Line 1510 is

Credit balance on account 66 “Settlements for short-term loans and borrowings”

plus

Credit balance on account 67 “Settlements on long-term loans and borrowings” (if the repayment period of debts as of the reporting date does not exceed 12 months).

Long-term debt can be converted into short-term debt if there are 365 days left until the principal amount is repaid. Upon expiration of the payment period, urgent debt is transferred to overdue.

Displaying borrowed funds in reports

The formation of data on short-term loans, borrowings and long-term liabilities in the balance sheet occurs on lines 1410 and 1510. Such external receipts are displayed in sections 4 and 5 of the liability side of the balance sheet:

- The fourth section and line 1410 are intended to reflect loans with a long repayment period.

- Fifth and line 1510 – short-term loans.

Attention! The structure of these columns may vary depending on the decoding of subaccounts used. New lines may appear, numbered 14101 or 15101.

For borrowed funds received for a period of less than a year, account 66 is intended, for longer-term loans - 67. In accordance with accounting recommendations, interest and principal debt accounted for on these accounts should be divided:

- 66/01 or 67/01 – amounts of debt on loans.

- 66/02 or 67/02 – interest due to the creditor, which can be accrued monthly or once per reporting year.

Important! Interest paid under contracts should be accounted for as short-term liabilities, regardless of the method of calculation.

Calculation of the total amount of debts on line 1510 for accounting purposes will be calculated using the formula:

Borrowing costs include:

- interest due to the creditor;

— additional expenses related to loans received (examination, consultations, etc.).

The cost of an investment asset includes interest payable to the lender (creditor) if the accounting records recognize the expenses for the acquisition, production of an investment asset or loans associated with these actions, and work has begun on the acquisition, construction, production of an investment asset.

The following facts must be disclosed in the financial statements of the organization:

— presence and change in the amount of obligations under loans (credits);

— the amount of interest due to the lender (creditor), subject to inclusion in the value of investment assets;

— the amount of borrowing costs included in other expenses;

- the amount, types and repayment terms of issued bills of exchange, issued and sold bonds;

— repayment terms of loans (credits);

- the amount of income from the temporary use of funds from a received loan (credit) as long-term and (or) short-term financial investments;

- the amount of interest included in the cost of the investment asset, payable to the lender (creditor) for loans not related to the acquisition, construction and (or) production of the investment asset.

Long-term liabilities on the balance sheet (Section IV)

Important! Liabilities (short-term and long-term) on the balance sheet are always reflected in Liabilities.

In the balance sheet, information on all long-term liabilities of the enterprise can be found in section IV, which includes the following items:

- Borrowed funds (line 1410). These are loans and borrowings issued by a legal entity, interest on the use of funds and associated costs (fees for checking a loan agreement, paid consultations, commercial information, etc.).

- Deferred tax liabilities (line 1420). This is the portion of the organization's deferred income tax, which will ultimately increase the income tax planned for transfer to the budget in the next reporting period or in later periods.

- Estimated liabilities (line 1430). Debts of an enterprise that are planned to be repaid no earlier than in a year.

- Other liabilities (line 1450). All other debts that do not fall into any of the categories listed above.

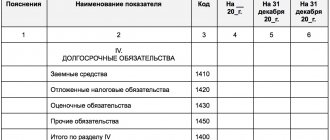

Let's see what the mentioned section IV looks like:

Let’s look at Section IV “Long-term liabilities” line by line and see how each line of the balance sheet is filled out:

| Section IV line | Line formation order | Algorithm for calculating the indicator* *K_ – credit balance |

| 1410 "Borrowed funds" | Information on all obligations of the company taken for a long term (this is considered to be a period of time from 1 calendar year) must be reflected. Accounts payable can arise as a result of receiving a loan in cash or in kind, in the form of an obligation on a bill of exchange, or a bank loan. To form a line, you need to take the credit balance of account 67 only for debts with a long payment period. | K67 (long-term debts only) |

| 1420 “Deferred tax liabilities” | Filled out only by enterprises guided by PBU 18/02. The line is formed by indicating the credit balance of account 77. In cases where firms allow themselves to offset tax liabilities and assets and present them in a consolidated form, the line must be filled out only when the credit balance of account 77 > debit balance of account 09 (by the amount of the difference between these indicators). | K77 |

| 1430 “Estimated Liabilities” | The amount of reserves formed according to PBU 8/2010 for long-term liabilities is indicated. As an example, we can point out the reserves formed for warranty repairs. The line is created by reflecting in it the credit balance of account 96 (for debts with a repayment period of 1 year or more), which was not written off as of December 31 of the reporting period. | K96 (only estimated liabilities with a long period of fulfillment) |

| 1450 “Other obligations” | Contains information about debts to counterparties with a repayment period of 1 year. It is formed as the balance of the following accounts: – account 60 (debts to contractors and suppliers for previously received deferred payments and installment plans for payment for goods supplied, only for credit debts with a long repayment period); – account 62 (debts to customers and consumers for advances received, prepayments for future supplies of goods, commercial loans, only for long-term debts); – account 68 (accounts payable with a long repayment period that arose in connection with payments to the budget (taxes, fees), for example, upon receipt of installment plans and deferrals for federal tax collections, investment tax credit); – account 69 (debts of an enterprise for the payment of insurance premiums with a long repayment period, for example, arising due to the restructuring of debt to extra-budgetary funds); – account 76 (debts not included in other categories with a long repayment period); – account 86 (loan account 86 – targeted financing with a time period for fulfilling obligations of at least 1 year, for example, when a developer becomes obligated to transfer a finished project to investors after receiving targeted financing for construction). | K60+K62+K68+K69+K76+K86 (only long-term liabilities) |

| 1400 “Total for Section IV” | Amount of lines 1410-1450 (total liabilities of the company). |

The total for the “Long-term liabilities” section is calculated in accordance with the following formula:

Long-term liabilities: borrowed funds (line 1410)

Borrowed funds reflected in line 1410 of Section IV include all bank loans issued at the end of the reporting period for a period of 1 year or more, various loans, bonded and bill of exchange debts. Such debts accumulate in the account. 67.

The amount of the loan taken is reflected in accounting in the amount specified in the loan agreement, not exceeding the amount of finance actually taken. Such an agreement is recognized as concluded at the time of actual receipt of funds (or other assets) from the borrower.

Debt on loans and credits is shown on the balance sheet, taking into account interest on the use of funds accumulated at the end of the reporting period.

Important! In the case of receiving a credit (not a loan), the amount under the agreement is subject to reflection in the balance sheet as accounts payable, but taking into account the terms of the agreement. This is due to the fact that banks reserve the right not to issue funds (if such a condition is contained in the agreement), and that in the event of an unreasonable refusal to issue a loan, the bank will be obliged to pay compensation to the client.

Long-term liabilities: deferred tax liabilities (line 1420)

Reflected on account 77 by type of obligation. Accounting entries:

- DEBIT 68.4.2 CREDIT 77 (occurrence of deferred tax liabilities);

- DEBIT 77 CREDIT 68.4.2 (reduction of deferred non-refundable assets).

Deferred tax liabilities appear on the balance sheet because taxable temporary differences arise (in effect, they are deferred taxes that will subsequently increase income taxes payable). These are reflected in accounting taking into account all taxable differences, and such liabilities are recognized precisely in the period during which they arose.

A temporary difference is income that forms profit (and expenses that form loss) within one reporting period, while the tax base is formed in another (other) periods.

Important! If a debt or an asset for which deferred tax liabilities were accrued is disposed of, the amount of IT is written off to the profit and loss accounts, which, according to the Tax Code, will not increase taxable profit.

Long-term liabilities: estimated liabilities (line 1430)

They are taken into account by accountants on account 96, recognized if 3 conditions are simultaneously met:

- The impossibility of avoiding the fulfillment of an obligation that arose earlier due to the implementation of economic activities.

- Probability of expense (reduction of economic benefits in order to fulfill an obligation).

- Possibility of a reasonable assessment of the amount of possible expenses (amount of obligation).

The listed conditions for accounting for estimated liabilities are not applicable in some cases. So, they are not taken into account when it comes to:

- amounts that are accounted for according to PBU 18/02 and affect the amount of income tax planned for transfer to the budget in the following periods or in later periods;

- valuation reserves;

- reserves that were formed from retained earnings; reserve capital;

- contracts under which at least one of the parties has not fulfilled its obligations in full as of the reporting date (with the exception of obviously unprofitable contracts, and an agreement under which a party can refuse to fulfill obligations unilaterally without any penalties is not recognized as such) .

Composition of the enterprise's liabilities.

To carry out production and economic activities, an organization operating separately from others must have its own and borrowed (attracted) financial resources.

OWN CAPITAL consists of authorized, additional and reserve capital, retained earnings and other financial reserves.

Authorized capital is the monetary value of the founders’ contributions.

Reserve capital - created through annual deductions from net profit, intended mainly to cover losses. The amount of reserve capital and the amount of mandatory contributions to it are determined by the charter or constituent documents.

Additional capital is formed due to the increase in the value of non-current assets - when revaluing fixed assets upward, at the expense of share premium and a number of other sources.

Retained earnings are the part of net profit remaining after distribution and directed to the needs of the enterprise.

Targeted financing and revenues are funds received from other enterprises, state and municipal bodies and intended for the implementation of targeted activities.

Other financial reserves are created in organizations in order to evenly include upcoming expenses in production or distribution costs.

Results

Accounting and reporting of borrowed funds in financial statements is not difficult.

Attention should be paid to their intended purpose, as well as the timeliness and correctness of interest calculations, not forgetting when preparing reports to correctly reflect the debt on interest related to long-term obligations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Balance lines 2021: decoding

An organization can create reserves: for upcoming vacation payments to employees; payment of annual remuneration for long service; payment of remuneration based on the results of work for the year; repair of fixed assets; covering other anticipated costs and other purposes.

BORROWED CAPITAL represents part of the financial resources attracted by the organization that belong to third parties.

The composition of borrowed capital includes:

Bank credits (loans) – funds provided by banks;

Borrowed funds – amounts of loans received from other organizations (non-banking) organizations and individuals.

The debt of the borrower's organization to the lender for received loans and borrowings in accounting is divided into short-term and long-term. Short-term debt is considered to be debt whose repayment period, according to the terms of the agreement, does not exceed 12 months. Long-term debt is considered to be debt whose repayment period, according to the terms of the agreement, exceeds 12 months.

There are urgent and overdue debts. Urgent debt is considered to be a debt the repayment period of which, according to the terms of the contract, has not come or has been extended (prolonged) in the prescribed manner; overdue is considered to be a debt whose repayment period has expired according to the terms of the contract.

Accounts payable – includes debt amounts:

- to suppliers and contractors for received and unpaid material assets (work performed and services rendered);

- to employees of the wage organization;

- on insurance premiums and contributions for insurance against industrial accidents and occupational diseases;

- for all types of payments to the budget;

- on advances received by the organization for the upcoming supply of goods (performance of work, provision of services), minus VAT accrued on these advances, etc.

A creditor is someone to whom a business owes money. The amount of obligations to the creditor is called accounts payable .

A balance sheet is an information system that, in general monetary terms, gives an idea of the financial condition of an organization as of a certain (reporting) date. Banks, for example, prepare their balance sheets daily.

The balance sheet shows the owner what he owns or how much capital he controls.

In its structure, it is a two-sided table, where the left side (asset) reflects the organization’s resources, and the right side (liability) reflects the sources of their formation. Moreover, both parts are equal in monetary terms, which follows from the principle of double entry. From a slightly different point of view (legal), liabilities can be defined as obligations - to the owners (capital) and to third parties and organizations (liabilities or accounts payable).

In this case, the balance diagram can be presented in the following form.

ASSETS = CAPITAL + LIABILITIES

BALANCE

| ASSETS | PASSIVE | What is the financial position of the organization? |

| Fixed assets | Equity | How much does the enterprise cost? |

| Current assets | Liabilities |

The balance sheet provides an answer to the first of the main questions, presenting to users the ratio of property and its sources, characterizing financial stability and liquidity, as well as the amount of the organization’s net assets, characterizing its cost.

Organizational assets are resources owned by the organization as a result of past operations. Otherwise, we can say that assets are the organization’s expenses (resources acquired in the past), which should bring it profit in the future.

Assets can also be called property.

Those costs that formed a product (products, services, work) that has already brought income to the enterprise in a given reporting period, that is, realized in the reporting period, are called expenses (everything that is reflected in the profit and loss statement).

An organization's liabilities are, from an economic point of view, sources of existing assets (property). Otherwise, they can be defined as the external and internal obligations of the organization.

An organization's liabilities (external liabilities) are the organization's debt resulting from past operations, the settlement of which should lead to an outflow of assets. That is, liabilities are borrowed sources of available resources.

External obligations - from a legal point of view, these are the rights of third parties to the property of an organization, that is, an economic entity (to the extent that the property of third parties has decreased and the property of the organization has increased).

In accounting, it has become a common practice to call this category simply “liabilities.”

Capital (internal liabilities) represents the investments of owners in the organization and the increase in these funds as a result of activities (profit) or as a result of other events (additional capital) over the entire existence of the organization. In other words, we can say that capital is the debt of an organization to its owners or, on the other hand, the property rights of the owners.

In accounting, this category is called “capital,” although in economics and financial analysis the terms “active capital” (in relation to assets), “equity capital” (in relation to what we simply called “capital”) and “ borrowed capital" (in relation to liabilities).

Net assets are equal to the difference between the organization's property (its assets) and its liabilities. Net assets are also equal to the capital of the organization. If they become less than the amount of the authorized capital, then the organization must be re-registered with a decrease in the amount of the authorized capital to the amount of net assets. If the net assets are less than the minimum authorized capital (100 minimum wages for limited liability companies and closed joint-stock companies and 1,000 minimum wages for open joint-stock companies), then such an organization must be liquidated. Here the minimum wage is the minimum wage established by federal law. It should be remembered that the federal law of June 19, 2000 No. 82-FZ (as amended on December 3, 2012) “On the minimum wage” established the basic minimum wage, from which social benefits and basic amounts in various laws are calculated (including including the minimum amount of authorized capital, fines, etc.) equal to 100 rubles.

When calculating net assets, the assets and liabilities taken into account are considered. At the same time, the debt of the founders on contributions to the authorized capital is excluded from the amount of assets, and the income of future periods is excluded from the amount of liabilities. The Procedure for assessing the value of net assets of joint-stock companies also requires reducing the value of assets by the amount of costs of repurchasing own shares from shareholders. But at present, shares purchased from shareholders are not reflected as part of financial investments with a minus sign, i.e. show a decrease in the real capital of the organization by this amount.

Net current assets (own working capital, working capital) is the difference between the value of current assets and short-term liabilities. Shows what part of the organization's working capital exists from its own sources. Otherwise, this value can be calculated by subtracting the amount of non-current assets from the amount of capital and long-term liabilities.

Asset and liability data are grouped in a specific way. In this case, the main criterion is the method of participation of funds in circulation and the functions they perform. Thus, the main parts of an asset are non-current assets and current assets.

Liabilities are divided into two components – equity and borrowed capital (liabilities). But in the liability side, the grouping of obligations in accordance with their duration is preserved.

Interpretation of individual balance sheet liability indicators

The asset lines of the new form of the balance sheet (Order No. 66n) reflect the company’s property - both tangible and intangible. The items in this part of the balance sheet are arranged according to the principle of increasing liquidity, while at the very top of the balance sheet asset there is property that remains in its original form almost until the end of its existence.

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises.”

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | 1100 | 190 | The total amount of non-current assets is reflected |

| Intangible assets | 1110 | 110 | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) |

| Fixed assets | 1150 | 120 | |

| Profitable investments in material assets | 1160 | 135 | |

| Financial investments | 1170 | 140 | |

| Deferred tax assets | 1180 | 145 | The debit balance of account 09 is indicated |

| Other noncurrent assets | 1190 | 150 | Filled in if there is information about non-current assets that are not reflected in the previous lines |

| Current assets | 1200 | 290 | The final result of current assets is determined |

| Reserves | 1210 | 210 | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) |

| Value added tax on purchased assets | 1220 | 220 | Indicate account balance 19 |

| Accounts receivable | 1230 | 240 | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected |

| Financial investments (excluding cash equivalents) | 1240 | 250 | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year |

| Cash and cash equivalents | 1250 | 260 | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) |

| Other current assets | 1260 | 270 | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) |

| Total assets | 1600 | 300 | Total of all assets |

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| TOTAL capital | 1300 | 490 | The line contains information about the company's capital as of the reporting date |

| Authorized capital (share capital, authorized capital, contributions of partners) | 1310 | 410 | Information on lines 1300–1370 is detailed in the statement of changes in equity and the statement of financial results (in terms of net profit for the reporting period). The company has the right to determine the additional amount of explanations about capital. |

| Revaluation of non-current assets | 1340 | 420 | |

| Additional capital (without revaluation) | 1350 | ||

| Reserve capital | 1360 | 430 | |

| Retained earnings (uncovered loss) | 1370 | 470 | |

| Long-term borrowed funds | 1410 | 510 | The information is deciphered in tabular (Form 5) or text form in the explanations to the balance sheet |

| Deferred tax liabilities | 1420 | — | Indicate the credit balance of account 77 |

| Estimated liabilities | 1430 | — | The credit balance of account 96 is reflected - estimated liabilities, the expected fulfillment period of which exceeds 12 months |

| Other long-term liabilities | 1450 | 520 | Provides information about long-term liabilities not indicated in the previous lines of the section |

| TOTAL long-term liabilities | 1400 | 590 | The final result of long-term liabilities is reflected |

| Short-term debt obligations | 1510 | 610 | Account credit balance 66 |

| Short-term accounts payable | 1520 | 620 | The total credit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 is reflected. The information is deciphered in the notes to the balance sheet (for example, in Form 5) |

| Other current liabilities | 1550 | 660 | Filled in if not all short-term liabilities are reflected in other lines of the section |

| Total current liabilities | 1500 | 690 | The total total of short-term liabilities is indicated |

| Liabilities of everything | 1700 | 700 | Summary of all liabilities |

Read about what characterizes simplified accounting in the article “Simplified reporting for small businesses.”

Therefore, in our opinion, it is incorrect to take into account obligations under contracts that the parties have not yet begun to fulfill. In addition, according to civil law, a loan agreement is considered concluded only from the moment the money is transferred to the borrower * (225).

Moreover, if the borrower receives money from the lender in an amount less than specified in the agreement, the agreement is considered concluded for the amount that was actually received * (226). Accounting for Interest PBU 15/2008 provides that interest on loans or credits received is accounted for evenly in the reporting period to which they relate.

line 1510 of the balance sheet what it consists of

Among borrowed capital, long-term (more than 12 months) and short-term (no more than 12 months) liabilities are distinguished.

Each individual indicator in the balance sheet for which the amount is entered (each element of an asset and a liability) is called an item . The assessment of balance sheet items is carried out based on the assumptions and requirements defined by PBU 1/2008 “Accounting Policies of the Organization” and other accounting provisions.

Asset items are arranged in order of increasing liquidity, and liability items are arranged in order of increasing maturity of liabilities.

Balance sheet items are divided into sections for the best grouping of the data provided. All articles required for reporting have a code, which makes it easier to find the article and links to the necessary data. Other articles are filled in at the discretion of the organization.

Date of publication: 2015-01-24; Read: 372 | Page copyright infringement

Storage of accounting documents

Reflection of loans in the company's balance sheet. Balance sheet section Name of the balance sheet item Balance sheet line number Amount in lines Long-term liabilities Borrowed funds 1410 4,500 Short-term liabilities Borrowed funds 1510 10 In the balance sheet, amounts are reflected in thousands of rubles, according to Order No. 66 no. Financial analysis of dependence How much the company needs borrowed funds is up to management to decide.

On the one hand, borrowed capital is a powerful resource needed in many situations. For example, if you need to expand your economic activity and buy expensive equipment that can quickly pay for itself and make a profit. On the other hand, it is very easy to fall into financial dependence and start attracting other people’s money at the slightest crisis, which will inevitably entail a high rate of increase in debt. Therefore, it is necessary to analyze this balance sheet item.

December 11, 2021 We discussed accounting for loans and borrowings in our consultation. And on which line of the balance sheet is debt on short-term loans and borrowings reflected? The form of the balance sheet was approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. In this form, 2 lines in the liability are intended to reflect debt on loans and borrowings:

- 1410 “Borrowed funds”;

- 1510 “Borrowed funds”.

Naturally, we are talking about loans and borrowings received.

Solvency and liquidity indicators

Indicators of this group characterize the possibility of making debt payments.

The overall degree of solvency is calculated as the ratio of the sum of long-term and current liabilities (i.e., the amount of borrowed funds) to average monthly revenue:

$$\text{Total solvency} = \frac{\text{Dorrowed capital}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 page 1400+1500-1530}}{\text{ f#2 page 2110/12 months}}$$

Revenue may not necessarily be calculated for a year; the calculation period can be 3, 6, 9 months; it all depends on how often the analyst plans to calculate this indicator and what reporting forms (annual or quarterly) are used for analysis.

This indicator has the dimension “months” and characterizes how many months the company needs to pay off all long-term and short-term obligations while maintaining the current level of revenue in a hypothetical case, if no other payments are made.

The degree of solvency for current liabilities is determined as the ratio of only current liabilities to average monthly revenue:

$$\text{Current solvency liabilities} = \frac{\text{Current liabilities}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 line 1500-1530}}{\text{form No. 2 line 2110/12 months}}$$

This indicator, like the previous one, has the dimension “months” and characterizes how many months the company needs to pay off short-term obligations while maintaining the current level of revenue without making other payments.

The recommended value for this indicator is . If this condition is met, the enterprise is considered solvent, otherwise it is insolvent. The three-month period is justified by the fact that for most enterprises, a sign of bankruptcy is the presence of debt, the repayment period of which expired exactly three months ago.

For enterprises that are subjects of natural monopolies (fuel and energy enterprises, etc.), strategic enterprises, the list of which is approved by the Government of the Russian Federation, and for credit institutions (banks), the signs of bankruptcy differ in the timing of delayed payments. Therefore, the recommended values of the indicator change accordingly, which are:

Balance line 1510 what contains

< 6 months for strategic enterprises and natural monopolies, for credit organizations - < 14 days.

The absolute liquidity ratio is the ratio of the value of quick assets to current liabilities:

As you already know, short-term financial investments and cash in the company’s accounts are considered quick-liquid assets.

$$К_\text{abs. liquidity} = \frac{\text{Highly liquid assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250}}{\text {f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid almost immediately (within a few days). As a rule, at domestic large and medium-sized industrial enterprises it amounts to a few percent.

The intermediate liquidity ratio is the ratio of the sum of quick assets and short-term receivables to current liabilities:

$$К_\text{industrial liquidity} = \frac{\text{Highly liquid assets+Accounts receivable}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250+1230 +1260}}{\text{f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid using current assets not involved in production, i.e. what part of the obligations can be repaid quickly enough (within a few months). It follows that in order to be able to repay the debt without any complications for current activities, all short-term liabilities must be covered by the specified assets. The recommended value of the indicator is .

The current ratio is calculated as the ratio of current assets to current liabilities:

$$К_\text{current liquidity} = \frac{\text{Current assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 page 1200}}{\text{form №1 pp. 1500-1530}}$$

It shows the portion of current assets covered by current liabilities. Indicator value > 2 (for countries with developed market economies).

In Russia in the late 1990s. the average value of the indicator was about 1. If it is > 1.5, then the enterprise is considered solvent.

The group of solvency and liquidity indicators allows you to assess the organization’s ability to pay its obligations through income from its activities (the first two indicators) and through the sale of existing property (the last 3 indicators).

What we reflect in lines 1410, 1510 of the balance sheet: borrowed funds

After completion of construction or additional equipment, the facilities are put into operation. For example, a company took out a loan for the construction of a bridge in the amount of 1,000,000 rubles for one year.

We recommend reading: After dividing the site, the navigator delivers to the wrong address

The bank's annual interest rate is 18%.

You need to calculate how much deductions to take into account each month:

- 180,000 / 12 months = 15,000 rubles – monthly interest accrual.

- 1,000,000 * 18% = 180,000 rubles per annum;

Since the loan term is one year, it is considered short-term, which means it will be displayed on account 66:

- Debit 51 Credit 66.01 – a loan was received in the amount of 1,000,000 rubles.

- Debit 08 Credit 66.02 – interest was accrued on the increase in the cost of the bridge in the amount of 15,000 rubles.

- Credit 66.02 Debit 51 – monthly payment to the bank of 15,000 rubles is transferred.

Debt on borrowed capital is shown in a separate line of the balance sheet, which all companies are required to submit

Financial stability indicators

This group of indicators characterizes the degree of security of the enterprise's production activities with its own financial sources and the degree of dependence on external sources (creditors, investors).

The financial independence ratio is calculated as the ratio of the sum of the value of equity (equity and reserves) to the sum of the enterprise’s assets:

$$К_\text{financial independent} = \frac{\text{Equity}}{\text{Assets}}=\frac{ \text{form No. 1 page 1300+1530}}{\text{ f#1 page 1600}}$$

The ratio shows the share of own (stable) sources of financing assets and characterizes the degree of dependence on creditors. Recommended value of the indicator.

The investment coverage ratio is calculated as the ratio of the amount of equity and long-term liabilities to the value of non-current assets:

$$К_\text{secured investment.} = \frac{\text{Equity funds+Long-term liabilities}}{\text{Non-current assets}}=\frac{ \text{form No. 1 page 1300+1530+ 1400}}{\text{f№1 page 1100}}$$

This ratio shows the extent to which non-current assets (buildings, structures, etc.) are secured by stable and long-term sources of financing.

The equity agility ratio is the ratio of the difference between equity and non-current assets to the amount of equity.

The difference between own funds and non-current assets is called: “own working capital”, “own capital in circulation”, “own working capital”, “net working capital”.

$$К_\text{maneuver.} = \frac{\text{Own funds-Non-current assets}}{\text{Own funds}}=\frac{ \text{form No. 1 page 1300+1530- 1100}}{\text{f№1 page 1300+1530}}$$

The indicator characterizes what share of equity funds finances current assets.

The ratio of own working capital is calculated as the ratio of own working capital and current assets (working capital):

$$К_\text{OSOS} = \frac{\text{Own working capital}}{\text{Current assets}}=\frac{ \text{form No. 1 page 1300+1530-1100}}{ \text{f№1 page 1200}}$$

This ratio shows what part of current assets is financed from own sources. Recommended value of the indicator.

The inventory coverage ratio (IPR) is calculated as the ratio of own working capital to the cost of inventories:

$$К_\text{providing inventory} = \frac{\text{Own working capital}}{\text{Inventories and costs}}=\frac{ \text{form No. 1 line 1300+1530-1100 }}{\text{f№1 page 1210+1220}}$$

If the value of this indicator is , then it follows that even if the company is denied a loan, it will still be able to continue its production activities, since its non-current assets and inventories are formed from its own stable sources.

The group of financial stability indicators allows us to assess the degree of dependence of the enterprise on external financing and the possibility of carrying out (continuing) activities at the expense of its own financial resources.

What is considered borrowed funds?

Depending on the type of organization that lent financial resources, they can be divided into two types:

- Loans.

- Loans.

The difference between types lies in the source of funding. Loans can only be provided by specialized organizations, that is, banks and other financial organizations. Loans can be issued by almost any legal entity and even an individual.

A loan is issued for the purpose of generating income for the lender, that is, at monetary interest. Loans can be interest-free. There is no benefit for a lender to risk their money without even receiving additional income. Therefore, an interest-free loan is found among affiliated and interdependent persons when several companies are united:

- to a corporation;

- holding;

- group.

Thus, you can divide the loans:

Indicators of business activity and production efficiency

This group includes turnover indicators and profitability indicators.

First, let's look at the procedure for calculating turnover indicators.

The general formula for calculating them is as follows:

$$\text{Turnover Rate} =\frac{\text{Sales Revenue (sometimes Cost)}}{\text{Average Asset Value}}$$

The average value of assets is calculated as the sum of the corresponding assets at the beginning and end of the accounting period:

$$\text{Average asset value} = \frac{\text{Value as of this year. + Cost per year}}{2}$$

For example, if current assets at the beginning of the year amounted to 500 thousand rubles, and at the end of the year 600 thousand rubles, then the average value of current assets is (500 + 600): 2 = 550 thousand rubles.

Asset turnover ratio:

$$K_\text{volume}Assets =\frac{\text{Sales revenue}}{\text{Average value of assets}}=\frac{ \text{form No. 2 p. 2110}}{\text{average on page 1600 f. No. 1}}$$

Shows how many rubles of income fall on 1 ruble invested in assets (capital return).

Equity turnover ratio:

$$K_\text{volume}Volume.Assets =\frac{\text{Sales revenue}}{\text{Average cost of working assets}}=\frac{ \text{form No. 2 line 2110}}{ \text{average for line 1200 f.№1}}$$

The value of this coefficient characterizes how many rubles of income fall on 1 ruble. own funds.

for the turnover ratio of non-current assets (in the denominator is the average for line 1,100 of the balance sheet) and the receivables turnover ratio (the average for line 1,230 f#1) is constructed in a similar way

Inventory turnover ratio:

$$K_\text{volume}Inventories =\frac{\text{Cost (production)}}{\text{Average amount of inventories}}=\frac{ \text{form No. 2 line 2120}}{\text {average for line 1210+1220 f.№1}}$$

The indicator characterizes how many rubles of costs fall on 1 ruble invested in inventories.

An indicator is also used, the inverse of this coefficient, which shows (how many rubles of inventories account for 1 ruble of production costs.

This group of turnover indicators indicates the effectiveness of using the corresponding groups of assets or resources of the enterprise in its activities for the production and sale of products.

Now let's look at profitability indicators.

The general formula for calculating these indicators is as follows:

$$\text{Profitability indicator} = \frac{\text{Profit}}{\text{Indicator}}$$

The numerator is usually sales profit, profit before tax, net profit, and the denominator is the value of assets, the amount of income and (or) costs.

Let's look at the most common indicators.

Return on assets:

$$R_\text{assets} = \frac{\text{Profit before tax}}{\text{Average assets}}= \frac{ \text{form No. 2 line 2300}}{\text{average on page 1600 f. No. 1}} $$

shows how many kopecks of profit before tax are earned per 1 ruble invested in assets.

Return on equity:

$$R_\text{equity average} = \frac{\text{Profit before tax}}{\text{Average equity capital}}= \frac{ \text{form No. 2 p. 2300}} {\text{average for page 1300+1350 f.№1}} $$

shows how many kopecks of balance sheet profit are provided by 1 ruble invested in own funds.

Return on Investment:

$$R_\text{investment} = \frac{\text{Profit before tax}}{\text{Average long-term capital}}= \frac{ \text{form No. 2 line 2300}}{\text {average for page 1300+1350+1400 f.№1}} $$

shows how many kopecks of balance sheet profit fall on 1 ruble. investments.

Profitability of products (activities):

$$R_\text{activities} = \frac{\text{Profit before tax}}{\text{Full cost}}= \frac{ \text{form No. 2 line 2300}}{\text{line 2120+2210+2220 f.№2}} $$

shows how many kopecks of tax profit are earned per 1 ruble. production and sales costs.

Return on sales:

$$R_\text{sales} = \frac{\text{Profit from sales}}{\text{Revenue}}= \frac{ \text{form No. 2 p.2200}}{\text{p. 2110 f.№2}} $$

This coefficient shows how many kopecks of profit from sales are generated per 1 ruble. sales income.

Net profit margin:

$$\text{Net profit rate} = \frac{\text{Net profit}}{\text{Revenue}}= \frac{ \text{form No. 2 p.2400}}{\text{p. 2110 f.№2}} $$

shows how many kopecks of net profit remain for the enterprise per 1 ruble. revenue.

In general, profitability indicators characterize the efficiency of an enterprise's use of its funds in order to make a profit.

It is necessary to make an important note regarding the calculation of indicators, the formulas for which use data both from Form No. 1 - “Balance Sheet”, and from Form No. 2 - “Profit and Loss Statement”. For example, when calculating return on investment, return on equity, etc. It must be remembered that form No. 1 is static, it characterizes the values of indicators for certain dates, and form No. 2 is dynamic, defining the indicators on a cumulative basis from the beginning of the year. Consequently, the values of the indicators depend on the reporting period. And this must be taken into account when comparing them.

Profit, revenue, cost increase on an accrual basis depending on the reporting period T = 3, 6, 9, 12 months. If you need to compare indicators calculated in different periods, it is advisable to bring them to the same period, for example, to a year.

Answers to frequently asked questions on “Long-term liabilities on the balance sheet”

Question: Is accounts payable reduced due to the accrual of value added tax on advances received by the enterprise?

Answer: Yes, accrued VAT on advances received by the company reduces the amount of accounts payable in the balance sheet on which the tax amount was calculated. In the same way, VAT on an advance issued by an organization is not reflected in the Liability side of the balance sheet, but reduces the amount of receivables in the Asset. Regarding your question, let's give an example: on the reporting date, an advance of 118 thousand rubles was received, including the amount of VAT at a rate of 18%, in Liability we will write (118 thousand rubles - 118 thousand rubles x 18/118) = 100 thousand. R.

Question: What to do with the assessment of deferred tax liabilities if the Tax Code of the Russian Federation provides for different income tax rates for certain types of company income?

Answer: In such a situation, the tax rate must correspond to the type of income that will lead to a decrease in the amount or complete repayment of the taxable temporary difference in future years (following the reporting or subsequent periods).

Explanation of balance sheet lines for accounts

Sometimes called the coverage ratio (CR)

This is one of the most important financial ratios. The higher the indicator, the better the solvency of the enterprise. A coefficient value of more than 2 is considered good. On the other hand, a value of more than 3 may indicate an irrational capital structure; this may be due to a slowdown in the turnover of funds invested in inventories or an unjustified increase in accounts receivable.

See also: Analysis of the financial condition of the enterprise by balance sheet and operating profit

long term duties

Long-term obligations are obligations with a maturity period of more than a year.

Long-term liabilities include debt obligations, deferred tax liabilities, and estimated liabilities of the organization.

When assessing the financial condition of an enterprise, long-term liabilities are usually divided into two groups:

- part of long-term accounts payable that will be repaid more than 12 months after the reporting date;

- part of long-term accounts payable that will be repaid before the expiration of the next 12 months after the reporting date.

Formula for calculating the current ratio

The current liquidity ratio (CTL) is calculated as the ratio of current (current) assets to short-term liabilities (current liabilities, short-term debt). The data for calculation is taken from the balance sheet. Thus the calculation formula is:

| Current assets | |

| Ktl = | ————————— |

| Short-term liabilities |

Look at the Excel table "Analysis of financial condition" 70 ratios, dynamics for 8 periods Bankruptcy risk assessment

Current assets:

- Cash in hand and in bank accounts.

- Accounts receivable net. Net accounts receivable are determined by subtracting the allowance for bad debts from the accounts receivable balance.

- Cost of inventory inventories. Inventories should have a relatively rapid turnover within a year.

- Other current assets (deferred expenses, investments in securities, etc.)).

Current liabilities

- Loans with immediate maturities (within a year)

- Unpaid requirements (suppliers, budget, etc.)

- Other current liabilities.

The formula for calculating the current liquidity ratio by groups of the structure of assets and liabilities:

| A1 + A2 + A3 | |

| Ktl = | ———— |

| P1 + P2 |

Formula for calculating the current ratio based on balance sheet data (Form 1):

| Summary of Section II | |

| Ktl = | ———————— |

| p.610+p.620+p.660 |

In order to reliably assess the liquidity of assets, it must be borne in mind that not all assets are equally liquid.

For example:

- Some inventory balances may have zero liquidity.

- Some receivables may have a maturity of more than one year.

- Issued loans and bills formally refer to current assets, but in fact they can be funds transferred for a long period to finance related structures.

Look at the Excel table "Analysis of financial condition" 70 ratios, dynamics for 8 periods Bankruptcy risk assessment

On the topic of the page

Sitemap - Detailed table of contents of the site.

© 2008-2018 IP Prokhorov V.V. OGRNIP 311645410900040 • Contacts • Guest book • Site map • Confidentiality

Published 10/23/09, revised 12/4/09 0004

Procedure for filling out the Balance Sheet

Current assets Inventories 1210 Account balances: – 10 “Materials” – 11 “Animals for growing and fattening” – 20 “Main production” – 21 “Semi-finished products of own production” – 23 “Auxiliary production” – 29 “Service production and farms” – 41 “Goods” (minus the credit balance on account 42 “Trade margin”, if goods are taken into account in sales prices) – 43 “Finished products” – 44 “Sales expenses” – 45 “Goods shipped” – 46 “Stages completed for work in progress » – 97 “Deferred expenses” (except for expenses reflected on lines 1110 and 1150 of the balance sheet) – 15 “Procurement and acquisition of material assets” – plus (minus) debit (credit) balance on account 16 “Deviation in the cost of material assets” – minus the credit balance on account 14 “Reserves for reduction in the value of material assets” Value added tax on