| Address | Work schedule | Contacts |

| st. Gorkogo, 158, Vologda | Mon-Thu 8:00–17:15, break 12:00–13:00; Fri 8:00–16:00, break 12:00–13:00 | +7 (47244) 5-26-72 +7 [email protected] [email protected] https://www.nalog.ru/ https://www.nalog.ru/ |

| st. Herzena, 1, Vologda | Mon-Thu 8:00–18:00; Fri 8:00–16:45 | 8 +7 +7 +7 +7 +7 (47233) 4-47-07 +7 (47233) 4-27-19 [email protected] https://www.nalog.ru/rn35/ifns/imns35_01/ https www.nalog.ru/ |

This website contains official reference information about the work of the tax service in Vologda. After reading it, you will know:

- what services the tax department provides to the population;

- office opening hours;

- addresses of branches in Vologda;

- single telephone number for consultations.

The information posted here is constantly checked and edited, so all information is up to date.

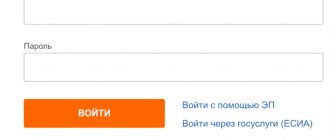

Login methods

First, let's look at all the options for registration and authorization in the service, which are provided by the Federal Tax Service of Russia.

Registration card details

If you have received a Taxpayer Registration Card, you will not need to create an account. To do this, you need to contact any Russian tax authority along with your identity card and fill out an application. If we are talking about obtaining a TIN for a person under the age of 14, you must contact the tax authority with a representative (parents, guardians).

After contacting the tax office and receiving a registration card, do the following:

- Go to the website https://lkfl2.nalog.ru/lkfl/login.

- Enter your login, which is your Taxpayer Identification Number.

- Enter the password specified in the registration card.

- Click the "Login" button.

To restore access, click the “Forgot your password?” link, indicate your TIN, email address and security word. After this, an email with a new password will be sent to your email.

If you did not indicate contact information in your personal account, then restoration is carried out by personally contacting any tax authority of the Russian Federation.

Electronic signature

If you have a certified electronic key issued by a Certification Authority, then it can be used as a means of authorization. The procedure is performed as follows:

- On the website https://lkfl2.nalog.ru/lkfl/login, click the “Login using electronic signature” link.

- If a special plugin is not installed on your PC, click the “Download” button.

- Run the downloaded file and install the plugin on your computer.

- Connect the drive with the key (hard drive or flash drive) and wait for verification from the site.

This method is suitable for individual entrepreneurs and legal entities. No need to recover passwords or logins.

State Services Account

The most convenient and common option is to log into the taxpayer’s personal account using a State Services account. To do this, go to https://lkfl2.nalog.ru/lkfl/login and click on the marked link.

You will see a page https://esia.gosuslugi.ru/ with an authorization form. Enter your login (phone number, email or SNILS), then enter your account password. Click "Login".

Give permission to use your profile on third-party services. After this, you can proceed to work in the taxpayer’s personal account.

Find out your debt in your personal tax office

Information on payments, charges, taxes and contributions is constantly updated and stored in the taxpayer’s profile. The main data is displayed on the home page of the account. To see detailed information, select the “Overpayment / Debt” column. The subsection will display data on taxes, fines and penalties for the current period.

Find out the debt by TIN

The Tax Code of the Russian Federation protects private tax information; therefore, it is possible to find out the taxpayer’s debt only from the account. The original public access service for debt information is no longer available. Currently, this service is received in the taxpayer’s office.

Find out your debt by last name

In the database register of the Federal Bailiff Service, every citizen has the right to check the receipt of information about himself. Go to the website, select search by individuals, fill in the data:

- Determine the territorial authority.

- Enter your full name.

- Please note your date of birth.

- Initiate the search using the “Find” button.

Registration through State Services

The method with authorization through State Services is only suitable for confirmed users. Let's briefly look at the procedure for creating a profile and going through identification:

- Open the portal https://www.gosuslugi.ru/ and click “Register”.

- Please provide your first and last name, mobile number and email.

- Receive a confirmation code on your phone and enter it on the website.

- Create a password for your account and complete registration.

The first stage is completed. Now you need to complete your account to get standard account status. To do this, go to your account settings and enter the following information:

- email;

- mobile phone;

- passport details;

- SNILS.

After filling out your profile, automatic verification will begin. If all data is confirmed, proceed to obtaining the third account status. To do this, find the nearest service center using the link https://map.gosuslugi.ru/co by selecting “Identity Confirmation” using the filter.

Contact the organization’s branch along with your passport and SNILS and go through the confirmation procedure. You can also complete this step using an electronic signature or registered mail if you are in a remote location.

Clients of Sberbank Online, Tinkoff and Post Bank Online can complete the procedure remotely through mobile banking on their phone or web interface.

LC capabilities

After gaining access to your personal taxpayer account for individuals, you will be able to familiarize yourself with the functions. On the main page you will find the following information:

- current tax debt;

- wallet condition;

- transition to the main sections of your personal account;

- buttons for moving to contact information, calendar and logging out of your account.

My taxes

In this section you can familiarize yourself with tax charges for each category (transport, real estate, land). Using the “Details” button you can view details for each type, and clicking on the amount opens the payment page. If you do not select a specific category, you can proceed to deposit the entire amount using the “Pay” button at the bottom of the page.

And also in this section you can manage tax deductions, view the history of transactions and open the section with information about income.

On the tax payment page you can choose one of 3 options:

- Bank card. You need to check the box for consent to data processing and click “Pay”. Then fill out the form with payment details and confirm the transaction.

- Receipt. Using this tab, you can download a receipt in PDF format to your computer.

- Credit institution website. From here you can go to the partner bank's website to make a payment.

Before performing the procedure, the amount is manually adjusted using a separate menu. In this way, the payment is divided into several transactions if necessary.

If you are going to pay taxes through a personal account on the state tax service portal, then top up your internal wallet. To do this, click on the balance in the upper right corner, click “Top up” and select the option to deposit money.

My property

In this section you can manage all property registered in the name of a taxpayer. The table is sorted by type and registration. There is detailed information about each house, vehicle and plot of land. Click on a block to view details.

From here you can do the following:

- report to the tax office about an error in information or charges for this object;

- submit an application for assignment of property;

- assign the status of preferential property.

For the last two functions, you will have to create an application by filling out a form and attaching supporting documents. After this, the application will be reviewed by the administration, and the response will be sent to the “Messages” section.

In the messages tab, a table with sent and incoming messages is available. They can be deleted, sorted, read, and downloaded attached documents.

Life situations

The “Life Situations” tab contains a table of all services provided by the portal:

- submission of applications and declarations;

- attachment of property;

- information about a bank account;

- request for certificates and other documents;

- change of personal data;

- contacting technical support;

- refusal to use LC;

- filing complaints and so on.

Each category has a brief and detailed description of the actions that need to be taken to use the service.

What to do next

Follow messages from the tax office.

You will be kept updated on the status of your return. If everything is in order with her, then within a month you will receive a deduction. But the tax office also has the right to conduct a desk audit, and then the process will take three months from the moment the documents are received. The countdown is not from the day the declaration was sent, but rather from the moment it was accepted. The status can also be viewed by selecting the menu items “Life situations” → “Submit 3‑NDFL declaration” → “Fill out online”.

If something goes wrong, you will be sent a message or an inspector will call you. In some cases, it will be enough for you to send the missing documents. If there were inaccuracies in the declaration, you will have to submit it again.

Settings

By clicking on your name, you will open the settings section. The following tabs are presented here:

- Contact Information. Change phone number, email, password, code word. A help section and a personal account deletion function are also available here.

- Personal Information. Changing passport data, SNILS, residence address, profile photo.

- Participation in organizations. Information about positions held in organizations.

- Action history. List of all transactions related to your personal account and taxes.

- Get EP. Tools for issuing regular email or connecting a qualified key.

- Accounts abroad. Information about bank accounts in other countries.

Through the official website Nalog.ru https://www.nalog.ru/ you can go to the personal accounts of individual entrepreneurs and legal entities.

Authorization with the tax office through State Services is the simplest and fastest method. When using a confirmed entry, you will immediately receive a completed profile in the taxpayer’s personal account and access to all functions of the site.