A professional deduction is a special personal income tax preference granted by law to individuals engaged in business or private practice.

Tax preferences are expressed in different forms. For example, a taxpayer may be entitled to a professional tax deduction in accordance with the provisions of the Tax Code. What is a professional tax deduction (hereinafter referred to as PTD) in simple words? In fact, this is the amount by which the taxable portion of the income of an entrepreneur or citizen engaged in private practice can be reduced, based on documents confirming expenses directly related to the extraction of income. In this way, it is possible to reduce the financial burden associated with the payment of mandatory contributions and tax deductions to the state. That is, you need to pay taxes in a smaller amount.

Professional tax deduction: what is it?

Following well-known rules, tax deductions involve the use of the amount of actual expenses approved in various documents. Note: there are situations when actual expenses may not be taken into account (applies to individual entrepreneurs). Then there is the right to provide a deduction of 20% of the amount of money earned.

Important ! As for awards for authors or incentives for the invention, execution and other use of scientific, literary and cultural works, payment for discoveries, inventions, industrial designs made by people - when there is no documentation recording expenses, the income received is subject to reduction according to given rules (percentage is used ratio to the amount of calculated income) - this is stated in paragraph three of Article 221 of the Tax Code.

Excerpt from Article 221 of the Tax Code of the Russian Federation

To identify the tax base, monetary expenses specified in official papers cannot be taken into account along with expenses that are within the framework of the established rules.

The type of tax deduction we are considering, when received, for several reasons, is not absorbed by one another, but is provided to the citizen in full, since each deduction involves taking into account one basis. There is no possibility of offsetting.

The expenses of citizens paying taxes also include the amount of taxes assumed by the law on taxes and fees for the types of activities prescribed in this article (excluding personal income tax), credited or paid for any tax period in a manner controlled by the laws on taxes and fees. This can also include money paid for insurance premiums for compulsory pension insurance, insurance premiums for compulsory medical insurance, credited or paid for a certain time period provided for by the legislative acts of our country.

The expenses of citizens paying taxes also include the amount of taxes

Important ! The exercise of a citizen's right to provide him with professional payments occurs through the execution of a written application sent to the tax agent. When it is absent, implementation is ensured by filing an application with the tax authority along with the simultaneous filing of a tax return at the end of the corresponding time period.

List of income subject to deductions:

- money received by an individual entrepreneur;

- funds received by a notary working privately, a lawyer who has created his own office and other citizens who carry out private practice;

- money received for performing labor duties specified in a civil contract;

- incentives for authors, payment for the creation, execution and other application of achievements of science, literature and art, rewards to scientists for discoveries, inventions and industrial designs received by taxpayers.

Excerpt from Article 221 of the Tax Code of the Russian Federation

Deduction for persons receiving royalties for the creation of intellectual property objects

Professional deductions are relevant for citizens who have income from copyright activities in various fields of art, as well as holders of patents for inventions and discoveries. An exception to this rule is the impossibility of using the deduction by persons whose copyright or patent for an invention was inherited or through alienation.

The amount of the benefit for this circle of persons is calculated based on the amount of costs incurred in full, with their documentary confirmation. In situations where there is no confirmation, you can receive a benefit at the current rate. Its size varies depending on the type of activity of the applicant (clause 3 of Article 221 of the Tax Code):

Cost rate as a percentage of income

artistic and graphic, architectural, design, photographic works;

sculpture, monumental and decorative, easel painting, film and theatrical decorative art and graphics;

musical stage, choral, symphonic works, music for theatre, film and television

Inventions, utility models, creation of industrial samples (to the amount of income received in the first 2 years of use)

The rules for submitting deductions are the same as those valid for individual entrepreneurs - through the customer (tax agent), or to the Federal Tax Service after filing 3-NDFL.

Conditions for obtaining a professional tax deduction for personal income tax

In order for you to be provided with the type of personal income tax deduction in question, the three listed criteria must be met together:

- the individual is not engaged in entrepreneurial activity;

- an individual is a tax resident of Russia;

- an individual has completed an application requesting the said deduction.

Important ! The deduction is provided in the form of the amount of expenses incurred by the person and due to the fulfillment of obligations under the GPA. The time period over which these expenses were made is not important.

General rules for providing deductions

In general, night vision insurance is provided for the full amount of documented expenses; no limits are set.

If expenses fully cover the income received, the tax base is considered equal to 0, that is, nothing needs to be paid to the budget. The declared expenses must correspond to the type of professional activity of the individual.

The Tax Code of the Russian Federation does not contain a list of mandatory documentation confirming the right to night vision equipment. But, in accordance with the opinion of regulatory authorities, it is impossible to receive a deduction without providing documents actually confirming payment.

Thus, in addition to KUDiR, contracts, acts, invoices, invoices, etc., you will definitely need to present receipts, checks, bank statements and other payment documents.

The difference between the amount of expenses and the amount of income that was not included in the professional deduction for the current tax period cannot be carried forward to the next year.

Individual entrepreneurs and authors of works (scientific developments), if it is impossible to confirm the expenses incurred with relevant documents, can take advantage of a deduction according to the established standard - as a percentage of the amount of income (from 20 to 40%).

Providing a professional deduction for individual entrepreneurs and persons implementing private practice

If you study the rules presented in paragraph one of Article 221 and paragraph one of Article 227 of the Tax Code, individual entrepreneurs and citizens working “for themselves” are able to reduce their own income by professional tax deductions.

Clause 1 of Article 227 of the Tax Code of the Russian Federation

This type of deduction is not provided to individuals who work “for themselves” but are not registered as a self-employed citizen.

It is permissible to reduce only that income that is received specifically from entrepreneurial work and private practice. Other money (for example, remuneration for work) is not reduced for the professional deduction of an individual entrepreneur, notary, lawyer, and other citizens working for themselves.

Features of NVGs for some people

A professional tax deduction for a lawyer is provided in the amount of expenses incurred related to the provision of legal services, according to the declared type of activity. Expenses for the acquisition and maintenance of property that can be used not only for professional activities cannot be taken into account for the purpose of granting preferences. At the same time, if the costs of maintaining and using personal property are directly related to the provision of services to customers, they can be taken into account for the purpose of receiving benefits if they are documented.

In this regard, people often think about the trade union deduction, but the trade union deduction has nothing to do with tax legislation. A trade union organization is created within an organization at the initiative of workers to protect their rights, after which a procedure for financing its activities is established on the basis of monthly contributions and other income withheld from wages. Trade unions can be organized not only within an organization, but also in a certain area, on an industry basis.

Amount of deduction, composition of expenses

Individual entrepreneurs, notaries, lawyers and other people working independently are provided with a deduction in the amount of expenses actually made that have official confirmation.

All individuals calculate their own expenses required to qualify for the deduction on their own. If you carefully study the second paragraph of paragraph one of Article 221 of the Tax Code, you can see that these actions follow the procedure provided for in Chapter 25 of the Tax Code of the Russian Federation. It follows from this that only those expenses that should be taken into account when taxing profits are used for deduction, based on Articles 253-269 of the Tax Code.

The procedure for paying taxes is specified in the articles of the Tax Code of the Russian Federation

The Supreme Arbitration Court of our country declared illegal for citizens paying taxes the procedure for recognizing cash expenses for the purchase of goods, from where these expenses are taken into account only during the time period when income from the sale of the purchased goods was received. Based on the provisions of Article 273 of the Tax Code, the moment of approval of expenses is not linked to the day of receipt of income. Hence, the Supreme Arbitration Court of Russia stated that the fifteenth paragraph of the Procedure for accounting for income and expenses and business transactions for an individual entrepreneur does not correspond to paragraph three of Article 273 of the Code.

Let's note ! The Ministry of Finance of our country continues to explain: the norms of Chapter 25 of the Tax Code are used only in relation to the list of expenses (Letters dated 02/17/2011 No. 03-04-05/8-97; dated 02/17/2011 No. 03-04-05/8-99; dated 02/16/2011 No. 03-04-05/8-91; dated 02/09/2011 No. 03-04-08/8-23). As for the moment of calculating income and expenses, the Ministry said that the former should relate only to the time period when they were actually received. The latter are subject to accounting for the current or future tax periods, since Chapter 23 of the Code contains no explanations on this issue.

Criteria that expenses made by a citizen must meet:

- the costs must be justified;

- expenses should be approved in documentary form;

- expenses must be made for work that involves generating income.

Expenses must be supported by documents

These statements are considered mandatory when accepting production costs and profit reductions. When an expense does not fit the criteria listed above, then such expense for tax purposes is not taken into account (based on paragraph one, paragraph one of Article 221, paragraph one of Article 252, paragraph forty-nine of Article 270 of the Tax Code).

Article 221 specifies a list of expenses that a citizen paying taxes can take into account when filing a deduction.

The procedure for obtaining a professional deduction

Individual entrepreneurs, lawyers, notaries and other persons working “for themselves” are able to request the type of deduction we are considering only from tax authorities, because these categories of citizens themselves calculate and pay taxes on personal income.

Individuals who work for themselves can request a tax deduction from tax authorities

To ensure a deduction, a person is obliged to send a tax return to the tax office at the end of the tax period (the third form is personal income tax). Other criteria for receiving the deduction we are considering are not established. A corresponding application is also not required.

Important ! According to the control authorities, an important condition for ensuring this type of deduction is the preparation of documentation where the expenses are stated. The reason, according to them, is that the deduction is provided in the form of the amount of expenses approved in the documents (Letters of the Ministry of Finance dated January 26, 2007 No. 03-04-07-01/16, Federal Tax Service of Russia dated February 9, 2007 No. GI-6 -04/ [email protected] ).

Tax return 3-NDFL

But this kind of statement does not correspond to reality, and this is confirmed by the Decision of the Supreme Arbitration Court of August 6, 2008, number 7698/08 (it was recognized as lawful on the basis of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of November 11, 2008, number 7307/08), by which the SAC:

- noted that the indication of paragraph one of Article 221 of the Tax Code to “documented expenses” does not mean that a citizen is obliged to show the tax authorities, along with the declarations, the papers where these expenses are recorded;

- indicated that a citizen paying taxes should not provide such documentation during a desk tax audit by order of the tax authorities, because there are no corresponding notes in the Tax Code.

The reason is that a desk audit is done based on the data of the tax return and the documentation attached to the declaration (the list is specified in the Tax Code). Taxpayers can attach some documents at their own discretion. This statement is based on paragraphs 1-3 of Article 88 of the Tax Code.

Based on paragraph 7 of Article 88 of the Code, during desk audits, tax control authorities cannot demand side information and documentation from a citizen when the law does not stipulate that they must be necessarily attached to the declaration.

Excerpts from Article 88 of the Tax Code of the Russian Federation

And due to the fact that when sending a personal income tax return, a citizen does not have to attach documentation approving a professional deduction, tax control is not able to demand these papers.

Important ! The letter of the Ministry of Finance of Russia dated January 26, 2007, number 03-04-07-01/16, was recognized as not meeting the criteria established by the Tax Code and not valid in the part where the Ministry of Finance issued additional explanations.

To summarize, let's say that in order to receive a professional tax deduction, you do not need to attach papers confirming the deduction to your declaration and application. They are not sent to the tax office and are not needed during a desk audit.

To receive a tax deduction, you do not need to attach documents confirming the deduction.

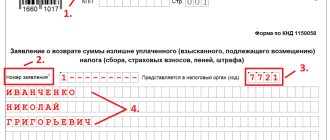

Application rules

An application drawn up by a citizen for the return of taxable amounts must comply with legal requirements. If a person decides to contact an employer, he reflects the following information in this document:

- in the upper right corner of the sheet the surname, first name, patronymic, date of birth, position, address of registration and actual residence of the employee, his contact telephone number, as well as the name of the institution, surname, first name, patronymic of the manager are indicated;

- on the next line in the middle the name is a statement;

- the descriptive part contains a request to refund the taxable amount;

- date and signature of the applicant.

Attached to it is a contract with the employer, agreements with agents, which reflect the expenditure part, payment information, checks, and reporting forms.

IMPORTANT! In a situation where it is not possible to confirm profit, this fact should be indicated in the content and the manager should be notified about it. In this case, the rate established by the Tax Code will be applied depending on the type of work or service.

If the deduction is issued at the collection service, a declaration and checks are submitted along with the application. It is formatted as follows:

- in the upper right corner of the sheet the name of the inspection of the territory where the applicant lives, as well as information about the individual - his last name, first name, patronymic, address of registration and actual residence, his contact telephone number;

- in the middle of the line the name is written - a statement;

- the content contains a justified request for a reduction in taxable amounts or a refund;

- dated and signed by the applicant.

All data must be correctly indicated, the information must be truthful and reasoned. The inspection usually has forms to fill out, and specialists give them to applicants.

Documentation required to apply for a professional deduction

Article 221 of the Tax Code does not provide an exact list of documentation that allows confirming the expenses of a particular citizen. To find out information about expenses, the first paragraph of this article advises you to refer to Chapter 25 of the “Organizational Income Tax”, which states that documented expenses mean expenses recorded in official papers, drawn up according to the rules prescribed by law. . Also taken into account may be documents drawn up taking into account business customs used in foreign countries where monetary expenses occurred. Another option - documentation that indirectly confirms the expenses incurred (this includes customs declarations, business trip orders, travel documentation, reports on work performed under contracts) - is stated in the fourth paragraph of the first paragraph of Article 252 of the Code.

Important ! In other words, citizens who pay taxes can confirm information about their own expenses not only through documentation that meets the requirements of the law (contracts, payment orders, cash register checks, cash receipts, etc.), but also through other official papers that provide indirect confirmation of the fact of spending Money.

People can approve information about expenses using various official papers

Income from rental property

At the moment, the issue of mandatory registration of housing rental activities is quite acute. Now we will consider a situation in which such actions are registered as entrepreneurship.

It is no secret that a person who rents out a home spends a certain part of the money on utilities and other nuances of maintaining the home. Is it possible to take such expenses into account for professional tax deduction?

The Russian Ministry of Finance reports that an entrepreneur has the right to receive a tax professional deduction in the amount of actual and officially confirmed costs for the maintenance of rented property only when such activity of a citizen (“renting out one’s own non-residential (or residential) real estate” in accordance with OKVED) is subject to registration in the Unified State Register of Individual Entrepreneurs. In any other situations, there is a possibility of facing questions from the Federal Tax Service.

If the activity (renting an apartment) is registered in the Unified State Register of Individual Entrepreneurs, a person can receive a professional tax deduction for housing maintenance

Possibility of returning over-withheld personal income tax

According to the first paragraph of Article 231 of the Tax Code of the Russian Federation, the author has the right to demand from his tax agent to return the amount of tax paid to the state tax service by mistake, if the agent did not provide the tax required by law. deduction.

This amount can be returned at the request of the author who worked under the contract, if less than 3 years have passed since the error. The organization seeks money for such a refund from future tax payments, either from the income of the author himself (if he continues to work under an agreement with this company), or from the income of other authors (if he is the tax agent of these authors).

The organization must make such a return within 3 months from the day the application was received.

If there are no papers confirming the fact of spending money

Naturally, there are cases when a person simply does not have documentation indicating the expenses incurred. In this case, it is possible to reduce the cost of professional tax payments by twenty percent of the total amount of money received for work activities.

This rule is relevant only for individual entrepreneurs. In other words, the following cannot take advantage of the 20% professional tax deduction:

- a citizen engaged in private practice - lawyer, notary, etc.;

- a person providing services specified in civil contracts and not registered as an individual entrepreneur,

- It will not be possible to take into account expenses that do not have official confirmation (information from Letters of the Ministry of Finance dated April 27, 2007 No. 03-04-05-01/129, dated 06.06.2007 No. 03-04-05-01/179).

Excerpt from Letter of the Ministry of Finance dated April 27, 2007 No. 03-04-05-01/129

When determining a professional tax deduction, an individual entrepreneur can only take into account those expenses that have official confirmation. You can also take into account the money spent in the amount of 20% of what you earned. Please note that these two methods cannot be used simultaneously.

Important ! Receipt of this type of deduction by people providing services or performing work is made on the basis of civil law contracts.

Based on paragraph two of Article 221 of the Tax Code, citizens working on the basis of civil contracts are able to reduce the money they receive for professional tax deductions.

The type of deduction we are considering can be used by any individual who earns money for work or civil services. This also applies to lawyers engaged in their work in the legal college, and also applies to individual entrepreneurs (legal basis - Letter of the Ministry of Finance dated July 28, 2005 No. 03-05-01-05/140).

Excerpt from Letter of the Ministry of Finance dated July 28, 2005 No. 03-05-01-05/140

If this form of agreement was drawn up with an organization or individual entrepreneur, this company or entrepreneur acts as a tax agent. Therefore, they should provide the person with a professional tax deduction.

If a similar form of agreement is drawn up with a person who is not an individual entrepreneur, you will have to contact the tax office to receive the required deduction.

This form of deduction is issued to a citizen who earns money on the basis of a civil contract involving the performance of various types of work or the provision of any services. What can be included here:

- contract agreement;

- a contract involving the performance of scientific, research, design or technological work;

- contract for the provision of services on a reimbursable basis.

Let's celebrate ! The Ministry of Finance claims that individuals receiving funds from contracts for the delivery or rental of housing cannot be provided with this type of deduction (based on Letters dated September 3, 2010 No. 03-04-05/3-521, July 13, 2010 No. 03- 04-05/3-389).

This form of deduction can be issued to a citizen earning money on the basis of a civil contract

However, tax officials have a different opinion. They argue that it is quite possible to use a tax deduction in such situations (Letters of the Federal Tax Service of the Russian Federation dated October 2, 2008 No. 3-5-04 / [email protected] , UNFS of the Russian Federation for Moscow dated March 5, 2008 No. 28-11/021762).

Deduction for authors of works and scientific developments

A professional deduction for royalties is provided to both individuals who do not have individual entrepreneur status and individual entrepreneurs in the amount of documented expenses.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

But, since in most cases, when creating copyrighted works and scientific developments, it is difficult to clearly determine the costs incurred in monetary terms, special standards established by Art. 221 Tax Code of the Russian Federation:

30

40

| Deduction rate in % (percentage of the amount of income received) | Creation (execution) activities |

| 20 | works of art and literature |

| scientific developments | |

| 25 | musical works |

| films (video, audio, television films) | |

| works of architecture and design | |

| photographs, artistic and graphic works | |

| models, inventions, industrial designs (in relation to income received during the first 2 years of use) | |

| works of sculpture | |

| arts and crafts | |

| easel and monumental decorative painting | |

| graphics made in various techniques | |

| theatrical arts | |

| musical and stage works | |

| works for wind and symphony orchestra | |

| music for films and theater productions |

Thus, authors can also choose for themselves the best option for using a professional deduction:

- as a percentage of the amount of income received;

- in the amount of documented expenses.

It should be noted that the provisions of the Tax Code of the Russian Federation on the application of professional deductions do not apply to copyrighted works (scientific developments) created by employees in the performance of official duties.

In addition, PNV cannot be used if the exclusive right to intellectual property has passed to a new owner through inheritance (alienation).

Thus, the publishing house withheld personal income tax from the author’s income in the amount of:

Scope of deduction and components of expenses

The deduction is provided in the form of funds actually spent that have official confirmation.

Let us note that there are no rules for determining the money spent by citizens working under civil contracts. It follows that citizens should independently identify the costs associated with the work they perform. They also differentiate what cannot be included in these expenses. It must be remembered that these expenses should not have been taken into account previously for the professional deduction.

What else applies to taxpayer expenses:

- taxes (excluding personal income tax) credited or paid for a given tax period (third paragraph of the third paragraph of Article 221 of the Tax Code);

- state duty paid for performing professional activities (seventh paragraph of the third paragraph of Article 221 of the Tax Code);

- insurance premiums related to compulsory pension or health insurance (third paragraph of the third paragraph of Article 221 of the Tax Code).

Taxpayer expenses also include insurance premiums, state duties, taxes

Since the 17th year, when calculating insurance plan contributions for compulsory pension insurance for people working “for themselves” and paying personal income tax, only actual expenses that have official confirmation are taken into account. They are considered in Chapter 23 of the Tax Code. If you study the Letter of the Ministry of Finance dated February 6, 2017 No. 03-15-07/6070, you can find out that people engaged in private practice (lawyers, individual entrepreneurs, notaries) in the process of identifying the basis for calculating insurance premiums can reduce income from of their work activities by the number of expenses made. The rules for calculating insurance contributions for compulsory pension insurance for such people are specified in subparagraph one of Article 430 of the Code (when the amount of money received does not exceed three hundred thousand rubles for a given period, then calculations are made on the basis of the minimum wage and tariffs. Otherwise, the contribution is calculated using adding one percent to the excess amount). If a citizen paying taxes receives more than three hundred thousand rubles in a year, this formula should be used:

Minimum wage x 12 x 26% + (income - 300,000 rubles) x 1% (but not more than 8 minimum wage x 26% x 12).

The amount of insurance premiums for self-employed citizens depends on the size of their income

The amount of money earned through self-employment in this case should be reduced by the amount of professional tax deductions described in article number 221 of the Tax Code.

Important ! If a citizen cannot provide documentation approving his expenses, then the general principle is used - 20 percent of the total amount of money earned in the course of business activities.

Features of the procedure for individual entrepreneurs

Individual entrepreneurs can include in the tax deduction any expenses that are directly or indirectly related to their professional activities. These could be the following categories:

- purchase of goods,

- purchase of equipment for production or packaging of products,

- purchasing materials necessary for work,

- fuel for transportation (for example, when delivering goods to customers),

- professional books and manuals necessary for conducting activities,

- employee salaries,

- utility bills for the operation of office space,

- office rental,

- various taxes and state duties related to business activities, etc.

Providing professional tax deduction by tax agents

To ensure this deduction from tax agents, a person must send them an application in writing. You don't have to wait until the end of the year to do this.

In addition to the application, the tax agent must receive from the taxpayer documentation approving monetary expenses (based on the Letter of the Department of Tax Administration of the Russian Federation for Moscow dated September 27, 2004, number 28-11/62835).

Letter of the Department of Tax Administration of the Russian Federation in Moscow dated September 27, 2004 number 28-11/62835

In general, there is no exact list of documents required to be submitted. There is no specific list anywhere in the laws. But it would be logical to say that all documents provided must confirm the person’s expenses and talk about their connection with the performance of work under civil law contracts. It follows from this that it is necessary to collect contracts, sales receipts, cash receipts, cash register receipts, and receipts from individuals.

When an agent is presented with a request for a professional tax deduction, he must comply with the citizen's request in the course of paying the monetary incentive specified in the contract.

Obtaining a professional tax deduction from the tax authority

When your profit was provided by an individual, and not by tax agents, you need to make a visit to the tax office. Only then will you be able to receive the type of deduction we are considering.

For this purpose, a citizen is obliged to draw up a tax return at the end of the year of profit and send it to the appropriate institution.

To receive a deduction, you must file a tax return.

Important ! Please note that an application is not required from you then.

Tax control authorities, by the way, say that in addition to the tax return, a person is required to attach documentation confirming the expenses he has made. It should be assumed that this statement applies not only to individual entrepreneurs, but also to individuals who earn money by performing work based on civil contracts.

Insurance contributions to funds

Norm clause 1 art. 7 of the Federal Law of July 24, 2009 No. 212-FZ: “Payments and other remunerations accrued by payers of insurance premiums in favor of individuals within the framework of civil contracts, the subject of which is the performance of work (provision of services) are recognized as subject to taxation by insurance contributions to extra-budgetary funds "

This means that those payments that will be accrued under contracts for the performance of work and the provision of services will be recognized as subject to taxation by insurance contributions to extra-budgetary funds.

But in this case there is a slight difference from an employment contract: contributions to the Social Insurance Fund of the Russian Federation for civil contracts are not accrued. This follows from paragraphs. 2 p. 3 art. 9 of the Federal Law of July 24, 2009 No. 212-FZ.

Providing this type of deduction to people receiving various types of remuneration

Some people receive money from royalties or awards for inventing, performing, or otherwise applying scientific findings, works of literature, and art. This point also applies to the authors of discoveries, inventions and industrial designs. All of these people are entitled to a reduction in income for professional tax deductions using the first paragraph of Article 221 of the Tax Code.

Important ! In the law of November 24, 2014 No. 367-FZ, these rules began to apply to developers of utility models. From now on, they also have access to a type of similar deduction.

The type of deduction we are studying can be used by any individual who is provided with the listed incentives, including individual entrepreneurs (Letter of the Ministry of Finance of Russia dated March 19, 2007, number 03-04-05-01/85).

Persons who receive money from royalties or awards for invention, etc., are entitled to a reduction in income for professional tax deductions

A professional tax deduction can be obtained by the authors of various scientific works, studies, developments, and the like. Then it concerns the expenses related to this scientific work.

This type of tax deduction is not provided when the author is given royalties for a work that is the result of his labor activity.

Summary

Professional deduction is in fact the only legal method of changing the amount intended for payment of personal income tax duty in the direction of a significant reduction and corresponding relief of the tax burden in relation to designated categories of citizens.

Let us recall these three categories: these are individual entrepreneurs, notaries and lawyers, representatives of private practice in the service sector, persons performing their work on the basis of agreements and authors of works receiving royalties.

Actively use your right to a professional deduction, remembering to declare it in a timely manner. And then your professional activity will receive a real “safeguard” from the law.

Practical examples

Let's say an individual entrepreneur makes money by selling food products through a store. Note that the profession of this citizen relates to the construction industry, so sometimes he is engaged in relevant work activities, concluding civil contracts. It follows from this that for part of the profit for the provision of construction services, he has the right to use a professional deduction.

The monetary expenses of a person paying taxes, similar to the cases with an individual entrepreneur implementing a private practice, can include the amount of relevant taxes (excluding personal income tax) credited or paid for the tax period.

The monetary expenses of a person paying taxes include the amount of taxes (except personal income tax)

Example: a citizen provides services to an organization on the basis of a contract agreement. The money paid for his work is 150 thousand rubles. The citizen is not an individual entrepreneur, the expenses related to the service provided amounted to 130 thousand rubles - this is the price of materials spent during the provision of the service.

Important ! To receive a professional tax deduction, a person must send a written application to the organization asking to be provided with this deduction. With the application, he must provide for review the papers where the expenses incurred by him are recorded.

In other words, the tax basis for calculating personal income tax is 20 thousand rubles (150 thousand minus 130 thousand). The tax required to be paid to the budget is 2 thousand 600 rubles (20 thousand rubles * 13%).

Who belongs to the category of taxpayers rewarded for the authorship or creation, performance and other use of scientific works, achievements of literature and art? This includes any individuals who are rewarded for the invention, execution or other application of scientific achievements, literary works, and works of art. It is worth mentioning here the citizens who made any discovery, invention, or created industrial designs. It is important to say that both authors and other people provided with this kind of incentive have the right to receive this type of tax deduction.

Both authors and other people provided with this kind of incentive have the right to receive a tax deduction.

The volume of professional deductions for this category of citizens paying taxes is those expenses that are actually incurred and are confirmed in official papers. When it is not possible to draw up documents, you must adhere to the following standards:

| Kind of activity | Cost standard (in % of the amount of income received) |

| Creation or use of works of literature, including theater, cinema, stage and circus | 20 |

| Creation of graphic works, artistic works, photographic works for printing, architectural works, design | 30 |

| Creation of musical or stage works for film, television, theater | 40 |

| Creation of other musical works (this includes those that are ready for publication) | 25 |

Example: a citizen is a composer. He created a piece of music and received an incentive of 300 thousand. The professional plan deduction here is 32 thousand (expenses are officially confirmed). At the same time, the citizen wrote a book for which he received 15 thousand, but there is no official confirmation of expenses. The person decided to use the percentage reduction as the best option: in the first scenario, the professional type of deduction will be 120 thousand, in the second - three.

To summarize, we can say that if you correctly analyze all the available data, you can very advantageously use the deduction that we talked about. This applies not only to individual entrepreneurs, but also to creative, scientific people, and people working under temporary civil contracts. The main thing is to keep documentation of costs and carefully study the Tax Code. Naturally, it is very difficult to understand the abyss of laws, so an experienced lawyer will be able to answer all the questions that interest you in detail.

Calculation examples

The mechanisms for calculating costs, documented and not, are fundamentally different. Here the payer can compare the amounts expected to be refunded and choose the option that is more convenient for him. In some situations, based on the amount of accrued income, it is more profitable for the applicant to issue a deduction if information on the profit received is not confirmed - especially if the budget revenue for the year is small. If the data is confirmed, he will return 13%, if there are no receipts - 20%.

If payment documents are available, the refund is calculated as follows:

During 2021, the entrepreneur organized his own business and sold products at retail. He spent 55 thousand rubles on all activities necessary for trading activities; his revenue for this period amounted to 135 thousand rubles. In fact, he can confirm 85 thousand rubles, this amount is his professional deduction. The inspectorate calculates personal income tax on the remaining amount of the profitable part, which means 135,000 rubles – 85,000 rubles = 50,000 rubles. It is this difference that accounts for the calculation and payment of tax at a rate of 13%.

In the absence of information about the income side of the business, the calculation proceeds as follows:

The person incurred production costs sold during 2017 in the form of 40 thousand rubles, and received 110 thousand rubles from this activity during this period, but there are no payment orders and checks. Then the rate will be 20%, 110,000 rubles * 20% = 22,000 rubles. This amount must be subtracted from the income received, 110,000 rubles – 22,000 rubles = 88,000 rubles. In this case, 88,000 rubles are subject to taxation of 13%.