How to fill out a payment order to transfer wages to a card according to the new rules from 06/01/2020? What should I indicate in the “Purpose of payment” field? What new income type codes should I put when sending a payment to the bank? In this article we will answer the most common questions and provide a sample payment order for salary 2021.

Useful on the topic:

- New salary rules from 2021

- New minimum wage from January 1, 2021: table by region

How to issue salaries in 2021

All employers are required to pay their employees wages at least every half month.

Salaries must be paid no later than the 15th day after the end of the period for which they were accrued. That is, the deadline (Part 6 of Article 136 of the Labor Code of the Russian Federation):

- for advance payment – the 30th day of the current month;

- for salary – the 15th day of the next month.

This fully applies to wages transferred to the card: transfer wages to employees’ bank accounts at least every half month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

An employee wants to receive their salary on a card? Then he must write an application for the transfer of his salary to the bank. In the application he indicates his bank account number. The employee has the right to choose the bank to transfer his salary. He must notify the employer of this in writing no later than 15 calendar days before the payment of wages.

This is stated in Part 3 of Art. 136 of the Labor Code of the Russian Federation.

What should the bank provide?

In order for clients to create registers for payments in accordance with legal requirements, banks must provide this opportunity.

there is no single form of the register and usually each bank has its own, each banking institution is obliged to take inventory of the form of the register used to ensure compliance with the rules indicated by the Bank of Russia in letter No. 45-1-2-OE/8360.

This applies to both paper registry forms and electronic ones, which are increasingly used.

Read also

08.07.2020

Changes in salary transfer rules in 2020

From June 1, 2021, new codes must be indicated on salary transfer slips. Banks will not accept payments without these new details from 06/01/2020.

So, in field 20 of the payment order “Name. Pl.” indicate the type of income code .

There are different codes for wages, benefits and compensation.

The new coding was required so that bailiffs knew from which payments funds could be withheld under writs of execution. Starting from 2021, you must indicate one of three codes for payments:

Until June 1, 2021, bailiffs had no way to find out what funds an individual received in their account. Neither the bailiffs nor the bank could separate the money that they had the right to withhold by law from those that could not be touched. To eliminate the problem, the new Law with amendments to the Federal Law “On Enforcement Proceedings” dated February 21, 2019 No. 12-FZ obliges employers to reflect the type of income code every time they transfer money to employees.

According to writs of execution, bailiffs have the right to write off money from the accounts of “physicists”. But not all income is legally withheld from debt. For example, you cannot write off sickness benefits or payments for a work injury. The list of such income is in paragraph 1 of Art. 101 of the Law of October 2, 2007 No. 229-FZ. The new law added one more item to it - financial assistance in emergency situations.

Legislators obliged the Bank of Russia to develop the appropriate codes and describe the system for reflecting them in salary slips (clause 5.1 of Article 70 of the Law “On Enforcement Proceedings” dated 02.10.2007 No. 229-FZ as amended by Law No. 12-FZ). Which is what he did, issuing instructions dated October 14, 2019 No. 5286-U.

The new rules apply to salary payments, settlements under GPC agreements, as well as other amounts from which debts cannot be collected.

In addition, from June 1, 2021, when transferring wages (or other income from this amount) to a bank account, the payment order must indicate the amount collected under the executive document (Part 3 of Article 98 of Law No. 229-FZ). A special procedure for indicating the collected amount in payments is given in ConsultantPlus:

It is recommended to indicate information about the collected amount in the “Purpose of payment” details of the payment order in the following sequence... (read in full).

Submitting documents to the bank to connect the organization to the salary project

In most cases, the bank with which an organization intends to enter into an agreement on a salary project is the one where it has a current account. For its clients, the bank not only provides benefits when issuing cards, but also reduces the commission for transferring funds or offers other favorable conditions. Third-party banks, not receiving current benefits from the client, will strive to make a profit from the costs of the project.

Depending on the bank’s policy, the procedure for submitting documents may be slightly different, but the main list of documents is approximately the same everywhere:

- application for the provision of funds transfer services within the framework of a salary project (according to the bank’s form);

- list of employees of the organization (full name, position);

- personal data of employees (full name, date of birth, passport details, information about registration at place of residence);

- regulations on the organization’s wages indicating the timing of payments;

- information about the employee authorized to resolve operational issues regarding the salary project: power of attorney, copy of the employee’s identity document

In addition to the specified papers, the bank may request copies of constituent documents, staffing, an album of signatures of authorized persons, etc.

IMPORTANT! It is worth remembering that the transfer of information about employees to the bank is subject to the Law “On the Protection of Personal Data” dated July 27, 2006 No. 152-FZ, therefore, in order to avoid controversial situations between the organization and its employees, it is necessary to collect their consent to the processing of personal data. data and transfer it to the bank.

After transferring the specified documents, an agreement is concluded with the bank to connect the organization to the salary project, plastic cards are issued for employees, and the company receives special software for generating salary registers.

Examples of payment orders for salary transfers in 2021

Let us explain what to indicate in some fields of the payment order for the transfer of wages to the cards of several employees in 2020:

- in the “Recipient” field – the name and location of the bank in which the employees’ accounts are opened (for example, Sberbank);

- in the “Amount” field – the total amount that needs to be transferred to the employees’ accounts;

- in the “Purpose of payment” field – the purpose of the payment and a link to the date and number of the salary register (for example, “Transfer of wages for July 2021 according to register No. 13 dated August 4, 2020”).

Payment due June 1, 2021

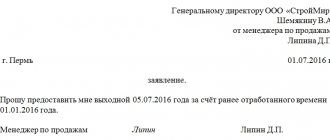

Here is a sample payment order for the transfer of wages to the card until 06/01/2020:

Sometimes, by force of law, the employer is obliged to pay compensation to the employee for delayed wages (Article 236 of the Labor Code of the Russian Federation). ConsultantPlus knows which type of income code to indicate in a payment order when transferring such compensation

Answer: When transferring compensation to an employee for delayed wages, the payment order should indicate the code of the type of income... (view in full).

Payment after June 1, 2021

And this is a sample payment order for the transfer of wages to the card starting from 06/01/2020, indicating new codes. Let's assume that the company transfers salaries. Then in the “Payment purpose” field you need to add code 1.

Often, an employer has to fill out a payment order for the transfer to the Federal Bailiff Service (FSSP) of Russia of alimony withheld from the employee’s salary. you how to do this correctly, taking into account all the changes in 2021 :

View the entire sample of filling out the payment.

Read also

22.01.2020

The procedure for issuing funds for reporting

Funds under the report are transferred either for business and operating expenses or for expenses associated with business trips.

The list of employees who have the right to receive funds on account is established by the Company Order.

Funds are transferred on account regardless of whether the accountable person is indebted for previous accountable amounts.

Individuals who have signed a civil contract with JSC Buttercup to perform work or provide services during the validity period of this agreement also have the right to receive funds on account from the cash desk of JSC Buttercup.

Checking mutual settlements

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for the account “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

In this case, the end date of the report must be the day of payment of wages.

The absence of a final balance in the “Settlements with personnel for wages” account means that there is no wage arrears for each employee.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, wages were paid on June 8, so the end date of the report should be June 09, i.e. the next day after the day the wages were paid.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

See also:

- Salary settings: 1C

- Accounting policy for NU: Insurance premiums

- Registration of salary project

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of an advance through a bank on bank cards Let's consider the features of reflecting in 1C the payment of an employee's advance through a bank....

- Settlements with an employee upon dismissal, including payment of compensation for unused vacation Dismissal of an employee is an operation without which no activity can proceed...

- Payment of dividends to founders: individuals and legal entities Let's consider the features of reflecting the accrual and payment of dividends in 1C...

- Universal report on checking the completion of part 2 of form 6-NDFL Filling out part 2 of form 6-NDFL still causes difficulties for users...

The employee does not want to receive payments on the card

Despite the fact that receiving salaries on a card is convenient and quite safe, some employees want to receive their money as before - through the organization’s cash desk.

According to paragraph 2 of Article 1 of the Civil Code of the Russian Federation, an employer cannot impose its will on an employee. Accordingly, it is impossible to force an employee to issue a card. Even if the organization has a salary project, you will have to adapt to the wishes of each employee if a compromise is not found that suits both parties.