The law establishes the employer's obligation to pay employees wages twice a month. In addition to remuneration for work, the employee may be paid compensation and incentive amounts. If the total of these payments for the month the employee receives is below the minimum wage established in the region, he is required to make an additional accrual to the minimum. In practice, there are quite a lot of nuances of such additional charges. Let's start with a question that interests many accountants: what is the nature of the additional payment to the minimum wage: compensatory or stimulating?

How to calculate and process a salary supplement up to the minimum wage ?

Minimum wage and actual earnings

Before we figure out how to calculate the additional payment up to the minimum wage and who is entitled to such an additional payment, let’s find out the relationship between earnings and the minimum amount for remuneration.

Working citizens are guaranteed a minimum wage at the state level (Article 133 of the Labor Code). The minimum wage is established by Law No. 82-FZ of June 19, 2000 “On the minimum wage.” The basis for this payment is the employee’s fulfillment of working hours and job duties for the month. If earnings are less than the established amount, it must be brought up to the minimum wage.

The “minimum” salary is not a constant value and corresponds to the minimum subsistence level established for able-bodied Russians. From January 1, 2019, according to Law No. 82-FZ, the minimum wage is 11,280 rubles. Each region, subject of the Russian Federation, has the right to set its own limit, but not lower than the federal value.

How is the supplement to the minimum wage made in 2021? For correct calculations and payments, the organization first needs to think through the entire procedure in advance. What if the salary is less than the minimum wage? This is not considered a violation: the Labor Code allows for a situation where the official salary is set below the legal limit.

Earnings may be below the minimum wage. This is possible when working part-time for a month and when working part-time. In these cases, the salary is calculated based on the time worked, and payment up to the minimum wage for those working less than full-time is carried out proportionally, taking into account the actual working time.

A new way to calculate the minimum wage

Starting from 2021, the rules for calculating the minimum wage and subsistence level in Russia are changing (Law No. 473-FZ dated December 29, 2020 “On amendments to certain legislative acts of the Russian Federation”).

The size of the minimum wage will now be determined based on the median wage for the previous year, and not on the subsistence level (consumption basket).

Median wage is the average earnings of workers, relative to which half of Russians have higher wages, and the other half have lower wages.

Note! The median salary should not be confused with the arithmetic mean. The median salary is usually lower than the arithmetic mean. This is primarily due to the uneven distribution of wages across regions and sectors of the economy, as well as the large gap between high and low wages in the country as a whole.

The median salary is calculated by the Federal State Statistics Service (Rosstat) taking into account the collected information, based on the methodology developed by this body. According to Rosstat, in 2021 the median salary was 34,335 rubles.

From 2021, it is proposed to set the ratio of the minimum wage to the median salary at 42%. Further, this ratio will be reviewed at least once every 5 years.

In addition, the minimum wage will be calculated immediately for the year, in contrast to the previous procedure, when it was calculated for each quarter.

Important! The minimum wage established for the current year should not be less than:

- the cost of living of the working population as a whole in the Russian Federation for a given year;

- The minimum wage established in the previous year.

When is it necessary to pay extra?

If a subordinate is paid less than the minimum wage, it is the employer’s responsibility to bring the salary up to the minimum wage. Let's look at how additional payments to the minimum wage are made in 2020:

- It is necessary to clarify the amount of the “minimum wage” established in the subject. If local authorities have not regulated a different limit for the region, you must be guided by the federal limit (currently 11,280 rubles).

- Determine the amount to be paid for the month, taking into account all charges: salary (tariff rate), bonuses and incentive payments, with the exception of the regional coefficient and compensation for work in a special climatic zone (Resolution of the Constitutional Court of December 7, 2021 No. 38-P)

- Compare accruals with the current minimum wage.

- Define the surcharge as the difference between the “minimum wage” and the accrual.

- Comparisons and additional payments (if necessary) are made every month.

It should be taken into account how such additional payment to the minimum wage is financed. How to pay extra correctly depends on the source of funds. State employees receive money from the authorities at the appropriate level, and commercial companies pay extra from their own funds.

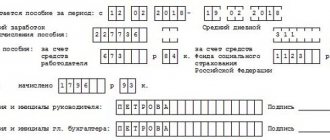

Calculation of the amount of additional payment up to the minimum wage

As examples, let's look at the most common situations, let's take the minimum wage, effective from 01/01/2021:

- The employee works full time, there are no regional coefficients or bonuses, the salary is 5,000 rubles, the monthly bonus is 2,000 rubles, a budgetary organization. So, the employee receives 7,000 rubles in hand, which is 5,792 rubles. less than the established minimum wage. Accordingly, he needs to pay an additional 5,792 rubles.

- The employee works for a Moscow company that is a party to the regional agreement on the minimum wage in Moscow. Salary – 15,000 rubles, monthly bonus – 2,000 rubles. Since at the moment the regional minimum wage in Moscow is 20,589 rubles. (see “Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations”), then the employee must pay an additional 3,589 rubles.

- The employee works in an area equated to the regions of the Far North. Salary - 5,000 rubles, regional coefficient - 1.2, bonus for length of service - 10%, no regional minimum wage. As we wrote above, for this category of workers, the salary part of the salary is brought up to the minimum wage level, without taking into account the coefficient and bonus for length of service. In this case, since there are no other additional payments, we evaluate only the salary. Accordingly, the employee must pay an additional RUB 7,792. And then the coefficient and bonus will be calculated on the salary amount increased to the minimum wage - 12,792 rubles.

Note! The regional coefficient and percentage increase in wages depend on the place where the employee actually works, and not on the location of the employer (see letter of Rostrud dated January 15, 2016 No. ТЗ/23333-6-1).

***

So, to an employee whose salary does not reach the established minimum wage level (federal or, in certain cases, regional), the employer is obliged to pay an additional amount so that the salary, taking it into account, is not lower than the minimum wage.

If an employee works part-time or has a part-time job, then his salary may be lower than the minimum wage, but its minimum threshold is determined as part of the minimum wage, proportional to the time worked. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Budgetary organizations

The earnings of employees at all budget levels must be no less than the “minimum wage”, and regional coefficients are calculated in addition to wages (Decision of the tripartite commission for the regulation of social and labor relations of December 25, 2018, protocol No. 12 “Unified recommendations... for 2021”). Funds are allocated by the budget of the appropriate level. In addition, extra-budgetary money and money received by the organization from business activities are also a source.

The peculiarity is that the location of an institution of federal significance does not matter. When financed from the federal budget, the minimum wage is applied based on the limit regulated at the federal level, that is, 11,280 rubles, and not on the amount approved for the subject where the organization is located.

When bringing wages to the minimum wage in budgetary institutions that are on the regional and local budget, the minimum established by the subject, taking into account the specifics of the area, will be applied. The calculation principle itself is similar to that stated above.

The procedure for establishing the minimum wage in the regions of the Russian Federation

The minimum wage differs in different regions of the Russian Federation and is determined depending on socio-economic conditions.

Risks! If a regional minimum wage is established in a constituent entity of the Russian Federation, it does not apply to employees of organizations receiving funding from the federal budget.

The regional minimum wage is established by a tripartite commission by concluding a regional agreement, which will be officially published along with an invitation to employers of the subject to join it.

Note! The employer is considered to have automatically acceded to the agreement if it does not send a reasoned refusal to the authorized body within 30 calendar days.

The table below shows the constituent entities of the Russian Federation in which the minimum wage differs from the federal one:

| The subject of the Russian Federation | Minimum wage, rub. | Base | |

| Republic of Tatarstan (Tatarstan) | for state and municipal institutions of the Republic - in the amount of the minimum wage | 12 792 | Agreement on the minimum wage in the Republic of Tatarstan for 2021 dated December 30, 2020 No. 313 |

| for employees of organizations in the non-budgetary sector of the economy | 15 400 | ||

| Altai region | for public sector workers, agricultural workers, workers participating in public works or temporarily employed under agreements between employers and employment services, as well as for employees from among citizens with disabilities employed under agreements on the creation or allocation of jobs for the employment of disabled people in account of the established quota in public organizations of disabled people - in the amount of the minimum wage | 12 792 | Regional agreement on the amount of the minimum wage in the Altai Territory for 2021 - 2021 dated December 17, 2018, Additional agreement to the regional agreement on the amount of the minimum wage in the Altai Territory for 2021 - 2021 dated December 17, 2018 (concluded on December 20, 2019) |

| for employees of the non-budgetary sector of the economy (without taking into account the regional coefficient) | 13 000 | ||

| Bryansk region | for public sector organizations | 12 850 | Regional agreement on the minimum wage in the Bryansk region for 2021 dated December 5, 2018 |

| for non-budgetary organizations | 13 200 | ||

| Volgograd region | in the amount of minimum wage: 1) for state and municipal institutions, non-profit organizations; 2) organizations created by public associations of disabled people; 3) workers carrying out labor activities in public and temporary jobs (including internships), organized by the employer for temporary employment of workers as part of the implementation of programs of additional measures to reduce tension in the labor market of the region and promote employment of the population | 12 792 | Regional agreement on the minimum wage in the Volgograd region dated June 26, 2019 No. RS-71/19 |

| for the extra-budgetary sphere - in the amount of 1.3 times the subsistence minimum of the working population of the region | |||

| for employers classified by type of economic activity as agriculture - in the amount of at least 1.3 times the subsistence minimum for the working population based on the results of the calendar year | |||

| Kaliningrad region | 14 000 | Regional agreement on the minimum wage in the Kaliningrad region dated May 18, 2018 | |

| Kemerovo region | for commercial organizations (except for organizations operating in the field of regulated pricing) and individual entrepreneurs - not less than 1.5 times the subsistence level of the working population of the region | 17 110 | Kuzbass regional agreement for 2021 - 2021 from 01/25/2016 |

| Leningrad region | from January 1, 2021 - 12,800, from April 1, 2021 - 13,000, from September 1, 2021 - 13,315, from December 1, 2021 - 14,250 | Regional agreement on the minimum wage in the Leningrad region for 2021 dated December 24, 2020 No. 6/C-20 | |

| Lipetsk region | for public sector employees - in the amount of the minimum wage | 12 792 | Regional agreement on the minimum wage in the Lipetsk region for 2021 - 2021 dated December 27, 2017 No. 46 (as amended on February 26, 2020) |

| for employees of non-budgetary organizations - not less than 1.2 times the subsistence level of the working-age population for the fourth quarter of the previous year, but not less than the minimum wage (12,792) | |||

| Moscow region | 15 000 | Agreement on the minimum wage in the Moscow region dated October 31, 2019 No. 243 | |

| Omsk region | for employees of organizations and individual entrepreneurs carrying out as the main type of economic activity “agriculture, forestry, hunting, fishing and fish farming”, non-profit organizations, organizations financed from the regional and local budgets of the region, as well as workers participating in public works organized in accordance with paragraph. 8 pp. 8 clause 1 art. 7.1-1 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” (without taking into account the regional coefficient established for the region) | 12 792 | Regional agreement on the minimum wage in the Omsk region dated December 23, 2020 N 70-RS |

| for employees of other employers (without taking into account the regional coefficient established for the region) | 13 377 | ||

| Pskov region | in the amount of minimum wage: 1) for employees of state institutions of the region and state unitary enterprises; 2) employees of municipal institutions and municipal unitary enterprises of municipalities of the region; 3) employees working in the region in socially oriented non-profit organizations; 4) employees working in the region in consumer cooperation organizations; 5) employees working in the region for small businesses | 12 792 | Regional agreement on the minimum wage in the Pskov region for 2021 dated December 30, 2020 No. MV-385 |

| for employees working in the region for other employers: | |||

| for employees belonging to the main personnel | the cost of living of the working-age population in the region for the second quarter of the previous year | ||

| for employees classified as support personnel - in the amount of the minimum wage | 12 792 | ||

| Rostov region | at enterprises and non-budgetary organizations - not lower than 1.2 | 5 350,4 | Rostov regional tripartite (regional) for 2021 - 2022 dated November 21, 2019 No. 13 |

| for public sector employees | 12 792 | ||

| Tula region | for employees of state and municipal institutions of the region | 12 792 | Regional agreement on the minimum wage in the Tula region dated December 21, 2020 |

| for non-budgetary workers | 14 200 | ||

| Ulyanovsk region | for employees of organizations established by the region or municipalities of the region, as well as for employees of small businesses - in the amount of the minimum wage | 12 792 | Regional agreement on the minimum wage in the Ulyanovsk region dated December 11, 2020 No. 107-DP |

| for employees of extra-budgetary spheres and medium-sized businesses | 14 800 | ||

| Moscow | in the amount of the subsistence minimum of the city’s working population | 20 589 | |

| Saint Petersburg | 19 000 | Regional agreement on the minimum wage in St. Petersburg for 2021 dated December 27, 2019 | |

What to include in the calculation

According to Art. 133, 133.1 and 135 of the Labor Code, remuneration involves a rate or salary and various types of additional payments, including compensation for work in conditions different from the norm, bonuses and incentives. Accordingly, in a monthly calculation, an additional payment to an employee up to the minimum wage may consist of amounts additional to the salary (tariff). For example:

- bonus for length of service;

- bonus for qualifications and professionalism;

- bonuses;

- additional payment for night work;

- additional payment for work on holidays and days off.

It is important that the “minimum wage” includes holidays and weekends if the employee worked within working hours. If attracted beyond the standard time, the accrual is added to the minimum amount.

Responsibility for wages below the minimum wage

If the labor inspectorate discovers the fact of underpayment of earnings up to the minimum wage, the employer faces a fine (in Part 1 of Article 527 of the Administrative Code). If the salary level is understated, a legal entity is subject to sanctions from 30,000 to 50,000 rubles, and up to 5,000 rubles for a contractor. The employer - individual entrepreneur will have to pay from 1000 to 5000 rubles.

In case of repeated violation, the fines increase to 70,000 rubles. There is a possibility that the tax service will be interested in the company with suspicion of paying gray wages. An employee can write an appeal to the State Tax Inspectorate demanding payment of the debt and compensation due for delayed wages.

How to pay the difference

It is not enough to know the correctness of the calculation and what the additional payment to the minimum wage in 2021 provides. How to pay extra correctly - it is important for the administration of the organization to resolve this issue. Options include:

- prepare orders monthly;

- sign an administrative document once, providing for a mandatory procedure every month: comparing the accrual with the “minimum wage” and determining the additional amount to be paid;

- Include a block on additional payment in local documents (regulations on the formation of the wage fund, collective agreement).

What should an employee do and where should he go?

If an employee is paid less than the minimum wage, he can complain to the regulatory authorities:

- An active trade union - it is authorized to resolve labor disputes between its members and the business entity. If necessary, he will provide assistance in preparing a complaint to the labor inspectorate, prosecutor's office, and other regulatory authorities.

- Labor Inspectorate - oversees compliance with labor laws. Accepts a written statement of violation, on the basis of which an inspection can be initiated. Does not resolve issues related to money - if an employee wants to receive compensation for the time when he had a salary less than the minimum wage, he must go to court.

- The prosecutor's office is a supervisory body that can receive statements of violations from employees and conduct inspections. Based on their results, the prosecutor's office is authorized to open administrative or criminal court cases.

- Court - to go to court, it is necessary to prepare an evidence base, as well as hire a lawyer who will represent the interests of the employee. Based on the results of the proceedings, the employee may be awarded compensation for the entire period, for delayed wages, coverage for moral damage caused, compensation for attorney fees, etc.

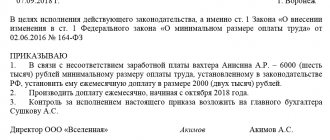

Making an order

There is no unified sample of an administrative document. The order is drawn up taking into account the specifics of document flow at a particular enterprise, but must contain:

- Name;

- date, place of signing;

- the basis for payment is the discrepancy between earnings and the minimum wage;

- personal information about the employee: full name, position, area of work (structural unit);

- amount to be paid;

- date of payment (simultaneously with earnings);

- indication of the officials responsible for the execution of the order;

- signature of the person issuing the order and the executors;

- date and signature of the employee receiving the amount regarding familiarization with the order.

Do not forget that the “minimum wage” is not constant; the minimum wage is revised annually. Therefore, from January of the next year, check its value.

Some nuances

What will be the consequences for the employer if his employee receives a “net” salary less than the minimum wage? The answer is clear: the employer is in no danger. Company managers may not join the regional agreement on the minimum wage.

To do this, a written refusal is required, but it must indicate the reasons for the legal entity’s non-adherence to the agreement. For example, if a company has recently opened, its director may not join the agreement.

Accordingly, he will pay wages below the minimum wage.

By engaging employees under an employment contract, an economic entity undertakes to pay them remuneration for their work. The amount of earnings is discussed and fixed in the agreement signed by the parties.

At the same time, the state also regulates this issue by establishing a minimum wage. Let’s take a closer look at whether an employee’s monthly official salary can be less than the minimum wage established by law.

The competent authority will check whether it was possible to pay wages less than the minimum wage

Important! Prosecution is preceded by an inspection, which can be carried out following a complaint from an employee or a report in the media, or on a scheduled basis (Article 360 of the Labor Code of the Russian Federation).

Inspections are usually carried out by a special supervisory body - a territorial body of the Federal Service for Labor and Employment (Rostrudinspektsiya) or the prosecutor's office, where employees often turn. However, if a violation is detected by the tax authority, it will be reported to the labor inspectorate under jurisdiction.

So there are many options for detecting this fact.

State labor inspectors are empowered to freely enter the territory of any employer upon presentation of a certificate (Article 357 of the Labor Code of the Russian Federation).

If violations are detected, an order to eliminate them may be issued. But most importantly, they can draw up a protocol on an administrative offense - such a power is enshrined in Art.

28.3 of the Code of Administrative Offenses of the Russian Federation (for more details about the procedure, see our article “Administrative liability of legal entities - concept”).

When conducting an inspection:

- There is no need to shy away from giving explanations. An employee who does not have sufficient information may refer to this when giving explanations, since the organization will have the opportunity to provide the necessary documents and explanations (objections) before considering the case.

- It happens that not all documents are available at the time of the audit (for example, they were transferred to the auditor). This also needs to be indicated in the explanations.

Who should sign

All orders are always written on behalf of the director of the organization - this is one of the main features of this document. In this regard, regardless of who is directly involved in drawing up the order - a secretary, a legal adviser or some other employee - he must hand over the completed form for signature to the main person of the enterprise, since without his autograph the order will not be valid.

All other company employees named in it must also sign the order - in this way they will attest that they are familiar with the order and agree to comply with it.

Rules for internal and external part-time workers

Part-time workers have the same labor protections as main employees. Such workers do not work a full schedule corresponding to a full working day, so a part-time employment contract is concluded with them, and additional payments to the minimum wage for part-time workers are made adjusted to the actual time worked.

For an internal part-time worker, there is another feature: the minimum payment must be compared separately for each employment contract:

- separately under the main employment contract without taking into account part-time salaries;

- separately under an employment contract for an additional place of work.

Calculation features for part-time workers

If you need to calculate wages for an incomplete month for a part-time employee

, the same principle applies, but the result of dividing the salary by 29.4 is no longer multiplied by the number of calendar days from the beginning of the month until the termination of work, but by the days actually worked by the employee according to his schedule.

According to legal requirements, when an employee works part-time

, the employer is obliged to pay for his work in proportion to the time worked by such an employee or depending on the amount of work performed by him.

Common mistakes

Error:

The labor inspectorate fined the entrepreneur because the employee’s salary was not increased after the federal minimum wage was raised. The employees took no action to collect the debt.

A comment:

If for a certain time wages were paid below the minimum wage, while salaries should have been increased, employees have the right to recover the debt from the employer.

Error:

The salary of a part-time employee was increased to the size of the federal minimum wage.

A comment:

Part-time workers are allowed by law not to increase their salaries in connection with the approval of a new minimum wage. But the salary must be calculated in proportion to the minimum wage, so in fact the payment will still increase.

Travel allowances from the minimum wage

Payment for days on a business trip, as well as vacation pay, depends on average earnings. When calculating payment for the time an employee spent on a business trip, compare the average monthly salary with the federal minimum wage. If an employee works full-time, his earnings during the trip cannot be less than the federal minimum. Do not take into account the regional or sectoral minimum wage (part 3 of article 139 of the Labor Code, clause 9 of the Regulations, approved by Government Decree No. 922 of December 24, 2007).

Read also

19.08.2019