Explanations to the tax office regarding VAT are explanations from the taxpayer in response to the request of the Federal Tax Service, which formulates the discrepancies identified by the audit. There are two categories of reasons for making such a request:

- decoding of information on preferential transactions included in the VAT return;

- detection of inaccuracies and errors in the report (there are 9 types of errors, each of which corresponds to a specific code).

Each reason has to be explained differently, and it should be remembered that tax authorities are only waiting for an answer to the questions posed, without requiring additional information.

About the problems of the situation

The Tax Code in Article 176 briefly describes the entire procedure for returning VAT to the payer from the budget. It should be borne in mind that VAT refund is considered a rather serious and complex procedure when compared with the application of a zero VAT rate or with a tax offset.

But from a purely theoretical point of view, the procedure is quite simple and clear. True, practice follows a different path.

Tax refunds to payers, of course, do not act as one of the core activities of tax authorities. Consequently, these authorities are in absolutely no hurry to reimburse VAT.

Often the reason for refusal of reimbursement is incorrect execution of primary documents by the taxpayer's counterparty supplier.

Accordingly, the taxpayer needs to carefully check the correctness of the invoices in order to avoid difficulties later.

In addition, the authorities are wary of this situation, since it is closely related to the problem of fraud. We are talking about the return of unjustified amounts of VAT.

Read on to learn how to fill out a UTII declaration. A good example.

In the news (here) you can change the legal address of an LLC yourself.

Ready-made business plan for beekeeping!

All this together leads to the fact that VAT refunds become an exceptional situation. As a standard, tax authorities, even in the absence of a substantiated position, refuse.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with the provision of an explanatory note, an invitation to the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In the explanatory note, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service initiates an on-site inspection, which may take several months.

What to write in an explanatory note:

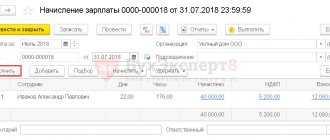

- Reduction of salary taxes. The reasons may be staff reduction, enterprise restructuring, or reduction in wages.

- A decrease in profits may occur due to termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the explanatory note.

- Increased costs as a result of decreased profits. The justification may be expansion of activities (increasing production volumes, opening a new branch, division, retail outlet), changing suppliers or increasing prices for inventories and raw materials (attach copies of contracts).

There can be quite a few reasons for reducing the tax burden. We will have to look into each specific case.

Conditions for VAT refund. Possible stages of the procedure

The main conditions for VAT refund are as follows:

- excess of the amount of deductions over the amount of accrued tax;

- availability of all documents confirming this;

- filing an application for VAT refund.

Next, in order to recover VAT from the budget, the taxpayer needs to submit a declaration to the appropriate tax service.

This document will have to confirm that deductions (more precisely, their amount) for the tax period exceed the amount of accrued tax. Therefore, the difference is either credited or refunded.

After receiving the declaration, the tax service must organize a desk audit. The purpose of this event is to confirm or refute the validity of the amount that supposedly needs to be returned. And if no violations are found, then based on the results of the inspection a decision will be made to reimburse funds from the budget.

However, it is necessary to take into account that the tax authority may find violations during the audit; therefore, a report will be drawn up indicating the violations found. In this case, the taxpayer has the right to protest the act and present his objections.

If, after considering the results of the audit and the taxpayer’s objections, the tax office still refuses to refund the VAT, then the taxpayer has the right to appeal such a decision to a higher tax authority.

Having failed to achieve a result in this situation, the taxpayer can go to court.

A court decision made in favor of the taxpayer gives him the right to receive funds from the budget, as well as to reimbursement of legal costs and interest for the delay in the return of funds.

Requirement from the Federal Tax Service

If the tax inspectorate has any questions during a desk audit of VAT reporting, a demand to the taxpayer will not be long in coming. The reasons for sending a request to reporting organizations are divided into two groups. Most often, the Federal Tax Service requires clarification:

- information on preferential transactions that were included in VAT reporting;

- identified discrepancies and errors in the declaration report (there are nine in total).

Each reason will have to be explained differently. When receiving a request from the Federal Tax Service, the company will have to explain to the controllers only the information that was requested. No additional information required. Of course, if the taxpayer himself has not discovered other shortcomings in the VAT return.

Reasons for VAT refund

Tax authorities often ask taxpayers to provide a written statement of the reasons that served as the basis for refunding VAT from the budget.

And although the taxpayer organization is not at all obliged to explain this, it is still better to start preparing the corresponding letter.

What reasons could there be? Since the basis for a VAT refund is the excess of the amount of deductions over the amount payable as VAT, you should explain in the letter what caused this situation. Perhaps the reason lies in a decrease in sales volumes. Perhaps it's something else. In any case, it is important to simply provide an explanation.

We are preparing explanations on VAT benefits

If the Federal Tax Service requests information about preferential transactions, then formulate the explanations in the form of a register of documents confirming the right to VAT benefits. This follows from Letters of the Federal Tax Service of Russia dated 02/22/2018 N SA-17-3/52, dated 01/26/2017 N ED-4-15/ [email protected]

You do not need to provide the documents themselves. All you need is a register in the prescribed form. The Federal Tax Service will request copies of supporting documentation later. A specific list of requested securities will be established depending on the assigned level of tax risk according to the reconciliation of the ASK VAT-2 RMS (Letter of the Federal Tax Service of Russia dated January 26, 2017 N ED-4-15 / [email protected] ).

The registry form is recommended in Appendix No. 1 to the Letter dated January 26, 2017 N ED-4-15/ [email protected]

Package of necessary documents

In order to increase their chances of receiving a tax refund, the payer should provide the most complete package of documents.

This is about:

- invoices;

- documents, the presence of which confirms the actual payment of tax at the time of import of goods into the territory of the Russian Federation;

- documents that confirm the payment of tax withheld by tax agents;

- other documents, including: agreements that the taxpayer entered into with suppliers and customers; payment orders to confirm payment to suppliers; financial statements; etc.

Read more about how to open a construction company in Russia. Step-by-step instruction.

In the article (tyts) how to calculate labor productivity per employee.

How to calculate return on equity?

The list, as we see, is non-exhaustive.

VAT discrepancies

In 2021, tax authorities have more reasons to submit VAT reporting requirements. Previously, there were only four defect codes in the declaration. Now the number has almost doubled. There are currently nine codes for markings in the VAT return.

Codes for types of errors in the value added tax return:

| Code | Explanation |

| 0000000001 | Discrepancy with counterparty reporting |

| 0000000002 | Inconsistency of information in sections 8 (purchase book) and section 9 (sales book). |

| 0000000003 | Discrepancies between invoices issued and received in sections 10 and 11 |

| 0000000004 | Error in a specific column of the report (the number of the erroneous declaration line is indicated in brackets) |

| 0000000005 | The invoice date in sections 8-12 is incorrect |

| 0000000006 | The date of the application for deduction exceeds the allowable period of three years |

| 0000000007 | The date of the invoice claimed for VAT deduction does not correspond to the period of activity |

| 0000000008 | The transaction code is incorrectly indicated in sections 8-12 of the declaration (the codifier is given in the Federal Tax Service order dated March 14, 2016 No. ММВ-7-3 / [email protected] ) |

| 0000000009 | Canceling entries are incorrectly reflected in section 9 of the declaration |

Details in the article: Error codes in the VAT return.

Don't forget about deadlines

Since it is obvious that the tax authorities are not inclined to promptly reimburse VAT from the budget, they should be constantly reminded of the deadlines.

So, if the audit does not reveal any violations, then the decision on VAT refund must be made within 7 days.

And the taxpayer must be notified of the audit carried out and the decision made within 10 days.

In addition, in court proceedings, the interest then paid for the delay in reimbursement begins to count from the 12th day after the completion of the audit.

When the tax office asks for clarification

The reasons why tax officials may have questions for a taxpayer during a desk audit are listed in clause 3 of Art. 88 of the Tax Code of the Russian Federation:

What the Federal Tax Service will require is to provide clarifications or make corrections to the reporting.

What the Federal Tax Service will require is to provide explanations justifying the change in indicators and the reduction in the amount of tax payable.

- Reason 3 – unprofitable indicators are stated in the reporting.

What the Federal Tax Service will require is to provide explanations justifying the amount of the loss received.

Having received a similar request from tax authorities to provide an explanation to the tax office (a sample can be seen below), it should be answered within 5 business days. There are no penalties for failure to submit, but you should not ignore the tax authorities’ requirements, since, without receiving a response, the Federal Tax Service may assess additional taxes and penalties.

Please note: if the taxpayer belongs to the category of those who are required to submit a tax return electronically in accordance with clause 3 of Art. 80 of the Tax Code of the Russian Federation (for example, on VAT), then he must ensure the receipt from the Federal Tax Service of electronic documents sent during the desk audit. This also applies to requests for explanations - within 6 days from the date of sending by the tax authorities, the taxpayer sends an electronic receipt to the Federal Tax Service Inspectorate confirming receipt of such a request (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation).

conclusions

Summing up the issue of VAT reimbursement from the budget, it is necessary to note the following:

- From a practical point of view, tax refund is a rather complex process.

- To receive a refund, all conditions must be met, all documents must be provided, and the reasons for the return must be explained.

- Tax authorities are not in the mood for refunds, so you should prepare for a delay in the process. It may not be possible without a trial.

Video on what VAT is and the procedure for its reimbursement:

How to submit clarifications to the Federal Tax Service on the new rules

It is important to follow the new rules for submitting explanations to the Federal Tax Service in 2020. For preferential transactions, it is permissible to send the register both on paper and electronically. In this case, the method of submitting the declaration to the Federal Tax Service is not taken into account.

If you submit explanations for errors and discrepancies, then you are allowed to report only in the form in which you submit the declaration. If the method is violated, the company or individual entrepreneur will be fined. The electronic format for submitting clarifications is fixed by Order of the Federal Tax Service of Russia dated December 16, 2016 N ММВ-7-15/ [email protected]

If a company or individual entrepreneur has the right to report on paper, then explanations can be sent in the form of a paper document. Otherwise, the explanations will be considered not provided, and the taxpayer will face penalties.

When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which it is mandatory to provide an explanatory note to the tax office upon request (we offer a sample for NPOs) are specified in clause 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector may suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so you can prepare an explanatory note on losses in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (Letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

Common mistakes when compiling

Below we will look at the most common mistakes made when preparing an explanation for the VAT return.

Mistake #1. The answer is provided on paper.

Before the legislative changes came into force, that is, before 01/01/17, the payer could choose the form of providing a response to the request - electronic or paper. After 01/01/17, the Federal Tax Service accepts only electronic responses; explanations provided on paper are considered invalid.

Mistake #2. The deadline for providing a response expires 5 days after it is sent by the Federal Tax Service.

The reporting point for the response deadline is the day the request was accepted (the day the receipt was sent). That is, from the moment the Federal Tax Service sends the request, the payer is given a maximum of 11 working days to accept it, as well as to draw up and send a response: 6 days - acceptance of the request plus 5 days - sending an explanation.

Mistake #3. The Federal Tax Service sends requests within 30 days from the date of filing the declaration.

Accountant's signature in explanations for VAT refund

There is another registration option - the relevant information can be written in a cover letter to the package of documents that the company submits to the inspectorate. But it is suitable only if there is nothing special to write about, that is, when purchases simply exceed sales. In this case, the covering letter is signed by the head of the company.

In addition to explaining the reasons for the refund, tax authorities often request information about the source of funds used to pay for goods, work, and services. Thus, inspectors try to detect signs of unjustified tax benefits. In such cases, you can simply write that the purchased goods, works, and services were paid for by bank transfer - by transferring funds from the company's current account to the current accounts of counterparties. All money in the current account is the property of the company. And where they came from, the company is not obliged to report as part of the desk audit.