As long as the individual entrepreneur is registered as an insurance employer, the Pension Fund and the Social Insurance Fund will expect him to submit reports on the payment of insurance premiums. Therefore, one of the most popular questions among individual entrepreneurs who have decided to close their business is how to deregister as an insured.

As long as the individual entrepreneur is registered as an insurance employer, the Pension Fund and the Social Insurance Fund will expect him to submit reports on the payment of insurance premiums. Therefore, one of the most popular questions among individual entrepreneurs who decide to close their business is how to deregister as an insurer.

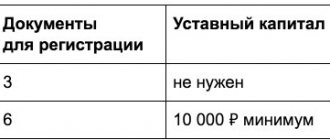

To terminate business activities, an individual entrepreneur must contact the tax office with a set of documents. If everything is in order with the documents, the Federal Tax Service will remove the individual entrepreneur from tax registration and exclude the entry from the Unified State Register of Individual Entrepreneurs.

In this situation, you do not need to contact the Pension Fund to deregister. The Fund itself will deregister the entrepreneur after receiving information from the tax authorities about the exclusion of the entry from the register.

If an individual entrepreneur does not have employees and has not paid “for himself” insurance premiums for disability, maternity and injuries, then there is also no need to contact the Social Insurance Fund.

But if the individual entrepreneur had employees on staff, then several steps will be required to deregister from the Pension Fund of Russia and the Social Insurance Fund as an employer.

Everything is individual

The algorithm of actions depends on whether you are an employer or not.

There are different regulations for closing individual entrepreneurs. If there were no employees on staff, it will be easier for you to close the business, since deductions were made only to the Pension Fund and the tax office. Entrepreneurs very rarely make insurance contributions to the Social Insurance Fund for themselves, so there is no need to send there an application to deregister an individual entrepreneur. Removing an individual entrepreneur from registration with the Pension Fund of the Russian Federation is a matter for the department. The Fund makes a decision independently and removes the record of an individual entrepreneur if he has no debts on reports and transfers of contributions. But you can “leave” yourself to be sure that all points are taken into account. To do this, you need to clarify whether there is a debt and send an application for deregistration to the Pension Fund.

Time requirements and formula

The answer to the question of when to submit 4-FSS during liquidation is contained in clause 15 of Art. 22.1 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ:

- If the liquidation occurs before the end of the billing period, the latest 4-FSS should be submitted before the day of filing the application for state registration in connection with the liquidation to the Federal Tax Service (for the period from the beginning of the billing period to the day of submission of the specified calculation, inclusive).

- Insurance premiums for injuries accrued at the time of submission of the last 4-FSS are required to be paid within 15 calendar days from the date of submission of such a report.

The amount of contributions to be paid is determined by the formula:

The same rules apply when submitting 4-FSS upon liquidation of an individual entrepreneur.

An application to the Federal Tax Service for state registration in connection with the liquidation was submitted on 03/03/2020, and 4-FSS during the liquidation of TransContractor LLC was submitted to social insurance the day before - 03/02/2020.

The report reflects data for the period from 01/01/2020 to 03/02/2020 inclusive.

Considering that during the specified period this company did not have any accruals in favor of individuals, the basis for calculating contributions for injuries is zero. At the beginning of the year there was no debt to the Social Insurance Fund - the company paid off all debts to social insurance last year. The amount payable according to the 4-FSS report upon liquidation is 0 rubles.

If the amount payable, calculated according to the above formula, turned out to be non-zero, it should have been transferred no later than 03/16/2020 (within 15 calendar days, counting from 03/02/2020 - the date of submission of the last 4-FSS).

Individual entrepreneur - employer

For an entrepreneur who has a staff of employees with whom employment contracts have been drawn up, other rules are provided. Closing an individual entrepreneur will not take you much time.

First of all, you need to properly end relationships with employees:

- Terminate the contract.

- Pay wages and other accruals to all employees at the time of closure of the individual enterprise.

- Transfer contributions to the tax, pension fund and social insurance fund.

Only after completing the listed cases, an individual who has lost the status of an individual entrepreneur can begin to collect a package of documents for the Pension Fund and the Social Insurance Fund.

Results

Before submitting an application for state registration in connection with liquidation to the tax office, you must submit 4-FSS to social insurance. Fr. is indicated on the title page of the report. The remaining fields of the form are filled in as usual.

If the liquidation occurred before the end of the calendar year, data in 4-FSS is presented from the beginning of the year to the day the report is submitted in connection with the liquidation. You can send the report in paper form or via TKS, depending on the number of individuals - the rules are the same as for the usual 4-FSS submission.

Sources:

- Federal Law of July 24, 1998 No. 125-FZ (as amended on December 2, 2019) “On compulsory social insurance against industrial accidents and occupational diseases”

- Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381 “On approval of the calculation form...”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deregistration from the Social Insurance Fund

The list of documents for deregistration with the Social Insurance Fund is as follows:

- Application form for deregistration of individual entrepreneurs with the Social Insurance Fund (Regulation No. 574).

- Copies of orders and agreements on termination of employment relations with each employee.

- Employer's passport.

You can contact the Social Insurance Fund with an application to close an individual entrepreneur as an employer at any time. There is no specific time frame for this procedure. Within two weeks (14 days), the Fund must consider the request and issue a notice of closure of the individual entrepreneur. Refusal comes only if there are still debts on insurance premiums.

Having received a positive answer, the former employer goes to the Pension Fund to get rid of this status here too.

Within two weeks, the Social Insurance Fund must consider the request and issue a notice of closure of the individual entrepreneur.

How to fire employees when closing an individual entrepreneur

If an individual entrepreneur has at least one employee, then the process of deregistration as an individual entrepreneur becomes much more complicated. Even before the start of measures to dismiss workers, the law obliges the employer to report layoffs to the employment center. Moreover, such an obligation is established not by the Labor Code, but by the Law of the Russian Federation of April 19, 1991 No. 1032-1 (as amended on December 8, 2020) “On employment in the Russian Federation.”

As stated in paragraph 2 of Art. 25 of this law, the employer-individual entrepreneur is obliged to notify the employment center in writing no later than two weeks before the start of layoffs.

The Labor Code of the Russian Federation establishes that if there is a risk of mass job loss, the employer is obliged to notify the employment agency no later than three months before the start of layoffs. Since the official form of notification of the employment center is not provided for by the legislation of the Russian Federation, you can use both the recommended form and your own (letter of Rostrud dated September 26, 2016 No. TZ/5624-6-1).

The proposed form can be found in Appendices No. 1-2 of the Decree of the Government of the Russian Federation No. 99 dated 02/05/1993. You can submit the document in your own form, which will contain the required columns for each employee:

- job title;

- profession;

- speciality;

- qualification requirements;

- terms of remuneration.

For failure to submit a notification to the employment center, the entrepreneur will be fined under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation in the amount of 300 to 500 rubles. Typically, this monetary penalty is not multiplied by the number of employees for whom notice was not filed.

It is better to dismiss according to clause 1, part 1, art. 81 (termination of contract upon liquidation of an organization or termination of activities by an individual entrepreneur). According to Part 1 of Art. 178 of the Labor Code of the Russian Federation, upon termination of an employment contract in connection with the liquidation of an organization, the dismissed employee is paid severance pay in the amount of average monthly earnings, and he also retains the average monthly earnings for the period of employment, but not more than two months from the date of dismissal (including severance pay).

However, the Supreme Court has repeatedly indicated that the payment by the employer of severance pay to the employee and the preservation of his average earnings for the period of his employment in connection with dismissal under clause 1 or clause 2 of part 1 of Art. 81 of the Labor Code of the Russian Federation are guaranteed only in case of dismissal of an employee from the organization. For persons employed by individuals, including individual entrepreneurs, the specified guarantee of the Labor Code of the Russian Federation is not provided. Termination of an employment contract for this category of workers is regulated by a special norm - Art. 307 of the Labor Code of the Russian Federation (Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated September 5, 2016 No. 74-KG16-23). Therefore, there is no need to pay severance pay if it is not stipulated in employment contracts with employees.

Next, the following activities should be carried out.

- For each employee, issue an order in form No. T-8 with the wording: “The employment contract was terminated due to the termination of activities by the individual entrepreneur, clause 1, part 1, art. 81 of the Labor Code of the Russian Federation."

- Familiarize employees with the orders and sign them.

- Make the following entry in your work book: “The employment contract was terminated due to the termination of activities by an individual entrepreneur, clause 1, part 1, art. 81 of the Labor Code of the Russian Federation."

- Issue each employee the SZV-STAZH form - this document confirms the insurance period and a certificate of income in the form of 2-NDFL.

- Add a notice of dismissal on the employee’s personal card, where he must sign.

- Make a final calculation of wages and compensation for unused vacation with employees.

Let us remind you that in 2021 the transition to electronic work books began. An individual entrepreneur issues a work book to an employee who has submitted a written application for the employer to provide him with information about his work activity. Thus, he is relieved of responsibility for its maintenance and storage.

When issuing a work book, a record is made of the employee’s submission of an application to provide him with information about his work activity in accordance with Art. 66.1 of the Labor Code of the Russian Federation (Part 3 of Article 2 of Law No. 439-FZ, letter of the Ministry of Labor of the Russian Federation dated February 12, 2020 No. 14-2/B-150).

The entry on the issuance of a work book must be certified by the signature of an individual entrepreneur or the person responsible for maintaining work books, a seal (if any) and the signature of the employee himself (Part 3 of Article 2 of Law No. 439-FZ, letter of the Ministry of Labor of the Russian Federation dated March 16, 2020 No. 14-2/B-267).

If an employee refuses to keep a work book in paper form, then upon dismissal he must be provided with the specified information about his work activity with this individual entrepreneur (in the STD-R form) (part 5 of article 66.1, part 4, 6 of article 84.1 Labor Code of the Russian Federation, Appendix No. 1 to Order of the Ministry of Labor of the Russian Federation dated January 20, 2020 No. 23n).

We do not recommend forcing employees to resign “on their own,” as this may lead to a legal challenge to the dismissal.

Thus, a woman filed a claim with her former employer, an individual entrepreneur, in the Central District Court of Chita for reinstatement at work, changing the wording of the dismissal, and collecting wages for the period of forced absence.

In the statement, she explained that she worked for an individual entrepreneur in a curtain salon as a sales consultant. During the entire period of work, she had no complaints; she performed her job duties properly. Subsequently, she informed the defendant about her pregnancy, in connection with which the defendant began to create unbearable working conditions: they began to shout at her, make claims for minor reasons, refuse to provide time for lunch, and exert psychological pressure with the aim of dismissing her at her own request.

Under pressure from the individual entrepreneur, she was forced to write a letter of resignation of her own free will, although in reality she did not want to terminate her employment relationship, and therefore on the same day she contacted the prosecutor’s office with a statement about the illegal actions of the individual entrepreneur. The next day, she attempted to withdraw her resignation letter, to which the individual entrepreneur explained that the dismissal order had already been prepared. Soon the individual entrepreneur liquidated his activities.

Refusing to satisfy the claims, the court of first instance concluded that there were no legal grounds to satisfy the plaintiff’s claims. At the same time, the court proceeded from the fact that the resignation letter was written by her in her own hand, it indicated the dates of dismissal and writing of this application, as well as the grounds for dismissal. From the text of the application it follows that the plaintiff expressed her will to dismiss from work at her own request from the date determined by her in the application, and therefore the order issued by the employer to dismiss the plaintiff corresponds to the contents of the resignation letter.

The district court concluded that the employer’s actions in issuing an order to dismiss the plaintiff were consistent with the requirements of paragraph 2 of Art. 80 of the Labor Code of the Russian Federation and cannot be regarded as violating the labor rights of the employee. The appellate court noted that since the entrepreneur ceased her activities as an individual entrepreneur, the decision of the district court regarding the refusal to reinstate the plaintiff at work must be left unchanged. At the same time, the judges recognized the employee as dismissed from her position as a sales consultant for an individual entrepreneur on the basis of clause 1 of part 1 of Art. 81 of the Labor Code of the Russian Federation (termination of activities by an individual entrepreneur). The appellate court also did not agree with the arguments of the first instance that evidence of forced dismissal was not presented.

As a result, the court decided to recognize the dismissal as illegal, to recognize the employee as dismissed from the position of sales consultant on the basis of paragraph 1 of part 1 of Article 81 of the Labor Code of the Russian Federation (in connection with the termination of activities by an individual entrepreneur), to oblige the individual entrepreneur to make an entry in the work book recognizing the dismissal record invalid, make a record of changing the wording and date of dismissal, collect wages from the individual entrepreneur in favor of the employee for the period of forced absence (Appeal ruling of the Trans-Baikal Regional Court dated December 11, 2015 in case No. 33-5111/2015).

Your next step will be to deregister the cash register.

Deregistration with the Pension Fund of Russia

To ensure that the Pension Fund does not have claims for non-payment of contributions for employees who were previously on staff, the former entrepreneur must notify the fund of the termination of employment contracts.

Package of documents:

- Application form in the form (Appendix 10 to Regulation No. 296) indicating the reason for the application.

- Copies of orders for the dismissal of employees due to the liquidation of individual entrepreneurs.

- Passport.

The Pension Fund can provide the client with a list of necessary documents, because each termination of a businessman’s activities is considered individually.

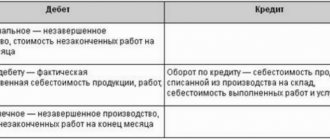

Filling out individual fields

Let us dwell in more detail on the features of filling out form 4-FSS during liquidation of the 2021 sample:

- Filling out the “Reporting period (code)” field.

FSS Order No. 381 does not contain special rules for filling out during liquidation. It doesn't say whether the field can be left blank.

Considering that liquidation procedures (including submission of the last 4-FSS), in our example, occur in the first quarter of 2020, this period was indicated on the title page as a reporting period.

- View about.

Regardless of what type of mark you put in this field (V, X or another), you will not be denied acceptance of the report - FSS Order No. 381 contains no instructions regarding the type and form of the mark to be placed.

- Filling out other form fields.

When liquidating in 2021, fill out the remaining fields of the 4-FSS title page in the usual manner - as you did in reports not related to termination of operations and liquidation.

Submit documents

An entrepreneur can submit documents to the funds independently or through a representative (by power of attorney):

- When applying in person, no additional documents are required to confirm the right to apply, except for a passport.

- If another person is involved in the procedure for closing and deregistering an individual entrepreneur, then he needs a power of attorney certified by a notary.

- All documents can be sent to the funds by registered mail with notification and an inventory of the contents of the envelope.

Any agency must respond within 14 days of receiving the request. After this, the business liquidation procedure is completed.

An individual entrepreneur, when closing his business, must report to both the tax authorities and extra-budgetary funds. An individual entrepreneur who does not have employees needs to deregister only with the tax office. Don’t forget to check all documents after closing the IP. It is also very important to ensure that any debt is paid off. If you do everything correctly, you will not have any problems during a possible inspection.

How to pass 4-FSS

How Form 4-FSS is submitted during liquidation is described in paragraph 15 of Art. 22.1 of Law No. 125 (with reference to Article 24 of the said law):

The latest 4-FSS report submitted to social insurance in electronic form will be considered received by the fund after the employer receives confirmation from the Social Insurance Fund (Clause 1, Article 24 of Law No. 125-FZ).

The following materials will familiarize you with the nuances of reporting:

- “How to submit a VAT report if there is no electronic reporting”;

- “How to pass SZV-M if an employee does not have SNILS”;

- “How to submit a report on related parties.”

Debts on contributions

Most often, “inactive” businessmen have debts specifically for contributions to extra-budgetary funds - pension and medical. They accumulate due to the fact that the entrepreneur must pay these fees even when the business outcome is negative or it is completely suspended. The longer the official “closure” of the individual entrepreneur is delayed, the more the snowball of debt to the Pension Fund and the Compulsory Medical Insurance Fund grows.

Often, during unprofitable periods, an entrepreneur simply has no money to make regular payments to the funds, so he leaves everything for later. After all, the entire amount of contributions can be paid for yourself until December 31st. The entrepreneur expects that profit will appear in the next quarter, but this does not happen. As a result, debts accumulate.

Some entrepreneurs are mistaken in believing that until they pay off their debts to the funds, they will not be able to deregister. Previously, in order to “close”, a certificate from the Pension Fund about the absence of debt was required. But now it is quite legal to terminate the activities of an individual entrepreneur if not all mandatory payments have been paid.