An accounting policy is a single document that establishes the rules for maintaining records in a commercial organization. It reflects the methods of document flow, inventory, information processing, evaluation and control of operations and activity facts. The application of the selected rules affects the financial result and the tax base.

Regulatory acts governing accounting and tax accounting provide a choice of ways to conduct them. The chosen method is recorded in the accounting policy.

There are three types of document:

- for accounting purposes - mandatory for all organizations;

- for tax purposes - mandatory for organizations and individual entrepreneurs;

- for reporting according to international standards IFRS - mandatory for organizations preparing reports according to IFRS.

If the organization has not formalized the chosen method by order, then during the inspection the regulatory authorities have the right to apply an accounting method that increases the tax burden.

Document approval deadlines

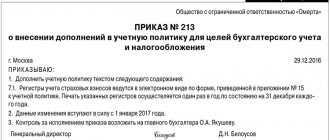

There is an opinion that accounting policies must be approved at the end of each calendar year. But that's not true. If nothing has changed in the activities, accounting and taxation of the organization, then there is no need to “re-approve” the document. You should use the existing one. If changes occur, you will have to rework the document. It is permissible to approve adjustments by a separate order, defining only specific innovations. The organization also has the right to cancel the old rules for reflecting business transactions and generating reports and prepare a new order.

The deadlines for approval and amendments to accounting policies are determined at the legislative level:

| Event | Approval period for BU | Deadline for tax accounting |

| Creation of a new organization | Approve the accounting rules no later than 90 calendar days from the date of registration of the organization (clause 9 of PBU 1/2008) | Approve the new accounting policy no later than the end of the first reporting tax period (clause 12 of article 167 of the Tax Code of the Russian Federation) |

| Alteration | According to generally accepted requirements, make changes in the current period, but apply the updated provisions from the new calendar year (clause 10 and clause 12 of PBU 1/2008) | If the company has changed its tax accounting methods or there have been significant changes in its activities, then the changes in accounting policies should be applied from the new tax period (Article 313 of the Tax Code of the Russian Federation). When changing legislative norms, use innovations from the date of entry into force of legislative innovations |

| Making additions | At the moment when clarifications and additions became necessary for further accounting (clause 10 of PBU 1/2008) | Approve the additions in the period in which these clarifications became necessary for tax accounting (Article 313 of the Tax Code of the Russian Federation) |

Please note that addition and modification are completely different things.

To quickly and correctly draw up a document, use the free accounting policy designer for 2021 from ConsultantPlus experts.

Why draw up an accounting policy?

This is the main document that establishes:

- the procedure for maintaining the accounting records of the institution;

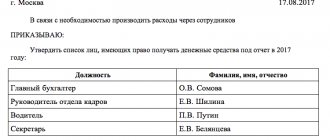

- circle of responsible persons;

- forms, registers and forms of primary documentation;

- document flow;

- the procedure and system for taxation of production or sale of goods, works, services.

It reveals in detail all the features of accounting and taxation.

The document is approved for a year or several years. But in 2021, all institutions, without exception, will have to incorporate a large number of changes established by the updated legislation.

When forming, you should rely on current legislation:

- Federal Law dated December 6, 2011 No. 402-FZ regarding the definition of the method of accounting at an enterprise, the definition of the circle of persons responsible for organization and maintenance.

- The new federal accounting standard is Order of the Ministry of Finance No. 274n dated December 30, 2017, which established exceptional provisions for public sector institutions.

- The founder's accounting policy is an innovation introduced by the Federal Accounting Service. Now the founding document of the company should be drawn up taking into account the requirements and provisions of the founder.

- Tax Code of the Russian Federation regarding the taxation system, tax periods, rates, benefits and deductions. Determined based on all current tax obligations for the current and subsequent years.

- Appendix No. 1 to Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n (PBU 1/2008). The regulations set out the specifics of drawing up accounting policies and mandatory requirements for the content of the working document.

- Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. Regulates the specifics of compiling, storing and recording primary documentation.

- Instructions dated December 1, 2010 No. 157n, dated December 16, 2010 No. 174n, dated March 25, 2011 No. 33n. Establish a Unified Chart of Accounts, the composition and procedure for preparing financial statements.

The simplified accounting policy is concise and meaningful for a small enterprise that conducts accounting in a simplified manner. Exceptions are: law firms, credit and microfinance firms, housing and credit cooperatives and those companies whose statements are subject to mandatory audit. Prescribe the maintenance of simplified accounting in the provisions of the accounting policy, otherwise punishment by regulatory authorities is inevitable.

In accounting

The document, entitled “accounting policies for accounting purposes,” discusses general accounting practices and industry specifics.

Regardless of the type of activity, organizations claim:

- working chart of accounts and forms of primary documents;

- a method of controlling the procurement, acquisition and write-off of inventories;

- method of calculating depreciation;

- error correction procedure.

Trade organizations indicate the method of reflecting transportation and procurement costs - in the cost of the goods or as they are sold.

Retail trade organizations indicate the method of accounting for goods - at purchase prices without markup.

Organizations with a long production cycle indicate the method of recognizing income as work, services, and products are ready.

Why and how to make it publicly available

Since 2021, the provisions of the UP have become publicly available and open. This applies not only to the founders in relation to their subordinate institutions, but also to all legal entities. Let us remind you that individual entrepreneurs are not required to keep accounting records and, therefore, to draw up a management document.

All representatives of the budget sector in 2021 are required to publish the provisions of the accounting policies on their official websites. In some cases, a copy of the order approving the accounting policy along with the text and attachments will have to be provided to the founder.

The approach allows you to monitor the relevance of the provisions introduced by the relevant order. In simple words, the founder is authorized to control:

- is accounting properly organized and maintained at the government agency;

- does it meet the stated requirements and standards;

- whether it meets the individual characteristics of the industry.

If inconsistencies are identified, give instructions to eliminate the violations as soon as possible.

In tax accounting

Depending on the applied tax regime, the accounting policy considers the following issues:

- income recognition method for calculating income tax: cash or accrual;

- method for determining the cost of write-off of materials and goods: by unit cost, weighted average or FIFO method - by the cost of the first purchases;

- method of calculating depreciation of fixed assets and intangible assets: linear or non-linear;

- the possibility of accruing reserves to regulate income tax: for doubtful debts for vacation pay, for warranty repairs and repairs of fixed assets;

- tax register form for calculating the taxable base: book of income and expenses, book of sales and book of purchases, independently developed registers.

Read more about the formation of accounting policies for tax purposes

What should a software package for OSNO contain?

(for accounting purposes).

(for tax accounting purposes).

This is the most extensive version of the accounting policy, since the most stringent requirements for accounting, preparation and submission of reports are applied to companies on OSNO.

The accounting policy on OSNO can be drawn up in a single document containing parts for accounting and tax accounting, or in two separate parts. At the same time, tax policy is the most important here, since it determines the process of forming the base and calculating the main types of taxes, and especially the income tax.

Key points to consider in the accounting part of the document:

- List of regulatory documents that are used for accounting. If a company uses IFRS in some area, then this must be stated;

- Accounting chart of accounts;

- Preparation of financial statements - a list of prepared forms (for example, small businesses are given the right to draw up a simplified balance sheet), details of disclosed indicators, preparation of explanatory notes to the balance sheet and annexes. This section also indicates if the company prepares interim reporting;

- Primary documents - here it is necessary to mention which forms are used in the standard form and which in your own. The latter will need to be enabled as applications.

- Who in the organization has the right to sign primary documents, bills, invoices, etc.;

- How exactly is the accounting of incoming materials carried out, how is the assessment carried out upon receipt and write-off;

- How exactly will exchange rate differences for assets in currency terms be determined?

- How exactly are administrative and commercial expenses written off, how is revenue recognized for products that have a production cycle of more than 12 months, how is work in progress accounted for;

- Income tax for accounting purposes - it is necessary to indicate whether the entity uses PBU 18/02, exactly how the amount of tax is determined for the report on financial results;

- The process of creating reserves - how exactly a reserve for doubtful debts is created (all companies are required to have one), whether a reserve fund is created (it is optional);

- Accounting for fixed assets - this section establishes how the useful life of fixed assets is determined, what depreciation method is used, how fixed assets with a price of up to 40 thousand rubles are written off, and the method of revaluation. For small businesses, it is possible to charge depreciation once a year, and this also needs to be canceled in the document.

In the tax part of the document, there is no need to indicate accounting and calculation methods if they are clearly indicated in the establishing documents. However, if it is proposed to choose one of several methods, then this must be included in the document.

In particular, the following points must be reflected:

- Which of the two methods is used to calculate depreciation?

- What method will be used to determine the price of materials and raw materials;

- If advance payments of income tax are made, how often are they made?

- How often are income tax returns filed?

- Which of the two ways will income be recognized?

- If the accrual method is selected in the previous paragraph, then how will payment for work be indicated, which started in one period and completed in another;

- Which of the expenses specified in the Tax Code will be considered direct;

- How tax accounting will be carried out - in accounting registers or separate ones.

You might be interested in:

Order of payment in a payment order: what to put in field 21 in 2021

For small businesses

Small businesses (SMBs) have the right to use simplified accounting registers and submit simplified financial statements.

If an organization wants to exercise this right, it must be written down in a document.

SMP has the right to refuse to apply 6 accounting standards, such as “Accounting for construction contracts” (PBU 2/2008), “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010) and others.

All accounting standards that are not applied by the entity should be listed in a special section “Application of accounting provisions.”

Simplified way of accounting

Explanations are also provided for organizations that use the simplified tax system and submit simplified reporting. These include non-profit organizations, small businesses (regardless of the taxation system they choose) and participants in the Skolkovo project. The above organizations are required to apply the accounting methods established by federal standards and, if there are several of them, choose one of the existing ones. Again, as mentioned above, if there is no suitable method, you can develop your own, more suitable and more rational.

I would like to additionally mention that the concept of “the requirement of rationality” itself has also undergone changes! Previously, this term meant that accounting should be conducted based on business conditions and the size of the organization. Now an addition has been developed, clarifying that the requirement of rationality, in addition to this, also includes the ratio of the costs of generating information and its usefulness (new edition of clause 6 of PBU 1/2008).

Irrelevant information

Now PBU 1/2008 has introduced a new definition - non-essential information. What does it mean? This information, the existence, absence or manner of reflection of which does not in any way affect economic decisions, is now called “irrelevant”. The organization itself determines what information is immaterial based on its size and nature. Clause 7.4 of PBU 1/2008 contains instructions for the case when the management of federal standards or the creation of new standards leads to the appearance of non-essential information. In such a situation, the accountant himself chooses accounting methods, that is, without applying standards. And yes, please note: this rule applies to all organizations.