An ordinary desk audit of the VAT declaration submitted at the end of the next quarter may turn into an unpleasant “surprise” for a company or individual entrepreneur. The fact is that tax authorities not only verify information about taxes and deductions within the enterprise, but also compare it with the declarations of counterparties, and the verification program used finds discrepancies due to any errors made by both parties. The result may be receiving a request from the Federal Tax Service to clarify the declaration data, submit a package of primary documents, and even refuse a tax refund. Let's try to figure out how an enterprise should act if the VAT reconciliation with the counterparty reveals inconsistencies due to the fact that the counterparty did not pay VAT.

VAT: discrepancies with the counterparty

The Federal Tax Service has always had and will continue to have questions if the VAT claimed for deduction does not correspond with the calculated tax amount in the partner’s declaration, i.e. the counterparty did not reflect VAT. These issues are regulated in Art. Tax Code of the Russian Federation, according to which the inspector is obliged to send the payer a request to provide explanations or make corrections to the declaration if a desk audit reveals inconsistencies or contradictions between the information available in the documents of both parties.

In a situation where VAT counterparties have not reported on the declaration and have not paid the tax, accepting a deduction on their invoices is considered by tax authorities as an unjustified tax benefit of the purchasing enterprise, and interaction with such partners is considered an imprudent action.

Often the consequence of this is the additional assessment of tax to be paid, the accrual of penalties and the imposition of a fine, but at the same time the Federal Tax Service must prove that the implementation of the deduction will entail the receipt of an unjustified tax benefit, and the company, intentionally or through negligence, entered into an agreement with an unscrupulous partner (clause p. . , , Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53). Tax authorities believe that VAT refunds should be made from the source that arose when the counterparty-supplier paid the corresponding amount of VAT. Its absence (if the counterparty has not paid VAT) does not give the buyer the right to deduct tax.

How to Avoid Mass Demands

Electronic document management

The surest way to reduce the number of discrepancies, and therefore the requirements of the Federal Tax Service, is to switch to EDI. In this case, the buyer and seller work with the same electronic document. If the EDI system is integrated with the accounting system, the invoice is automatically accepted for accounting. This means that discrepancies associated with the transfer of data to the accounting system are excluded.

However, in practice, even those companies that have switched to EDI do not exchange electronic documents with 100% of their counterparties. Many small companies conduct document flow through web versions of EDI systems. This means that documents are accepted for accounting manually and may get lost. EDI, therefore, does not cancel reconciliation. Rather, these processes complement each other.

Reconciliation on paper

Before the procedure for declaring VAT changed in 2015, enterprises did not need to reconcile all invoice data with counterparties. An analogy can only be seen in the balance reconciliation that joint-stock companies carry out annually as part of the inventory of receivables and payables. However, the act of reconciling mutual settlements, which is used in this case, solves a completely different problem than comparing details in invoices.

So, in the act of reconciliation of mutual settlements:

- The TIN of the counterparty may not be indicated, and if it is provided, it will be in the header of the document;

- the invoice itself may not be included in the act, and, accordingly, the data from it;

- The rate and amount of VAT is not indicated.

Thus, in order to use reconciliation reports to compare invoice data, the form will have to be adapted. And this will require updating the accounting system.

Another aspect is time. In large companies, it takes at least a week to generate reports for all counterparties. It takes about three more weeks to send out the acts to suppliers and wait for a response from them. Of course, if one of the counterparties uses EDI, reconciliation acts can be signed with an electronic signature and sent electronically. This will save time on sending documents, but you will have to compare the data manually. In addition to the amount and fact of shipment, for each transaction you need to check a number of other parameters, and all this is slow.

Meanwhile, time is critical in the case of VAT. Taking into account the reporting deadlines (clause 5 of Article 174 of the Tax Code of the Russian Federation), at the end of the quarter, companies have less than 25 days to prepare a declaration, including reconciliation of invoice data. Will everyone have time to check it manually?

View discrepancies with counterparties for free

Automatic online reconciliation

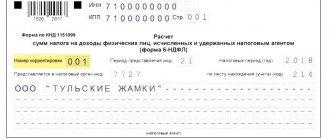

To enable taxpayers to check with counterparties automatically, SKB Kontur has developed the Kontur.VAT+ service. It tracks both errors in the details of counterparties, checking them against the tax authorities’ databases, as well as disagreements regarding amounts, dates, invoice numbers and other details.

In addition, users can evaluate the trustworthiness of their suppliers and contractors and refuse to cooperate with a company if a combination of signs indicates that it may have financial problems or is very similar to a fly-by-night company.

If the counterparty did not pay VAT, and the Federal Tax Service requires an explanation

When receiving a request from the Federal Tax Service, the taxpayer must provide evidence (documents and explanations) of the reality of the transactions carried out, and not rush to generate an updated declaration. For example, he should prove his prudence in choosing a partner. It is good if, before executing the contract, the viability and capabilities of the counterparty were carefully checked - i.e. were:

- its constituent documents were requested, information about its registration in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs was received;

- information was received about the actual location of the partner, the availability of production or retail space;

- published reporting documents were analyzed and the possibilities of fulfilling his obligations were assessed, etc.

We talked in more detail about how to check the counterparty of the VAT payer, including using the services of the Federal Tax Service, in one of our articles.

The reliability of a partner must be assessed based on a set of criteria, making maximum use of the information received from all available sources. This was also stated in the letter of the Federal Tax Service No. AS-4-2/17710 dated October 17, 2012. That is, a pre-check of the counterparty and information provided by the Federal Tax Service on this matter will make it possible to ward off accusations of imprudence in the actions of the declarant when choosing a counterparty. In addition, the enterprise must submit to the inspection a package of primary documents confirming the reality of the transaction, the recording of received assets, their payment in full, invoices, etc.

Failure to provide explanations is a guarantee that the Federal Tax Service will accuse the company of receiving unjustified benefits and deprive it of the right to deduction. If the higher body of the Federal Tax Service does not take into account the submitted documents, it makes sense to resolve this issue in court, since Art. The Constitution of the Russian Federation does not allow us to conclude that the payer is responsible for the actions of all enterprises participating in the multi-stage process of paying VAT, and non-payment of tax by the counterparty cannot clearly deprive the buyer of the right to deduction (Definitions of the Constitutional Court of the Russian Federation of January 10, 2002 No. 4-O, dated 16.10 .2003 No. 329-O, dated November 10, 2016 No. 2561-O).

Judicial practice is extremely diverse, with many examples both confirming this approach and refuting it. But there are also cases when going to court is useless.

Refusal to deduct VAT

The inspectorate denied the company a VAT deduction.

The basis for the refusal was the conclusion of the tax authorities about the lack of due diligence of the payer when choosing its counterparties for transactions. In particular, the payer did not control the fulfillment by counterparties of their tax obligations. As a result, VAT did not go to the budget. It is impossible to reimburse from the budget a tax that was not received there. According to the payer, the inspector’s decision violates his rights. The applicant insists that he is not obliged to control the activities of his counterparties and be responsible for their violations. The court noted that the deduction may be denied in the absence of a real business transaction or in the carelessness of the payer in choosing a problematic counterparty. From the case materials it followed that the payer submitted a set of all necessary documents in order to receive deductions. The fact that the work was completed was confirmed and not disputed by the tax authorities. The funds paid to the disputed counterparties were not returned to the payer. According to the complainant, he exercised full caution when choosing controversial contractors. Thus, the society analyzed information from open sources about organizations, and also requested copies of documents confirming their legal capacity. Accounting for additional VAT in tax expenses >>>

He also established regular monitoring of contractors’ fulfillment of obligations to customers - recipients of budget funds. He monitored the business reputation of his counterparties and could not doubt the quality of the work performed. The disputed contractors performed work under state and municipal contracts. There was no fictitious document flow or aimless movement of funds, but there were normal economic relations between the applicant and his counterparties. Despite all the above circumstances, the cassation decided that the company does not have the right to deduction. The judges explained that the participation of controversial counterparties in numerous state and municipal contracts only indicates that measures have been taken to verify the business reputation of the counterparties. But this circumstance cannot be considered as a sufficient basis for granting the applicant the right to a deduction. According to the court, the fact that the work was actually performed and the payer incurred costs is only a sufficient basis for taking into account the corresponding costs as income tax expenses. In this case, the payer was not assessed additional income tax. Consequently, there are no violations on the part of the inspectorate. In this case, the presence of work performed and costs incurred is not enough to obtain a deduction. The case materials confirmed that tax reporting was submitted by the payer's counterparties with minimal amounts of taxes. Or even with zero indicators. The specified counterparties did not submit documents for conducting a counter audit at the request of the tax authority. The court recalled that VAT refers to indirect taxes. Accordingly, in order to grant the right to tax deductions for it, it is necessary, among other things, to create a source in the budget for obtaining the right to tax deductions. In other words, in order for the buyer to qualify for the deduction, the supplier must first pay VAT to the budget. In the disputed case this did not happen. In such circumstances, the court refused to deduct the tax to the applicant.

A selection of successful and unsuccessful methods for tax optimization of income tax, property tax, VAT, personal income tax and insurance contributions >>>

VAT: unscrupulous counterparty

Situations are possible when companies purchase goods or services that are exempt from taxation (Article 149 of the Tax Code of the Russian Federation), and sellers, despite the exemption, issue VAT invoices at the current rate. In this case, the acquirer, considering them to be the basis for applying a deduction, generates a declaration, calculating the amount of deduction for these transactions.

However, the Federal Tax Service Inspectorate, having checked the declaration, will refuse to refund the VAT, since the supplier, when issuing VAT, did not transfer it to the budget. Here we are already talking about the supplier’s dishonesty, since by imposing VAT on preferential transactions, he increased their cost by the amount of tax that remained with him. Regarding such cases, the Ministry of Finance of the Russian Federation provides clarifications in letter No. 03-07-03/48174 dated August 17, 2016, where it comes to the conclusion that it is impossible to deduct “input” VAT on an invoice for which there is no source. The courts are in full agreement with the Ministry of Finance on this issue - collecting VAT from the counterparty is impossible in principle.

Note that the buyer has the right to demand from such a supplier the return of the amounts of tax unreasonably transferred to him, considering them as unjust enrichment and charging interest for the use of someone else's funds. The Supreme Court agrees with this approach, setting out its position in Ruling No. 305-KG15-10553 dated October 5, 2015.

Unfortunately, it is difficult for the buyer to protect himself from the dishonesty of the counterparty supplier. You can somewhat reduce the risks by asking him to provide copies of payment documents for VAT transfers. True, not every seller will agree to this, citing the fact that the company’s financial documents constitute its trade secret. Therefore, we can only hope for the integrity of our partners, but also do not forget to check their reliability in all available ways.

Non-payment of tax by the seller

Finally, the third part of the clarifications of the RF Supreme Court concerns the refusal to deduct input VAT due to the fact that the seller did not transfer the tax amount to the budget. Here the judges came up with a clear rule: in such a situation, it is possible to “remove” deductions from the buyer who actually received the goods (work or service) only if it is proven that he knew or should have known about the seller’s dishonest behavior.

The fact that the buyer should be aware of violations committed by the counterparty is confirmed, first of all, by the fact of their interdependence or affiliation (for more information, see “Tax risks: is it possible to conclude transactions between “friends”).

Carry out automatic reconciliation of invoices with counterparties Connect to the service

If the specified connection between the parties to the transaction is absent, then the results of the verification of the counterparty, carried out taking into account the above recommendations of the Armed Forces of the Russian Federation, should be taken into account. In other words, it is assessed how reasonably and conscientiously the buyer acted when concluding a specific contract (taking into account the regularity and price of the transaction, the specifics of the product, etc.). And during such an inspection, could he, in principle, establish facts of illegal behavior of the seller: nominal (i.e., the absence of real activity of the seller, in connection with which the contract will actually be fulfilled by another person), distortion of reporting, withdrawal of money using fictitious documents or cashing out, transfer funds to low-tax foreign jurisdictions, etc.

Use Article 145 of the Tax Code of the Russian Federation

According to Article 145, LLCs and individual entrepreneurs on the general taxation system have the right not to pay VAT if for three consecutive calendar months preceding the current one, business revenue was no more than 2 million rubles. If a business earns on average no more than 700 thousand rubles per month, then you can take advantage of the benefit.

An ideal option for entrepreneurs who, for various reasons, are forced to work on the operating system, but do not receive much income. For example, companies whose share is 25% owned by another legal entity.

But there are also exceptions. This option cannot be used by entrepreneurs who sell excise goods. Read the law for a complete list of exceptions.

The courts require control over whether the counterparty has paid VAT

In the article: What arguments do the courts listen to from tax officials? How can the company justify its position? What can you do to minimize the risk of claims?

Tax authorities often deny the right to refund VAT after learning that the company's supplier has not paid the tax. In some cases, officials may also be supported by the court. In particular, even the Presidium of the Supreme Arbitration Court of the Russian Federation made a decision in their favor (resolution No. 12210/07 dated February 12, 2008). Moreover, some lower courts already refer to its conclusions in practice (for example, resolution of the Federal Arbitration Court of the Ural District dated May 28, 2008 No. F09-3810/08-S3).

OFFICIAL POSITION Andrey BRUSNITSYN , 3rd class adviser to the state civil service of the Russian Federation:

— Since this decision was made by the Presidium of the Supreme Arbitration Court of the Russian Federation, which is obliged to monitor the uniformity of arbitration practice (clause 1 of Article 304 of the Arbitration Procedural Code), I believe that this position will become widespread.

It turns out that taxpayers still need to control whether the counterparty has paid taxes. Why do the courts side with officials and refuse to deduct VAT?

TAX FILES USE REFERENCES TO HIGH COURT DECISIONS

Officials appeal to arbitration practices that are positive for them. After all, decisions, for example, of the Constitutional Court are binding on the entire territory of Russia (Article 6 of the Federal Constitutional Law of July 21, 1994 No. 1-FKZ “On the Constitutional Court of the Russian Federation”).

Thus, in the ruling dated July 25, 2001 No. 138O, the Constitutional Court o. According to tax authorities, a company that has entered into an agreement with a counterparty that has not paid VAT to the budget is itself unscrupulous. This means that he cannot use in his defense the nuances of the law that allow VAT to be offset when the partner has not paid the tax. When resolving such issues, district courts often agree with this argument (for example, decisions of the federal arbitration courts of the Ural district dated 09.10.07 No. Ф09-3532/07-С3, Volga district dated 05.18.06 No. A55-12502/2005-3).

OFFICIAL POSITION Andrey BRUSNITSYN , 3rd class adviser to the state civil service of the Russian Federation:

— Still, the presumption of good faith, which the Constitutional Court of the Russian Federation spoke about in the said resolution, means that the taxpayer is considered to be fulfilling his duties properly until the contrary is proven by the tax authority. And only if the tax authority proves the taxpayer’s intention to obtain an unjustified tax benefit, then certain actions, including those aimed at obtaining a tax deduction, can be considered an abuse of right. However, some inspectors interpret this completely differently.

According to the rulings of the Constitutional Court dated April 8, 2004 No. 169-O and November 4, 2004 No. 324-O, the right to reimbursement of VAT amounts from the budget corresponds to the obligation to pay tax to the budget. That is, tax authorities may deny the right to deduct VAT if the supplier has not remitted the tax. Thus, the court considered this argument to be justified in the decisions of the federal arbitration courts of Western Siberia dated July 23, 2008 No. F04-4437/2008 (8402-A75-41), Moscow dated February 4, 2008 No. KA-A40/8852-07, dated January 21. 08 No. KA-A40/14503-07 districts.

In addition to the decisions of the Constitutional Court, there are also decisions of the Presidium of the Supreme Arbitration Court of the Russian Federation in favor of the tax authorities. In particular, resolutions of December 13, 2005 No. 9841/05, 10048/05, 10053/05. In them, the court noted that if the tax authority provides evidence of the absence of business transactions and payment of taxes to the budget, then one should not limit oneself to a formal check of the compliance of the taxpayer’s documents with the requirements of the Tax Code of the Russian Federation. It is necessary to evaluate all the evidence in the case in its entirety and in its interrelation in order to eliminate internal contradictions and discrepancies between them. The courts take this argument into account when making a decision in favor of the inspectors (decrees of the federal arbitration courts of the Moscow district of 09/02/08 No. KA-A40/8149-08-P, Volga district of 05/30/08 No. A57-12614/07).

Tax authorities also refer to the already mentioned resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 12, 2008 No. 12210/07. The court found that the company had a real opportunity to study the history of relationships between previous owners of real estate, indicating the supplier’s deliberate actions to evade VAT when selling the building.

OFFICIAL POSITION Andrey BRUSNITSYN , 3rd class adviser to the state civil service of the Russian Federation:

— Indeed, the legislation does not establish the taxpayer’s liability for the actions of third parties, including by depriving him of the right to a tax deduction. At the same time, the rule “know your counterparty” is one of the main ones in business. If, based on the results of an objective audit, it turns out that the taxpayer had the opportunity to obtain information about the payment of tax by the counterparty, but he did not take advantage of it, then the refusal to deduct may be quite justified.

Thus, there is quite a lot of arbitration practice in favor of inspectors, including from higher courts. However, there is an opportunity to fight off the claims of officials.

WHAT CAN THE TAXPAYER OPPOSITE?

Companies can cite several arguments in their defense. There is a high probability that the court will take them into account when making a decision.

The dependence of the deduction on the payment of VAT by the counterparty has not been established. Tax legislation does not provide for such a basis for receiving tax deductions as payment of VAT to the budget by suppliers. Article 172 of the Tax Code of the Russian Federation states that a company can receive a deduction if three conditions are met: the goods, work, service are capitalized, intended for activities subject to VAT, and the company has an invoice. There are no other conditions for deduction, and tax authorities do not have the right to add new ones.

EXPERT COMMENT Rafael USMANOV , Deputy General Director for Consulting JSC Scott, Riggs and Fletcher (audit):

— In a recent ruling dated August 19, 2008 No. 8947/08, the Supreme Arbitration Court also emphasized that failure by counterparties to fulfill their obligations to pay VAT cannot serve as a basis for denial of tax deductions.

There is no obligation to check the counterparty. When justifying their claims, neither tax authorities nor the courts that take their side refer to the Tax Code. After all, there is not a word about the need to check the supplier. Rather, on the contrary, there is an indication that the taxpayer does not have the right to monitor his counterparties. Even failure to fulfill the obligation to pay tax to the budget, if this cannot be qualified as a tax offense, is a tax secret that is not subject to disclosure (subclause 3, clause 1, article 102 of the Tax Code of the Russian Federation).

The courts most often agree with this argument (for example, decisions of the federal arbitration courts of the Ural from 07/01/08 No. Ф09-3955/08-С2, Moscow from 05/14/08 No. KA-A40/4150-08, West Siberian from 04/30/08 No. F04-2792/2008 (4587-A46-41), Volga region dated April 15, 2008 No. A55-14893/07).

The company is not responsible for the actions of partners. There is also a decision of the Constitutional Court in support of taxpayers. Thus, in its ruling dated October 16, 2003 No. 329-O, the Constitutional Court of the Russian Federation specifically stipulated that the use of the concept of “good faith” cannot impose additional responsibilities on the company. The taxpayer is not responsible for the actions of all organizations participating in the multi-stage process of paying and transferring taxes to the budget (decrees of the Moscow Federal Arbitration Court No. KA-A41/8662-08 of September 15, 2008, No. A56-38571/ of the North-West Federal Arbitration Court of September 5, 2008). 2007, Volga region dated August 28, 2008 No. A65-610/08 districts).

In addition, the main condition for bringing tax liability is the company’s fault (Clause 6, Article 108 of the Tax Code of the Russian Federation). According to paragraph 1 of Article 110 of the Tax Code of the Russian Federation, a person who has committed an unlawful act intentionally or through negligence is recognized as guilty of committing a tax offense. Non-payment of VAT is committed by the counterparty. It turns out that the taxpayer is being punished for the actions or inaction of another person, which is unlawful.

PRACTITIONER'S OPINION Nellya EROKHINA , group chief accountant:

— Indeed, the organization cannot and should not be held responsible for violations committed by other persons. In my opinion, the offender should be held accountable, but not the person who entered into a contractual relationship with him.

Failure to pay tax by a counterparty does not indicate receipt of a tax benefit. The Plenum of the Supreme Arbitration Court of the Russian Federation, in paragraph 10 of Resolution No. 53 dated October 12, 2006, indicated that the fact that the counterparty of the audited company violated its tax obligations does not in itself constitute evidence that it received an unjustified tax benefit. To confirm the validity of the refusal to deduct, the inspection must prove that the company did not exercise due diligence when choosing a partner and was aware of violations committed by the counterparty. In the absence of such evidence, the court may take the side of the company (for example, decisions of the federal arbitration courts of the North Caucasus dated 08.28.08 No. Ф08-4925/2008, Ural courts No. Ф09-6183/08-С3 dated 01.09.08, Central from 04.08.08 No. A-62-5126/2007 districts).

The company is not required to prove its innocence. Article 108 of the Tax Code of the Russian Federation establishes that a person brought to tax liability is not obliged to prove his innocence of committing a tax offense. Consequently, it is the tax authorities who must collect information that the organization had the intent to extract unjustified benefits. Or prove the existence of a conspiracy between the organization and contractors aimed at refunding taxes.

In particular, the Federal Arbitration Court of the Volga District agreed with the tax authorities that only bona fide taxpayers have the right to deduction (resolution dated February 10, 2006 No. A55-4112/05-10). However, in his opinion, this only means that if inspectors have doubts about the company, they should be the ones to obtain evidence.

PRACTITIONER'S OPINION Roman OMELYANCHUK , financial consultant:

— Since tax authorities make the right to deduction dependent on the receipt of such information, their own logic can be used against them. The fact is that the buyer, receiving a VAT deduction, avoids unjustified expenses that could have been incurred if the tax authorities had refused the deduction. And according to paragraph 1 of Article 3 of the Federal Law of July 29, 2004 No. 98-FZ “On Trade Secrets,” information that allows, under existing or possible circumstances, to increase income or avoid unjustified expenses is recognized as a trade secret. As a result, by collecting financial and economic information about the counterparty, the buyer directly violates the law.

PRECAUTIONARY MEASURES TO HELP MINIMIZE THE RISK

At the same time, not every company is ready to defend its rights in court. To minimize the risks of possible claims from tax authorities, you can follow these steps.

First, obtain a copy of the counterparty’s registration certificate in the Unified State Register of Legal Entities. Thus, the company is convinced of the existence of the counterparty and its civil legal capacity. Of course, the absence of such a document does not always entail a denial of the right to deduct VAT (resolutions of the federal arbitration courts of the Northwestern district dated 06/09/08 No. A44-2525/2007, Ural district dated 03/18/08 No. F09-1522/08-С3 ). However, it is safer to get it. Usually, this step is already enough for the courts to recognize: the company has shown due diligence (decrees of the federal arbitration courts of the Volga region dated July 15, 2008 No. A57-579/08, West Siberian of April 30, 2008 No. F04-2792/2008 (4587-A46- 41) districts).

Secondly, you can request a copy of the VAT return with a note from the tax authorities about receipt of the dispatch protocol or postal notification, depending on the method of sending the reports. In this case, it is enough to have not the entire declaration, but only the first sheet, indicating that it exists, is signed and sent.

In addition, you can obtain an extract from the sales book about the transaction between the companies, indicating the amount of the transaction reflected in the tax registers. The statement can be issued in a free manner, for example, as a copy of a sales book, but sorted by a single buyer.

EXPERT COMMENT Valery BAKHTIN , expert at the First Consulting House “What to do Consult”:

— It is advisable to take other precautions that are not related to the payment of tax by the counterparty, but in general to his legal capacity. In particular, it is safer to have a certified copy of the counterparty’s charter. He is obliged to submit it in accordance with paragraph 4 of Article 11 of the Federal Law dated December 26, 1995 No. 208-FZ or paragraph 3 of Article 12 of the Federal Law dated February 8, 1998 No. 14-FZ, depending on the legal form of the company. It is also necessary to request copies of the decision on the appointment of a director, the order on the appointment of an accountant or other authorized persons. These documents confirm the authority of the persons signing contracts, invoices, and invoices.

I note that it is also useful to have postal notifications about the delivery of letters to the counterparty’s address. They will confirm that the organization really exists at the specified address. And checking the actual payment of taxes by the counterparty is a direct function of the tax authorities. That is, in this case, officials shift their immediate responsibilities to the taxpayer.

Yu. Zvezdina, nalogplan.ru

See Also

Tax Consulting

Judicial practice on the issue of VAT calculation

An updated declaration helps to recover VAT

Checking the VAT return. Refund, clarification...

The problem of VAT deduction: the impact of accounting

VAT refund on an erroneous invoice

Corrected invoice: inspectors or judges?

The invoice is late, or When time is not money

“Anonymous” invoice and VAT deduction

Invoice for the borrower

VAT deduction without invoice

The procedure for appealing acts of tax authorities

When the tax office has the right to refuse admission

The reasons when the tax office does not accept reports on legal grounds are established in the Administrative Regulations of the Federal Tax Service, approved by Order of the Ministry of Finance dated July 2, 2012 No. 99n.

Reports will not be accepted if:

- The Federal Tax Service did not provide documents proving the identity and authority of the person providing the reporting. When submitting reports via secure communication channels via the Internet, the grounds for refusal are considered to be: an expired power of attorney or inconsistency of passport data.

- Reporting does not comply with established forms, standards and completion requirements.

- The reporting is not certified by the manager. If the electronic report file is signed by UKEP, but the electronic signature does not comply with the established rules for cryptographic information protection, then the Federal Tax Service does not accept VAT and other reporting legally.

- The reporting was submitted to the territorial branch of the Federal Tax Service, whose competence does not include the responsibility for accepting these reports.

The manager must report to the head of the Federal Tax Service

Tax officials require the head of the organization to appear at the inspectorate with a passport and a full package of constituent documents for an appointment with the head of the Federal Tax Service. Moreover, they add that the declaration will be accepted only after a personal reception with the inspection management. In fact, the queue to see the head of the Tax Service is scheduled several weeks in advance, therefore, fines cannot be avoided.

This is how the inspectorate fights against unscrupulous managers who deliberately underestimate the amount of tax liabilities, and against fly-by-night companies that are set up as front men.

The official position of the inspectorate is radically different from the situations in practice. For example, tax officials announced a massive server failure due to which the tax office does not accept VAT returns, so the process was temporarily suspended. Moreover, based on the press’s explanations, the deadline for submitting the report will be the date of sending the receipt of the secure communication channel or the inspector’s mark on the paper report.

Voluntary repayment of arrears and penalties

On the question of whether voluntary repayment of arrears and penalties is a mitigating circumstance, there are also 2 opinions.

First: if arrears and penalties are repaid ahead of schedule, then this circumstance can be considered a mitigating factor in case of non-payment or incomplete payment of tax.

The most convincing arguments are presented in the resolution of the Federal Antimonopoly Service of the North Caucasus District dated October 23, 2013 in case No. A32-37825/2012. In it, the arbitration judges noted that by early payment of arrears and penalties, the taxpayer compensated for the negative consequences for the budget, so his guilt could be mitigated.

Similar arguments are contained in the decisions of the Federal Antimonopoly Service of the West Siberian District dated March 4, 2013 in case No. A27-15083/2012 and the FAS Volga-Vyatka District dated September 19, 2012 in case No. A28-11341/2011.

The arbitrators also recognize the payment of arrears and penalties before scheduling a tax audit as a mitigating circumstance. If the taxpayer timely and independently eliminated the debt on the basis of updated declarations, then these actions, in their opinion, reduce the degree of guilt. Such arguments are contained in the decisions of the FAS Volga District dated 02/21/2012 in case No. A55-12545/2011 and the FAS Moscow District dated 10/13/2008 No. KA-A40/8307-08 in case No. A40-64015/07-107-371.

In the resolution of the Arbitration Court of the West Siberian District dated June 16, 2016 No. F04-2227/2016 in case No. A27-17694/2015, payment of arrears and penalties before the inspection inspection made a decision was also recognized as a mitigating circumstance that allows reducing the amount of the fine. Second opinion: early repayment of arrears and penalties cannot be considered a mitigating circumstance in case of non-payment or incomplete payment of tax.

Particularly indicative is the resolution of the Federal Antimonopoly Service of the North-Western District dated 02/08/2008 in case No. A05-6875/2007. The arbitration judges indicated that recognition of the validity of the Federal Tax Service's demands does not entail mitigation of the organization's guilt. The taxpayer must fulfill tax payment obligations independently, without tax audits.

Similar conclusions are contained in the resolution of the Federal Antimonopoly Service of the West Siberian District dated January 31, 2012 in case No. A27-6262/2011 (by the decision of the Supreme Arbitration Court of the Russian Federation dated April 20, 2012 No. VAS-4621/12, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused).

Overpayment of tax

When asked whether overpayment of tax is a mitigating circumstance, there are 2 opposing positions.

The first point of view is based on the assertion that overpayment of tax is a mitigating circumstance in determining the degree of guilt in non-payment of this tax. Decisions of various instances of arbitration courts speak in favor of this position.

Thus, the Federal Antimonopoly Service of the North Caucasus District, in a resolution dated May 13, 2011 in case No. A32-24703/2010, indicated that the presence of an overpayment of tax on an organization’s accounts indicates inaccuracies in calculations, and not a desire to evade the taxpayer’s obligations. Therefore, such circumstances can be considered mitigating, despite their absence in the list given in paragraphs. 3 p. 1 art. 112 of the Tax Code of the Russian Federation.

Similar arguments are contained in the decisions of the FAS of the West Siberian District dated July 10, 2012 in case No. A45-23284/2011 and the FAS of the North Caucasus District dated March 15, 2011 in case No. A32-18613/2010.

The overpayment, which exceeds the amount of the detected arrears at the time of the audit, further convinces the judges of the taxpayer’s innocence. This position is confirmed by the resolution of the Federal Antimonopoly Service of the West Siberian District dated 04/07/2008 No. F04-1668/2008(1938-A45-25) in case No. A45-806/2004-SA40/45.

Similar arguments are presented, in addition, in the decisions of the Federal Antimonopoly Service of the Moscow District dated January 30, 2007, February 6, 2007 No. KG-A40/12966-06 in case No. A40-32425/05-14-286 (determined by the Supreme Arbitration Court of the Russian Federation dated May 31, 2007 No. 6329 /07 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation) and the FAS of the West Siberian District dated March 21, 2007 No. F04-1683/2007 (32718-A75-26) in case No. A75-6311/2006 (as determined by the Supreme Arbitration Court of the Russian Federation dated July 23. 2007 No. 8578/07 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation).

It is noteworthy that arbitration courts made decisions in favor of mitigating liability not only for VAT, but also for income tax, as well as corporate property tax.

An alternative point of view says that overpayment of tax cannot serve as a mitigating circumstance in determining the degree of guilt if late payment of VAT or other tax is committed.

This position is contained in only one judicial act - the resolution of the Federal Antimonopoly Service of the Ural District dated August 20, 2008 No. F09-5323/08-S3 in case No. A71-3098/2007. The arbitration judges indicated that the establishment of mitigating circumstances is within the competence of the judicial authorities. On this basis, the taxpayer's request to reduce the fine was rejected.

How to get a benefit?

To take advantage of the benefit, a package of documents is sent to the Federal Tax Service by the 20th. For example, if you are planning a transition from October 2021, then by October 20 you send three documents to the Federal Tax Service:

- Notification of transition;

- Extract from the sales book for 3 months (August, September, October);

- Extract from the balance sheet.

The notification is issued in the approved form. The package is reviewed quite quickly, but keep the situation under control. Call the inspector and make sure that they received everything and that the documents were filled out without errors. The tax office will respond with a notification that the transition has been approved.

Work under the new scheme lasts a year, then it needs to be extended. But if revenue for 3 consecutive months becomes more than 2 million, then the company returns to the obligation to pay VAT. You can come back with a new statement and evidence that revenue has returned to previous levels.

After receiving the benefit, the company is exempt from paying VAT and filing a declaration. But you will still have to issue invoices (with a note that without VAT) and keep a sales book. The latter will be requested by the Federal Tax Service during the inspection, so take it seriously.

Results

For late payment of tax, liability in the form of a penalty always occurs, but a fine is assessed only if the reason for late payment of VAT was an understatement of the tax base.

If the tax authority determines that the understatement was deliberate, the amount of the fine will double - from 20 to 40 percent. The fine may be reduced if the taxpayer has at least one mitigating circumstance. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What circumstances mitigate liability for a tax offense?

In paragraphs 3 p. 1 art. 112 of the Tax Code of the Russian Federation lists circumstances that mitigate (when determining the degree) the guilt of incomplete payment or complete non-payment of taxes. For example, these include a combination of difficult personal (family) circumstances or the presence of a threat. The list is not closed, so the tax inspectorate or the court may consider other circumstances not included in the list to be mitigating.

See also the material “Mitigating circumstances can help reduce the fine by more than half .