remuneration to individuals is the minimum wage (up to 300,000 rubles), established at the beginning of the period. If the amount exceeds 300,000 rubles, the object of taxation is income.

Filling algorithm

Let's make a calculation of insurance premiums using the example of NAUKA LLC. Let it be a payer of insurance premiums under the simplified tax system and apply the basic tariff of insurance premiums (22% pension insurance; 5.1% medical insurance; 2.9% social insurance). NAUKA LLC has two employees on its staff. The report was compiled for the 4th quarter of 2017.

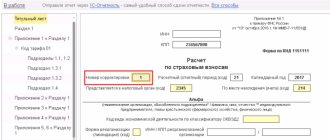

Title page

On the title page we fill out the TIN, KPP and number the page. If you are submitting a report for this period for the first time, the adjustment number is set to 0.

Next, fill in the reporting period code, in this case annual (code 34), year 2021.

The following information must also be filled out on the title page:

- Tax authority code,

- code of the location of the organization of the Russian Federation,

- name of company,

- OKVED code,

- contact phone number of the manager or accountant.

We recommend recording the number of pages on which the report was published after completing the report.

Below, only the left part is filled in - information about the payer of insurance premiums. Date and signature are added.

Note! The insurance premium payer or his representative must put the date and signature not only on the title page, but also on several others where space is provided for this.

For our LLC, we include the following pages in the report:

- Section 1. Summary data of the payer of insurance premiums (on two pages)

- Appendix 1 to Section 1 (Subsection 1.1)

- Appendix 1 to Section 1 (Subsection 1.2)

- Appendix 1 to Section 1 (Subsection 1.1)

- Appendix 2 to section 1 (two pages)

- Appendix 3 to section 1

- Appendix 4 to section 1 (end)

- Section 3 (on two pages) – to be filled out for each employee.

Next pages

We recommend that you start filling out the data by determining the base for calculating insurance premiums. It is calculated as follows: the total amount of payroll for all employees is taken and non-taxable amounts (sick leave payments, benefits, financial assistance, etc.) are subtracted from it.

Now we calculate the amount of insurance premiums from the calculated base. For an LLC using the simplified tax system and the basic tax rate, this is 22% pension insurance; 5.1% health insurance; 2.9% social insurance.

Enter the calculated values into the report. On the sheet “Appendix 1 to Section 1” Subsection 1.1 refers to compulsory pension insurance, Subsection 1.2 to compulsory medical insurance.

In the picture in line 060

- amounts 4761.12 rubles, 5707.46 rubles, 5566 rubles. – monthly calculated insurance premiums;

- amount 16034.58 rub. – addition of the calculated contributions indicated above;

- the amount 66128.58 is an annual amount with an increase, that is, calculated from January to December.

“Appendix 2 to Section 1” refers to compulsory social insurance in case of temporary disability and in connection with maternity.

Filling out sick leave payments

Sick leave payments are completed quarterly (last 3 months). During this reporting period, one of the employees of NAUKA LLC was on sick leave for 7 days. We take this information and the amount of hospital payments from the payroll (form T-51) and enter it into our report in “Appendix 3 to Section 1” in the table.

The first column of the table indicates the total number of sick leaves taken into account, even if they were all brought by the same person. The second column contains the amount of sick days (for all employees). The third column reflects the total amount paid for all sick leave. In the fourth - the amount that is reimbursed to the organization from the federal budget. Since the first three days of sick leave are paid to the employee by the organization, and the subsequent days - from the federation. budget.

The table below reveals specific types of sick leave.

“Appendix 4 to Section 1” indicates the total amounts of compensation from the federal budget with the number of sick leaves and the sum of days for them in the corresponding paragraph of the appendix.

Completing Section 1. Summary data of the payer of insurance premiums

After we have calculated the insurance premiums, we must enter them nicely into “Section 1”. We have the calculated amounts in the Subsections, all that remains is to transfer them here.

In our case, this is Subsection 1.1, Subsection 1.2

and continuation of Appendix 2 to section 1.

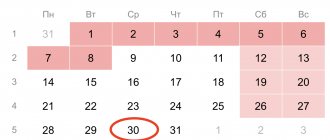

Reporting deadlines

Since 2021, all issues regarding contributions are regulated by the Tax Code of the Russian Federation. The deadline for submitting the calculation is established by clause 7 of Art. 431 Tax Code of the Russian Federation. Every three months, the calculation should be sent to the Federal Tax Service no later than the 30th day of the month following the reporting period.

Until February 1, 2021 inclusive, it is necessary to ensure the delivery of a report on contributions for 2021 to the Federal Tax Service. It should be taken into account that from 01/01/2020, policyholders with more than 10 people are required to submit calculations electronically.

And also in 2021, the tax service expects calculations:

- for the first quarter - no later than 04/30/2021;

- for half a year - no later than 07/30/2021;

- for 9 months - no later than 01.11.2021.

Submit a single calculation of insurance premiums on time and without errors! Use Kontur.Extern for 3 months for free!

Try it

How do tax authorities check a report?

The program for checking the calculation of insurance premiums after its receipt by the tax office includes:

- Verification of compliance with the control ratios established by the Federal Tax Service by Letter dated December 29, 2017 No. GD-4-11/ [email protected]

- When submitting an electronic report: checking the compliance of the provided file with the established submission format (Appendix 3 of Order MMV-7-11/ [email protected] ).

Checking the calculation of insurance premiums for compliance with control ratios includes about 300 indicators. It is very difficult to check all of them manually, so specialized software is used. Checked:

- correctness of filling in the details (reporting period, data on insured persons);

- the ratio of indicators within the form (for example, the correspondence of the total amounts of insurance premiums given in section 1 with the amount of accruals for each insured person);

- compliance of DAM indicators and other reporting forms (for example, the amount of income paid, reflected in 6-NDFL, and the base for calculating social insurance contributions are compared).

Basis for calculating contributions

The base as an object of taxation is the sum of all payments accrued by payers for a certain period in favor of individuals, except for payments that are not subject to taxation separately for each individual at the end of each month on an accrual basis.

The majority of payers pay contributions in the amount of 30%, which are distributed as follows:

| Tariffs in 2017-2021 (in%) | Insurance premiums for OPS | Insurance premiums for OSS | Insurance premiums for compulsory medical insurance (do not depend on the maximum base) | |

| Regarding payments to foreigners and stateless persons | Regarding payments to residents | |||

| Less than the maximum base value | 22% | 1,8% | 2,9% | 5,1% |

| More than the maximum base value | 10% | – | – | |

The maximum base for calculating contributions is subject to indexation annually from January 1 and is:

| Period | OPS | OSS |

| 2017 | 876,000 rub. | 755,000 rub. |

| 2021 | 1021000 rub. | 815,000 rub. |

| 2021 | 1,150,000 rub. | 865,000 rub. |

For some categories of payers, reduced contribution rates apply.

If the employer has carried out a special assessment of working conditions or certification of workplaces that are recognized as harmful or dangerous, then payers, depending on the class, pay additional tariffs determined for each class.

Official version of CheckPFR from the developer's website

On the website page you can download Bukhsoft for free in one file. Technical support will help users update CheckPFR to the latest version at any time. The archive that should be downloaded includes:

- installer exe

- msxml6_xmsi

- detailed step-by-step installation instructions in .doc format

- user manual in .doc format

To install CheckPFR on your computer, just open the archive and run the .exe file, following the pop-up prompts. Silent installation will automatically unpack the components into the specified directory.

The program is distributed absolutely free of charge and is intended for use only in the Russian Federation.

For the program to work properly, you should regularly check for the latest updates. The official website releases information about the latest updates with a list of changes made to the program.

Calculation name

Many accountants are now discussing that, in connection with the transfer of insurance premiums under the control of the Federal Tax Service, a new form of calculation, RSV-1, should be approved from 2021. However, as it turned out, the reporting form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551 is simply called “Calculation of insurance premiums”. And there is no mention of “RSV-1” in the name of the calculation. This is a completely new calculation, which, in fact, has nothing to do with RSV-1. The RSV-1 calculation has been canceled since 2021 and the name “RSV-1” has become a thing of the past along with it. At the same time, in our opinion, it would be convenient for accountants to call the new calculation of contributions “DAM”. These three letters will mean “Calculation of Insurance Premiums”.

New in the form of calculating insurance premiums in 2021 for certain categories of payers

Some innovations apply only to certain policyholders. In particular, in the new form:

A field for a closed (liquidated) separate division appeared on the title page. In case of adjustment, the form for the unit deprived of the powers of the insured is submitted by the parent organization to its Federal Tax Service Inspectorate in the designated cell.

Peasant farms fill out section 2 of the report. In Appendix 1, they now need to indicate the details of the identity document (code, as well as series and number) for each member of the household, including the head of the peasant farm.

Changes to the main part of the form

Most of the clarifications concerned section 1 of the Calculation. What has changed:

a cell has been added - payer type (“1” - if payments to individuals were accrued, “2” - if they were not);

in Appendix 2 for social insurance, the field “Payer Tariff Code” was included, the line “Number of individuals from whose payments insurance premiums were calculated” was added; the policyholder must fill out as many applications 2 as the applicable tariffs;

previous appendices 7, 8 were deleted - on the basis of Article 427 of the Tax Code of the Russian Federation, which abolished reduced contributions for a number of taxpayers;

subsections 1.1 and 1.2 of Appendix 1 are supplemented with a line that specifies expenses accepted for deduction under copyright agreements or related to intellectual activity (according to paragraph 8 of Article 421 of the Tax Code);

in subsection 1.3.2, the basis for filling out the calculation has been removed, since the indicators must correspond only to the special assessment (the working conditions class code is inserted);

Appendix 7 is reserved for reduced contributions when creating animated audiovisual products (clause 15, clause 1, article 427 of the Tax Code).

Some of the changes were of a technical nature - for example, in Appendix 10 the lines were renumbered, subsection 1.4 was moved to 1.1, in Appendix 5 the codes were adjusted (for payers on the simplified tax system and UTII code “01”).

The total number of applications has decreased - instead of 10 there are now 9.

CheckPFR

The latest version of CheckPFR 2021 for Windows has received minor updates to the interface and external design. The program is developed by the Branch of the Pension Fund of the Russian Federation in the Republic of Bashkortostan. It replaced the standard CheckXML-UFA and was officially adopted in the spring of 2014.

Download the CheckPFR 2021 program for free using the direct link:

Download additional files for CheckPFR:

CheckPFR is software for checking and working with reporting data provided by employers. It is able to check settlement accounts of insurance premiums and display information on individual personalized accounts, which are submitted by policyholders in electronic format 7.0. The transfer of accountable materials to the Pension Fund of the Russian Federation and their entry into the database occurs using media (floppy disks, disks, USB flash drives) or via the Internet electronic channel.

Answers to common questions

Question #1 : What is the cost of a benchmark ratio testing program?

Answer : The software posted on the official website of the Federal Tax Service is provided free of charge. You just need to install it on your PC. And to check, you need to download the RSV in xml format and load it into the program. If the control ratios are not met (the software provides explanations of where and why the ratios do not converge), the Federal Tax Service will not accept the calculation, and the policyholder will be fined for failure to submit the DAM (in the worst case, the accounts of the employer may be blocked for 10 days).

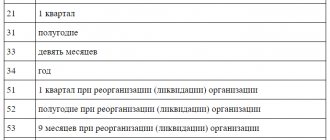

Codes

In addition to monetary indicators, the report contains cells displaying encoded values. This:

- tariff code;

- period code;

- presentation method code;

- organization form code;

- performance venue code;

- category code;

- document type code, etc.

In our article we will look at some of them.

Fare codes

In order to know how to correctly fill out the calculation of insurance premiums in the appropriate coded cells, you need to refer to the Procedure for preparing tax reports, which is approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/551. The Appendix contains a breakdown of all codes displayed in the reporting.

Payers must indicate the tariff code; when calculating insurance premiums, it is displayed in cell 001 App. 1 Sec. 1. All tariff codes are given in Appendix 5 to the Procedure for generating tax reporting.

For example, if an employer acts as a payer of mandatory social benefits. insurance, carries out its activities in the OSN system, then it indicates the value “01” in this cell of the form. If the payer uses the simplified tax system, then the calculation of insurance premiums, an example of filling is presented below, in cell 001 reflects the code “02”.

It should also be noted that when a company applies several tariffs, that is, business is carried out in several systems, then the document will contain as many Appendices 1 as the number of tariffs the company used during the reporting period.

The tariff code displays the calculation of insurance premiums for 2021, you can download the form on our website, not only in Section. 1 Adj. 1, but also in Sect. 3 in cell 270.

Category code

Questions often arise with filling out Section 3, which contains personalized data about insured employees. This section is filled out separately for each employed person, his full name, SNILS, INN, passport details, etc. are indicated. The category code in the calculation of insurance premiums is displayed in cell 200; the entire list of codes can be found in Appendix. 8 Procedure for drawing up reporting documents.

For example, if a worker belongs to the category of natural persons. persons in respect of whom pension contributions are made, then such insured persons belong to the “NR” category.

Document type code

The code of the type of document that certifies the identity of an employed person is indicated in Section. 3, containing personalized data about working people, namely in cell 140. All document codes are represented by the Procedure for filling out the calculation of insurance premiums in Appendix 6. In frequent cases, employees present a passport to confirm their identity. If this is a citizen of Russia, then the code “21” corresponds to such a document; if the passport was issued by another state, then the code “10” corresponds to it.

All encoded cells in the document have a special meaning; if the displayed values do not correspond, the calculation of insurance premiums for 2017, the form is presented below, may not be accepted by the tax authorities. And this, in turn, threatens big troubles for fee payers.

Features of working with CheckPFR

The program is capable of checking the following reporting forms:

- quarterly report RSV-1, RSV-2, RSV-3

- documentary personalized accounting S3V-6-1, S3V-6-2, ADV-6-2, S3V-6-4, SPV-1, ADV-11.

Submission of reporting material is implemented through constant updating of the program. You should always check for the latest updates before launching the application. This is especially important when working with the personalized accounting form RSV-1.