The organization can issue itself or receive borrowed funds. According to the terms of loans, short-term and long-term are distinguished. Another nuance that affects accounting is whether the loan is provided without payment for the use of funds (interest-free) or whether interest must be paid (interest-bearing). In this article we will look at examples of postings for loans issued and received.

A legal entity, individual entrepreneur and individual can receive a loan. In turn, the organization can temporarily issue funds and property for use, both to other companies and to individuals (its employees, founders, strangers).

Step-by-step instruction

On November 1, the Organization received a loan from a counterparty in the amount of RUB 450,000. for a period of 18 months at 15% per annum. According to the terms of the agreement, the principal amount of the debt is paid in equal installments monthly, interest is accrued monthly on the balance of the debt. Payment of debt and interest is made according to the payment schedule.

On November 30 and December 31, interest was accrued and the principal and interest were paid according to schedule.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receiving a loan from a counterparty | |||||||

| November 01 | 51 | 67.03 | 450 000 | 450 000 | Receiving a loan from a counterparty | Receipt to the current account - Receiving a loan from a counterparty | |

| Reflection in the accounting of accrued interest on the loan for November | |||||||

| November 30th | 91.02 | 67.04 | 5 363,01 | 5 363,01 | 5 363,01 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for November | |||||||

| November 30th | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Payment of interest for November | |||||||

| November 30th | 67.04 | 51 | 5 363,01 | 5 363,01 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 91.02 | 67.04 | 5 414,38 | 5 414,38 | 5 414,38 | Interest accrual | Manual entry - Operation |

| Payment of loan principal for December | |||||||

| 31th of December | 67.03 | 51 | 25 000 | 25 000 | Payment of principal | Write-off from the current account - Repayment of the loan to the counterparty | |

| Reflection in accounting of accrued interest on a loan for December | |||||||

| 31th of December | 67.04 | 51 | 5 414,38 | 5 414,38 | Payment of interest | Write-off from the current account - Repayment of the loan to the counterparty | |

Accrual

When issuing a loan, the lender prescribes in the agreement the procedure and terms for paying interest. Depending on these conditions in the accounting book, the lender recognizes interest as other or income from ordinary types of employment. The second situation is possible if the issuance of loans is the subject of the organization’s activities. Then the interest is taken into account according to KT90. If interest amounts are recognized as other income, then they are reflected according to KT91.

Receiving a loan from a counterparty

Regulatory regulation

Under a loan agreement, one party (the lender) transfers or undertakes to transfer into ownership the other party (borrower) money, things defined by generic characteristics, or securities, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of things received by him of the same type and quality or the same securities (clause 1 of Article 807 of the Civil Code of the Russian Federation).

Loan and credit are not the same thing! Under a loan agreement, a bank or other credit organization undertakes to provide funds to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest for its use, as well as other payments provided for in the loan agreement, including those related to the provision loan (Clause 1, Article 819 of the Civil Code of the Russian Federation).

The main differences between a loan and a loan:

- The loan is issued only by the bank. The loan can be obtained from other legal entities, as well as individuals.

- The loan necessarily requires the payment of interest. The loan may be interest-free.

- The loan is issued exclusively in cash. The loan can be issued in kind or in securities.

- Loans are “subject to” the regulations of the Bank of Russia. For loans between persons other than credit institutions, these regulations may be considered as recommended.

The rules for accounting for loans are described in PBU 15/2008 “Accounting for expenses on loans and credits.” The amount received under the loan agreement is accounts payable and is accounted for depending on the loan term: if the term is up to a year inclusive - in account 66.03 “Short-term loans”, if the term is more than a year - in account 67.03 “Long-term loans” (1C chart of accounts).

The costs associated with the execution of the loan agreement and accounted for separately from the principal debt include (clause 3 of PBU 15/2008):

- interest on the loan;

- associated costs - payment for information and consulting services, contract review, etc.

Related expenses are taken into account evenly throughout the entire term of the loan agreement (clause 8 of PBU 15/2008).

As of June 1, 2021, the legislative regulation of loan agreements has changed significantly. Details As of June 1, 2018, changes to credit and loan agreements came into force.

Accounting in 1C

Receipt of funds under a loan agreement is documented in the document Receipt to current account transaction type Receipt of a loan from a counterparty .

Please pay attention to filling out the fields:

- Amount - the amount received under the loan agreement, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. PDF As a result of selecting such an agreement in the document Receipt to the current account, the following is automatically set:

- Settlement account - 67.03 “Long-term loans”.

Postings according to the document

The document generates the posting:

- Dt Kt 67.03 - receiving a loan from a counterparty.

Specifics of loan accounting

The key factor in the correct display of loan transactions in accounting is the lender’s understanding of the question: whether the funds lent are a financial investment for the company.

Monetary or material assets lent are recognized as a financial investment under the following conditions:

- the relationship between the lender and the borrower is secured by a formal agreement;

- the lender assumes all potential risks of non-payment or non-repayment of the loan;

- the transferred assets will generate stable income for the company during the contract period (financial assets or material assets are transferred for use at interest at a rate agreed in advance).

If these three conditions are not met, the agreement concluded between the parties concerned is an interest-free loan agreement.

The second factor of correct accounting is the period for which the loan is provided. Short-term loans are issued for a period of less than 12 months, long-term - for a period of more than a year. The account number on which it will be recorded depends on the loan term.

Reflection in accounting of accrued interest for November and December

The amount of interest on the loan (or the condition of no interest) is specified in the agreement. If there is no such clause, then interest is paid at the key rate of the Bank of Russia in force during the settlement periods. Exceptions are loans between citizens (including individual entrepreneurs) in the amount of no more than 100 thousand rubles. and loans in kind, which are interest-free by default, unless the agreement provides for other conditions (clause 1, clause 4 of Article 809 of the Civil Code of the Russian Federation).

The accrued interest is reflected in the accounting system (clauses 6-7 PBU 15/2008, clause 5, clause 11, clause 18 PBU 10/99):

- as part of other expenses in the reporting period interest accrual;

- in the initial cost of the investment asset.

In NU, accrued interest is reflected in non-operating expenses:

- for uncontrolled transactions - based on the actual interest rate (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation, clause 1, article 269 of the Tax Code of the Russian Federation);

- for controlled transactions - within the maximum threshold of the key rate of the Central Bank of the Russian Federation or international rates EURIBOR, SHIBOR, LIBOR, depending on the currency of the loan (clause 1.1, clause 1.2 of Article 269 of the Tax Code of the Russian Federation).

As a rule, interest on loans is accrued by analogy with bank loans: from the next day after the amount is received until the day the loan is repaid inclusive - this procedure is provided for in clause 3.14 of the Regulations of the Central Bank of the Russian Federation dated August 4, 2003 N 236-P. However, for loans it is not mandatory, so the contract can provide for a different procedure: for example, establish a fixed amount of interest (clause 2 of Article 809 of the Civil Code of the Russian Federation).

In our example, interest, according to the loan agreement, is accrued on the balance of the debt monthly according to the following formula:

Let's calculate interest for November and December:

In the following months the calculation will be similar.

Accounting in 1C

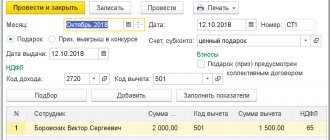

The accrual of interest is reflected in the document Transaction entered manually, the transaction type Transaction in the section Operations – Accounting – Transactions entered manually:

- in accounting - on account 91.02 “Other expenses”;

- in NU - as part of non-operating expenses.

Interest accrual for November.

Interest accrual for December and subsequent months is processed in the same way.

For more convenient work, you can define a template for reflecting accrued interest in accounting. To do this, you need to create a Standard Operation document in the Operations – Accounting – Standard Operations section.

Loan issued: accounting entries

If a loan is issued to another organization, the postings will be as follows:

Dt 58.3 Kt 51.

Interest-free borrowing:

Dt 76 Kt 51, 52.

Issuing a loan to the founder, posting:

Dt 76 Kt 50, 51.

Such an accounting entry is prepared if the founder is not an employee.

Issuing a loan to an employee (the postings will be similar for the founder-employee of the organization):

Dt 73.1 Kt 50, 51.

If an organization issues an interest-bearing loan to an employee, then interest is calculated as follows (clause 7 of PBU 9/99):

Dt 73.1 Kt 91.1.

If interest is accrued on a loan issued to another organization, the accounting entry will be as follows:

Dt 76 Kt 91.1.

You can issue funds to an employee as follows:

Dt 58.3 Kt 50, 51 - a loan was issued to an employee (postings).

Borrowed assets can be not only in the form of money. Accounting entries for such cases:

- Dt 58.3 Kt 10, 41 - interest-bearing loan to another organization or employee;

- Dt 76 Kt 10, 41 - interest-free loan.

Payment of principal for November and December

Accounting in 1C

Payment of the principal debt is reflected in the document Write-off from the current account type of operation Loan repayment to the counterparty in the Bank and cash desk section - Bank - Bank statements - Write-off.

Please pay attention to filling out the fields:

- Amount - the amount of the principal debt to be paid, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

- Type of payment - Debt repayment .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. PDF As a result of selecting such an agreement and the type of payment Debt Repayment in the document Write-off from the current account, the following is automatically set:

- Settlement account - 67.03 “Long-term loans”.

Payment of the principal debt for December and subsequent months is processed in the same way.

Postings according to the document

The document generates the posting:

- Dt 67.03 Kt - payment of the principal debt.

Example 1

The company received two loans: the first for six months in the amount of 150 thousand rubles, and the second for 36 months. in the amount of 680 thousand rubles. When preparing documents for the second loan, an additional fee for a lawyer was paid in the amount of 5 thousand rubles. Let's reflect these operations in accounting:

| D-t | Kit | Operation description | Amount, thousand rubles |

| 51 | 66 | Short-term loan provided | 150 |

| 66 | 50 | Short-term loan repaid in 6 months | |

| 51 | 67 | Long-term loan provided | 680 |

| 60 | 51 | Paid lawyer's services | 5 |

| 91 | 67 | Lawyer's services are expensed | |

| 67 | 51 | Loan repaid | 680 |

Payment of interest for November and December

Accounting in 1C

The payment of interest is reflected in the document Write-off from the current account transaction type Repayment of loan to the counterparty in the Bank and cash desk section - Bank - Bank statements - Write-off.

Please pay attention to filling out the fields:

- Amount - the amount of interest paid, according to the bank statement.

- Agreement - loan agreement with Agreement Type - Other .

- Type of payment - Payment of interest .

In our example, payments under the loan agreement are carried out in rubles, the term of the agreement is more than a year. As a result of selecting such an agreement and payment type, Payment of Interest in the document Write-off from the current account is automatically set:

- Settlement account - 67.04 “Interest on long-term loans.”

Payment of the principal debt for December and subsequent months is processed in the same way.

Postings according to the document

The document generates the posting:

- Dt 67.04 Kt - payment of interest.

Reporting

Long-term loans received are reflected in the balance sheet according to:

- line 1410 “Borrowed funds” - the balance of debt is reflected;

- line corresponding to the investment asset - in the amount of interest taken into account in the cost of acquisition of this asset.

If there is less than a year left until the loan is repaid, it can be transferred to short-term accounts payable. The possibility of transfer must be recorded in the accounting policies of the organization. If the loan is converted to short-term, it will be reflected according to:

- page 1510 “Borrowed funds”.

In the income tax return, the amounts of accrued interest are reflected as part of non-operating expenses: PDF

- Sheet 02 Appendix No. 2 page 201 “Expenses in the form of interest on debt obligations...”

In the income statement, accrued interest is reflected according to:

- page 2330 “Interest Payable.”

See also:

- Purchasing materials using loan funds

- Purchase of fixed assets using loan funds

- What is the difference between a founder's loan and financial assistance?

- Financial assistance from the founder: features of registration and taxation

- Loan forgiveness by the founder

- Changes regarding the conclusion of credit and loan agreements came into force on June 1, 2018

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Issuance of loans to individuals

The company has the right to issue repayments or assets in non-monetary form to individuals. The latter are the founders, employees or outside citizens.

When drawing up an agreement, the personal data of an individual, passport details, as well as the address of actual residence and the telephone number valid at the time of drawing up the agreement are indicated.

Important! Loans issued by employees can be interest-bearing or interest-free. The decision to issue repayable financial assistance to an employee or founder is made by the company’s management or the meeting of shareholders.

In accounting, two accounts can be used to display interest-bearing loans:

- 58 “Financial investments”.

- 73 “Settlements with personnel for other operations.”

The decision on which account will be used to account for interest-bearing loans issued to individuals is made by the company independently. But it must be enshrined in the order on the Accounting Policy for accounting purposes. For interest-free loans, account 73 is always used.

Financial aid

Do not confuse loan forgiveness with gratuitous financial assistance. In the second case, we are talking about covering losses and preventing bankruptcy at the expense of the founder’s funds. Financial assistance can be in the form of a contribution to assets (LLC) or a gratuitous transfer of funds. In the second case, the amount received for the year must be included in other income: D-t 51 K-t 91. In these operations, account 98 of the same name is not used, since it records income from receipts of non-monetary assets.

Example 3

The founder provided the organization with a loan in the amount of 200 thousand rubles. with maturity in 10 months. The service fee is 2% per annum.

| D-t | Kit | Operation description | Amount, thousand rubles |

| 51 | 66 | Loan provided from the founder | 200 |

| 91 | Interest accrued | 3,333 | |

| 66 | 51 | Interest paid | 200 |

| Interest paid | 3,333 |

Example 2

The company received a loan in the amount of 120 thousand rubles, for which it is necessary to pay 10% per annum. For the first (17 days) of using the funds, 567 rubles were accrued as interest, for the second month - 1 thousand rubles, for the third - 400 rubles. The loan was then repaid.

| D-t | Kit | Operation description | Amount, thousand rubles |

| 51 | 66 | Short-term loan provided | 120 |

| 91 | Interest accrued for the 1st month | 0,567 | |

| 66 | 51 | Interest paid | |

| 91 | 66 | Interest accrued for the 2nd month | 1 |

| 66 | 51 | Interest paid | |

| 91.2 | 66 | Interest accrued for the 3rd month | 400 |

| 66 | 51 | Interest paid | |

| Loan repayment | 120 000 |